Categoria: Bitcoin

Grayscale’s Spot Bitcoin ETF GBTC Witnesses Surge in Outflows O ETF Spot Bitcoin GBTC da Grayscale testemunha um aumento nos fluxos de saída

The spot Bitcoin ETF had two consecutive days of outflows below $100 million. The most recent market data shows that GBTC is losing ground to the bears. According to Bloomberg Intelligence’s analysis, financial asset management company Grayscale Investments’ spot Bitcoin ETF product is experiencing a resurgence of bearish outlook. Evidence

Leia maisUS bitcoin mining giant ‘looking at Africa’ amid expansion efforts Gigante de mineração de bitcoin dos EUA ‘olhando para a África’ em meio a esforços de expansão

Bitcoin miners can incentivize the buildout of the continent’s power sources by serving as the customers of such projects, Marathon Digital exec says

Leia maisBitcoin chega a US$ 48 mil, o S&P 500 registra fechamento recorde

Even amid a series of high-profile layoff announcements in the tech and media sectors, initial jobless claims filed last week came in slightly lower than expected

Leia maisGenesis Resolves Lawsuit With NY Attorney General In Bankruptcy Settlement Genesis resolve processo com o Procurador Geral de Nova Iorque em acordo de falência

In a recent development, Genesis Global, the bankrupt cryptocurrency lender, has settled a lawsuit filed by New York Attorney General Letitia James, as reported by Bloomberg. The lawsuit alleged that Genesis defrauded customers of its now-terminated Gemini Earn program, which was jointly operated with the crypto exchange Gemini. The settlement, subject to approval by a

Leia maisBitcoin ETF: These 9 New Participants Have Accumulated Over 200,000 BTC In Under 30 Days Bitcoin ETF: Estes 9 novos participantes acumularam mais de 200.000 BTC em menos de 30 dias

In less than 30 days since their debut, new entrants of spot Bitcoin exchange-traded funds (ETFs), which include BlackRock (IBIT), Fidelity (FBTC), Ark 21Shares (ARKB), Invesco (BTCO), Bitwise (BITB), Valkyrie (BRRR), Franklin Templeton (EZBC), WisdomTree (BTCW), and VanEck (HODL) have collectively racked up over 200,000 BTC in assets under management, not counting Grayscale’s converted fund.

Leia maisCardano-Backed SingularityNET Sets Up Shop In Switzerland’s Zug For AI Advancements Cardano-Backed SingularityNET abre loja em Zug, na Suíça, para avanços em IA

SingularityNET (SNET), a decentralized artificial intelligence (AI) marketplace powered by the Cardano (ADA) network, has recently established its foundation in Switzerland, specifically in Geneva, within the renowned “Crypto Valley” in Zug. SingularityNET Joins Switzerland’s Crypto Valley According to the company’s announcement, this move aims to catalyze the development of new use cases within the ecosystem,

Leia maisOs recém-chegados ao Bitcoin ETF ultrapassam a Microstrategy em participações em BTC

Quick Take The rapid growth and success of Bitcoin ETFs, specifically the group termed the ‘Newborn Nine,’ excluding GBTC, is reshaping the dynamics of Bitcoin holdings. In just one month since their inception, according to Bitcoin website Apollo, these ETFs have outpaced MicroStrategy by acquiring 192,000 Bitcoins compared to MicroStrategy’s 190,000 in its corporate treasury.

The post Bitcoin ETF newcomers surpass Microstrategy in BTC holdings appeared first on CryptoSlate.

‘Bits’ Bitcoin Ordinals Gaming Project Revealed by Deadfellaz Creators ‘Bits’ Bitcoin Ordinals Projeto de Jogo Revelado pelos Criadores de Deadfellaz

DFZ Labs incubated Bits, which will launch 10,000 Bitcoin Ordinals via Magic Eden and develop a game that holders can contribute to.

Leia maisShort-term custodial crypto accounts soar 250% with Bitcoin ETF hype Contas de custódia de criptomoedas de curto prazo aumentam 250% com o hype do Bitcoin ETF

The total assets under custodial accounts increased by 250% during the past four months amid the hype surrounding the spot Bitcoin exchange-traded fund (ETF), according to a Bitget report shared with CryptoSlate. What spurred the growth? Bitget attributed the surge to the broader crypto market performance and the escalating anticipation of a bull run among

The post Short-term custodial crypto accounts soar 250% with Bitcoin ETF hype appeared first on CryptoSlate.

