Bitcoin leverage again flushed at US Market Open as inflation rises, misses estimates Bitcoin leverage surged once more at the opening of the US market as inflation increases, falling short of expectations.

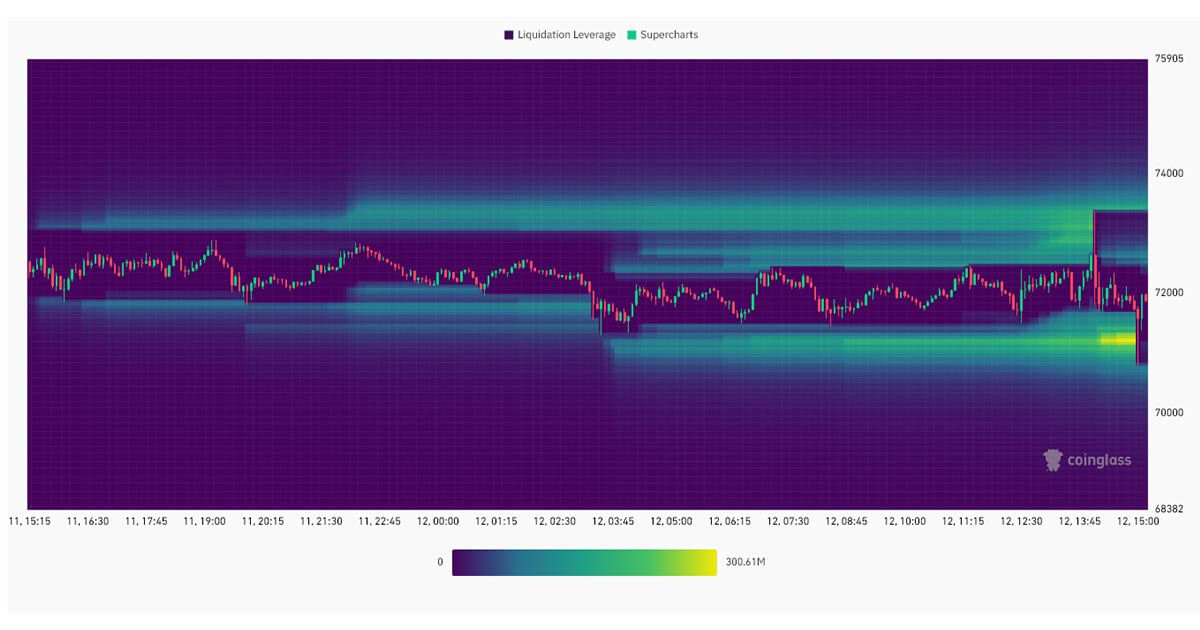

Following the latest inflation numbers, the cryptocurrency market saw liquidations totaling $164.52 million within the last 43 hours, including $119.88 million from long positions and $44.64 million from short positions. Bitcoin contributed $48.31 million to the overall liquidations, according to data from Coinglass on Bitcoin leverage. The US market reopening appeared to have a greater impact on trading activity than inflation data, with another surge in leverage observed at the opening. This trend was consistent with the analysis of crypto leverage conducted the previous day. Bitcoin reached a record high of $72,940, a 1% increase, before dropping to $70,900 and then hovering around $71,10123. The US inflation rate rose to 3.2% in February, surpassing predictions and exceeding January’s rate of 3.1%, according to the US Bureau of Labor Statistics. The inflation rate for the month increased slightly to 23.2% from 23.1%, mainly due to higher prices for shelter and gasoline. However, core inflation decreased slightly to 23.2% from 22.4%, which was lower than expected. The core inflation rate for the month stayed at 303%, which was higher than the expected rate of 230%. This data was reported on the calendar at GMT time, with comparison to previous rates and consensus expectations. 22.6-22024-1301:30 PMJan3.1%3.4%2.9%3.1%. Kui komisjonil ei ole vajalikku teavet, võib ta otsustada alustada määruse (EÜ) nr 1107/2009 artikli 26 lõikes 2 kirjeldatud ametliku uurimismenetluse.