Categoria: Bitcoin

Por que a maioria das moedas de memes morre jovem

Meme coins are fun (and often funny), but most of them burn out fast rather than return fabled 1,000x gains. Here’s why.

Leia maisPolygon: pode o MATIC alcançar US$ 2 em meio ao aumento do Bitcoin para US$ 63.000? Polygon: Can MATIC Reach $2 Amid Bitcoin’s Rally to $63,000?

Polygon (MATIC), one of the most popular layer-2 scaling solutions for Ethereum, has recently caught the eye of crypto…

Leia maisSolana ultrapassa os 128 dólares: será que a SOL vai atingir os 200 dólares a seguir?

Solana has experienced notable growth in the DeFi, NFT, and Web3 markets since its inception in April 2019. Numerous…

Leia maisMais Bitcoin Tailwinds? Estes estressores bancários provavelmente levarão o BTC a US$ 100.000 More Bitcoin Tailwinds? These Banking Stressors Will Likely Take BTC To $100,000

Going by an analysis of one analyst on X, the Bitcoin rally is happening at a crucial time in the broader financial market. With the world’s first cryptocurrency marching closer to $70,000, it is not all rosy for banks in the United States, considering what’s to happen in the next few weeks. Late Q1 Through

Leia maisBitcoin está crescendo: Aqui estão os maiores ganhos de preço de um único dia do BTC na história Bitcoin Is Mooning: Here Are BTC’s Biggest Single-Day Price Gains in History

The price of BTC is nearing a new all-time high, jumping 6% from $59,831 to $63,585 yesterday.

Leia maisA BlackRock lidera a entrada recorde de 673 milhões de dólares em ETFs de Bitcoin em um único dia. BlackRock leads as Bitcoin ETFs hit record $673 million inflow in a single day

Quick Take Bitcoin Exchange-Traded Funds (ETFs) are witnessing a remarkable surge, setting a new record with the biggest day of inflows to date. Data from BitMEX shows a $673 million inflow in a single day, the equivalent of 11,122 Bitcoin. The spike in inflows signifies an increased interest in Bitcoin-backed financial products. BlackRock’s IBIT saw

The post BlackRock leads as Bitcoin ETFs hit record $673 million inflow in a single day appeared first on CryptoSlate.

Os especuladores de preços vêem a maior perda de um único dia de US $ 774 milhões YTD em meio à trajetória ascendente do Bitcoin Price speculators sees highest single-day loss of $774 million YTD amid Bitcoin upward trajectory

Speculators on crypto derivatives suffered significant losses in the past day, totaling around $774 million, marking the highest single-day loss of the year due to volatile market swings. Bitcoin, the bellwether digital asset, surged to its highest level since November 2021, surpassing the $63,000 mark in a remarkable rally. However, the euphoria was short-lived as

The post Price speculators sees highest single-day loss of $774 million YTD amid Bitcoin upward trajectory appeared first on CryptoSlate.

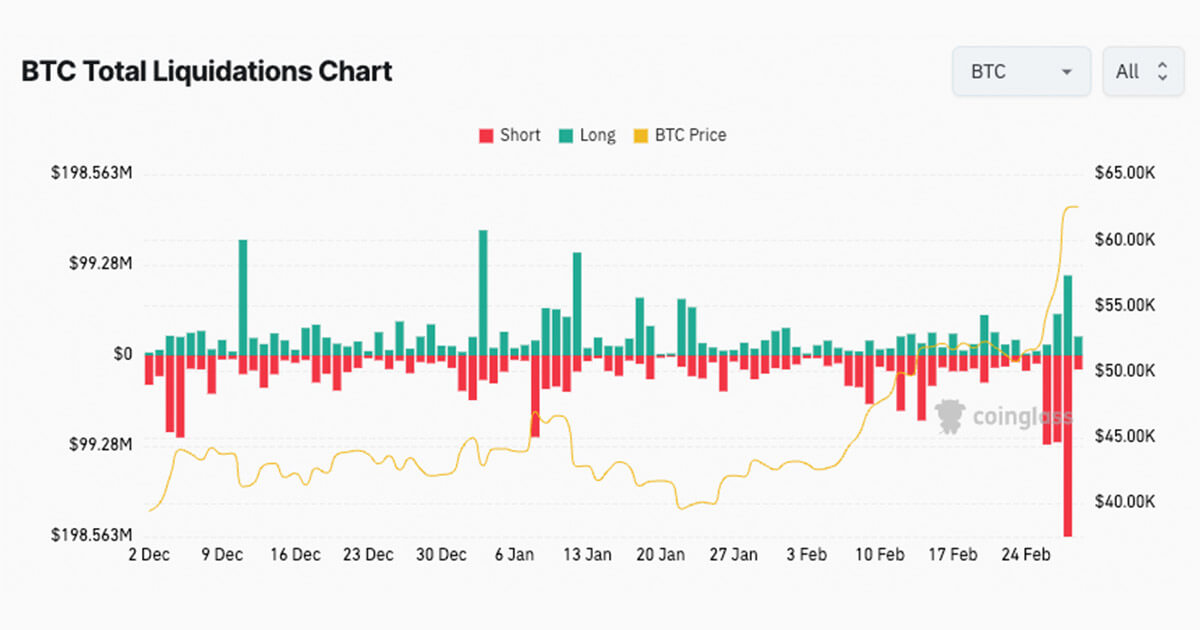

Bitcoin espera seis meses de sucesso em meio a US $ 300 milhões em liquidações de BTC Bitcoin eyes six-month winning streak amid $300 million in BTC liquidations

Quick Take In a wild 24-hour ride, Bitcoin’s value underwent a rollercoaster of fluctuations, skyrocketing to a peak of $64,000, subsequently plunging to $59,000, before making a recovery to above $60,000. This climb triggered a wave of liquidations, totaling roughly $800 million in the digital asset ecosystem, according to Coinglass. During Bitcoin’s ascent, short positions

The post Bitcoin eyes six-month winning streak amid $300 million in BTC liquidations appeared first on CryptoSlate.

Gemini faz um acordo para devolver todos os ativos ‘em espécie’ aos usuários do Earn em vez do equivalente em dólares histórico Gemini strikes deal to return all assets ‘in kind’ to Earn users instead of historic dollar equivalent

Crypto exchange Gemini said Earn users would receive “100% of their digital assets back in kind” following an in-principle agreement with bankrupt Genesis and other creditors of the failed lender, according to a Feb. 28 statement. The firm explained: “This means, for example, that if you had lent one bitcoin in the Earn program, you

The post Gemini strikes deal to return all assets ‘in kind’ to Earn users instead of historic dollar equivalent appeared first on CryptoSlate.

Newborn Nine atinge novo pico com US $ 6 bilhões no volume total de comércio Newborn Nine hits new peak with $6 billion in total trade volume

Quick Take Yesterday, Feb. 28, the newborn-nine spot Bitcoin ETFs doubled their trade volume record, with roughly $6 billion traded. BlackRock IBIT emerged as the frontrunner with $3.3 billion, followed by Fidelity with $1.4 billion. In addition, IBIT surpassed the Invesco QQQ ETF on its own, according to senior Bloomberg ETF analyst Eric Balchunas. The

The post Newborn Nine hits new peak with $6 billion in total trade volume appeared first on CryptoSlate.