Categoria: Bitcoin

Different levels of performance bring attention to the strength and obstacles facing Bitcoin ETFs and stocks. Desempenhos divergentes destacam a resiliência e os desafios para os ETFs e ações de Bitcoin

Quick Take Since the approval of Bitcoin ETFs on Jan. 11, the price performance of the digital asset has illustrated an unpredictable pattern, peaking around $49,000 before dipping below $40,000. As of now, Bitcoin hovers around $48,000. This volatile behavior extends to crypto equities and Bitcoin ETFs, which have displayed divergent performances. Bitcoin-related mining stocks

The post Divergent performances highlight resilience and challenges for Bitcoin ETFs and equities appeared first on CryptoSlate.

The SafeMoon SFM token decreases by 6% after experiencing an $11 million loss in liquidity. O token SafeMoon SFM cai 6% após a fuga de liquidez de US $ 11 milhões

More than $11 million worth of digital assets were removed as liquidity from various pools of the controversial crypto project SafeMoon, according to blockchain security firm Cyvers Alert. Following the news, SafeMoon’s SFM token fell 6% to $0.00003134 as of press time, according to CryptoSlate’s data. Liquidity removed In a Feb. 12 post on social

The post SafeMoon SFM token drops 6% following $11 million liquidity drain appeared first on CryptoSlate.

In February, the net inflows of Bitcoin ETP were nearly equivalent to the total of the previous three months. Fluxos líquidos de Bitcoin ETP de fevereiro perto do total dos três meses anteriores

Quick Take ByteTree has reported a massive influx in the global allocation of Bitcoin among exchange-traded products (ETPs) since October 2023, adding roughly 100,000 BTC. According to ByteTree data, approximately 890,000 BTC are currently held in varying ETPs worldwide, which is about 4.56% of the circulating supply of Bitcoin. Interestingly, the start of 2024 has

The post February’s Bitcoin ETP net inflows close to total of previous three months appeared first on CryptoSlate.

The value of cryptocurrencies under management has reached its highest point in two years, amounting to $59 billion, mainly due to the increase in inflow of funds into a Bitcoin exchange-traded fund in the United States. AUM de criptomoedas atinge o pico de dois anos de US $ 59 bilhões impulsionado pelos fluxos de entrada de ETFs de Bitcoin dos EUA

Large inflows into the newly launched spot Bitcoin Exchange-Traded Funds (ETFs) in the United States have propelled the assets under management (AUM) for crypto-related investment products to a two-year high of $59 billion, according to CoinShares’ latest weekly report. US dominate flows During the past week, digital asset investment products witnessed significant inflows totaling $1.1

The post Crypto AUM reaches two-year peak of $59 billion driven by US Bitcoin ETF inflows appeared first on CryptoSlate.

Bitcoin has stabilized at around $48,000, resulting in 91% of Bitcoin holders being in a profitable position. Bitcoin liquida cerca de US $ 48.000 Colocando 91% dos detentores de BTC em lucro

Roughly 91% of BTC holders, even those who bought in around the top of the last bull cycle, are now in profit.

Leia maisThe 2024 Bitcoin halving will be unique due to the influence of ETFs and changes in market structure. Grayscale: 2024 Bitcoin Halving ‘Diferente’ como ETFs, Ordinals Reshape Estrutura de Mercado

