[#title_feedzy_rewrite]

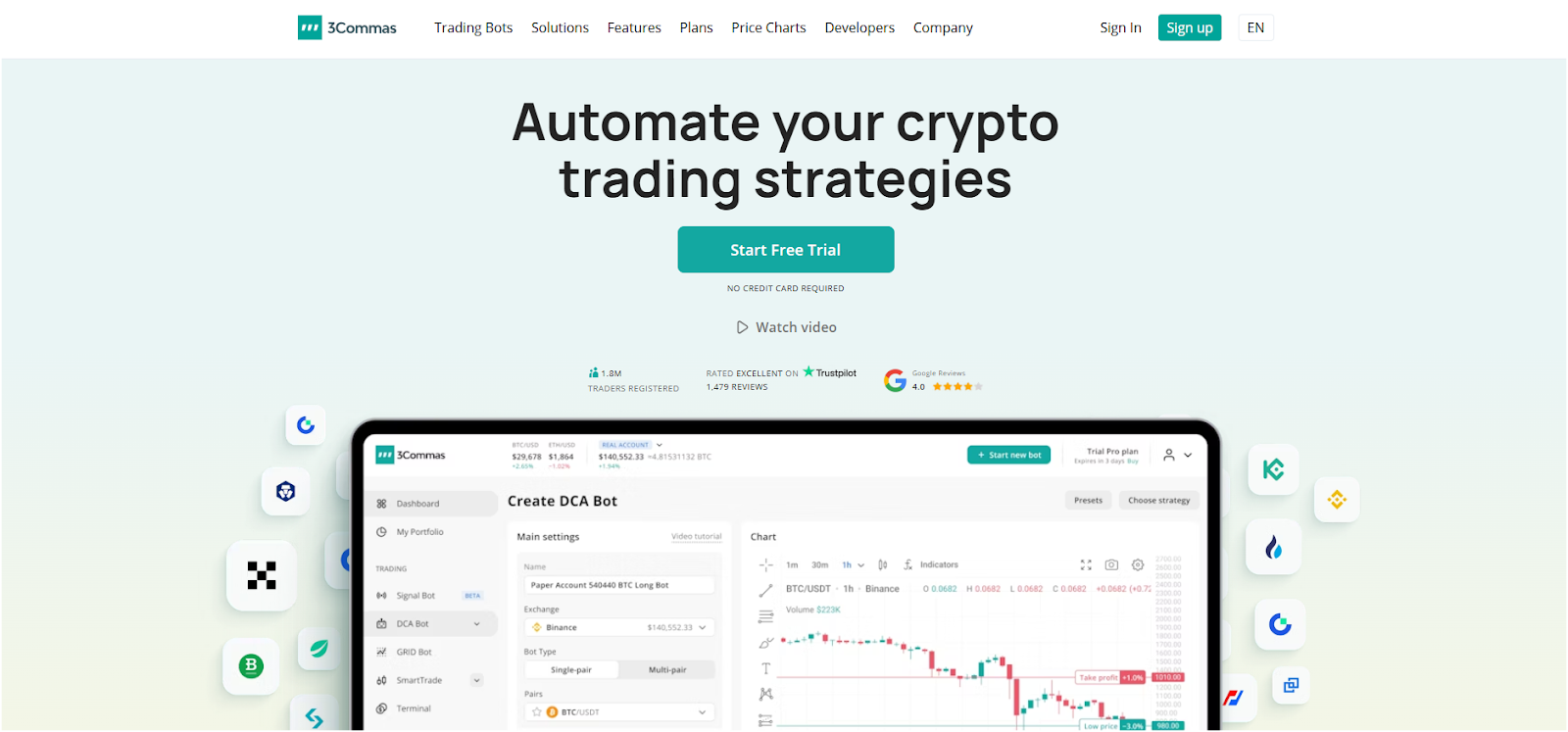

3Commas helps you trade coins like Bitcoin and Ethereum by using trading bots that work all day and night. You can connect it to popular exchanges like Binance or Coinbase and manage everything in one place. It’s great for beginners and experienced traders because it has automatic trading options and tools for manual trades too. Plus, you can track your portfolio and test ideas with a demo account.

This 3Commas review guide will explain its features, types of trading bots, pricing, supported crypto exchanges, usability, and how to use it to automate your trades.

