[#title_feedzy_rewrite]

U.S. spot Bitcoin ETFs have recorded inflows for 4 straight days, signaling renewed investor confidence. With two days surpassing $900 million in net inflows, the market is buzzing with optimism. But is this a true recovery or just a temporary surge? Let’s explore the data and factors driving this trend.

Bitcoin ETFs Record Consecutive Inflows

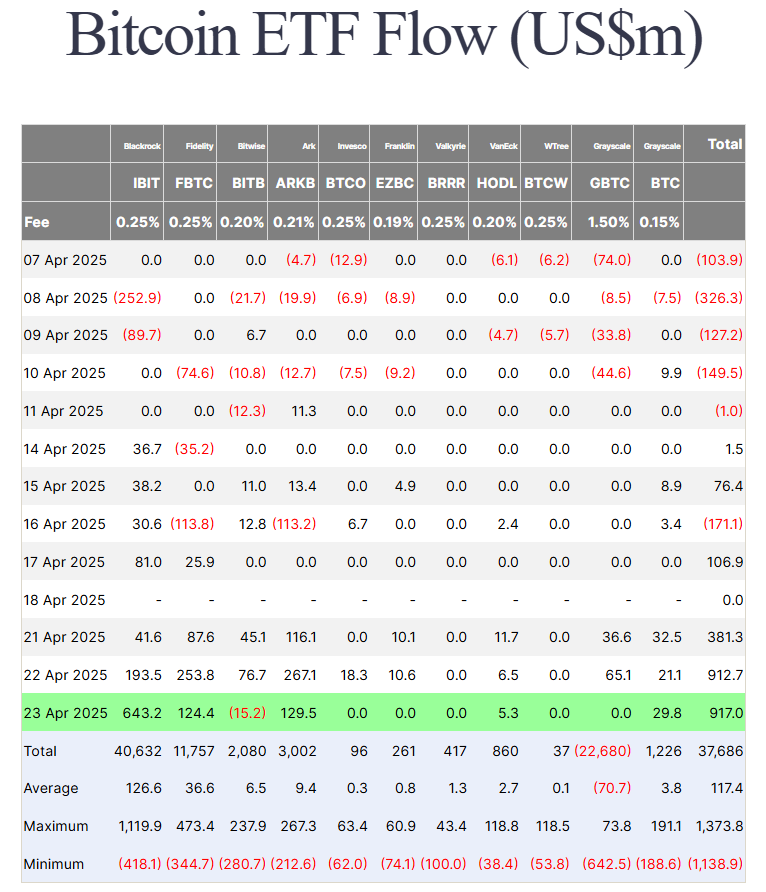

Over the past 4 days, U.S. spot Bitcoin ETFs have seen consistent net inflows, with total inflows reaching approximately $963.55 million. Notably, 2 consecutive days—Tuesday and Wednesday—witnessed massive inflows of $912 million and $917 million, respectively, marking the highest single-day inflows since President Donald Trump’s inauguration.

Source: Farside Investors

Leading ETFs like BlackRock’s iShares Bitcoin Trust (IBIT), Fidelity’s FBTC, and ARK 21Shares’ ARKB have driven this surge, with IBIT alone recording $193 million in inflows on Tuesday and over $4 billion in trading volume. As of today, April 24, 2025, Bitcoin ETFs continued to have positive flows, with estimates of $936.43 million in net inflows for Wednesday, reinforcing the bullish sentiment. This streak follows a volatile period of outflows, making the current momentum particularly significant.

Is the Market Truly Recovering?

Recent developments point to a potential recovery in the BTC market, driven by high-profile events and shifting economic dynamics.

On April 23, 2025, President Donald Trump announced a potential reduction in U.S. tariffs on Chinese goods, easing earlier market fears of a steep 145% rate. This development, part of ongoing U.S.-China trade negotiations, has reduced economic uncertainty, creating a more favorable environment for risk assets like Bitcoin.

Additionally, Trump clarified that he has no intention of firing Federal Reserve Chairman Jerome Powell, despite prior criticisms, signaling stability in U.S. monetary policy. His continued push for a Strategic Bitcoin Reserve, emphasized during the March 7 White House Crypto Summit, has further bolstered institutional confidence, driving robust inflows into Bitcoin ETFs. Macroeconomic factors, such as a weakening U.S. Dollar Index and anticipated Federal Reserve rate cuts in mid-2025, enhance Bitcoin’s appeal as an inflation hedge.

Read more: Market Turns Bullish Following Trump’s China and Powell Remarks

However, challenges persist. Ongoing concerns about Trump’s proposed trade policies and persistent inflationary pressures could lead to volatility. The market’s recovery depends on sustained ETF inflows, broader institutional adoption, and clarity in U.S. crypto regulations. Investors should closely monitor these evolving dynamics to assess the longevity of this bullish trend.

The four-day inflow streak in Bitcoin ETFs, coupled with strong daily flows, points to a potential market recovery. Trump’s supportive rhetoric and favorable macroeconomic shifts are key drivers, but volatility and policy uncertainties linger. Investors should monitor ETF flows and global economic trends to gauge whether this bullish trend will persist.

The post Bitcoin ETFs See 4 Days of Inflows – Is the Market Recovering? appeared first on NFT Evening.