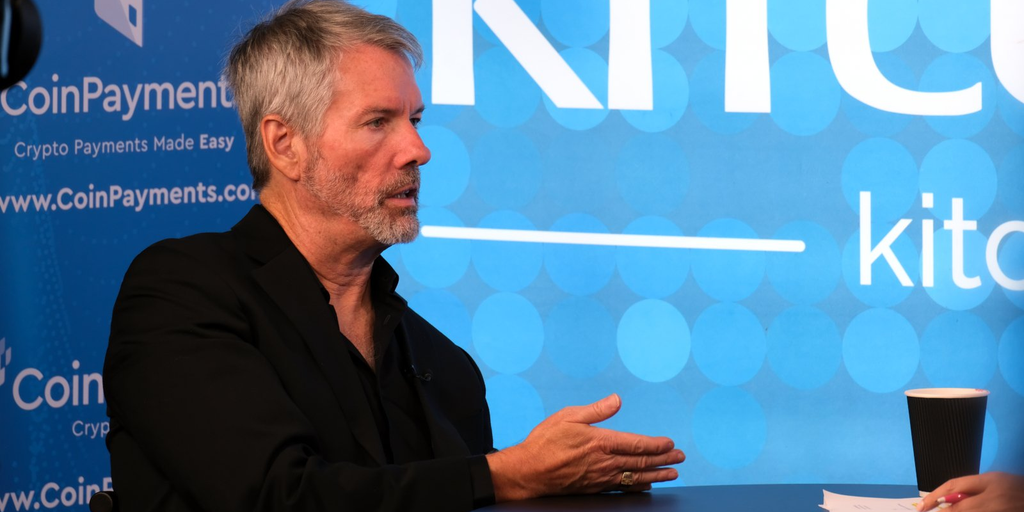

Michael Saylor Isn’t Selling: ‘Bitcoin Is the Exit Strategy’ Michael Saylor is holding onto his Bitcoin investments and views them as his way out of financial turmoil.

Michael Saylor, co-founder and chair of MicroStrategy, stated in a Bloomberg Television interview on Tuesday that the approval of spot Bitcoin ETFs has created an opportunity for institutional capital to enter the Bitcoin market, with demand exceeding supply. He expressed optimism, saying that this development will benefit all participants in the market. “Saylor told Bloomberg’s Katie Greifeld that MicroStrategy has an operating strategy for Bitcoin that involves leverage.” When analyzing the activity of spot ETFs, it is evident that they are enabling the digital evolution of financial assets. Every day, a significant amount of money is moving from the traditional analog world to the digital economy, totaling hundreds of millions of dollars. Gary Gensler, the chair of the U.S. Securities and Exchange Commission, mentioned to CNBC that the approval of Bitcoin ETFs does not mean they are endorsing the digital asset. Gensler stated that the SEC remains neutral on the merits of the investment. “This did not imply approval of Bitcoin itself, but rather guidance on how to trade it through Exchange Traded products.” MicroStrategy, a well-known owner of Bitcoin, has acquired more than 190,000 BTC, valued at approximately $10 billion. Saylor has not followed traditional methods in investing in Bitcoin with MicroStrategy, stating that he plans to keep buying regardless of market highs.