[#title_feedzy_rewrite]

![[#title_feedzy_rewrite]](https://postcryptocoins.com/wp-content/uploads/2025/05/image-101-1024x537-BB7tC9.jpg)

XRP’s global banking expansion is picking up steam right now as hundreds of financial institutions are adopting RippleNet.…

XRP’s global banking expansion is picking up steam right now as hundreds of financial institutions are adopting RippleNet. With the current price sitting at around $2.39, many investors are wondering about the potential returns they might see on a $1,000 XRP investment over the next couple of years.

Also Read: De-Dollarization: JP Morgan’s Latest Warning on US Dollar’s Overvaluation & Downfall

XRP’s Global Banking Expansion and Its Future Value Potential

RippleNet’s Growing Banking Network

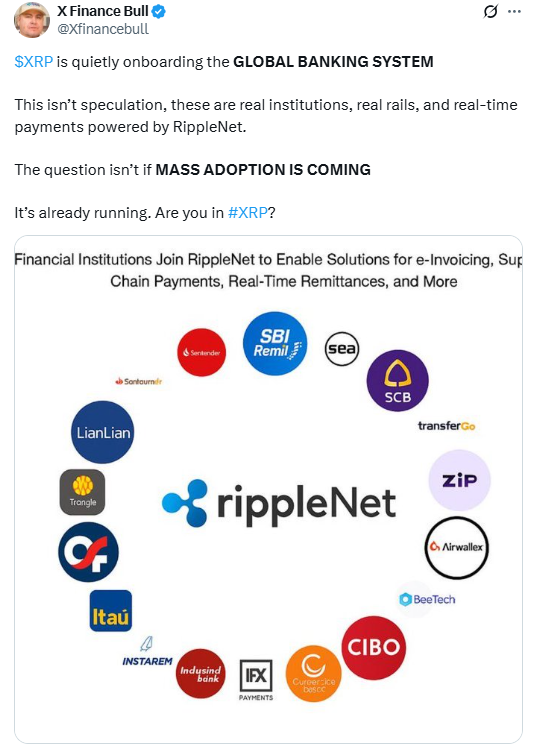

The XRP global banking expansion continues to gain traction as over 300 financial institutions around the world have now connected to RippleNet. A recent tweet from crypto commentator X Finance Bull actually highlighted this widespread adoption that’s happening right now.

X Finance Bull stated:

“$XRP is quietly onboarding the GLOBAL BANKING SYSTEM. This isn’t speculation, these are real institutions, real rails, and real-time payments powered by RippleNet. The question isn’t if MASS ADOPTION IS COMING. It’s already running. Are you in #XRP?”

These partners include major players like Santander, SBI Remit, Itaú, and also TransferGo, showing real-world crypto investment returns through institutional adoption that’s happening at this very moment.

Also Read: Ethereum Pectra Upgrade Price: ETH Surges 18% to $2,200

What $1,000 XRP Could Be Worth by 2027

For a $1,000 XRP investment today, the future value projections look a bit challenging. At the current prices, this amount would buy you approximately 418 XRP tokens. According to an analysis from CoinCodex, XRP’s future value might actually decline over the next couple of years.

CoinCodex stated:

“In 2026, XRP (XRP) is anticipated to change hands in a trading channel between $1.401609 and $1.83995, leading to an average annualized price of $1.559755. This could result in a potential return on investment of -23.03% compared to the current rates. Given the expected dip, investors could profit from negative activity by shorting XRP.”

Based on these projections, a $1,000 investment might be worth approximately $652 by 2026, which represents a 35% loss. The XRP global banking expansion has yet to translate into positive price action in the medium term, and this is something investors should be aware of.

However, if you were to invest $1,000 in XRP today and implement a shorting strategy in July 2025, you could see a 24.98% return, bringing your investment to approximately $1,250. Similarly, a well-timed short position in June 2025 might yield a 22.42% return. Even later in the year, December 2025 shows a potential 19.17% ROI through shorting. This suggests that despite the overall downward trend in XRP’s future value, specific months offer promising profit opportunities for active traders.

XRP analyst J4b1 shared a much more optimistic view on the cryptocurrency’s prospects. In his analysis published on May 6, 2025, J4b1 suggests that XRP’s global banking expansion could drive prices significantly higher than current levels.

According to the analyst’s models, XRP’s 2025 price could range from $6.37 on the conservative end to $30 in an optimistic, utility-driven scenario. He emphasized that these aren’t meme-level predictions but are based on fundamental analysis and early institutional modeling.

Is XRP about to explode or already overpriced?

Is buying at $2.20 smart or is it too late? Let’s break it down with data, historical context, and Ripple’s price control strategy.

pic.twitter.com/UHvbYD4GJl

— J4b1 (@XRPJ4b1) May 4, 2025

Technical Indicators and Market Sentiment

Current technical indicators for XRP show some mixed signals at the moment. While it’s trading above both the 50-day ($2.19) and the 200-day ($1.904341) Simple Moving Averages, the 14-day RSI of 62.06 suggests it might be approaching overbought territory.

Another user, MissXRP, commented on the banking adoption:

“Absolutely! The adoption of RippleNet by global banks is happening right now, and it’s only going to grow from here. The infrastructure is already being built — it’s not a matter of if anymore, it’s about when the world wakes up to it.”

Also Read: China-Russia Anti-Dollar Alliance: Xi Condemns ‘Hegemonic Bullying’

Monthly XRP price predictions indicate that there will be price movements for XRP in 2025/2026 with opportunities worth 7-39% between certain months where shorting becomes profitable. Patience beyond the two-year horizon may be needed for such people concerned with the XRP global banking expansion and long-term crypto returns.

Even though RippleNet is gaining more financial partnerships and more institutions are joining in, the future value projections of XRP point to investors curbing their expectations for massive short-term returns from their $1000 XRP investment for now at least.