[#title_feedzy_rewrite]

![[#title_feedzy_rewrite]](https://postcryptocoins.com/wp-content/uploads/2025/05/blacrock-sec-meeting-request-jwnstB.jpg)

One of the most prominent financial firms, BlackRock, has met with the US Securities and Exchange Commission (SEC)…

One of the most prominent financial firms, BlackRock, has met with the US Securities and Exchange Commission (SEC) to engage in talks that could have a major impact on the digital asset sector. Indeed, the $10 trillion asset manager held discussions with the agency Crypto Task Force to talk through four key facets, according to a recent memo.

Over the last two years, the asset manager has been one of the biggest drivers of Bitcoin’s unprecedented surge to $100,000. Moreover, BlackRock recently revealed a remarkable $32 million in Q1 revenue from its iShares Bitcoin Trust (IBIT) in an SEC filing made this week.

JUST IN: $10 trillion asset manager BlackRock meets with SEC Crypto Task Force to discuss:

• Staking

• Options

• Tokenization

• ETF approval standards pic.twitter.com/hDTKnJS3wN— Watcher.Guru (@WatcherGuru) May 9, 2025

Also Read: BlackRock To Invest in XRP? High Net-Worth People Want Cryptocurrencies

BlackRock & SEC Crypto Task Force Meet: Here’s What They Discussed

It has been a big week for the cryptocurrency market. Following the announcement of a new trade deal between the US and UK, the sector surged amid easing concerns within the geopolitical sector. Thereafter, Bitcoin surged to a $100,000 price for the first time since February.

As the industry is looking particularly strong, things could get even more interesting. Specifically, BlackRock and the SEC’s Crypto Task Force held critical talks on Friday. Indeed, several executives from the asset manager attended the meeting, including head of regulatory affairs Benjamin Tecmire and head of digital assets Robert Mitchnick.

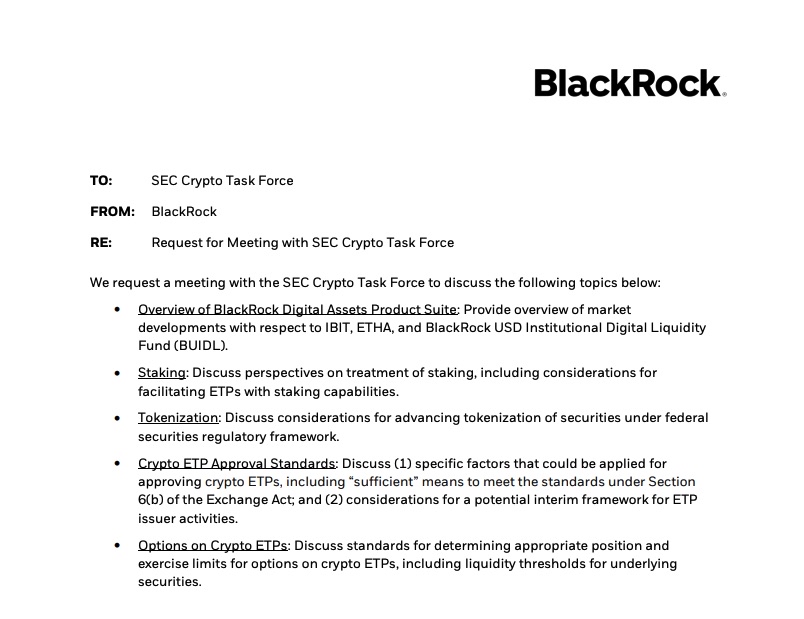

Source: BlackRock

Also Read: Tesla: BlackRock Buys for 26th Straight Quarter: TSLA Eyes $300

According to notes from the meeting request, the two sides discussed BlackRock’s digital asset product suite, staking, tokenization, crypto-based ETF approval standards, and options on exchange-traded products.

Specifically, the meeting saw them explore treatment of staking, regulatory action to support tokenization, and ETF approval standards from the agency. Altogether, the meeting looks to only support BlackRock’s growing presence in the crypto sector. Moreover, it speaks to the Crypto Task Force’s willingness to be an audience to these firms clearly seeking out advancement in industry-wide regulation.