[#title_feedzy_rewrite]

As of May 2025, Bitcoin (BTC) continues to demonstrate its dominance in the cryptocurrency market, outpacing traditional fiat currencies like the US dollar (USD) in multiple metrics.

A recent advertisement from Coinbase highlighted that, in contrast to the limit of Bitcoin supply, the Fed prints out new dollars every day. If Bitcoin is not a true store of value, what should it be?

JUST IN: Coinbase releases new #Bitcoin commercial showcasing how much fiat is being printed out of thin air

/ 21 million pic.twitter.com/Ar2UNfpdDF

— Bitcoin Magazine (@BitcoinMagazine) May 12, 2025

No Limit on The USD Money Supply

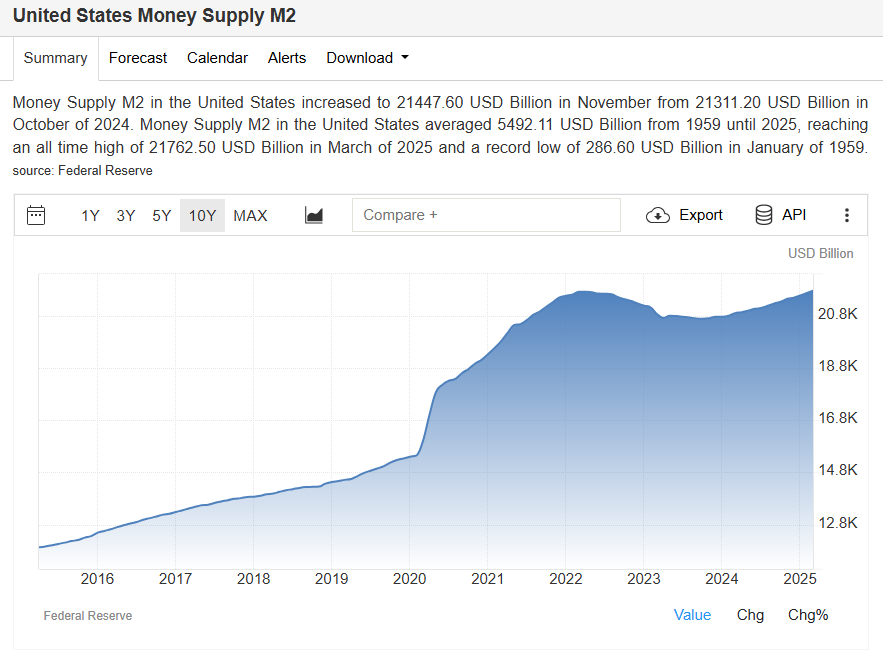

The Federal Reserve expands the money supply through tools like open market operations, quantitative easing, or adjusting reserve requirements. $465 million daily is the monetary base growth, equating to ~$170 billion annually in recent years (based on Fed balance sheet data). This isn’t literal cash but digital reserves banks hold, increasing liquidity.

Moreover, the Fed can create money as needed, guided by economic goals (e.g., inflation control, employment). Since 2008, the monetary base grew from ~$800 billion to ~$5.7 trillion by 2025, partly due to crisis responses.

Source: Trading Economics

Money supply growth can lead to inflation, reducing the dollar’s purchasing power. Since 1913, the dollar has lost ~95% of its value; recent inflation (e.g., 7% in 2021) reflects this.

Read more: BTC Hovers Near $106k, ETH and XRP Test Key Resistance Levels

Fixed Supply of Bitcoin Ensures Scarcity

Bitcoin BTC has a hard cap of 21 million coins, coded into its protocol. New bitcoins are created via mining, with issuance halving every ~4 years (next halving ~2028). Currently, ~19.8 million bitcoins are in circulation, with the final coin to be mined around 2140.

Compared to the USD, which is subject to inflation and monetary policy changes, Bitcoin’s decentralized nature offers a hedge against traditional financial systems. Over the past year, the USD has experienced inflationary pressures, with the annual inflation rate in the US hovering around 3-4% (based on historical trends up to 2023), while Bitcoin’s fixed supply cap of 21 million coins ensures scarcity, driving its value higher over time.

