Cheatsheet: MicroStrategy has now outperformed Nvidia this year

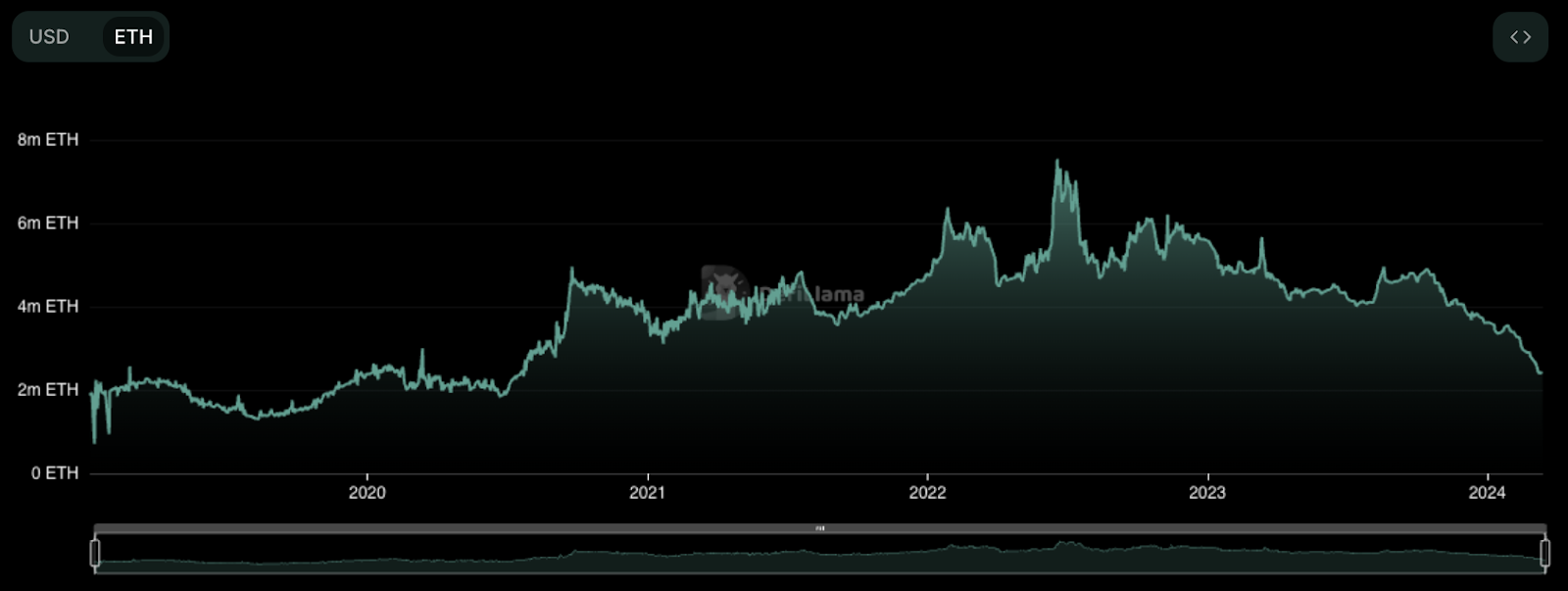

DeFi users appear to be eager for ether to reach all-time highs, as they exhibit signs of impatience. David Canellis wrote this information. March 13, 2024 08:19 am. The image from Sundry Photography/Shutterstock was edited by Blockworks. This is Cheatsheet, a guide to current events in the world of cryptocurrency. Bitcoin has just reached a new record high above $73,000, but it seems like all other cryptocurrencies are doing well too. Altcoins are performing better than memecoins, with several cryptocurrencies on different layer-1 networks outperforming dog tokens consistently. Toncoin (TON) has been the top performer in the top 100 for three days in a row, with a 21% increase in value. It has seen a significant increase of almost two-thirds in the past week and is now ranked as the 0003rd largest cryptocurrency by market cap, ahead of polygon (MATIC), chainlink (LINK) and tron (TRX). The trading bot BananaGun, powered by TON, continues to consume more ETH compared to Arbitrum and MetaMask on layer-2, indicating increased on-chain activity. THORChain (RUNE) has outperformed others in terms of weekly gains with a 16.4% increase in the past day and over doubling in value in seven days. The network is designed as a liquidity network for facilitating cross-chain token exchanges. Yesterday, THORChain recorded its highest daily trading volume ever at $639.6 million. Meanwhile, Bitcoin has increased by 1.5% and Ether has remained relatively stable, trading at $4,050, which is still 17% below its all-time high. The rising prices have led to DeFi’s total value locked (TVL) nearing levels not seen since the collapse of Terra, now exceeding $104 billion. However, it is important to note that Ethereum’s applications have experienced a decrease in the amount of ETH being held over the past month. This includes losses of approximately 80,000 ETH ($324.3 million) across various apps, with Layer-2s Arbitrum and Optimism seeing a decrease of nearly 15% in their ETH holdings (equivalent to about 205,000 ETH worth $830.5 million). Additionally, Maker, the protocol behind DAI, has seen a significant decrease of about 770,000 ETH ($3.11 billion), resulting in a 123% reduction in their ether holdings.