3Commas Review: Summary

| Platform Type | Crypto trading bot platform |

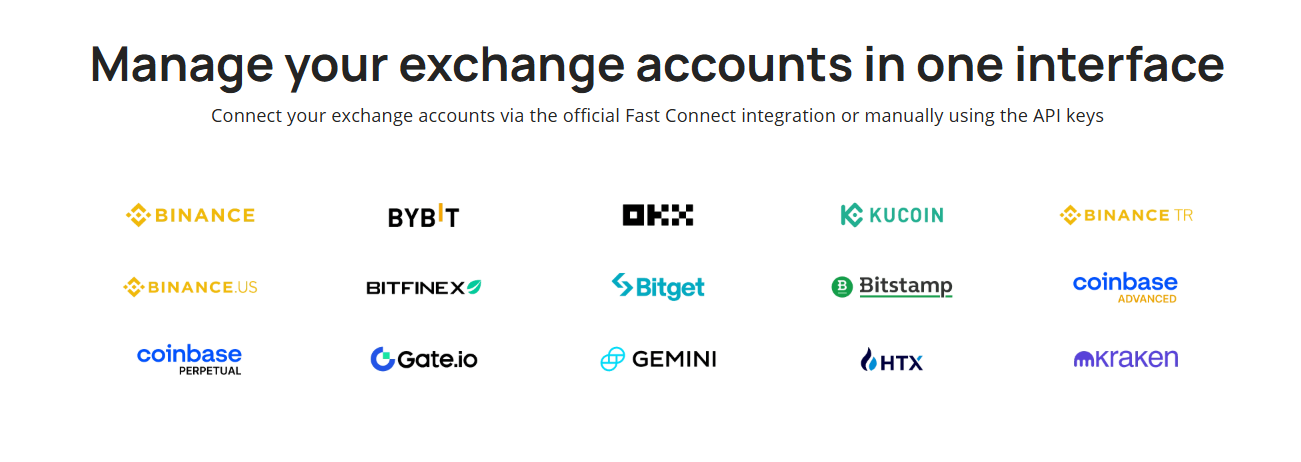

| Supported Exchanges | Binance, Coinbase, KuCoin, Bybit, and 14+ others |

| Key Features | DCA Bot, Grid Bot, Smart Trade, Signals Bot, TradingView Integrations |

| Automation | 24/7 trading bots |

| Manual Trading | Smart Trade (Stop Loss, Take Profit) |

| Portfolio Tracking | Multi-exchange dashboard, analytics |

| Demo Account | Yes |

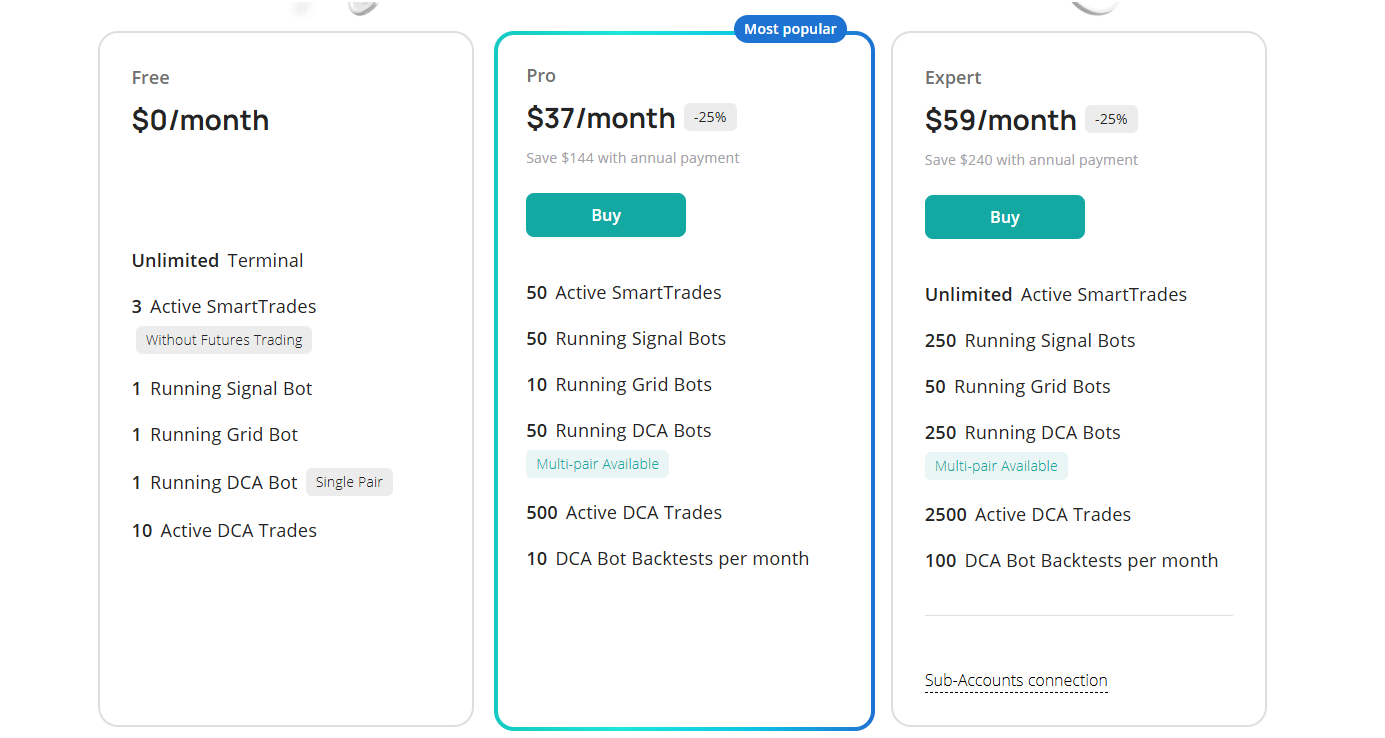

| Pricing | Free, $37/mo (Pro), $59/mo (Expert) |

| Payment Options | Credit card, PayPal, Crypto (BTC, USDT) |

| Security | Very High (Encrypted APIs, 2FA, IP whitelisting) |

| Customer Support | 24/7 Help Center, tickets, Telegram |

| Supported Cryptos | Depends on linked exchange pairs |

What is 3Commas?

