[#title_feedzy_rewrite]

Ethereum has officially completed the Pectra upgrade on its mainnet as of May 7, 2025. This is widely regarded as the most significant Ethereum upgrade since The Merge in 2022.

How will the price of ETH react in the weeks and months ahead following this upgrade? This article will analyze the market impact and investor sentiment surrounding Pectra, based on the latest available data and developments.

What Is the Pectra Upgrade?

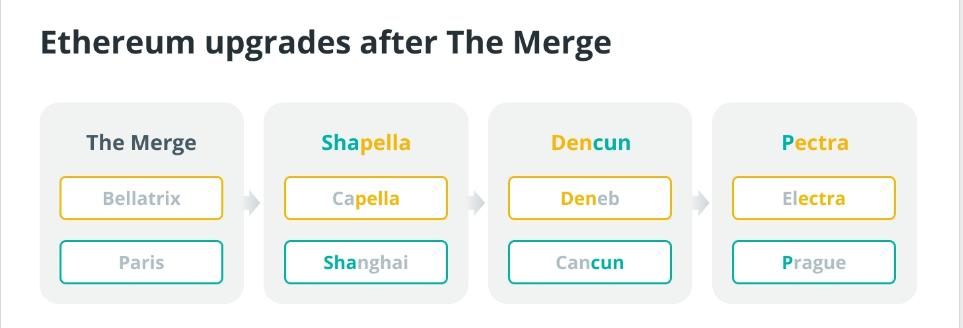

Pectra is the combined name for two simultaneous Ethereum upgrades: Prague (targeting the execution layer) and Electra (targeting the consensus layer). This hard fork incorporates a total of 11 Ethereum Improvement Proposals (EIPs) – the most included in a single upgrade to date.

The primary goals of Pectra are to enhance scalability, improve user experience, and optimize staking mechanics on the Ethereum network.

The upgrade leverages sharding techniques and Layer 2 solutions to increase transaction throughput and reduce network fees. Notably, it doubles the data capacity for Layer 2 blobs, helping to alleviate mainnet congestion and lower gas costs.

With the introduction of Account Abstraction, Pectra enables Externally Owned Accounts (EOAs) to perform actions previously reserved for smart contracts. For example, EIP-7702 allows users to pay gas fees using non-ETH tokens or bundle multiple actions into a single transaction, streamlining the user experience.

Another major change involves validators. EIP-7251 increases the effective staking limit per validator from 32 ETH to 2,048 ETH. This means validators can stake significantly more ETH on a single node without needing to manage multiple smaller nodes, improving efficiency and operational simplicity.

These improvements could encourage more participants to stake, potentially reducing ETH’s circulating supply – a factor that may support upward price pressure.

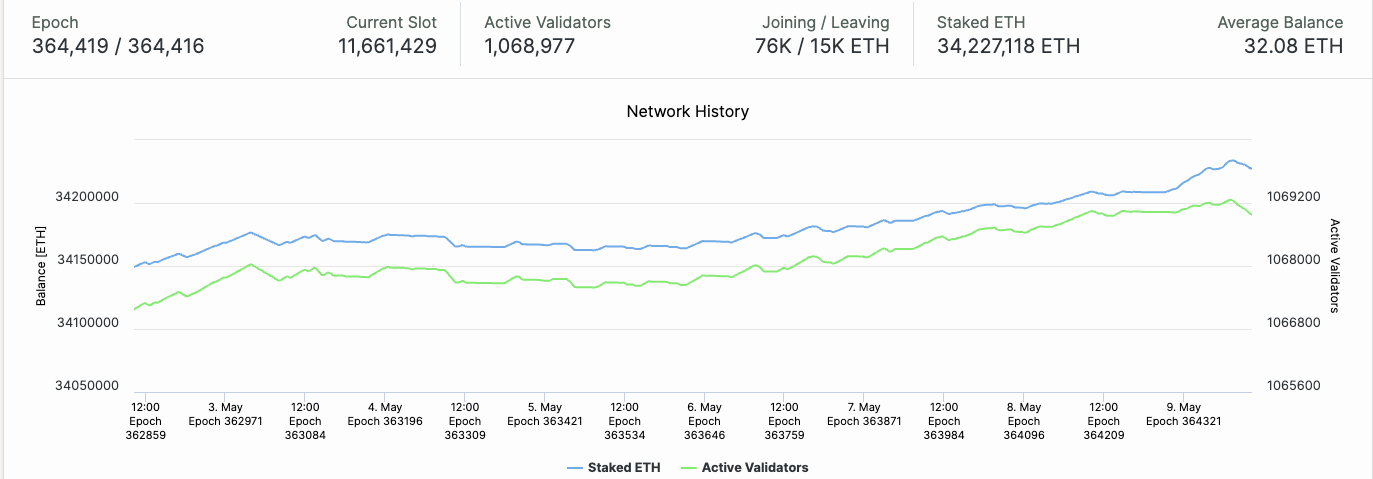

Number of Ethereum validator after Pectra – Source: Beaconcha

How Did the Market React After the Pectra Upgrade?

