[#title_feedzy_rewrite]

The cryptocurrency market faced a turbulent start to the week, with Bitcoin (BTC) leading a broad sell-off that wiped out $700 million in long positions and sent major altcoins like Dogecoin (DOGE) and Cardano (ADA) tumbling by as much as 7%.

The downturn, reported by CoinDesk on May 13, 2025, reflects a cooling of risk appetite among traders, driven by macroeconomic uncertainty and shifting capital flows. Here’s a deep dive into today’s market dynamics, price movements, and the forces shaping the crypto landscape.

Sell the news action hit bitcoin today, which pulled back below $102K after challenging $106K hours ago. Further underperformance could be in the cards as tariff worries disappear.https://t.co/tkDjsyxFNA

— CoinDesk (@CoinDesk) May 12, 2025

Bitcoin Drops to $100k and Liquidation Cascade

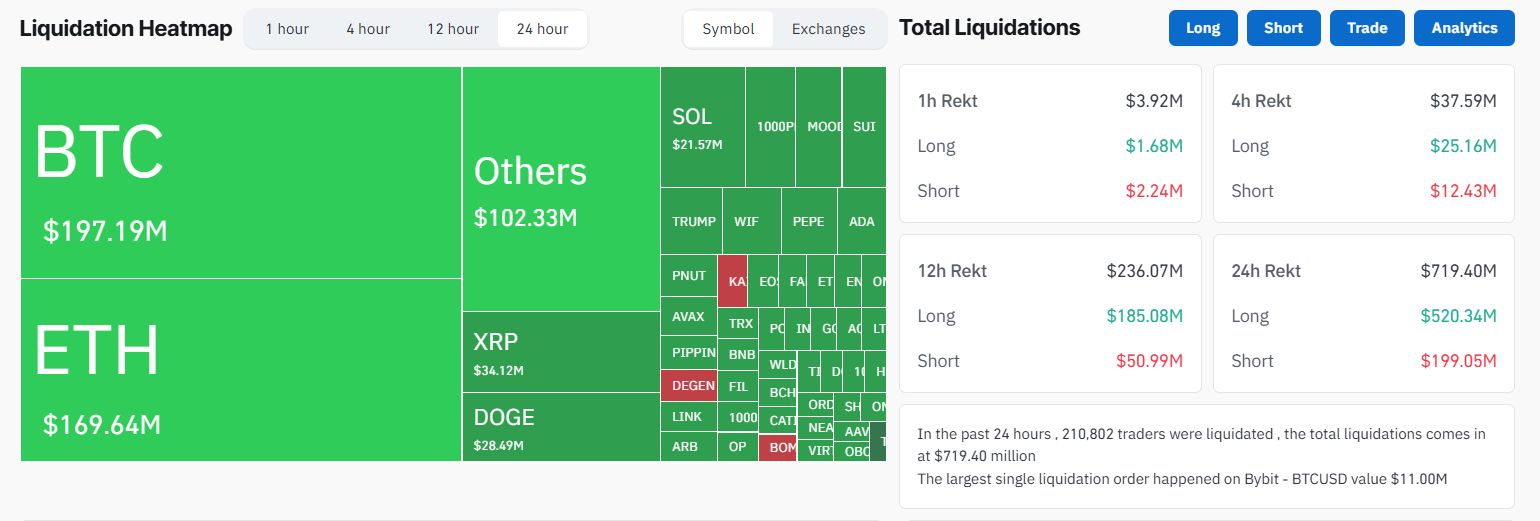

Bitcoin BTC, the market’s bellwether, dropped 2% to hover around $101,000, erasing gains made earlier in the week when it briefly crossed $105,000. This pullback triggered a massive $700 million in long liquidations, as leveraged traders betting on higher prices were caught off guard.

Source: TradingView

Liquidations occur when exchanges forcibly close leveraged positions due to insufficient margin, often amplifying price swings in volatile markets like crypto. The largest single liquidation was a BTCUSDT futures trade on Bybit, valued at $11 million.

Source: CoinGlass

The sell-off was partly attributed to profit-taking after Bitcoin’s recent rally, coupled with broader market caution. Posts on X highlighted a “soft” Asia trading session, with total market capitalization shedding $15.5 billion and capital flowing into stablecoins as investors sought safety. Other indicators including the Crypto Fear & Greed Index, a sentiment gauge, remains in “fear” territory, suggesting potential for a near-term bottom but also reflecting persistent unease.