3Commas is the best crypto trading bot platform that helps you trade digital coins like BTC and ETH. The platform is web-based and connects with popular exchanges like Binance, Coinbase, and KuCoin, so you can manage all your trades and portfolios in one place.

3Commas is best for its automated trading bots. These bots are tools that trade for you based on rules you set. They work 24/7, so you don’t have to watch the market all the time. The platform offers different bots, like the DCA bot, which buys coins slowly to avoid big price swings, and the Grid bot, which makes money when prices bounce up and down. You can tweak these bots to fit your style or copy strategies from top traders.

It is more than just bots, though. 3Commas provides a SmartTrade feature for manual trading. This feature lets you set stop-loss and take-profit orders to protect your money or lock in gains. The platform is also excellent for tracking your portfolio. You can see how your coins are doing across multiple crypto trading platforms with clear graphs and stats.

The platform is user-friendly with a clean dashboard. You start by signing up, linking your exchange accounts with API keys, and picking a plan. 3Commas has a free version with basic tools, but paid plans—starting at $37 a month—unlock more features like extra bots and signals. It is safe too; your funds stay on the exchange, and 3Commas can’t withdraw them.

Pros

- Easy Automation: You can set up bots to trade 24/7, saving you time. They follow your rules even when you’re not watching, which is great for busy schedules.

- Demo Account: You get a free practice mode to test bots without losing real money.

- Lots of Tools and Bots: Features like DCA Bot, Grid Bot, and Smart Trade give you options for different markets. You can pick what fits your style.

- Exchange Support: It works with big top crypto exchanges like Binance and Coinbase. You can manage all your trades in one place.

- Portfolio Tracking: You will see all your crypto holdings and profits clearly. It’s simple to check how you’re doing without extra work.

- Signal Options: You can use expert signals from the Marketplace or TradingView to start your crypto trading.

Cons

- Costs Money: The free plan is basic, and full features need a paid subscription—starting at $37 monthly which is costly for some users.

- Learning Curve: Setting up bots can confuse beginners. You need to watch tutorials to get it right.

- Signal Risks: Some Marketplace signals are bad, and you could lose cash if you pick a weak one. Research is key.

3Commas Key Features

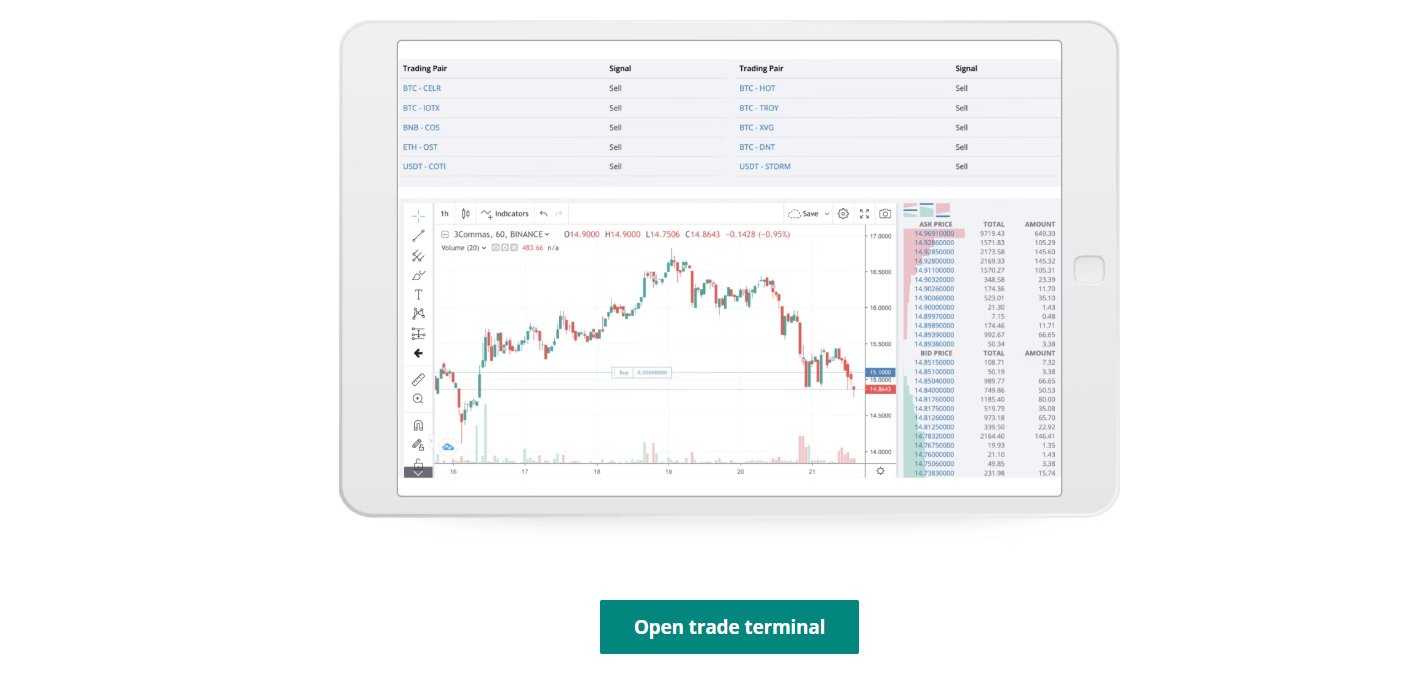

Smart Trade Terminal

The Smart Trade Terminal is designed to enhance manual trading on cryptocurrency exchanges. It provides traders with advanced tools to execute strategies that surpass the basic market and limit orders typically offered by exchanges. This terminal integrates with multiple exchanges via API keys and allows users to manage trades across platforms from a single interface.

