[#title_feedzy_rewrite]

Geoff Kendrick, head of digital assets research at Standard Chartered Bank, predicts Bitcoin could soar to $200,000 by the end of 2025, potentially reaching an all-time high. He ties this bullish outlook to growing concerns about the Federal Reserve’s independence and Bitcoin’s role as a hedge against risks in the traditional financial system. As economic uncertainties loom, this forecast highlights Bitcoin’s growing appeal in volatile markets.

A Hedge Against Financial Risks

Kendrick emphasizes Bitcoin’s decentralized ledger as a shield against vulnerabilities in centralized financial systems. Unlike traditional assets, Bitcoin operates independently of government or institutional control, making it a safe haven during crises.

According to Investing.com, the collapse of Silicon Valley Bank in March 2023 exemplified this, as Bitcoin rallied while TradFi assets faltered. Investors increasingly view Bitcoin as a buffer against systemic risks, particularly when trust in conventional institutions wanes. This unique positioning underpins Standard Chartered’s optimism about Bitcoin’s price trajectory.

Fed Independence and Treasury Bond Dynamics

Recent concerns about the Federal Reserve’s autonomy have fueled Bitcoin’s appeal. Former President Donald Trump’s remarks about potentially replacing Fed Chair Jerome Powell, who has resisted aggressive rate cuts, have raised fears of political interference. Such uncertainties amplify Bitcoin’s value as a decentralized asset.

Kendrick also points to the U.S. Treasury term premium, which hit a 12-year high in 2025, reflecting investor caution toward long-term Treasury bonds compared to short-term ones. Bitcoin has historically benefited from such yield disparities, as seen in its climb to a six-week high of $90,459, according to LSEG data.

Standard Chartered’s Bold Forecast

Standard Chartered’s $200,000 prediction for 2025 reflects confidence in Bitcoin’s long-term growth. Kendrick projects an even loftier target of $500,000 by 2028, driven by persistent macroeconomic uncertainties and eroding trust in centralized financial systems.

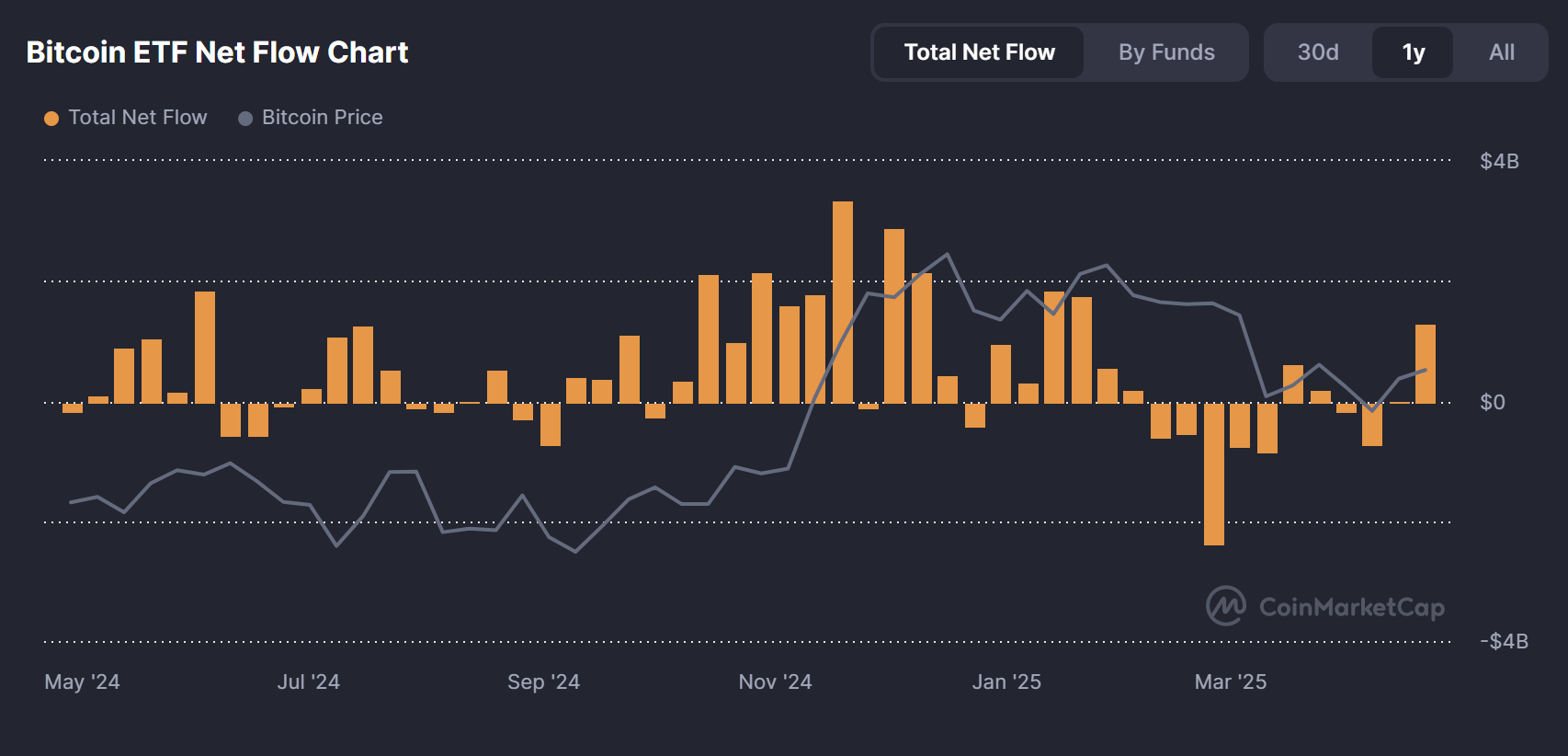

Market trends support this view with robust institutional demand and inflows into Bitcoin ETFs. As of April 22, 2025, the Bitcoin ETF net flow recorded a significant inflow of $912.70 million, with historical values showing $248.70 million over the last three months. Bitcoin has also surged to over $93,500, followed by the recovery of the whole crypto market.

Source: CoinMarketCap

These factors signal growing mainstream adoption, which could propel Bitcoin’s price higher. Still, the path to $200,000 hinges on sustained investor confidence and favorable economic conditions.

Despite the optimism, Bitcoin’s volatility cannot be ignored. Price predictions are inherently speculative, and external factors like regulatory crackdowns, shifts in monetary policy, or reduced institutional interest could derail Standard Chartered’s forecast. Investors must approach such projections with caution, conducting thorough research before making decisions. While Bitcoin’s decentralized nature offers resilience, its price remains sensitive to global economic and political developments.

The post Standard Chartered: Bitcoin Could Soar to $200,000 by 2025 appeared first on NFT Evening.