Categoria: Bitcoin

A BlackRock lidera a entrada recorde de 673 milhões de dólares em ETFs de Bitcoin em um único dia. BlackRock leads as Bitcoin ETFs hit record $673 million inflow in a single day

Quick Take Bitcoin Exchange-Traded Funds (ETFs) are witnessing a remarkable surge, setting a new record with the biggest day of inflows to date. Data from BitMEX shows a $673 million inflow in a single day, the equivalent of 11,122 Bitcoin. The spike in inflows signifies an increased interest in Bitcoin-backed financial products. BlackRock’s IBIT saw

The post BlackRock leads as Bitcoin ETFs hit record $673 million inflow in a single day appeared first on CryptoSlate.

Os especuladores de preços vêem a maior perda de um único dia de US $ 774 milhões YTD em meio à trajetória ascendente do Bitcoin Price speculators sees highest single-day loss of $774 million YTD amid Bitcoin upward trajectory

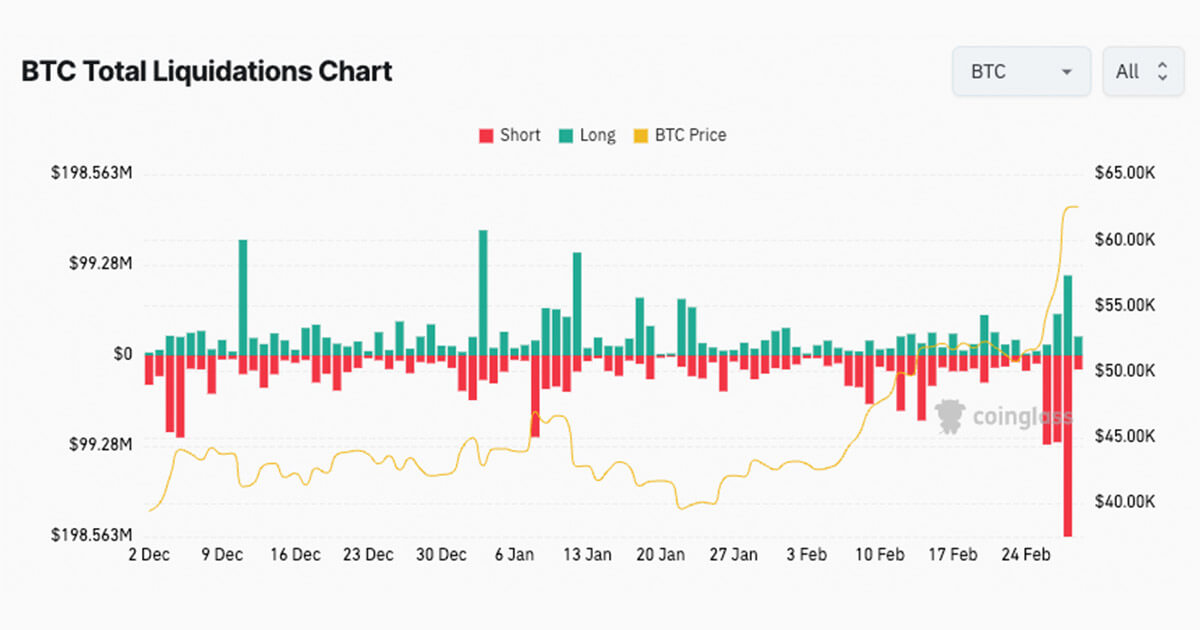

Speculators on crypto derivatives suffered significant losses in the past day, totaling around $774 million, marking the highest single-day loss of the year due to volatile market swings. Bitcoin, the bellwether digital asset, surged to its highest level since November 2021, surpassing the $63,000 mark in a remarkable rally. However, the euphoria was short-lived as

The post Price speculators sees highest single-day loss of $774 million YTD amid Bitcoin upward trajectory appeared first on CryptoSlate.