Key features include the ability to set simultaneous Stop Loss and Take Profit orders. Stop Loss protects against losses by automatically closing a trade if the price drops to a specified level, while Take Profit secures profits by closing the trade when a target price is reached.

Advanced traders can also use Trailing Stop Loss and Trailing Take Profit, which adjust dynamically as the price moves, maximizing gains or minimizing losses without constant monitoring.

Another notable option is Split Targets, which allows users to sell portions of their holdings at different price levels—e.g., selling 50% at $10,000 and 25% at $11,000—optimizing profit-taking in volatile markets.

The terminal also supports TradingView charts. You can place orders manually or adjust them by dragging them on the chart. Additional features like Smart Cover help recover losses by selling at a higher price and repurchasing at a lower one during market dips.

Crypto Signals

Crypto Signals on 3Commas are actionable triggers that guide trading bots to buy or sell assets based on expert analysis or predefined conditions. These signals are taken from the 3Commas Marketplace. Here, signal providers offer subscription-based strategies.

The platform also supports free signals, though paid options typically promise higher quality due to their detailed development using technical indicators like RSI or MACD.

Trading signals serve as the “deal start condition” for bots. For instance, a provider might analyze historical market data and current trends to signal a buy when Bitcoin dips below a support level. Now, you can connect your exchange accounts via API, subscribe to a signal provider, and configure a bot to act on these signals automatically. The Marketplace displays performance metrics—such as real profit/loss percentages from other users’ trades.

Some users report consistent profits with reputable signals like CQS Scalping, while others caution against unreliable providers. Signals vary in risk levels—categorized as Stable (top 20% by Sharpe ratio) or Risky—helping users align them with their risk tolerance.

Demo Trading Account

The Demo Trading Account is a risk-free environment provided by 3Commas to help users practice trading strategies without using real funds. It simulates trading on the Binance Spot exchange, offering a virtual portfolio to test bots, manual trades, or signal-based strategies.

To use it, you need to create a 3Commas account and activate the demo mode and now this mode mirrors live market conditions. You can configure bots—like DCA or Grid—or experiment with Smart Trade settings, observing how these perform against real-time price movements.

The demo account supports all features, including TradingView integration and signal testing. The demo environment also aids in understanding market volatility’s impact on bot performance.

For example, a user might test a Grid Bot in a sideways market to see how it buys low and sells high. Results are tracked, providing insights into potential profitability.

TradingView Signals

TradingView is a leading technical analysis platform that offers over 100 indicators and allows users to create custom strategies using Pine Script. 3Commas connects to these via webhooks and enables bots to execute trades based on user-defined alerts.

To set this up, you need to select “TradingView Custom Signals” as a bot’s start condition, configure a webhook URL in TradingView, and define alerts—e.g., buying when an RSI crosses below 30. The bot then acts on these signals, supporting both Spot and Futures trading across exchanges like Binance and Bybit.

The integration supports multi-pair trading that monitors numerous assets for optimal opportunities. You can easily adjust order sizes, leverage, and safety orders.

