[#title_feedzy_rewrite]

Wondering if XRP is a good investment in 2025? Discover everything you need to know about XRP‘s price outlook, technology, risks, and investment potential in this in-depth guide.

About XRP

XRP, the native cryptocurrency of the XRP Ledger developed by Ripple Labs, has long been one of the most debated digital assets in the crypto world. While some see it as a bridge currency for global remittances, others dismiss it due to its prolonged regulatory struggles with the U.S. Securities and Exchange Commission (SEC). Now in 2025, with Ripple’s expanding partnerships and a clearer legal status, many investors are reassessing the core question: Is XRP a viable long-term investment?

This article offers a detailed examination of XRP’s fundamentals, recent market performance, evolving regulatory landscape, and future potential, all tailored to help investors make informed decisions.

Read more: XRP Deep Dive: A Masssive Player in Today’s Crypto Market

Understanding XRP: Technology and Purpose

XRP operates on the XRP Ledger (XRPL), a decentralized, open-source blockchain designed to support fast, efficient, and cost-effective cross-border payments with consistently low fees. It was developed as an alternative to the legacy SWIFT system, also known as the Society for Worldwide Interbank Financial Telecommunications, which remains dominant but suffers from latency and high costs.

Unlike Bitcoin or Ethereum, which use Proof-of-Work or Proof-of-Stake mechanisms, the XRPL employs a consensus algorithm that allows participants to validate transactions and settle them in seconds with minimal fees.

