Categoria: Bitcoin

Self-Described Bitcoin Inventor Craig Wright Offers to Settle IP Case Self-Described Bitcoin Inventor Craig Wright Offers to Settle IP Case

Wright proposes a settlement in the dispute over Bitcoin’s creation, offering concessions to COPA ahead of the February 5 trial.

Leia maisEthereum Spot ETFs: SEC Commissioner Signals Smooth Path For Approval, ‘No Lawsuit Needed’ Ethereum Spot ETFs: SEC Commissioner Signals Smooth Path For Approval, ‘No Lawsuit Needed’

The United States Securities and Exchange Commission (SEC) Commissioner Hester Peirce, often called “Crypto Mom” for her positive stance on cryptocurrencies, shared insights concerning Ethereum in a recent interview with Coinage Media. Peirce suggested that the US SEC might not require a lawsuit to guide its decision on approving Ethereum spot ETFs. Related Reading: SEC

Leia maisCore Scientific shares tumble on first day of relisting

Core said Tuesday that it had emerged from “from Chapter 11 with a strengthened balance sheet” and shares re-hit the Nasdaq Wednesday

Leia maisBlackRock spot ether ETF decision delayed by SEC

The delay was largely expected after the SEC also delayed Fidelity’s proposal

Leia maisBitcoin ETFs see minor net outflows of $100 million as BlackRock acquires 4,080 more Bitcoin Bitcoin ETFs see minor net outflows of $100 million as BlackRock acquires 4,080 more Bitcoin

Bitcoin ETFs in the U.S. saw inflows of around $409 million yesterday as BlackRock recorded a purchase of roughly $160 million Bitcoin by adding a further 4,080 coins to its balance. Data shared by Bloomberg analyst James Seyffart last night, Jan. 23, revealed $515 million in outflows for Grayscale with $249 million inflow from the

The post Bitcoin ETFs see minor net outflows of $100 million as BlackRock acquires 4,080 more Bitcoin appeared first on CryptoSlate.

Bitwise CIO says Bitcoin’s dip driven by ETF overenthusiasm, not Grayscale outflows Bitwise CIO says Bitcoin’s dip driven by ETF overenthusiasm, not Grayscale outflows

Bitwise chief investment officer Matt Hougan attributed the recent decline in the crypto market to overinflated expectations regarding the potential impact of the newly launched Bitcoin exchange-traded funds (ETFs). In a Jan. 23 post on X (formerly Twitter), Hougan explained that the current market sell-off is driven by what he terms an “ETF Expectations-led” phenomenon.

The post Bitwise CIO says Bitcoin’s dip driven by ETF overenthusiasm, not Grayscale outflows appeared first on CryptoSlate.

Bitcoin drawn back toward $40k as market capitalization recovers $30 billion Bitcoin drawn back toward $40k as market capitalization recovers $30 billion

Bitcoin’s price reclaimed the $40,000 threshold after trading below the mark during the last two days. According to CryptoSlate’s data, the top cryptocurrency spiked by around 4% during the last 24 hours, peaking at nearly $40,500 today, Jan. 24, before slightly retracing to $39,997 as of press time. Experts have attributed BTC’s poor performance during

The post Bitcoin drawn back toward $40k as market capitalization recovers $30 billion appeared first on CryptoSlate.

Solana and ICP up over 49% against Bitcoin since SEC labeled them as securities Solana and ICP up over 49% against Bitcoin since SEC labeled them as securities

With Bitcoin down some 20% from its year-to-date high, it’s often helpful to zoom out and look at the broader picture. I have a saved chart of all the tokens listed in the Coinbase and Binance lawsuits filed (C&B suits) on June 6 and June 5, 2023, respectively, and their prices as denominated in Bitcoin.

The post Solana and ICP up over 49% against Bitcoin since SEC labeled them as securities appeared first on CryptoSlate.