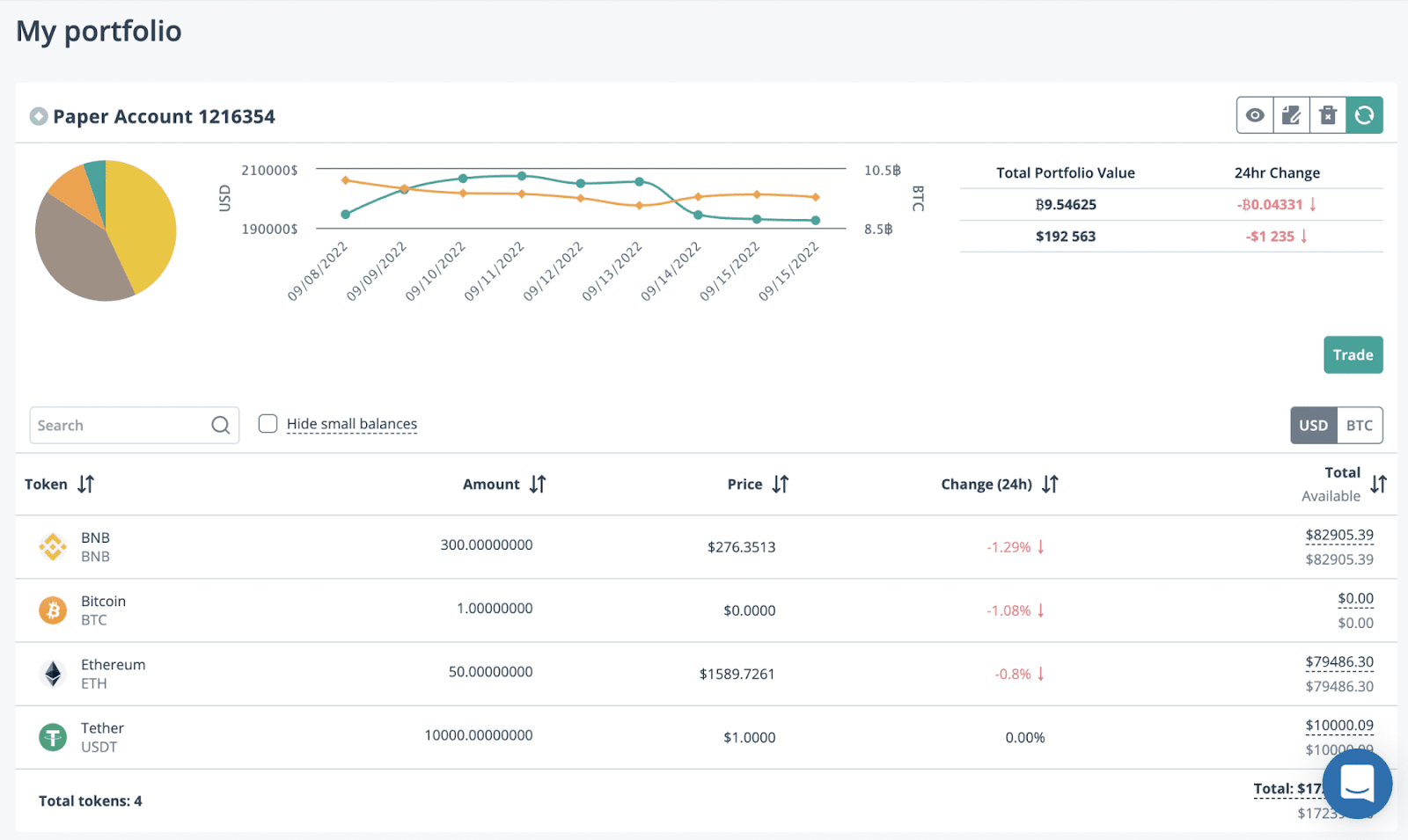

Portfolio Management

Portfolio Management on 3Commas allows you to track your cryptocurrency holdings across multiple exchanges and wallets from one dashboard. You can link exchange accounts via API or add external wallet addresses and gain a consolidated view of your assets, profits, and losses in real-time.

The interface displays detailed analytics, such as total portfolio value, individual asset performance, and historical trends. 3Commas bots can also rebalance your portfolios—e.g., maintaining a 70% crypto, 30% stablecoin split—by executing trades based on predefined rules.