Sustained Demand from First-Time Buyers

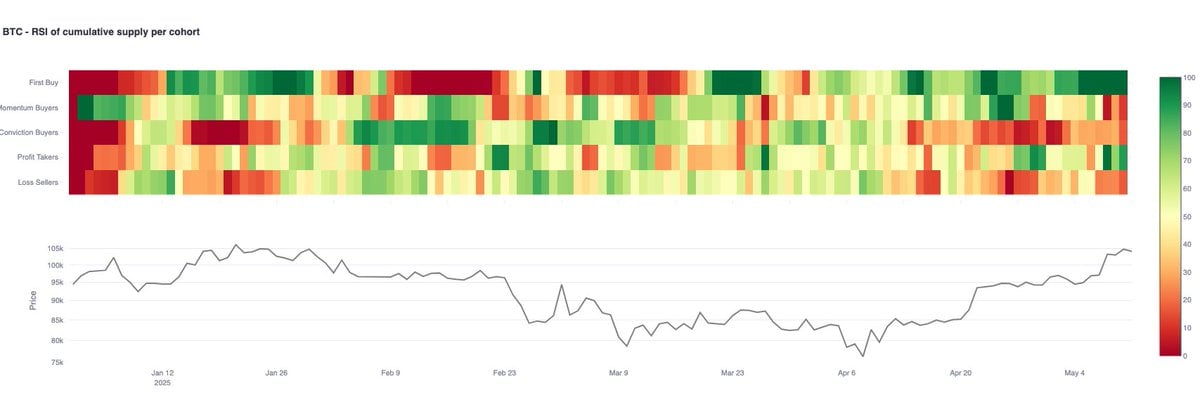

Glassnode’s recent Supply Mapping analysis provides a deeper look into Bitcoin’s market dynamics. On May 12, 2025, Glassnode reported that the Relative Strength Index (RSI) for First-Time Buyers has held at 100 for an entire week, indicating unprecedented demand from new entrants into the Bitcoin market.

This metric, illustrated in Glassnode’s heatmap of cumulative supply RSI by cohort, shows a strong influx of fresh capital, a bullish signal for Bitcoin’s long-term growth. The heatmap reveals sustained green zones for First-Time Buyers, reflecting their aggressive purchasing behavior even at elevated price levels.

Source: X

However, the same report notes weaker participation from Momentum Buyers, with an RSI of approximately 11, suggesting that trend-following investors are not yet fueling the rally. Additionally, Profit Takers are on the rise, which could indicate potential selling pressure if new inflows slow down.

Despite this, the overall trend of new buyers entering the market at such a high RSI level demonstrates confidence in Bitcoin’s future value, further solidifying its outperformance over the USD.

Speculative Momentum and Hot Capital Inflows

Glassnode’s earlier analysis from April 30, 2025, highlighted a surge in “hot capital” inflows into Bitcoin, driven by both First-Time Buyers and Momentum Buyers. This speculative enthusiasm indicates that Bitcoin is entering a new stage of market interest, with short-term capital rotating faster.

Since 21 Apr, $BTC hot capital rose from $20.7B to $39.1B – an increase of $18.7B or +92%. This is one of the fastest upticks in short-term realized cap in recent months, signaling a surge in active capital turnover. pic.twitter.com/vM1lRgHJj7

— glassnode (@glassnode) April 29, 2025

While Ethereum has also seen an uptick in Profit Taker activity, Bitcoin’s demand surge appears more robust, with fewer obstacles to its upward momentum. This trend further supports Bitcoin’s outperformance over the USD, as investors increasingly turn to digital assets to hedge against fiat currency depreciation.

Source: Glassnode

Bitcoin as a Digital Store of Value

Bitcoin’s fundamental design also gives it an edge over the USD. With a fixed supply and a decentralized network, Bitcoin is often compared to digital gold – a store of value that is immune to inflation and government interference.

Coinbase notes that Bitcoin is divisible into smaller units called satoshis (1 satoshi = 0.00000001 BTC), making it highly flexible for transactions. Additionally, Bitcoin’s ability to be sent, received, and stored using cryptographic keys enhances its privacy and control, features that the USD cannot replicate in its traditional form.

The post Coinbase: Bitcoin is Superior to USD appeared first on NFT Evening.