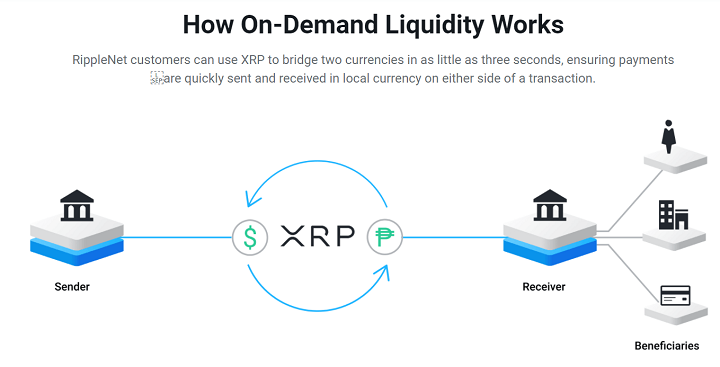

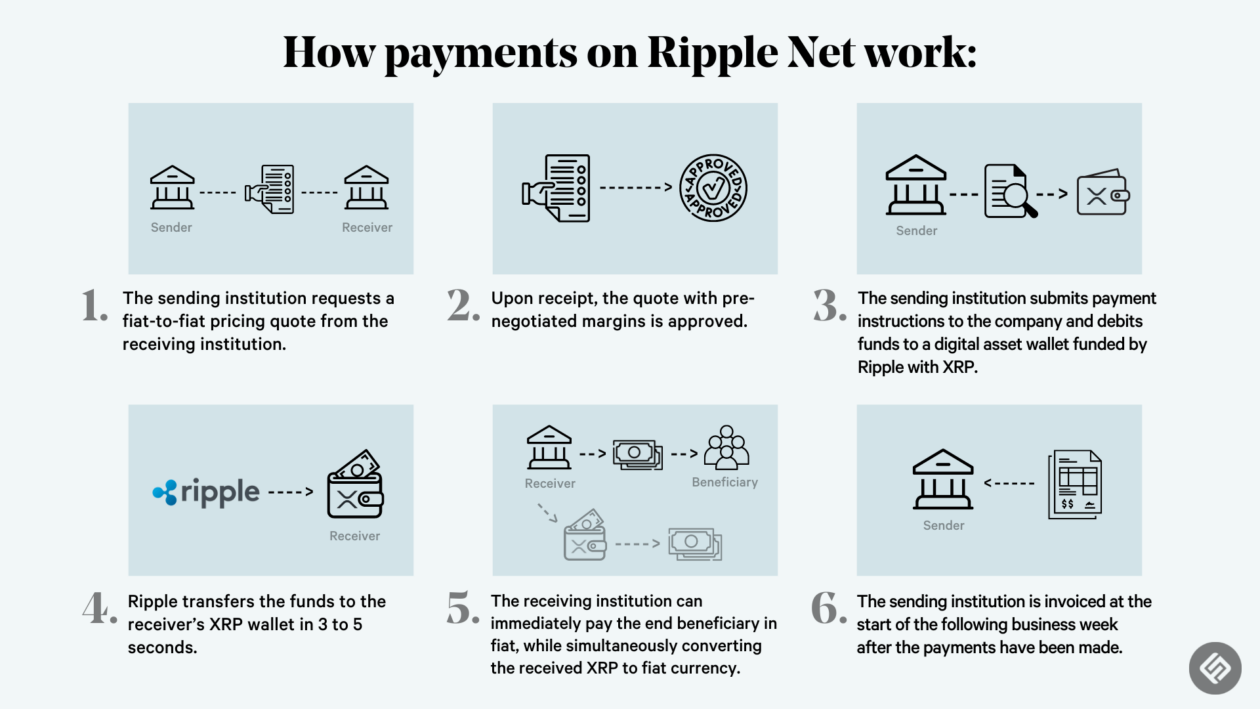

Created in 2012, XRP was envisioned as a bridge currency to facilitate liquidity between fiat currencies, particularly in global remittance corridors and international money transfers. Ripple Labs, the company behind the token’s enterprise solutions, focuses on integrating blockchain technology into traditional banking infrastructure through tools like RippleNet and On-Demand Liquidity (ODL).

Source: XRP

The SEC Lawsuit and Legal Clarity in 2025

One of the most significant overhangs on XRP’s investment potential has been its legal battle with the U.S. SEC. In December 2020, the SEC filed a lawsuit against Ripple Labs, alleging that its sale of XRP constituted an unregistered securities offering. This case dragged on for over three years, leading to delistings and depressed investor sentiment.

Source: SEC

However, a pivotal moment came in July 2023 when a federal judge ruled that XRP is not a security when sold on public exchanges to investors, though some institutional sales were deemed securities. As of May 2025, Ripple and the SEC are in the final stages of negotiating penalties for those specific sales.

This outcome has allowed XRP to regain listings on major U.S. platforms like Coinbase and Kraken, and has revived interest among both institutional and retail investors.

Price History and 2025 Market Position

XRP’s price history reflects its turbulent regulatory backdrop. Its market share has remained notable despite challenges, consistently placing XRP among the top-ranking cryptocurrencies by capitalization and usage volume.

After peaking at $3.84 during the 2018 bull run, XRP spent years trading sideways. The SEC case further hampered its performance between 2020 and 2022. However, the partial legal victory in mid-2023 catalyzed a sharp rally, with XRP jumping over 70% in a single day.

Source: CoinGecko

As of May 2025, XRP is trading around $2.43, according to LiteFinance and ITBFX, with a modest daily increase of 0.02532%. Its market capitalization now hovers around $130 billion, further cementing its position as one of the top 5 cryptocurrencies globally.

In a significant development, XRP was added to the U.S. cryptocurrency reserve list in March 2025. This milestone has reinforced XRP’s perceived legitimacy in institutional circles and bolstered its long-term investment thesis. Both LiteFinance and ITBFX cite this event as a turning point that could lead to greater demand and price stability in the future.

Real-World Adoption and Ripple’s Global Strategy

What sets XRP apart from many other cryptocurrencies is its tangible use case in real-world financial infrastructure. Ripple has consistently positioned XRP as a utility token, not just a speculative asset.

RippleNet, the company’s flagship network, connects hundreds of financial institutions and enables real-time cross-border settlements. These financial institutions include traditional banks, payment processors, and fintech platforms operating globally, all seeking faster and more cost-efficient transaction alternatives.financial institutions and enables real-time cross-border settlements.

Read more: XRP Staking Guide: How to Earn XRP Rewards in 2025

XRP plays a vital role in this ecosystem through its On-Demand Liquidity (ODL) service, which eliminates the need for pre-funded accounts by acting as a bridge asset.

In 2025, Ripple has expanded its reach by partnering with central banks, fintech firms, and a growing number of financial institutions worldwide. Notably, it has collaborated with the Central Bank of Brazil on a pilot program for blockchain-based settlements. Moreover, Ripple is involved in more than 20 CBDC initiatives, including with the governments of Palau, Montenegro, and Bhutan. The acquisition of Metaco in 2023 further strengthened Ripple’s enterprise-grade custody solutions, attracting more institutional players.

