[#title_feedzy_rewrite]

Will Bitcoin’s $100K milestone trigger another sell-off? Explore past trends, current market signals, and altcoin impacts in this BTC price prediction article. Stay prepared with key trading insights.

$100k as a psychological barrier

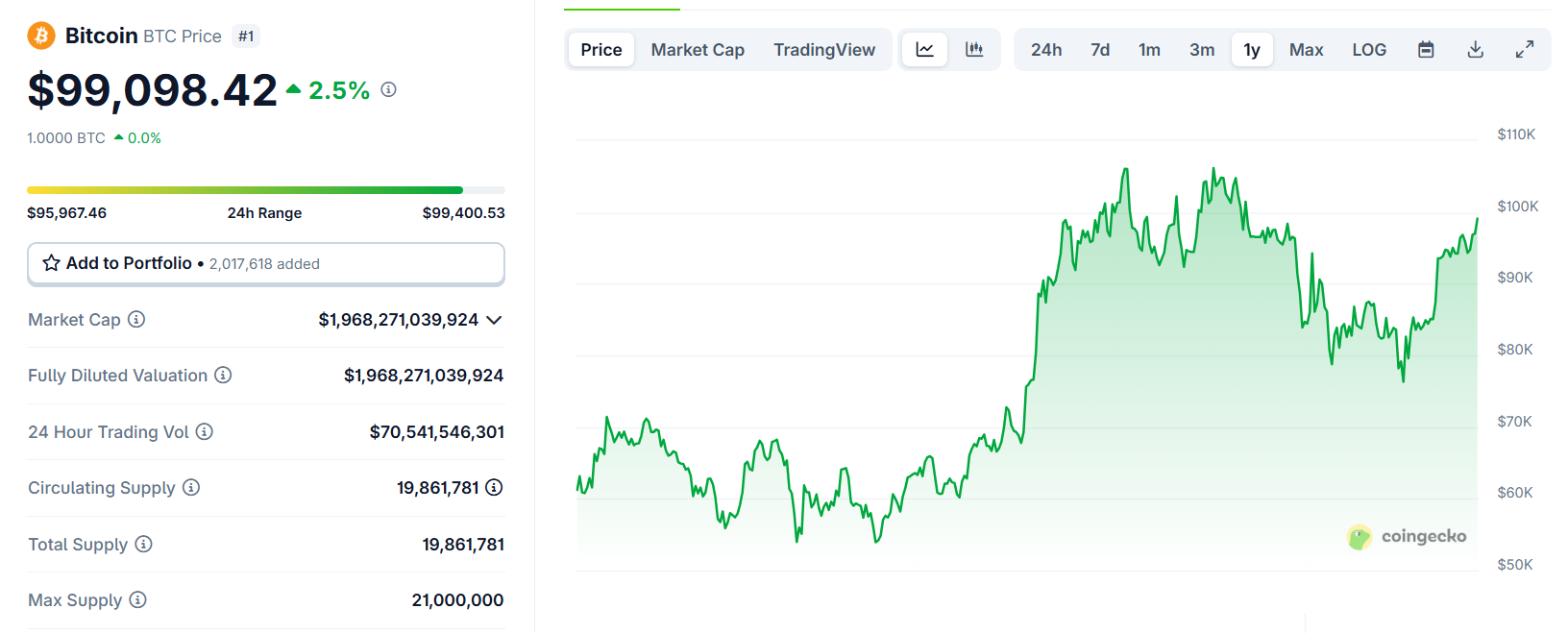

Historically, Bitcoin (BTC) has faced significant resistance at major psychological price levels, with $100,000 being a notable milestone. In late 2024, when BTC briefly touched $100k, it triggered a sharp sell-off.

This phenomenon, often driven by profit-taking from short-term traders and institutional players, saw BTC retreat by 10-15% within days. The $100k level, viewed as a euphoric peak, prompted holders to lock in gains, leading to heightened volatility and a temporary correction.

Such behavior aligns with previous milestones like $10k in 2017 and $50k in 2021, where rapid surges were followed by pullbacks as market sentiment shifted.

Source: CoinGecko

What will happen when BTC reaches $100k again?

In 2024, as BTC rallied from $80k to $100k, trading volume spiked, and leverage in derivatives markets soared, indicating speculative fervor. Each time BTC neared this level, on-chain data showed increased activity from whale wallets transferring to exchanges, a signal of potential selling pressure.

As mentioned by @FastOptical, there will be a big sell wall at $100k:

100k will be a big sell wall to get through cc @ChainStatsPro market depth, orderbooks snapshot. $btc pic.twitter.com/xDtyJ2j5ho

— Liquidity Price (@FastOptical) May 8, 2025

However, not every approach led to a dump. For instance, in Q3 2024, BTC consolidated around $95k for weeks without a major correction, supported by strong institutional buying and ETF inflows.

The key differentiator appears to be market conditions: overheated sentiment (high funding rates, excessive leverage) often precedes sell-offs, while steady accumulation mitigates dumps.