Ethereum, XRP, and Solana Under Pressure

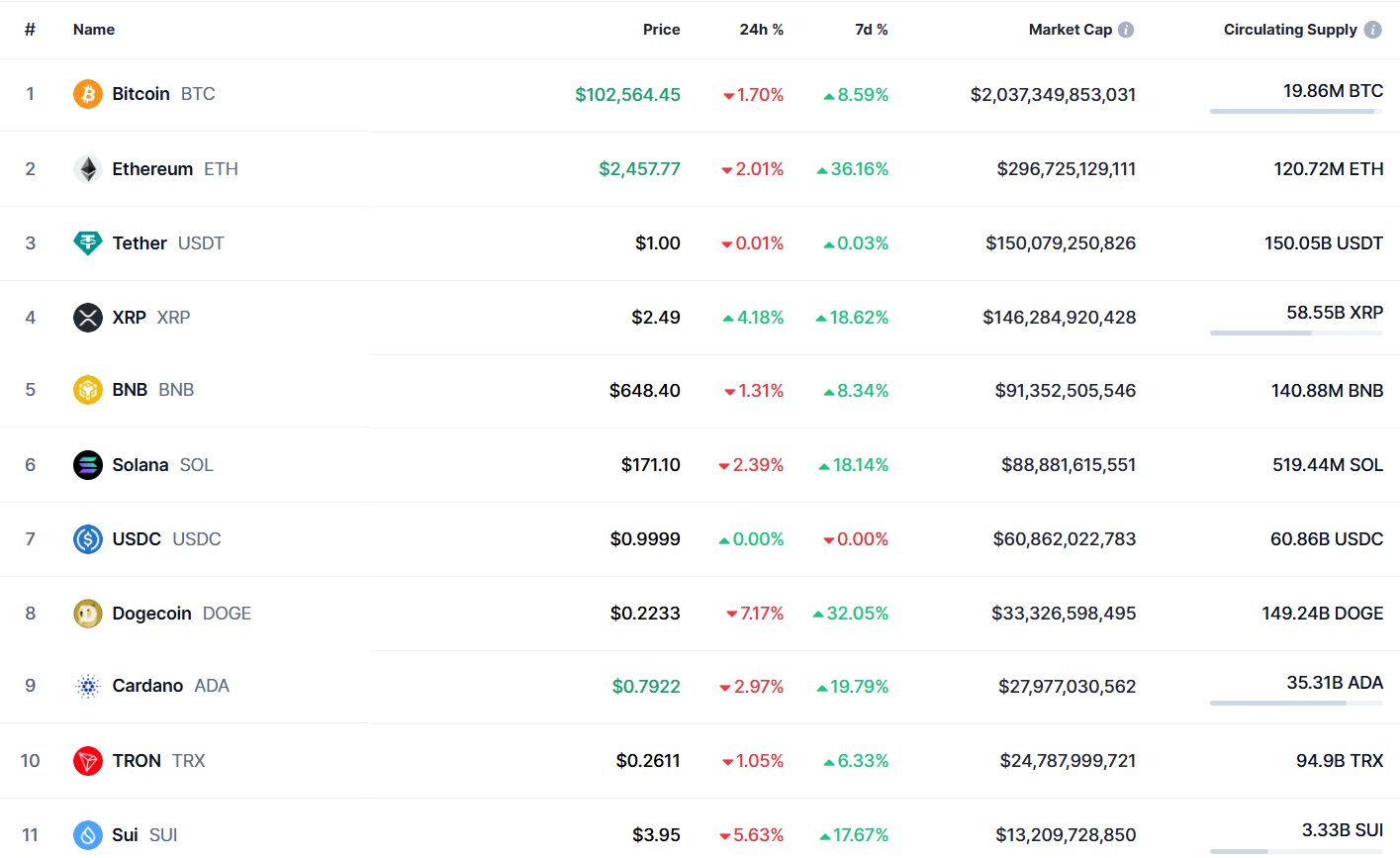

Ethereum ETH fell 2.2%, trading near $2,450. The decline follows a 36% surge last week, fueled by optimism around Ethereum’s Pectra upgrade and a U.S.-UK trade deal. However, today’s risk-off sentiment reversed those gains, with ETH futures contributing significantly to the liquidation tally.

Source: TradingView

XRP, often a darling of retail traders, gains 4%, trading at $2.5.

Read more: Wellgistics Adopts $50M XRP: A Catalyst for Price Growth?

Source: TradingView

Solana SOL, a high-performance blockchain token, also dropped 2.5%, trading at $170.

Source: TradingView

Large-cap altcoins like DOGE and ADA led losses, each down 7%. DOGE, trading at $0.2, has struggled to maintain momentum despite speculation around a potential ETF and Elon Musk’s influence.

Source: CoinGecko

Macro Factors and Outlook

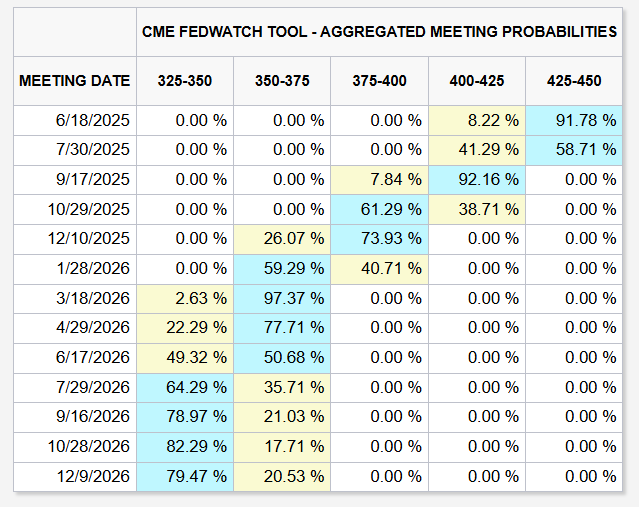

Today’s downturn aligns with macroeconomic headwinds, including uncertainty over Federal Reserve rate cuts and fears of stagflation. The CME FedWatch Tool indicates a 41.29% chance of a rate cut to 4.00%-4.25% by July, but traders remain wary of inflationary pressures from potential U.S. tariffs. Bitcoin’s role as a hedge against volatility continues to attract inflows into spot BTC ETFs, with BlackRock’s IBIT seeing $4.3 billion in monthly inflows.

Source: CME Group

While the market remains in a “holding pattern,” as noted by CoinDesk, Bitcoin’s dominance at 59% suggests capital is consolidating into safer assets. For now, traders are eyeing key support levels—$96,000 for BTC, $2,300 for ETH, and $2.20 for XRP – as potential inflection points. With volatility likely to persist, cautious positioning and robust risk management are critical in navigating this dynamic market.

The post Bitcoin Drop to $101k Triggers $700M in Liquidations appeared first on NFT Evening.