Automated Trading With Bots

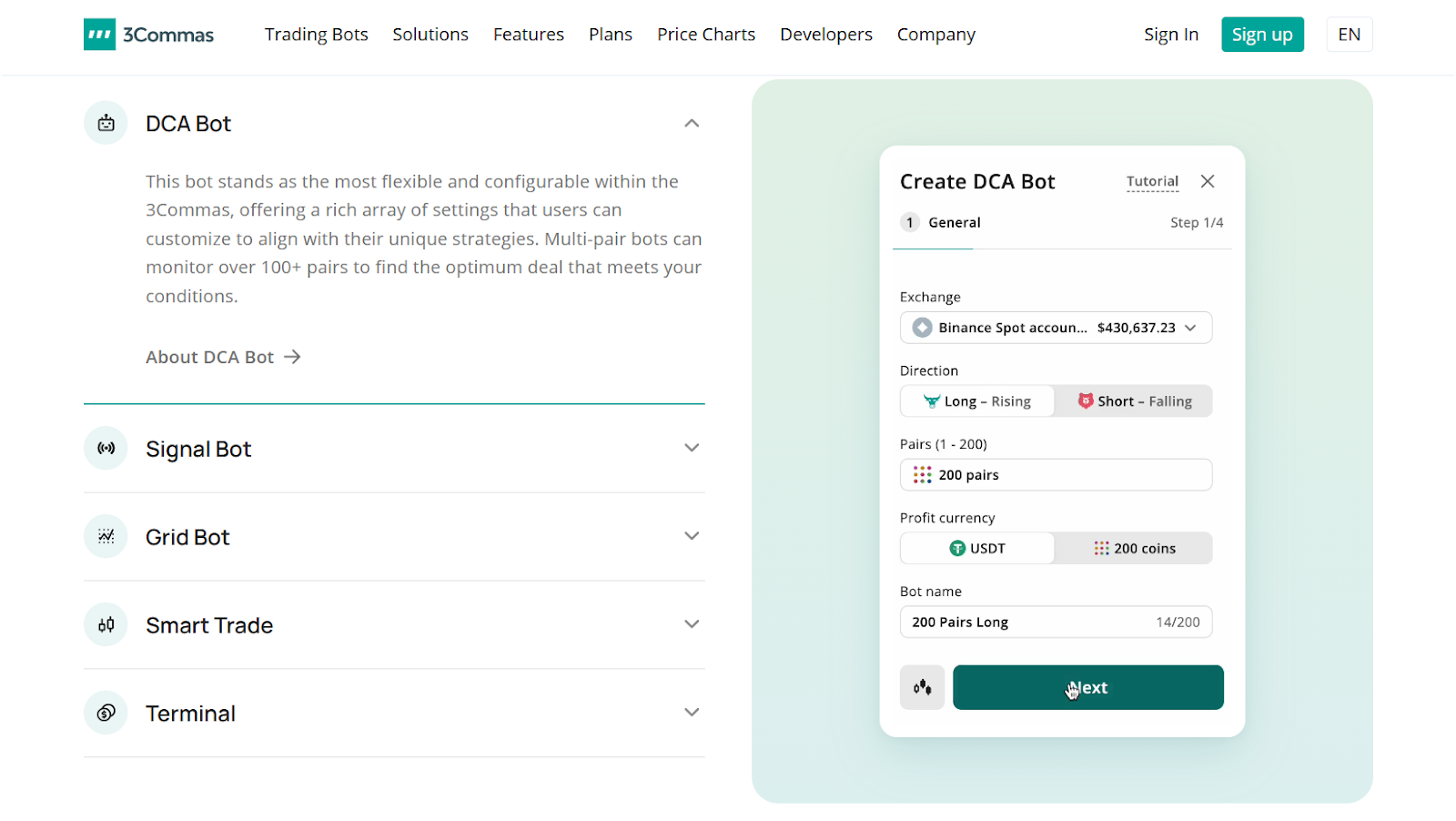

Signal Bot

The Signal Bot is a 3Commas tool that trades for you based on signals—tips from experts or tools telling you when to buy or sell. You must connect it to your exchange, pick a signal source, and let it run. Signals come from places like the 3Commas Marketplace or TradingView, where pros share their ideas. For example, a signal might say “Buy Ethereum now” if the price hits a certain point.

You have to set up the bot by choosing how much to trade and whether it’s for Spot or Futures markets. You can even decide if it does Long trades (buying low, selling high) or Short trades (selling high, buying low). You can tweak the bot too—like adding a Stop Loss to limit losses if the market crashes. It’s good for you if you trust others’ analysis but don’t want to trade manually.

DCA Bot

The DCA Bot uses Dollar-Cost Averaging to help you buy crypto smarter. DCA means you buy a little bit at a time, even if the price changes, to lower your risk.

Here’s how it works: if the price drops, the bot buys more at the lower price. If it keeps dropping, it buys again, spreading out your money. When the price goes up, it sells to make a profit. You can set a Take Profit target—like 3%—and a Stop Loss to protect yourself. You also pick how many extra buys it makes if the price falls, usually 3 to 5 times.

You can start it manually or use signals—like from TradingView—to tell it when to begin. It works on Spot trading and Futures trading, and you can adjust things like trade size or leverage.

Grid Bot

The Grid Trading Bot is made for markets that don’t move much—called sideways markets. You set it up by picking a coin and a price range—like $50 to $60 for a token. The bot then places buy and sell orders in that range, like a grid. If the price hits $51, it buys; if it hits $53, it sells. It keeps doing this to make small profits over and over.

You decide how many orders it places—say, 10 buys and 10 sells—and how much money it uses. The tighter your grid, the more trades it makes, but you need enough cash to cover all the orders. It’s automatic, so you don’t have to watch it all the time. It works best on Spot trading mostly.

3Commas Pricing

3Commas has clear pricing plans to fit different traders’ needs. It offers three main plans: Free, Pro, and Expert. Each one gives you access to tools like trading bots and portfolio tracking, but the features grow as you move up the tiers.

- Free Plan: The Free plan is exactly what it sounds like—zero cost. It is perfect for beginners who want to test the platform. You get basic portfolio tracking, one DCA bot (Dollar-Cost Averaging), one Grid bot, and access to 3 active smart trades. The platform limits you to one active deal at a time, though, so it’s not for high-volume traders. It is a solid way to start without spending a dime.

- $37/month: The Pro plan costs $37 per month if you pay yearly, or $49 monthly if you prefer flexibility. It is a step up, giving you 50 active smart trades, 50 DCA bots, and 10 Grid bots. You also get SmartTrade tools for manual trading with stop-loss and take-profit options.

- $59/month: The Advanced plan is priced at $59 per month with an annual payment or $79 monthly otherwise. It is built for traders who want more power. You get unlimited 250 DCA and 50 Grid bots, plus access to signals bots for advanced strategies. It also offers unlimited smart trades.

3Commas offers discounts if you pay yearly—up to 25% off compared to monthly billing. You can pay with credit cards, PayPal, or crypto like Bitcoin or USDT, but recurring payments aren’t available with crypto due to technical limits.

The platform also has a referral program: share a link, and your friends get 10% off their subscription while you earn 40% of their fees as a bonus. You can use that bonus for your own subscription or withdraw it to a USDT wallet once it hits $50.

3Commas Customer Support

3Commas provides solid 24/7 customer support to keep traders on track. The main support hub is the Help Center on their website. It is packed with articles, FAQs, and guides on everything from setting up bots to fixing API issues. You can search for answers there anytime, and it’s super handy for quick fixes.

The platform also has a ticket system—submit a request via email (support@3commas.io) or the site, and their team gets back to you. Most users say responses come within a few hours, though Expert plan users get priority, so they might see replies even faster.

3Commas is active on social media too. You can hit them up on Telegram, Twitter, or Facebook. Their Telegram group is especially lively, with staff and community members jumping in to help. It is more informal but works if you need a fast chat. The platform’s support team speaks English and Russian officially.