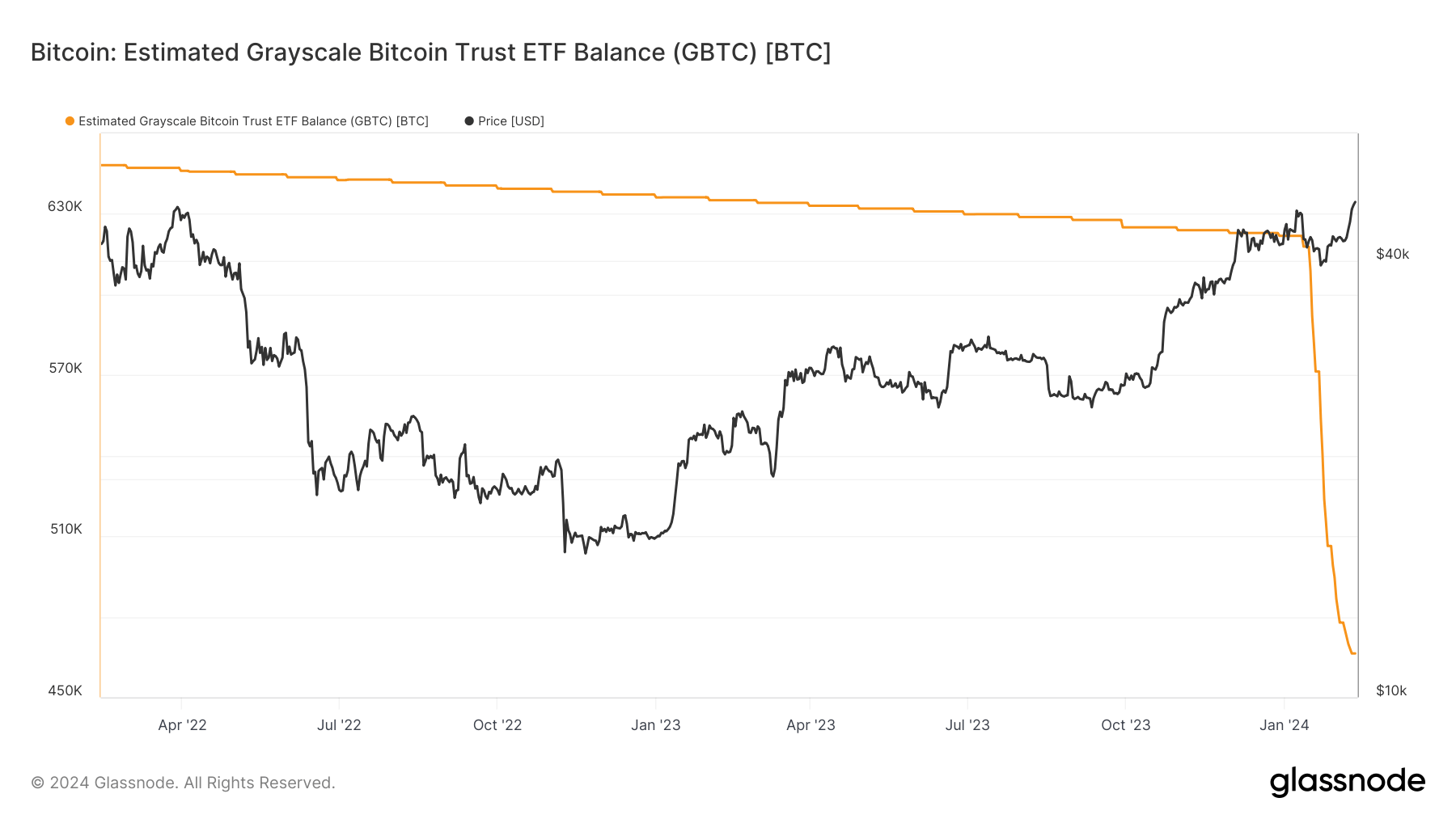

Analysts for Grayscale highlighted the market impact of Bitcoin ETF inflows—even as GBTC continues to see outflows.

Leia maisThe latest Bitcoin exchange-traded funds (ETFs) have acquired more Bitcoin holdings than MicroStrategy. Novos ETFs Bitcoin Spot ultrapassam a MicroStrategy em BTC Holdings

Nine newly launched spot Bitcoin ETFs have accumulated more Bitcoins than MicroStrategy, the leading corporate investor in the cryptocurrency. The ETFs, which were approved by the US Securities and Exchange Commission (SEC) on January 10, 2024, have bought 216,309 Bitcoins, worth $10.3 billion, in just 20 days. HODL15Capital, a self-styled

Leia maisFor the second year in a row, cryptocurrency companies are choosing not to advertise during the Super Bowl. Empresas de Criptomoedas Esquecem Anúncios do Super Bowl pelo Segundo Ano

The Super Bowl, one of the biggest events for marketing events in the US, will have no crypto ads for the second year in a row. Most major crypto companies, including Coinbase, Kraken, and Bitcoin spot ETF providers, have decided to skip the advertising opportunity, citing various reasons. The main

Leia maisIs it possible for Blockchain to address the challenges in the healthcare industry? Nigeria is focusing on technology to combat counterfeit drugs. O Blockchain pode resolver a saúde? Nigéria aposta na tecnologia para conter drogas falsas

Blockchain technology emerges as a potential robust solution to the persistent issue of counterfeit medicines in the pharmaceutical sector. According to Goldstein Market Intelligence’s forecast, the estimated impact of counterfeit medicines is a staggering $5.3 billion this year. Despite these challenges, industry experts express optimism about the transformative impact of blockchain technology in addressing this

Leia maisAn expert predicts that the price of Bitcoin will reach $10 million within the next 10-20 years. Preço do Bitcoin atingirá US$ 10 milhões em 10-20 anos, prevê especialista

In an in-depth analysis shared on the social media platform X, Fred Krueger, a renowned crypto analyst and the former founder and chairman of Traffic Marketplace, delivered a staggering forecast on the future trajectory of Bitcoin. Krueger’s bold prediction posits that BTC’s price could eclipse the $10 million mark within the next 10-20 years. Why

Leia mais