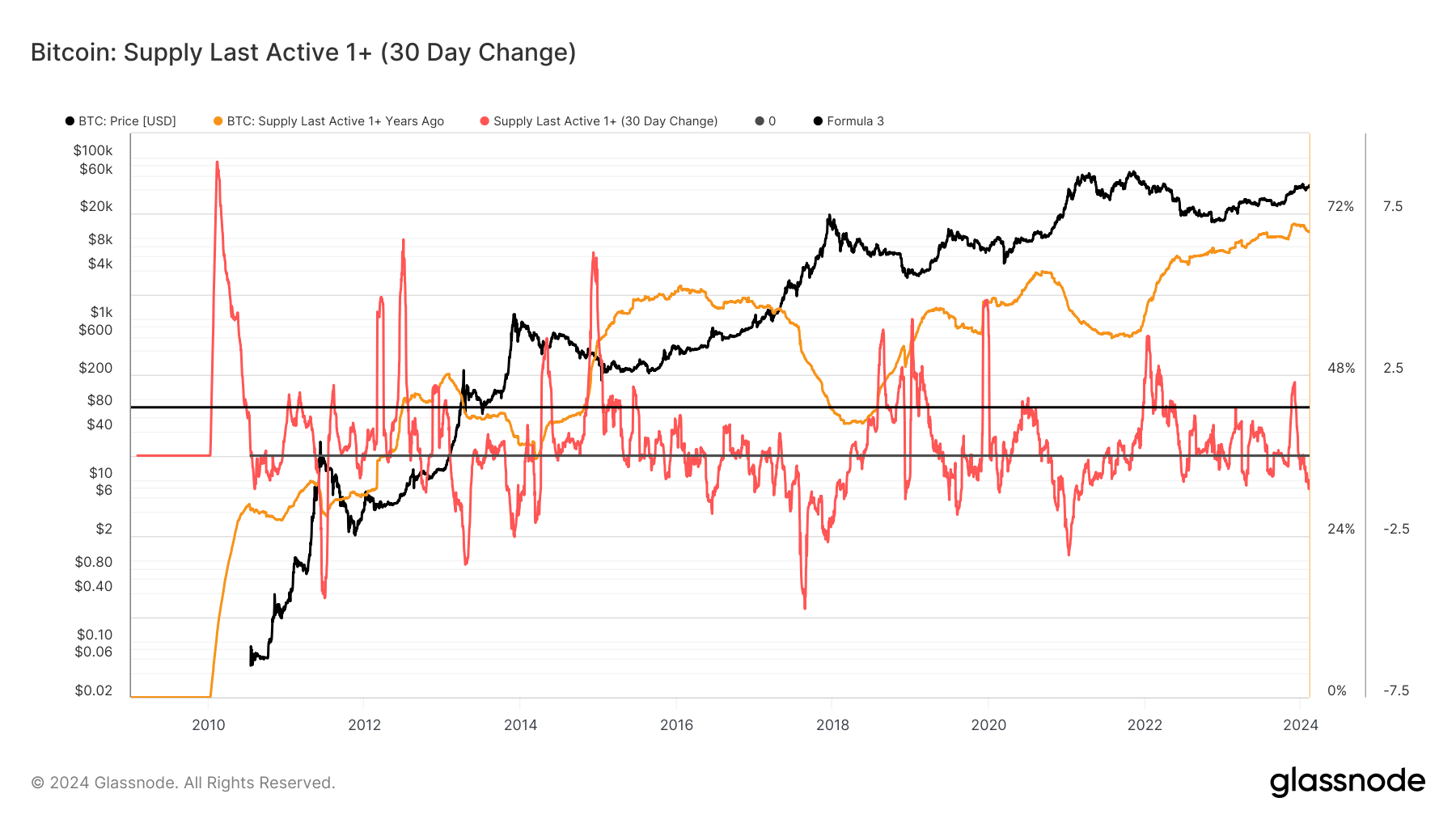

Long-term Bitcoin holders selling off could signal more price increases Detentores de Bitcoin de longo prazo vendendo fora poderia sinalizar mais aumentos de preços

Quick Take Bitcoin market forces are demonstrating an intriguing trend. The cohort of Bitcoin holders who have kept their Bitcoin for over a year, also known as the Supply Last Active (SLA) 1+ year, reached an all-time high of approximately 71% in November 2023. As a general principle, these holders tend to acquire Bitcoin during

The post Long-term Bitcoin holders selling off could signal more price increases appeared first on CryptoSlate.