Tokenomics and Supply Structure

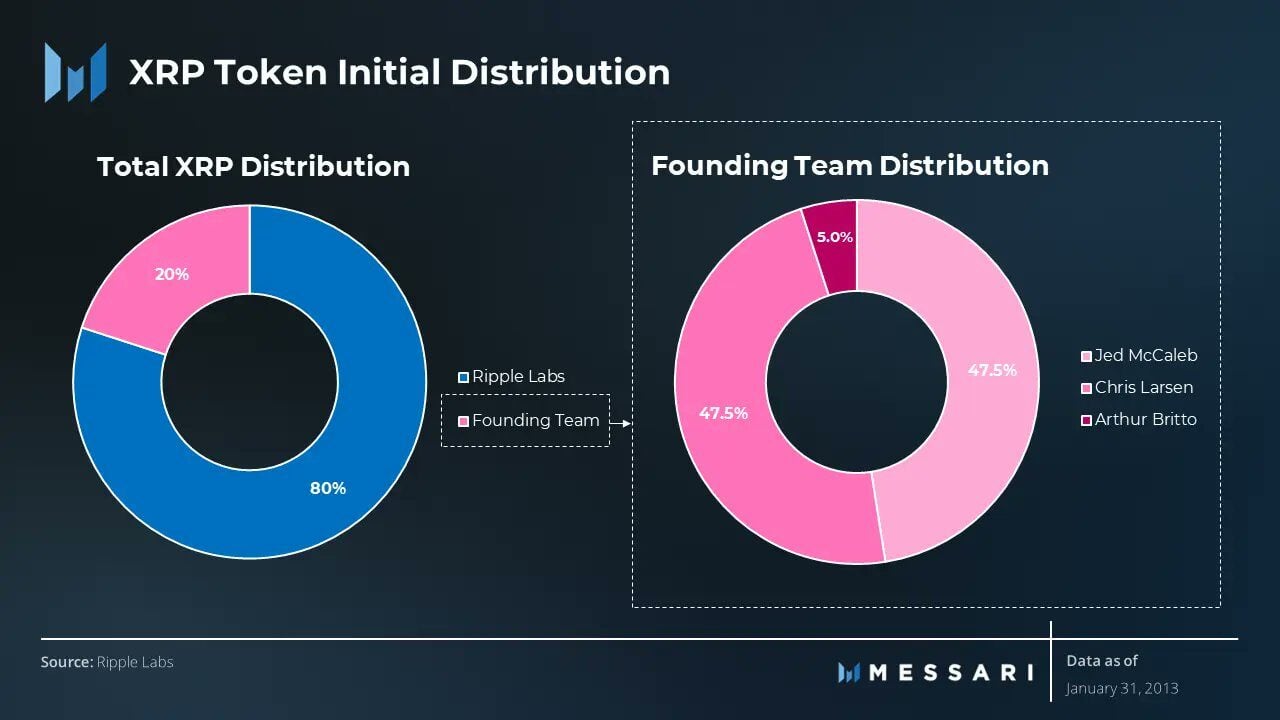

XRP has a total supply capped at 100 billion tokens. As of May 2025, around 54 billion XRP are in circulation. The remaining tokens are held in escrow by Ripple and released gradually to maintain market stability.

This transparent escrow mechanism provides a predictable release schedule and helps mitigate inflationary pressure. However, Ripple’s control over a significant portion of the supply continues to be a point of contention for decentralization advocates.

Source: Messari

Historically, the annual increase in circulating supply has ranged between 1–3%, which is moderate compared to many newer cryptocurrencies. This structure supports a relatively stable long-term monetary policy, a factor institutional investors often consider favorably.

Investment Advantages and Potential Risks

XRP offers a mix of compelling strengths and notable risks that prospective investors must weigh carefully.

On the positive side, XRP’s utility in global payments, its rapid transaction speed, and energy-efficient design position it as a scalable solution for real-world financial applications. The growing legal clarity in the U.S. enhances its credibility, and Ripple’s expanding footprint in CBDCs suggests a long-term strategic vision.

Its price accessibility also allows smaller investors to enter the market more easily compared to high-priced assets like Bitcoin – a feature highlighted by ITBFX and PrimeXBT as a reason for growing retail interest.

However, risks remain. Ripple’s ongoing legal entanglements concerning institutional sales could still result in financial penalties. Moreover, concerns about centralization persist due to Ripple’s large token holdings. XRP also trails behind Ethereum, Solana, and other smart contract platforms in terms of DeFi and developer activity.

Market Sentiment and Technical Outlook

XRP vs Bitcoin Correlation: Investment Efficiency

According to data from Yahoo Finance, XRP outperformed Bitcoin significantly in 2024 — with XRP gaining nearly 270% in price, compared to Bitcoin’s 40% growth. This suggests that XRP may offer superior short-term upside potential, especially during bullish cycles, although Bitcoin continues to be viewed as a more stable long-term store of value.

Macro Factors Influencing XRP

XRP’s price trajectory is also tied closely to macroeconomic conditions. Analysts note that potential interest rate cuts by the U.S. Federal Reserve could stimulate capital flows into risk assets, including cryptocurrencies.

If Bitcoin were to rally to $100,000 or even $150,000 under such macro easing scenarios, XRP would likely benefit from correlated upside momentum.

Source: TradingView

Technical Indicators

This section reflects the latest technical analysis on XRP’s price movement and short-term trading behavior, as well as recent XRP trading activity that may influence future price action.

