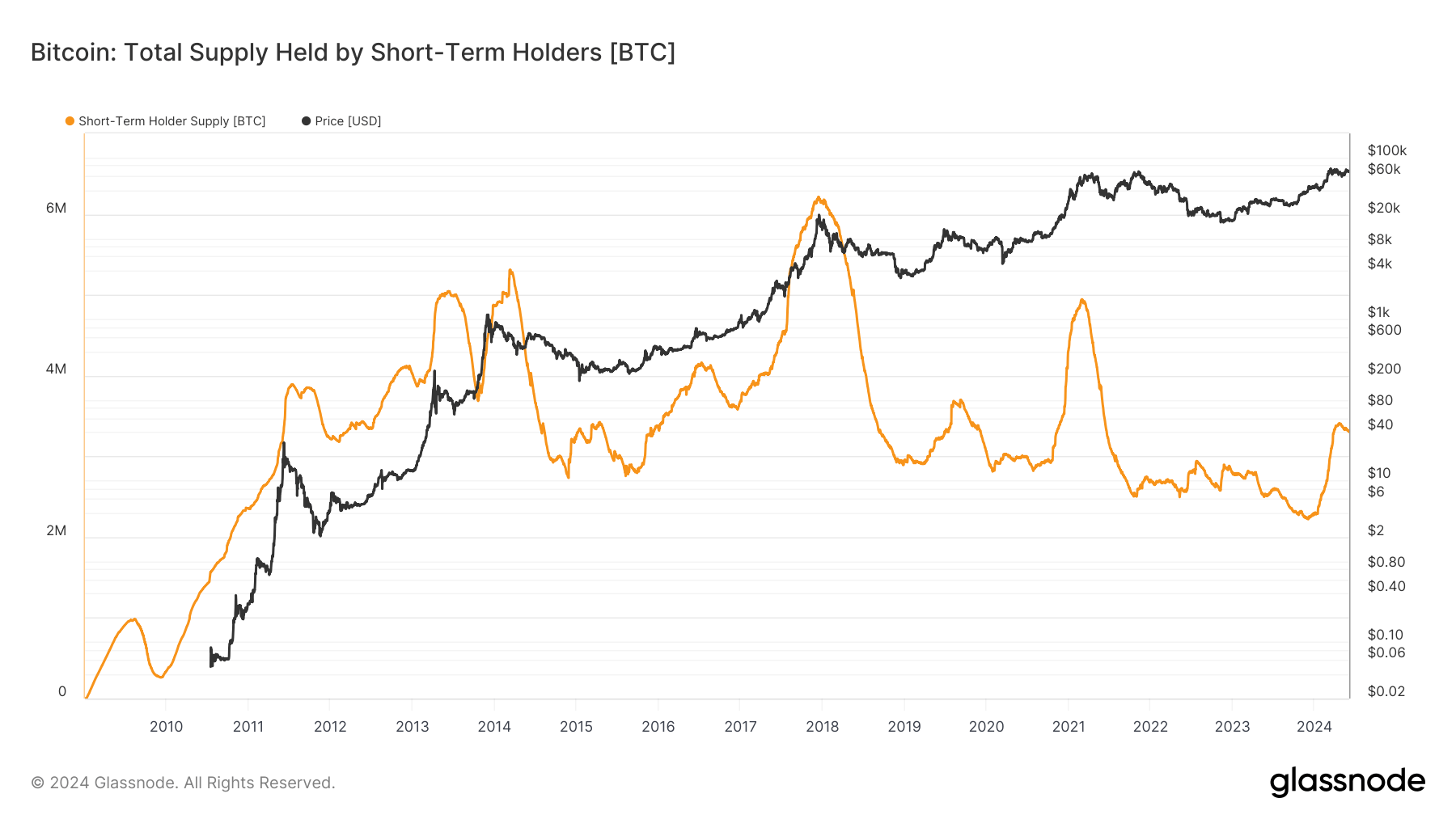

In the span of six months, short-term holders of Bitcoin have grown their holdings by more than 1 million BTC.

Definition: The overall amount of circulating supply held by short-term holders defines Onchain Highlights [BTC]. The distinction between long-term and short-term holders is based on when they made their average purchase, using a logistic function with a center point of 155 days. Recently, short-term holders of Bitcoin have increased their holdings by more than 1 million BTC within a six-month period.

The total supply of Bitcoin held by short-term holders refers to the overall circulating supply held by investors for a short duration of time. The concept of long-term and short-term holder supply is determined based on the average date of the entity’s purchases, using a logistic function with a center at 155 days and a width of 10 days. The amount of supply held by short-term holders is tracked by Glassnode. Information from Glassnode shows that there has been a notable increase in the holdings of short-term BTC holders, rising from 2.2 million BTC in January to more than 3.4 million BTC by mid-April. This trend highlights increased market involvement from investors who hold onto their investments for shorter periods of time, typically less than 155 days. However, since April, there has been a slight decrease to approximately 3.3 million. Importantly, this rise is consistent with overall historical trends and the behavior of investors when a bull market begins. Historically, individuals who hold Bitcoin for short periods of time have both taken advantage of and played a role in causing fluctuations in its price. For instance, in November 2023, short-term investors earned $1.8 billion in profits within a 48-hour timeframe, demonstrating their ability to quickly respond to changes in the market. Short-term holder supply saw an increase in 2019 before leveling off in anticipation of the 2021 bull run. The data on supply held by short-term holders comes from Glassnode.