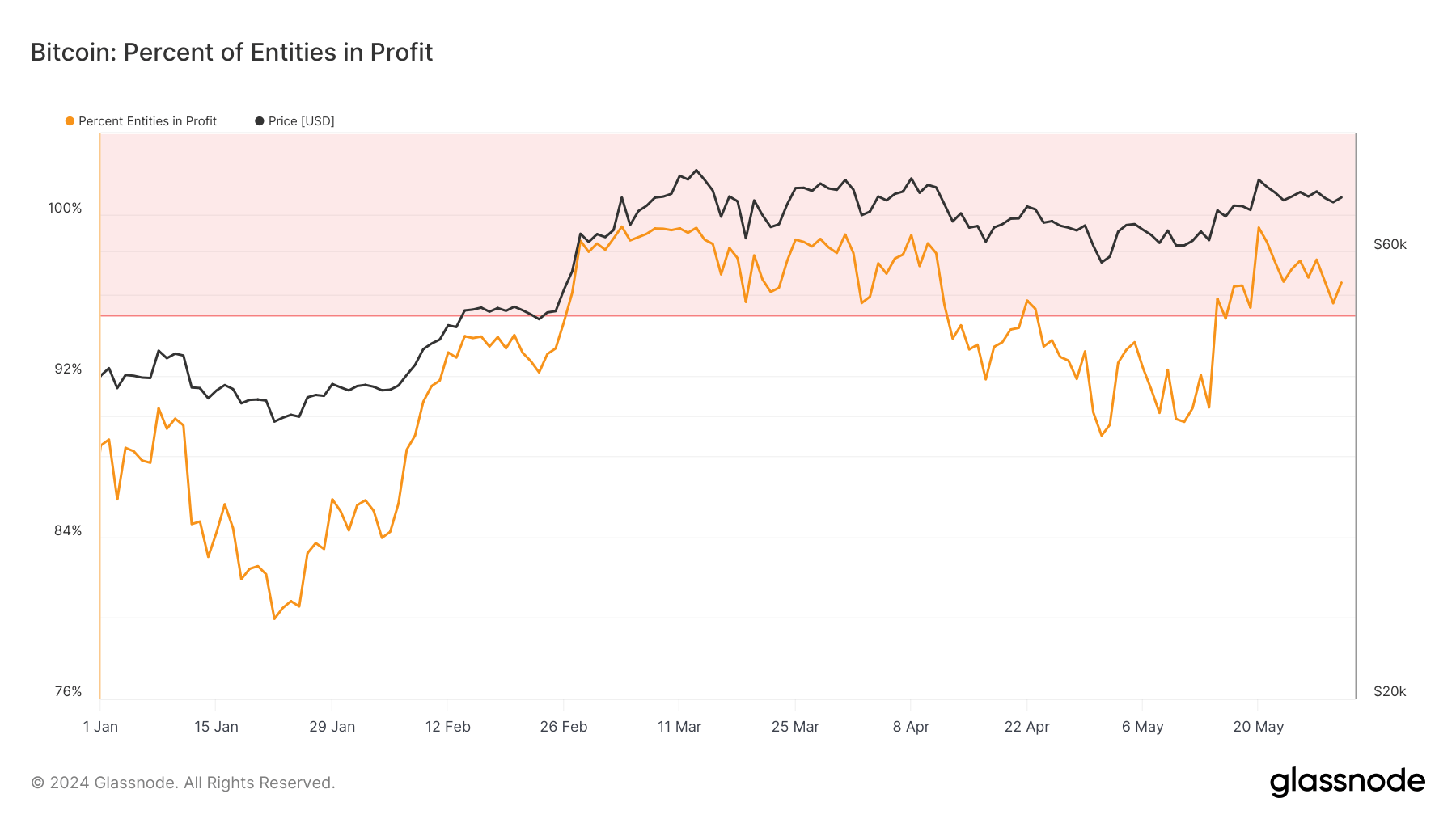

Despite fluctuations in the market, more than 90% of the current supply of Bitcoin continues to be profitable.

Definition: Onchain Highlights refers to the percentage of network entities currently experiencing a profit, calculated based on the Bitcoin purchased at a price lower than the current market value. The “Buy price” refers to the price at which coins were sent to addresses owned by the entity. CryptoSlate reports that despite market volatility, over 90% of Bitcoin supply remains profitable according to current market trends.

Meaning: The proportion of entities in the network that have purchased Bitcoin at a lower price than its current value and are currently making a profit. The “buy price” refers to the cost at which coins were sent to addresses controlled by a certain entity. Current market trends for Bitcoin show a complex relationship between price changes and the profitability of those holding the asset. Recent information from Glassnode shows that a large number of Bitcoin holders are still making a profit despite recent market ups and downs, with more than 90% of the supply being profitable as of May. This suggests that holders are holding onto their positions despite market fluctuations, which shows strong support for Bitcoin. Additionally, Bitcoin’s price movements in 2024 are similar to the volatile periods seen in previous years, especially in 2017. The asset has seen several large drops and increases, leading to a rollercoaster pattern of market activity. This fluctuation demonstrates the speculative nature of the market and emphasizes how external factors like regulatory changes and macroeconomic conditions can affect Bitcoin’s value. Percentage of entities currently making a profit: (Source: Glassnode). Data from Glassnode shows that the Bitcoin market is currently being supported by certain levels that are boosting the confidence of investors, despite the usual ups and downs. The stabilization of Bitcoin’s price at important support levels and the ongoing profitability of most investors indicate a solid foundation in the market that may help prevent major downturns and maintain stability in the future.