Following Ethereum’s successful Pectra upgrade on May 7, 2025, the market response turned out to be far more optimistic than initially expected. Contrary to early signs of hesitation, Ethereum’s price surged more than 12% within 24 hours after the upgrade, breaking past the key psychological barrier of $2,000. This marked one of ETH’s strongest single-day gains in recent months, as investor sentiment across the broader crypto market also turned bullish.

Initially, the reaction appeared muted – ETH hovered around $1,900 on the day of the upgrade, with little change in trading volume or capital inflows. However, momentum quickly shifted as confidence in the upgrade’s success spread.

By May 8, ETH had rallied significantly, supported not just by the upgrade itself, but by a more favorable macro backdrop: a broader market rally, easing inflation data in the U.S., and renewed interest in risk assets.

Source: CoinGecko

This time, unlike past upgrades such as Merge or Shanghai, the rally didn’t happen instantly but unfolded over several hours as market participants digested the implications.

Analysts see ETH rising further if network activity grows and capital flows back to Layer-1s. With upgrades done, investors now watch if they boost real usage and Ethereum fee growth.

In short, Ethereum’s price has responded positively to Pectra, in line with an overall bullish tone in the crypto market. The upgrade marked a tech milestone and could revive institutional interest and long-term Ethereum growth.

ETH Price History Following Major Network Upgrades

To gauge Pectra’s impact, we can look at how past Ethereum upgrades affected ETH price. Historical data shows that price reactions vary significantly depending on the market context at the time of each upgrade:

- Beacon Chain (December 2020): Launched at the start of a strong crypto bull market. ETH jumped 125% after Beacon Chain launch, then rallied over 230% by February 20, 2021.

- London Hard Fork (August 2021): ETH rose from ~$2,600 to ~$2,780 (+7%) on the day of the upgrade. This upward momentum continued over the following weeks, pushing ETH above $3,000 and eventually approaching $4,000 by early September.

- The Merge (September 2022): Despite its technical significance, ETH fell by around 15% within a week of the upgrade, dropping from $1,600 to $1,350. The market was in a clear downtrend, which muted any potential upside.

- Shanghai/Shapella (April 2023): ETH spiked to $2,110, an 11-month high, during the week following the upgrade, before pulling back to ~$1,920. The net short-term gain was around 10%.

- Dencun (Late 2024): Despite being a major technical milestone, the Dencun upgrade did not trigger a new price rally, as it coincided with the beginning of a market-wide correction following a speculative run-up.

Looking back at these past events, a few key takeaways emerge.

The overall market environment plays a major role in how ETH reacts to upgrades. In a bull market (like late 2020 or 2021), upgrade announcements tend to fuel additional upside momentum. In contrast, during a downtrend (as seen in 2022), even major upgrades struggle to reverse the prevailing downward trend.

Moreover, some upgrades may not immediately impact price, but they lay the groundwork for long-term structural shifts. EIP-1559 added ETH burn, making it deflationary – a change that became clear only after several years.

Short-term traders may ignore it, but long-term investors see it as key to Ethereum’s future growth

Price Prediction ETH After Pectra

ETH rose 12% after Pectra, breaking $2,000 for the first time since early April.

This strong upward move suggests that, contrary to some expectations, there was no major “sell-the-news” event. Instead, bullish momentum has taken over, supported by a surge in trading volume and renewed investor interest.

In the short term, ETH is likely to consolidate within the $2,000–$2,300 range, with $2,300–$2,350 acting as the next key resistance zone. A daily close above that could open the door for a move toward $2,500.

Although this article focuses on the short-term outlook, it’s worth briefly addressing the medium- to long-term view. Pectra lays important groundwork for Ethereum’s future. By 2025–2026, Pectra may fuel ETH’s growth if macro conditions turn favorable for crypto.

Read more: Will Bitcoin Price Reaching $100k Trigger Another Sell-Off?

The post ETH Price Prediction after Pectra Upgrade in May appeared first on NFT Evening.