For bigger issues, like account security or payment glitches, the ticket system is your best bet. The platform doesn’t list a phone number, which some traders might miss, but the online options cover most bases. You also get a dedicated account manager if you’re on the Expert plan or a partner program.

3Commas Supported Cryptocurrencies

3Commas supports a large range of cryptocurrencies, but it depends on the exchanges you connect. The platform itself doesn’t hold your coins or limit what you trade—it links to your exchange accounts via API keys and trades whatever those platforms offer.

The best crypto exchanges like Binance, Coinbase Pro, and KuCoin are on the list. Binance alone offers over 350 trading pairs, including majors like Bitcoin (BTC), Ethereum (ETH), and Tether (USDT), plus altcoins like Cardano (ADA) and Solana (SOL). Other exchanges like Bybit and OKX add futures trading, where you can use bots on BTC, ETH, and top altcoins with leverage. The platform also works with Gate.io, which has over 1,700 pairs. The platform lets you pick any pair your exchange supports for bots or manual trades.

3Commas Design and Usability

3Commas is built to be easy on the eyes and simple to use, even if you’re new to trading. The platform’s design is clean and modern, with a web-based dashboard you can access from any browser. It also has mobile apps for iOS and Android, so you can trade on the go.

The dashboard is where it all happens. It is split into sections like Portfolio, Bots, SmartTrade, and Marketplace, all laid out on the left sidebar. You click what you need, and the main screen updates fast. The platform uses a dark theme by default, which is easy on the eyes, especially if you’re staring at charts all day. You can switch to light mode if that’s your vibe, though. Everything’s labeled clearly, so you won’t get lost.

Setting up is also easy for beginners. You just need to sign up with an email and link your crypto exchange accounts with API keys. The Bots section lets you create DCA or Grid bots with a few clicks and you can pick your pair, set your budget, and hit start. It is very straightforward, but advanced users can also use detailed settings like safety orders or trailing stops.

The mobile apps mirror the web version. You get the same layout, of course, just scaled down. You can check your entire portfolio, change bot settings, or place trades from your phone. It is very smooth and with no major bugs reported lately. The platform’s Portfolio tab shows your balances across multiple exchanges with graphs and stats and you can easily track your wins and losses.

3Commas Security: Is it Safe to Use?

The top 3Commas security measures are encrypted API keys, sign center protection, IP whitelisting, fast connect with OAuth, 2FA, Cloudflare partnership, API disabling after password reset, strong password recommendations, web application firewall, DDoS attack protection, and SSL/TLS encryption.

- Encrypted API Keys: 3Commas uses encrypted API keys to link with your exchange accounts. This setup lets the platform place trades but blocks it from moving your funds or seeing your exchange password. It keeps your funds secure where they’re held on the exchange.

- Sign Center Protection: The platform includes a Sign Center to store API keys safely. It’s a separate system that only signs trade requests when you approve them. This design stops hackers from snagging your keys even if they breach other parts of the platform.

- IP Whitelisting: 3Commas supports IP whitelisting for extra security. You can set it so only specific IP addresses you trust can use your API keys. It prevents strangers from accessing your account from random locations.

- Fast Connect with OAuth: Fast Connect is an option for exchanges like Binance and OKX. It links your account without you typing in API keys manually.

- Two-factor authentication (2FA): 3Commas pushes you to enable two-factor authentication. You enter a code from your phone or app alongside your password to log in. It makes breaking into your account super tough for anyone without your device.

- Cloudflare Partnership: 3Commas teams up with Cloudflare to strengthen its defenses. This service adds firewalls and shields against online attacks like DDoS. It keeps the platform stable and safe from threats trying to crash it.

- API Disabling After Password Reset: The platform cuts off API connections if you reset your password. This stops any sneaky trades if someone messes with your account. It gives you time to fix things without risking your funds.

- Strong Password Recommendations: 3Commas tells you to use strong, unique passwords for your account. A hard-to-guess password that’s not reused elsewhere lowers your hack risk. You can rely on a password manager to keep it safe and easy to remember.

- Web Application Firewall: It uses a Web Application Firewall (WAF) to protect its platform. It filters out harmful traffic and blocks attacks aimed at exploiting website weaknesses.

- DDoS Attack Protection: 3Commas has DDoS attack protection to keep services running smoothly. It stops attackers from overwhelming the platform with fake traffic. This ensures you can trade without interruptions from online floods.

- SSL/TLS Encryption Between Visitors and Origin Servers: 3Commas applies SSL/TLS encryption for all connections between you and its servers. It scrambles data so no one can spy on your info during trades. The platform keeps your details private and secure every time you log in.

How to Use 3Commas?

Step 1: Create a 3Commas Account

First, you need to sign up for 3Commas. Go to their official website, 3commas.io, and click “Sign Up” at the top. You’ll see a form asking for your email and a password. Type in your email—like john@gmail.com—and pick a strong password with letters and numbers.

Hit “Sign Up,” and they’ll send you a confirmation email. Open your inbox, find the email, and click the link to verify your account. Once verified, log in with your email and password. You now have a free Basic account, which lets you try some features.

