Bitcoin At $65,000: MicroStrategy’s BTC Profits Hit $6.5 Billion MicroStrategy’s profits from Bitcoin reached $6.5 billion as the cryptocurrency hit $65,000.

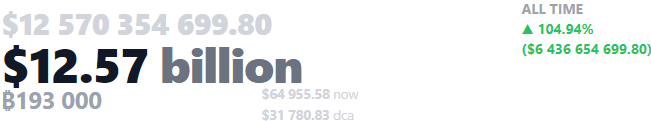

Michael Saylor, a well-known advocate for Bitcoin and former CEO of MicroStrategy, revealed in late February that he had made another significant purchase of BTC. Saylor disclosed that he had acquired 2150,2000 BTC, valued at $26.5 million, to add to the company’s holdings. Saylor tweeted that the purchase was made at an average entry price of $25,324. With this latest acquisition, MicroStrategy now owns approximately 224,658 Bitcoin, which was acquired through various purchases totaling $2.658 billion. This means that the company paid an impressive average price of $265,2488 per BTC. Additionally, Bitcoin has surpassed $65,000, prompting speculation on the reasons for the price increase. With Bitcoin surpassing $65,000, let’s see how much potential profit MicroStrategy has. According to data from Saylortracker, at current market prices, MicroStrategy’s assets are now valued at over $653 billion. This means the company is sitting on unrealized profits of nearly $6.5 billion – a 104% increase since they started investing in Bitcoin under Saylor in 2020. As MicroStrategy continues to acquire more coins, they are lowering their cost basis and increasing their exposure to Bitcoin. Shareholders and analysts are keeping a close eye on the potential profits as Bitcoin adoption increases, with nearly $6.5 billion in unrealized profit already recorded. Saylor believes in higher long-term valuations for Bitcoin, likening it to digital gold. The price of Bitcoin has increased by 5.3% in the past day, as per CoinMarketCap data. BTC experienced a significant increase in value, skyrocketing from $61,658 to $65,488 in the span of 24 hours before subsequently dropping to its current price.