As of May 2025, with BTC hovering around $98k, low leverage and balanced sentiment suggest a possible breakout above $100k, though vigilance for sudden shifts remains critical.

Altcoin follows Bitcoin

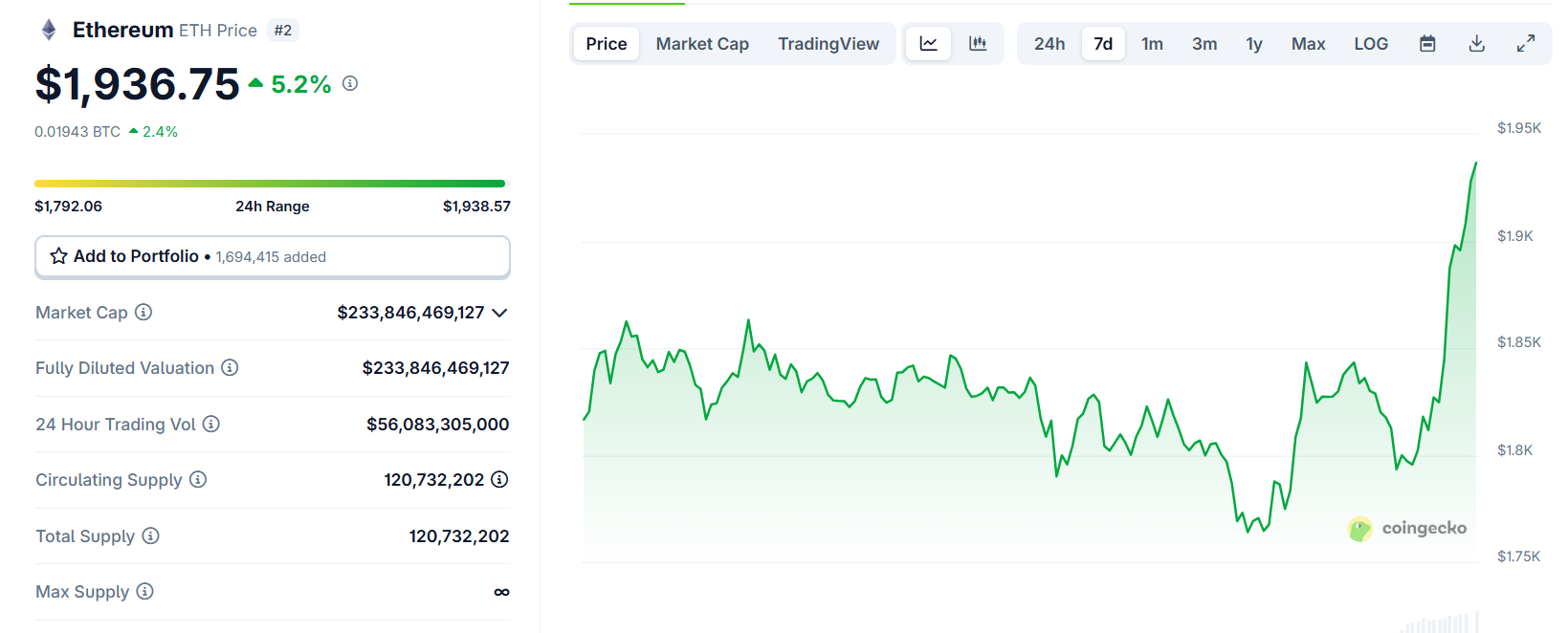

Altcoins typically follow Bitcoin’s price action, amplifying its movements. When BTC surged to $100k in 2024, major altcoins like Ethereum (ETH) and Solana (SOL) rallied 20-30% in tandem, only to face sharper corrections during BTC’s pullback.

Source: CoinGecko

This correlation stems from market psychology: BTC’s dominance drives capital flows, and a BTC sell-off often triggers panic in altcoin markets. Smaller-cap altcoins, with lower liquidity, are hit hardest, sometimes dropping 40-50% in hours.

Trade with caution

For traders, this dynamic underscores the need for caution. Key considerations include:

- BTC Dominance: A rising BTC dominance index often signals altcoin underperformance, especially during corrections.

- Liquidity Management: Avoid over-leveraging altcoin positions, as volatility spikes during BTC dumps.

- Selective Opportunities: Altcoins with strong fundamentals (e.g., layer-1 protocols with high developer activity, DEX, DeFi) may recover faster post-correction.

- Risk Mitigation: Set stop-losses and diversify exposure to reduce downside risk during BTC-led volatility.

Traders and investors should approach the $100k milestone with a clear strategy. First, track on-chain metrics like exchange inflows and whale activity to gauge selling pressure. Second, monitor derivatives markets for signs of overheating (e.g., high funding rates or open interest). Third, prioritize capital preservation by reducing leverage and securing profits in altcoins during BTC’s approach to $100k.

While $100k could mark a historic breakout, preparing for volatility is key to navigating this pivotal moment.

The post Will Bitcoin Price Reaching $100k Trigger Another Sell-Off? appeared first on NFT Evening.