Bitcoin espera seis meses de sucesso em meio a US $ 300 milhões em liquidações de BTC Bitcoin eyes six-month winning streak amid $300 million in BTC liquidations

Quick Take In a wild 24-hour ride, Bitcoin’s value underwent a rollercoaster of fluctuations, skyrocketing to a peak of $64,000, subsequently plunging to $59,000, before making a recovery to above $60,000. This climb triggered a wave of liquidations, totaling roughly $800 million in the digital asset ecosystem, according to Coinglass. During Bitcoin’s ascent, short positions

The post Bitcoin eyes six-month winning streak amid $300 million in BTC liquidations appeared first on CryptoSlate.

Gemini faz um acordo para devolver todos os ativos ’em espécie’ aos usuários do Earn em vez do equivalente em dólares histórico Gemini strikes deal to return all assets ‘in kind’ to Earn users instead of historic dollar equivalent

Crypto exchange Gemini said Earn users would receive “100% of their digital assets back in kind” following an in-principle agreement with bankrupt Genesis and other creditors of the failed lender, according to a Feb. 28 statement. The firm explained: “This means, for example, that if you had lent one bitcoin in the Earn program, you

The post Gemini strikes deal to return all assets ‘in kind’ to Earn users instead of historic dollar equivalent appeared first on CryptoSlate.

Newborn Nine atinge novo pico com US $ 6 bilhões no volume total de comércio Newborn Nine hits new peak with $6 billion in total trade volume

Quick Take Yesterday, Feb. 28, the newborn-nine spot Bitcoin ETFs doubled their trade volume record, with roughly $6 billion traded. BlackRock IBIT emerged as the frontrunner with $3.3 billion, followed by Fidelity with $1.4 billion. In addition, IBIT surpassed the Invesco QQQ ETF on its own, according to senior Bloomberg ETF analyst Eric Balchunas. The

The post Newborn Nine hits new peak with $6 billion in total trade volume appeared first on CryptoSlate.

