[#title_feedzy_rewrite]

![[#title_feedzy_rewrite]](https://postcryptocoins.com/wp-content/uploads/2025/05/1957f483-1024x585-PZM0TB.jpg)

BlackRock XRP ETF discussions have officially begun as the asset management giant confirms SEC meeting request. Meanwhile, as…

BlackRock XRP ETF discussions have officially begun as the asset management giant confirms SEC meeting request. Meanwhile, as a whale investor puts $6 million on XRP’s price rise, this information has been made public. A possible $3 price target is achieved in case an ETF is approved formally.

BLACKROCK CONFIRMS $XRP ETF MEETING!! pic.twitter.com/mXejLYaf39

—

BSC Gems Alert

(@BSCGemsAlert) May 9, 2025

Also Read: Bitcoin: Michael Saylor Reveals Strategy To Get 100x Return from BTC

How BlackRock’s XRP ETF Could Trigger a $3 Rally in 2025

BlackRock Confirms SEC Meeting on XRP ETF Potential

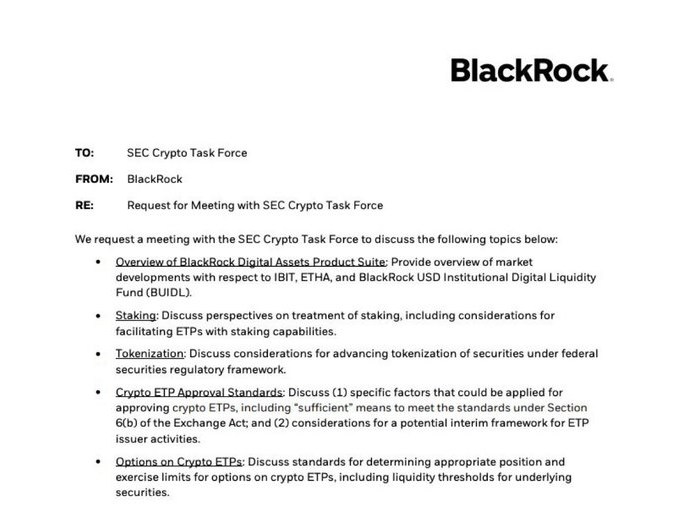

The possibility of a BlackRock XRP ETF launch taking place has become more promising since the company asked formally for the engagement with the crypto task force of the SEC. The schedule describes important points for the approval of crypto ETFs and relevant regulatory aspects.

The meeting request from BlackRock states:

“We request a meeting with the SEC Crypto Task Force to discuss the following topics below: Overview of BlackRock Digital Assets Product Suite: Provide overview of market developments with respect to BIT, ETHA and BlackRock USD Institutional Digital Liquidity Fund (BIDL).”

Whale Investor Places $6M XRP Bet

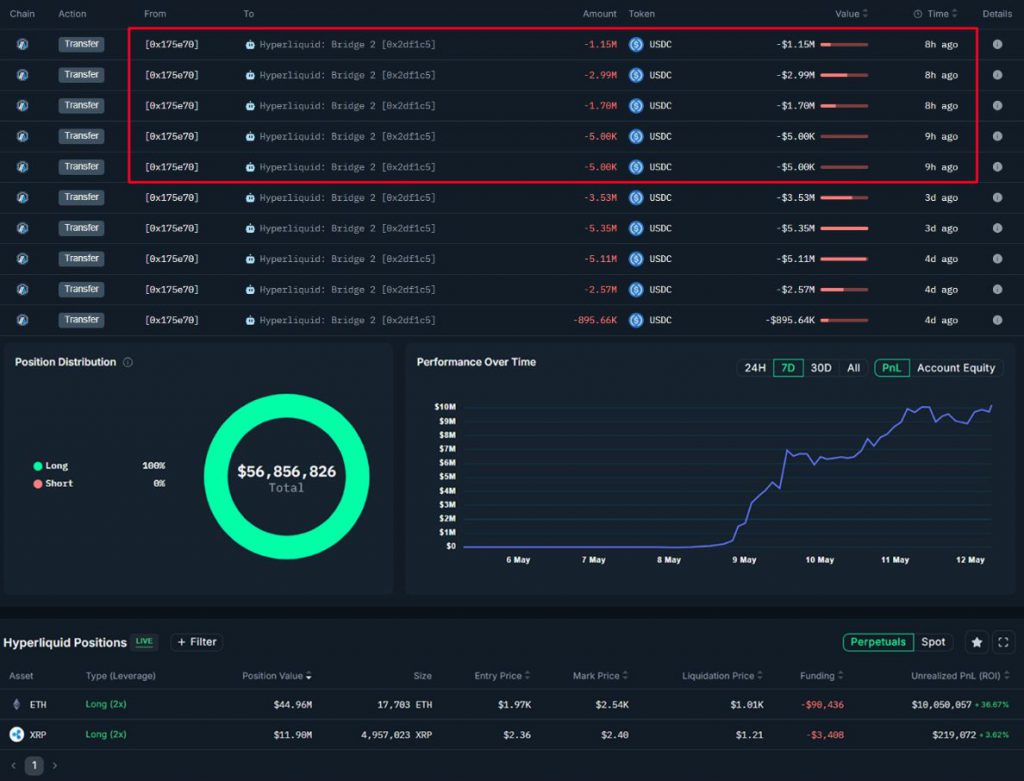

A major investor has shown extraordinary confidence in an XRP price surge, potentially tied to BlackRock XRP ETF developments. This whale deposited $5.84 million in USDC to establish a leveraged XRP position.

Onchain Lens reported:

“8 hours ago, a whale deposited $5.84M $USDC into #HyperLiquid to place a long position on $XRP with 2x leverage.”

8 hours ago, a whale deposited $5.84M $USDC into #HyperLiquid to place a long position on $XRP with 2x leverage.

The whale previously opened a long position on $ETH with 2x leverage, resulting in a floating profit of $10M+.

Address: 0x175e7023e8dc93d0c044852685ac33e856b577b4… https://t.co/tIyIzgQArc pic.twitter.com/FnpidzM4NC

— Onchain Lens (@OnchainLens) May 12, 2025

Also Read: United States Cuts Tariffs on Chinese Goods From 145% to 30% for 90 Days

Analysts Target $3 XRP Price Point

Technical indicators suggest $3 as a realistic target if regulatory clarity continues improving and a BlackRock XRP ETF materializes. Chart patterns show a series of higher lows forming support trends.

Market analyst arman_shirinyan noted on TradingView:

“XRP $3 is next target.”

ETF Approval Timeline and Competition

Just like approved Bitcoin and Ethereum ETFs, filing its submission after the model has been used for Bitcoin and Ethereum ETFs, the BlackRock XRP ETF can be approved in a period that is 6 to 8 months after its filing. The SEC’s part decision behind Ripple is that automated XRP transactions do not qualify as security.

BlackRock’s meeting request specifically addresses:

“Crypto ETF Approval Standards: Discuss the standards applied for improving crypto ETF filings, including ‘sufficient’ means to meet the standards under Section 6(b) of the Exchange Act and considerations for a potential interim framework for ETP issuer activities.”

Also Read: Bitcoin: AI Predicts Bitcoin’s Price If Zuckerberg Adds BTC To Meta