[#title_feedzy_rewrite]

Maple Finance (SYRUP) and Kamino Finance (KMNO) will be the next Seed Tags projects being listed on Binance.

Listing Details

- Trading pairs: KMNO/USDT, KMNO/USDC SYRUP/USDT and SYRUP/USDC

- Listing date: 2025-05-06 15:00 (UTC)

- Withdrawal open at: 2025-05-07 15:00 (UTC)

Token Details

SYRUP

- Contracts: 0x643C4E15d7d62Ad0aBeC4a9BD4b001aA3Ef52d66 (Ethereum) & 0x688AEe022AA544f150678B8E5720b6b96a9E9a2F (Base)

- Total Supply: 1.15B SYRUP

Token Allocation:

- Seed Investors, Team, and Advisors: 51% of the total supply, subject to a 24-month linear vesting schedule.

- Treasury: 14% allocated to the Maple Treasury for protocol development and ecosystem growth.

- Public Sale: 5% sold during a public auction to foster community involvement.

- Liquidity Mining Incentives: 30% designated to reward participants who provide liquidity and support the platform’s operations.

KMNO

- Contracts: KMNo3nJsBXfcpJTVhZcXLW7RmTwTt4GVFE7suUBo9sS (Solana)

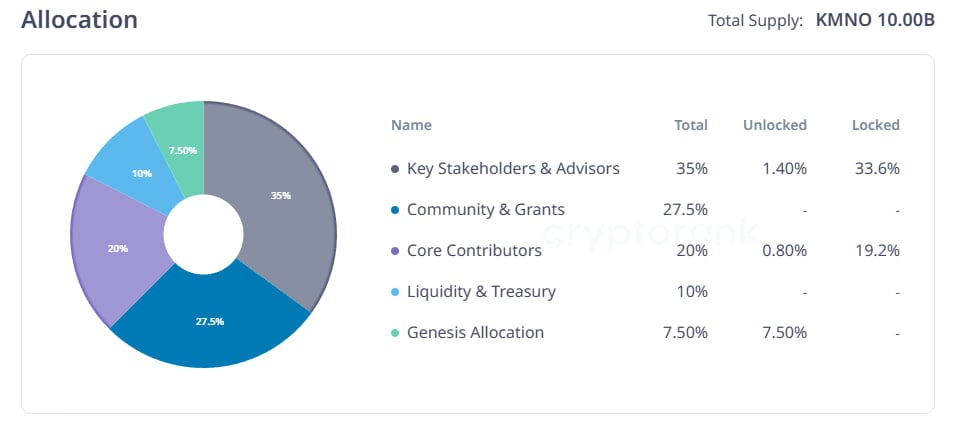

- Token Supply: 10B KMNO

Token Allocation:

- Community Incentives: 35% (3.5 billion tokens) allocated for growth initiatives, including builder grants, user rewards, and community incentives, managed by the Kamino Treasury.

- Team & Advisors: 35% (3.5 billion tokens) reserved for key stakeholders and advisors, locked for 12 months, vesting linearly over 24 months.

- Core Contributors: 20% (2 billion tokens) allocated to the core team (product, engineering, risk management, operations), locked for 12 months, vesting linearly over 24 months.

- Liquidity Provision: 10% (1 billion tokens) designated for growing liquidity across various venues (e.g., DEXs like Orca, Raydium, Meteora) throughout the token’s lifecycle.

- Initial Community Airdrop (KMNO Genesis): 7.5% (750 million tokens) distributed to early users based on Kamino Points snapshot taken on March 31, 2024.

Source: Cryptorank

About Maple Finance (SYRUP)

Maple Finance is a DeFi protocol focused on institutional lending, providing undercollateralized loans to vetted borrowers such as market makers, hedge funds, and crypto institutions. It operates on Ethereum and Solana, offering fixed-rate, short-duration lending pools with yields typically around 10-12% APY. The protocol emphasizes transparency, compliance (KYC/AML), and risk management, distinguishing it from retail-focused DeFi platforms.

SYRUP is the native governance and utility token of Maple Finance and its retail-oriented sister protocol, Syrup.fi. SYRUP is a rebranded token from MPL.

Social Accounts:

About Kamino Finance (KMNO)

What is Kamino finance (KMNO) Kamino Finance is a DeFi protocol built on the Solana blockchain, offering a suite of automated, capital-efficient financial products, including lending, borrowing, leveraged yield farming, and liquidity provision. It aims to simplify DeFi for both retail and advanced users by providing user-friendly tools like Automated Liquidity Vaults, K-Lend, Multiply (up to 5x leverage), and Long/Short strategies. Kamino is a leading DeFi protocol on Solana, with $2.17 billion in total value locked (TVL) and $30,000 in average daily revenue as of Q1 2025, as per DeFiLlama.

KMNO is the native governance and utility token of Kamino Finance. It incentivizes user participation, governs the protocol, and enhances liquidity across DeFi ecosystems.

Social accounts:

The post Maple (SYRUP) and Kamino (KMNO) will be Listed on Binance appeared first on NFT Evening.