Step 2: Connect Your Exchange

Next, you link 3Commas to your crypto exchange, like Binance or Coinbase. Log into 3Commas, click “My Exchanges” on the left, and then “Connect an Exchange.”

Pick your exchange from the list—say, Binance—and you’ll need API keys. Go to Binance, login, and find “API Management” under your profile. Create a new key, name it “3Commas,” and enable trading but not withdrawals for safety. Copy the API Key and Secret Key.

Back in 3Commas, paste these into the boxes and click “Connect.” It links up fast, letting your bot trade on your exchange account without giving 3Commas your money.

Step 3: Set Up a Trading Bot

Now, you pick and set up a bot. From the 3Commas dashboard, click “DCA Bot” or “Grid Bot” under the “Bots” section. Let’s say you choose DCA Bot. Click “Create Bot,” pick your exchange (like Binance), and select a trading pair—like BTC/USDT.

Decide how much money to use, maybe $100, and set a Take Profit goal, like 3%. You can also add a Stop Loss at -5% to limit losses. Choose a signal to start—like a price drop—or start it manually. Hit “Create,” and your bot begins trading based on your rules.

Step 4: Monitor and Adjust Your Trades

Finally, you keep an eye on your bot and tweak it. Go to the “Bots” tab to see your active bots. It shows your profits, losses, and trades in real-time. If your DCA Bot isn’t making money—like if the market’s flat—you can pause it by clicking “Disable.” Adjust settings—like raising Take Profit to 5%—and save changes.

Use the “Portfolio” tab to check all your holdings across exchanges. You can also try the Demo Account to test new ideas without risk. This step keeps your trading smart and safe.

Alternatives to 3Commas Comparison

The best 3Commas alternatives are HassBot, Cryptohopper, and Bitsgap. Here is a quick 3Commas vs Cryptohopper, 3Commas vs Bitsgap, and 3Commas vs HassBot review:

| 3Commas | HaasBot | Cryptohopper | Bitsgap | |

| Automation | DCA, Grid, Signal | Trade Bot, Manual Scripts | Copy Bot, DCA, Strategy Designer | Grid, DCA, Combo Bot, Loop Bot |

| Cost | $39/month | $99/3 months | $24/month | $22/month |

| Exchange Support | 14 | 21 | 13 | 15+ |

| Demo Account | Yes | Yes | Yes | Yes |

| Signal Options | Marketplace, TradingView | Custom HaasScript | Pro, DIY | Basic |

| Portfolio Tracking | Yes | Yes | Yes | Yes |

Conclusions

To sum up our 3Commas trading bot review, it makes crypto trading easier and smarter for you. You can use tools like the DCA Bot, Grid Bot, and Smart Trade and you can perform automated trading strategies and save time. It connects to your cryptocurrency exchanges, tracks your portfolio, and offers a demo account to practice safely.

You’ll need to learn a bit to set it up, and paid plans start at $37 monthly for full features. It’s not a guaranteed money-maker and success depends on your strategy and the market. Overall, 3Commas is a great tool if you want control and automation in your trading journey.

FAQs

Is the 3Commas bot legit?

Yes, 3Commas bot is legit. It’s a real platform used by thousands since 2017, registered in Estonia, and partners with trusted exchanges like Binance. You need to connect it with API keys, and it doesn’t withdraw your digital assets—trades happen on your exchange account only. It’s safe if you use strong passwords and two-factor authentication. Our research shows it’s a solid company, not a fake one, so you can trust it works as promised.

Is 3Commas profitable?

3Commas bot trading can be profitable, but it’s not guaranteed. Profit depends on your strategy, market conditions, and settings. The DCA Bot or Grid Bot can make money, like 1-5% per trade, if you set them upright. Data from 3Commas’ Marketplace shows signal profits vary—some hit 20% monthly, others flop. You need to test and tweak your bots, not just turn them on.

Is 3Commas good for beginners?

Yes, it’s good for beginners with some effort. It has a Demo Account where you practice without real money, which helps you learn. The interface is simple, and Smart Trade makes manual trading easy. Tutorials and customer support are there, so you can figure it out. It’s not super hard, but you need to watch some videos or read guides to start.

Is 3Commas free?

No, 3Commas is not fully free, but it has a free tier. You get a Basic plan for free with limited stuff—like one DCA Bot, one Grid Bot, and Portfolio tracking. Full features, like more Signal Bots or more grids, need a paid plan, starting at $37 monthly with a yearly deal.

How much money can you make with a crypto bot?

You can make 0-20% monthly or even higher, but it varies a lot. Profits depend on your bot, market, and cash. A Grid Bot might earn 1-3% in a flat market, while a DCA Bot could hit 10% in a dip. 3Commas’ data says top signals reach 20%, but most average less. You won’t get rich quick—it’s not certain. Your strategy and timing matter more than the bot itself, so don’t expect millions without a solid plan.

How to connect 3Commas to Binance?

You can connect 3Commas to Binance using API keys. First, log into Binance, go to API Management, and create a key—give it a name and enable trading, but not withdrawals for safety. Copy the API key and Secret key. Then, in 3Commas, go to “My Exchanges,” click “Connect an exchange,” pick Binance, and paste those keys. Save it, and you’re linked.

The post 3Commas Review 2025: Pros & Cons, Features, Pricing, and More appeared first on NFT Evening.