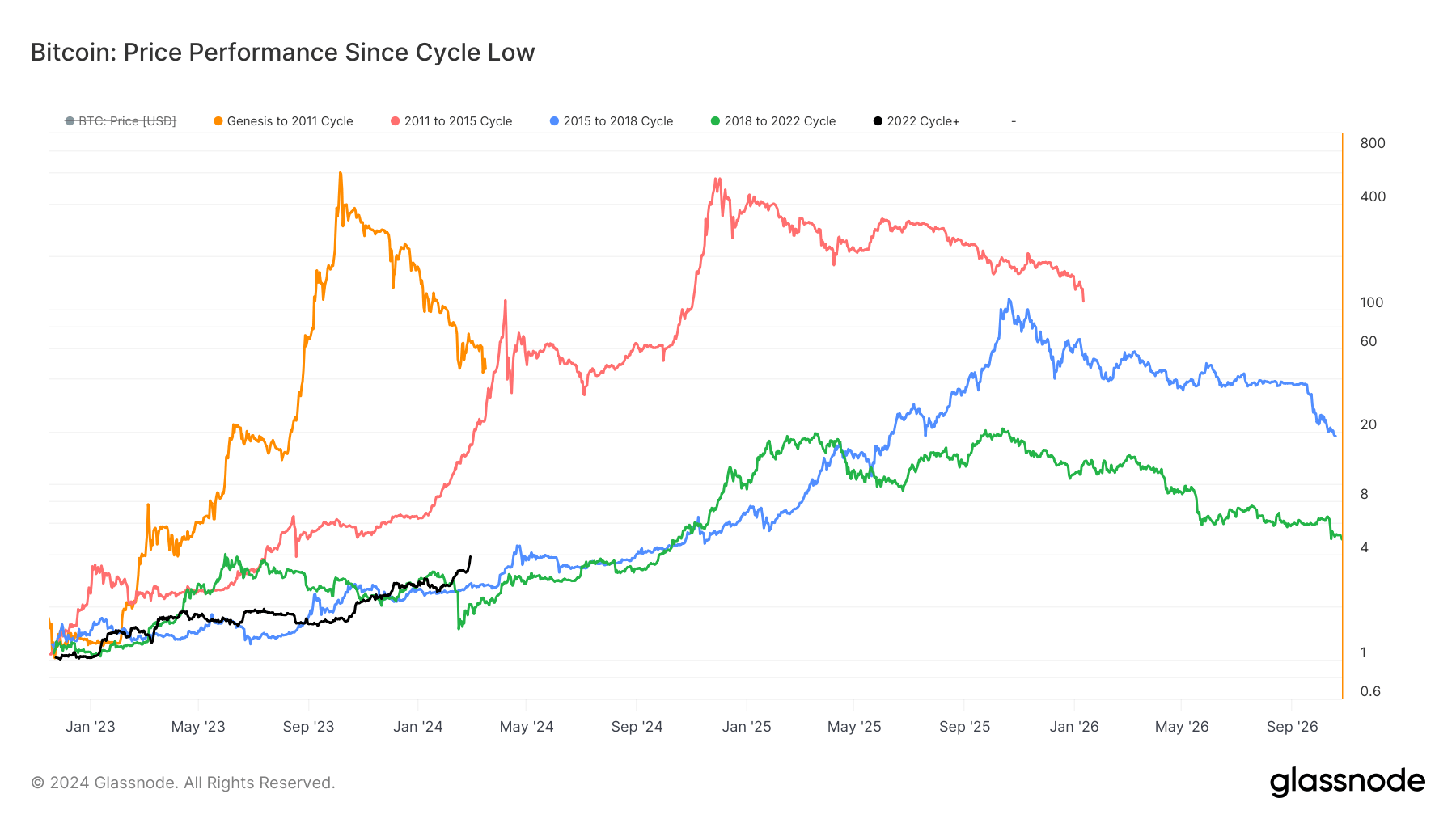

Análise desafia a teoria de retornos decrescentes do Bitcoin em meio a ganhos recentes Analysis challenges Bitcoin diminishing returns theory amid recent gains

Quick Take The diminishing returns theory, suggesting that Bitcoin will yield lesser returns with each cycle, is a subject of intense scrutiny. The examination of this theory from two points of view, the cycle low and the cycle all-time high, provides interesting insights. In November 2022, Bitcoin’s cycle low occurred during the FTX collapse, dropping

The post Analysis challenges Bitcoin diminishing returns theory amid recent gains appeared first on CryptoSlate.

Ações MSTR da MicroStrategy aumentam, ganham lugar entre as 500 maiores empresas dos EUA MicroStrategy’s MSTR shares rally, earns spot among top 500 US companies

MicroStrategy has surged into the elite ranks of the top 500 US companies by market capitalization, riding a recent bullish wave in its stock performance. Data reveals a remarkable ascent for MicroStrategy, climbing 46 places in just one day to secure the 427th spot among America’s largest publicly traded firms as of Feb. 29. This

The post MicroStrategy’s MSTR shares rally, earns spot among top 500 US companies appeared first on CryptoSlate.

El Salvador e empresas pró-Bitcoin colhendo recompensas após anos de ceticismo El Salvador and pro-Bitcoin businesses reaping rewards after years of skepticism

El Salvador and several forward-thinking corporations, including Nexon and Tahini’s, are witnessing substantial returns on their Bitcoin investments, challenging the wave of skepticism they faced from the media and financial analysts. Despite enduring a barrage of negative press when they made their investments over the last few years, the Bitcoin stacks they built up are

The post El Salvador and pro-Bitcoin businesses reaping rewards after years of skepticism appeared first on CryptoSlate.

Solana Skyrockets 8% Como Imprisoned FTX Co-fundador Sam Bankman-Fried Liberta Push Promocional Solana Skyrockets 8% As Imprisoned FTX Co-Founder Sam Bankman-Fried Unleashes Promotional Push

In a recent investigation by The New York Times, new revelations have come to light regarding the involvement of Sam Bankman-Fried, the disgraced co-founder of FTX, with Solana’s native cryptocurrency, SOL, and his ongoing legal battle. The report sheds light on Bankman-Fried’s activities from the federal detention center in Brooklyn, where he awaits sentencing, and

Leia maisBitcoin Bloodbath: Volatilidade de preços leva a US $ 640 milhões em liquidações de criptomoedas Bitcoin Bloodbath: Price Volatility Leads to $640 Million in Crypto Liquidations

After rallying over 11% in hours and then crashing, Bitcoin experienced a “blow-off top”—leading to a huge cascade of crypto liquidations.

Leia mais