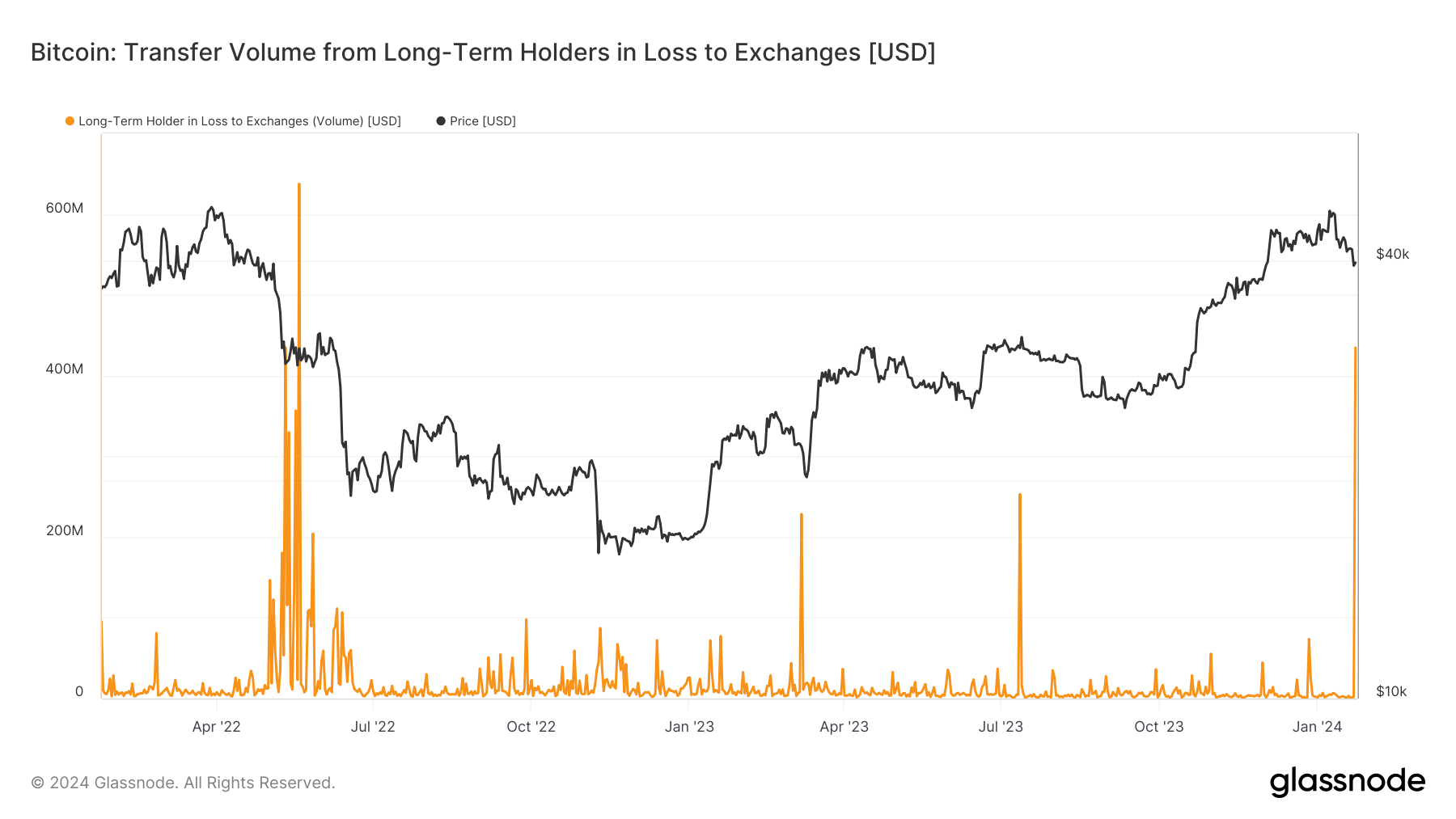

Long-term Bitcoin holders’ recent sell-off raises ghosts of past capitulations Long-term Bitcoin holders’ recent sell-off raises ghosts of past capitulations

Quick Take Bitcoin’s long-term holders (LTHs), those who have held for more than 155 days, have traditionally been perceived as the ‘smarter money’ due to their experience weathering Bitcoin volatility. Key to their strategy is buying Bitcoin during price slumps and offloading during market euphoria. However, observed recent trends hint at a shift. Data analysis

The post Long-term Bitcoin holders’ recent sell-off raises ghosts of past capitulations appeared first on CryptoSlate.

Grayscale sends 19,236 BTC to Coinbase, moves 8,000 BTC internally Grayscale sends 19,236 BTC to Coinbase, moves 8,000 BTC internally

As the Grayscale Bitcoin outflows continue, the fund today, Jan. 24, sent a further 19,236 BTC valued $754,782,168 at according to the current CF Benchmark Net York Variant Index rate of $39,238. According to Arkham Intelligence data this brings the total outflows from the fund to Coinbase Prime to 93,700 BTC ($3.68 billion) since Jan.

The post Grayscale sends 19,236 BTC to Coinbase, moves 8,000 BTC internally appeared first on CryptoSlate.