[#title_feedzy_rewrite]

The cryptocurrency market is experiencing a robust rally today, with Bitcoin (BTC) and Ethereum (ETH) leading the charge. As of May 9, 2025, Bitcoin has soared past $100,000 for the first time since early February, while Ethereum is showing significant strength, climbing to around $2,200.

The total crypto market capitalization has breached $3,3 trillion, reflecting a 3.4% increase in the last 24 hours. This bullish momentum is driven by a combination of macroeconomic developments, institutional adoption, and technical breakouts.

Bitcoin Breaking the $100,000 Barrier

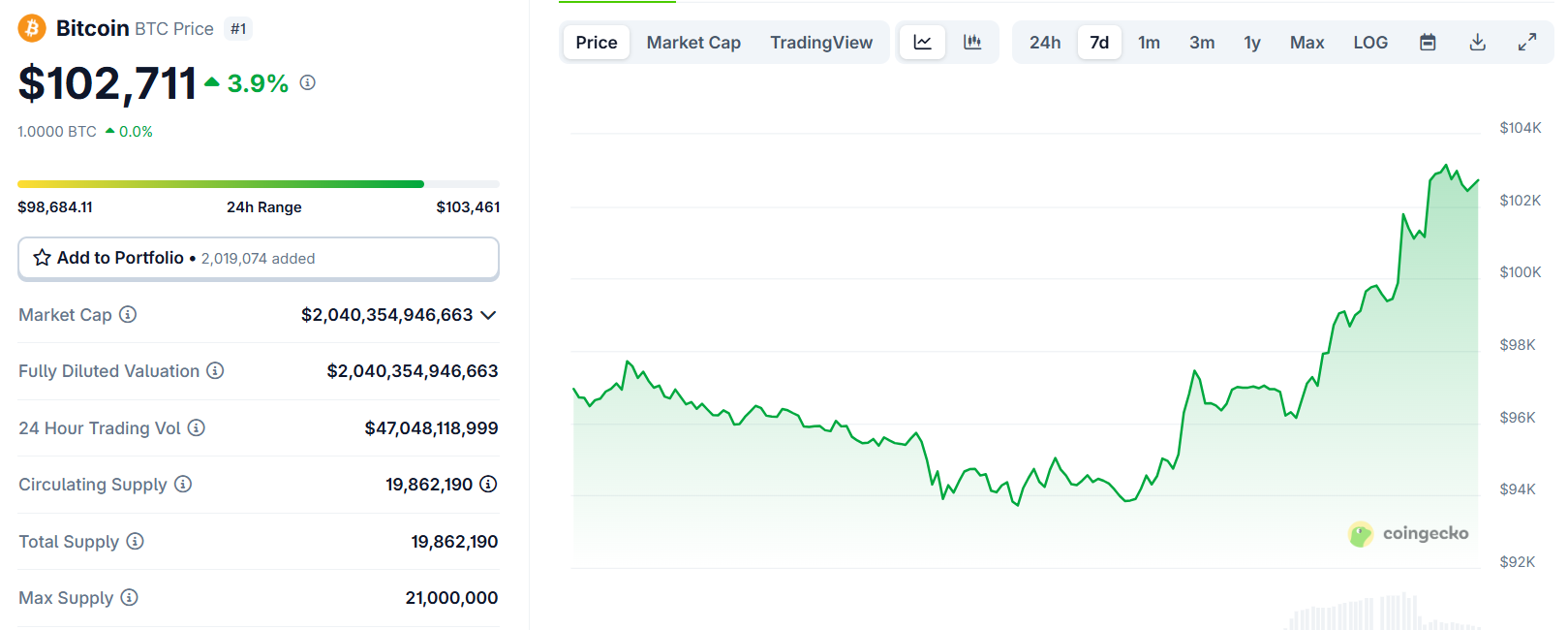

Bitcoin is trading at approximately $102,700, up nearly 4% in the last 24 hours, with daily trading volume surging to $47 billion. This marks a significant milestone, as BTC has reclaimed the $100k level after dipping to $75,000 in early April following trade tariff concerns.

Source: CoinGecko

Several momentums are behind this rally:

- Easing US-China Trade Tensions: Optimism over potential progress in US-China trade talks has boosted risk-on sentiment across global markets, including cryptocurrencies. China’s commerce ministry recently signaled openness to negotiations, reducing fears of escalating tariffs that previously weighed on risk assets. This has driven Bitcoin’s price, as investors view it as a hedge against economic uncertainty.

- Massive Short Liquidations: The derivatives market has seen significant activity, with $341 million in short Bitcoin positions liquidated in the last 24 hours. This imbalance reflects strong bullish momentum, as bearish traders are forced to cover their positions, further pushing prices upward.

Source: CoinGlass

- Institutional and Regulatory Tailwinds: Recent developments, such as the US Office of the Comptroller of the Currency (OCC) relaxing rules to allow banks to buy and sell client crypto assets, have bolstered institutional confidence. Additionally, Arizona’s passage of a Bitcoin reserve bill and record inflows into Bitcoin ETFs signal growing mainstream adoption.

- Federal Reserve’s Steady Rates: The Federal Reserve’s decision to maintain interest rates at 4.25%-4.50% on May 7 has reinforced Bitcoin’s appeal as a store of value, especially amid stagflation fears. Investors are increasingly turning to BTC as “digital gold” to hedge against fiat currency erosion.

Ethereum Riding the Altcoins Wave

Ethereum is trading at around $2,200, reflecting a 16.8% gain in the last 24 hours and a 20.2% surge over the past week. ETH’s market capitalization stands at $267.45 billion, solidifying its position as the second-largest cryptocurrency.

Source: CoinGecko

The recent activation of Ethereum’s Pectra upgrade on May 7 has further fueled optimism. Pectra introduced smart accounts, higher staking limits, and improved scalability through key Ethereum Improvement Proposals (EIPs). Features like EIP-7702 (enabling externally owned accounts to act as smart contracts) and EIP-7691 (increasing data blobs for layer-2 scalability) have enhanced Ethereum’s utility for dApps and smart contracts, attracting developers and investors.

Learn more: Ethereum Price Prediction after Pectra Upgrade in May

Like Bitcoin, Ethereum has seen significant short liquidations, with $283 million in short ETH positions wiped out in the last 24 hours.

Caution ahead

The crypto market is riding a wave of optimism driven by easing trade tensions, pro-crypto policies, and strong technical breakouts. Bitcoin’s surge past $100k and Ethereum’s rally to $2,200 reflect a potent mix of institutional inflows, short liquidations, and macroeconomic tailwinds.

While risks like potential Fed policy shifts and technical pullbacks loom, the current momentum underscores crypto’s growing role as a mainstream asset class. Investors should stay informed and cautious, as the market’s volatility remains a double-edged sword.

The post Bitcoin Price Surpasses $100k amid Trade Optimism appeared first on NFT Evening.