Technically, XRP has recently experienced a corrective pullback. Analysts from LiteFinance and ITBFX suggest that short-term traders may consider opening short positions, targeting a profit zone around $2.105. This reflects short-term bearish pressure even as the broader outlook remains optimistic.

Previously, XRP was trading within a range between $0.65 and $0.75. The strong breakout above $2 in Q1 2025 is widely attributed to favorable regulatory clarity and increased demand from institutional buyers. If XRP maintains momentum, potential targets include $2.80 and $3.20 within 2025.

Source: TradingView

Long-term targets above $5 remain speculative but attainable if Ripple’s CBDC strategy bears fruit and cross-border payment rails adopt XRP at scale. According to ITBFX, sustained development and adoption could push XRP into the $7–$10 range by 2030 under bullish scenarios.

So, Is XRP a Good Investment in 2025?

Price Outlook for 2025

The price of XRP is likely to depend heavily on several intertwined factors, most notably the degree of global regulatory clarity particularly the outcome of Ripple’s ongoing legal battle with the SEC, as well as how major jurisdictions classify XRP within their legal frameworks and the pace of institutional adoption, including whether banks, remittance providers, and central banks choose to integrate RippleNet or the XRP Ledger into their payment infrastructure.

Forecasts gathered from multiple sources, including Barron’s and Yahoo Finance, estimate that XRP’s price could range from $1.80 to as high as $8.40 by the end of 2025 – depending on the pace of global adoption and the resolution of regulatory uncertainties.

This price prediction is grounded in both macroeconomic trends and ongoing institutional interest in Ripple’s technology. – depending on the pace of global adoption and the resolution of regulatory uncertainties. In more optimistic scenarios where Ripple’s technologies are adopted at scale and macro conditions remain favorable, projections even suggest XRP could exceed $10.

The answer to this question ultimately depends on your individual investment profile. For investors who believe in blockchain-based financial solutions, XRP offers a strong narrative backed by enterprise adoption and regulatory progress.

Read more: Trading with Free Crypto Signals in Evening Trader Channel

It is not a meme coin or a fleeting trend. Serious infrastructure, global partnerships with financial institutions, and a maturing legal environment all support XRP. Moreover, its addition to the U.S. crypto reserve and growing institutional backing further reinforce its credibility.

Ripple CEO Brad Garlinghouse has remained vocal about XRP’s strategic direction, stating, “We’re building a future where XRP plays a central role in global finance.”

Independent analysts like Linda Jones have argued that XRP remains significantly undervalued due to its suppressed valuation during the SEC case, while noting its strong utility base.

Even critics like Charles Hoskinson, founder of Cardano, have acknowledged that XRP’s legal clarity is beneficial for the entire crypto sector.

However, investors seeking quick speculative gains or deep DeFi engagement may find other assets more suitable.

In sum, for those with a medium to long-term horizon, XRP presents an increasingly compelling investment case in 2025, especially at current valuations that reflect lingering uncertainty rather than future potential.

Conclusion

XRP has transitioned from a legally embattled token to a strategically positioned asset in the global payments landscape. With Ripple’s proactive involvement in CBDCs, financial networks, and tokenized assets, XRP stands out as a cryptocurrency with real-world purpose.

Though risks remain, the path forward for XRP appears more stable than ever. For investors willing to embrace calculated risk in pursuit of transformative returns, XRP may well prove to be a wise addition to a diversified crypto portfolio.

In short, if you’re still asking, “is XRP a good investment?” – the answer lies in balancing risk, timing, and belief in blockchain utility.

Frequently Asked Questions

Is XRP better than Bitcoin?

Bitcoin and XRP serve different purposes. While Bitcoin serves as a decentralized store of value, XRP supports efficient cross-border payments and caters to institutional use.

Can XRP reach $10?

While ambitious, a $10 target is theoretically possible if XRP achieves widespread utility in global settlements and sees exponential growth in demand and liquidity. ITBFX forecasts suggest such a scenario could play out by 2030 in the most optimistic adoption path.

Where can I buy XRP?

XRP is available on major exchanges such as Binance, Coinbase, Kraken, and Bitstamp.

Is XRP safe to invest in?

With greater regulatory clarity post-SEC ruling and U.S. reserve recognition, XRP is safer than it was in previous years. However, like all crypto investments, XRP experiences volatility, and investors should approach it with caution.

Does XRP have a use case beyond speculation?

Yes. Ripple integrates XRP into its cross-border payment systems and actively explores its use in numerous central bank digital currency initiatives.

The post Is XRP a Good Investment in 2025? A Comprehensive Guide for Investors appeared first on NFT Evening.