[#title_feedzy_rewrite]

Hyperliquid, a decentralized exchange built on its own Layer-1 blockchain, has solidified its position as a major player in the crypto derivatives market, ranking among the top venues for perpetual Bitcoin swaps.

With its innovative approach to cost-effective trading and high-performance infrastructure, Hyperliquid is challenging the dominance of centralized exchanges like Binance, marking a significant shift in the DeFi landscape.

Hyperliquid’s Rise to Prominence in Crypto Derivatives

Hyperliquid has rapidly ascended to become a leading platform for crypto derivatives, particularly in perpetual Bitcoin swaps, also known as “perps.” According to a Bloomberg report dated May 13, 2025, the decentralized exchange (DEX) now ranks among the biggest venues for these financial instruments, a remarkable feat in a market historically dominated by centralized giants like Binance.

One exchange is realizing the DeFi dream of breaking into a market dominated by Binance and other centralized exchanges, @MuyaoShen writes in the @Crypto newsletter https://t.co/Z7SOFnGv7c

— Bloomberg (@business) May 13, 2025

Hyperliquid’s success is rooted in its foundation as a peer-to-peer trading platform with minimal intermediaries, aligning with the core ethos of decentralized finance (DeFi). This model has allowed Hyperliquid to carve out a significant share of the derivatives market, which has long been a stronghold of centralized exchanges.

The platform’s growth comes at a pivotal time for DeFi, as decentralized exchanges strive to break into markets traditionally controlled by centralized players. Hyperliquid’s ability to offer perpetual futures trading—a popular derivative product allowing traders to speculate on Bitcoin’s price without an expiration date—has been a key driver of its popularity.

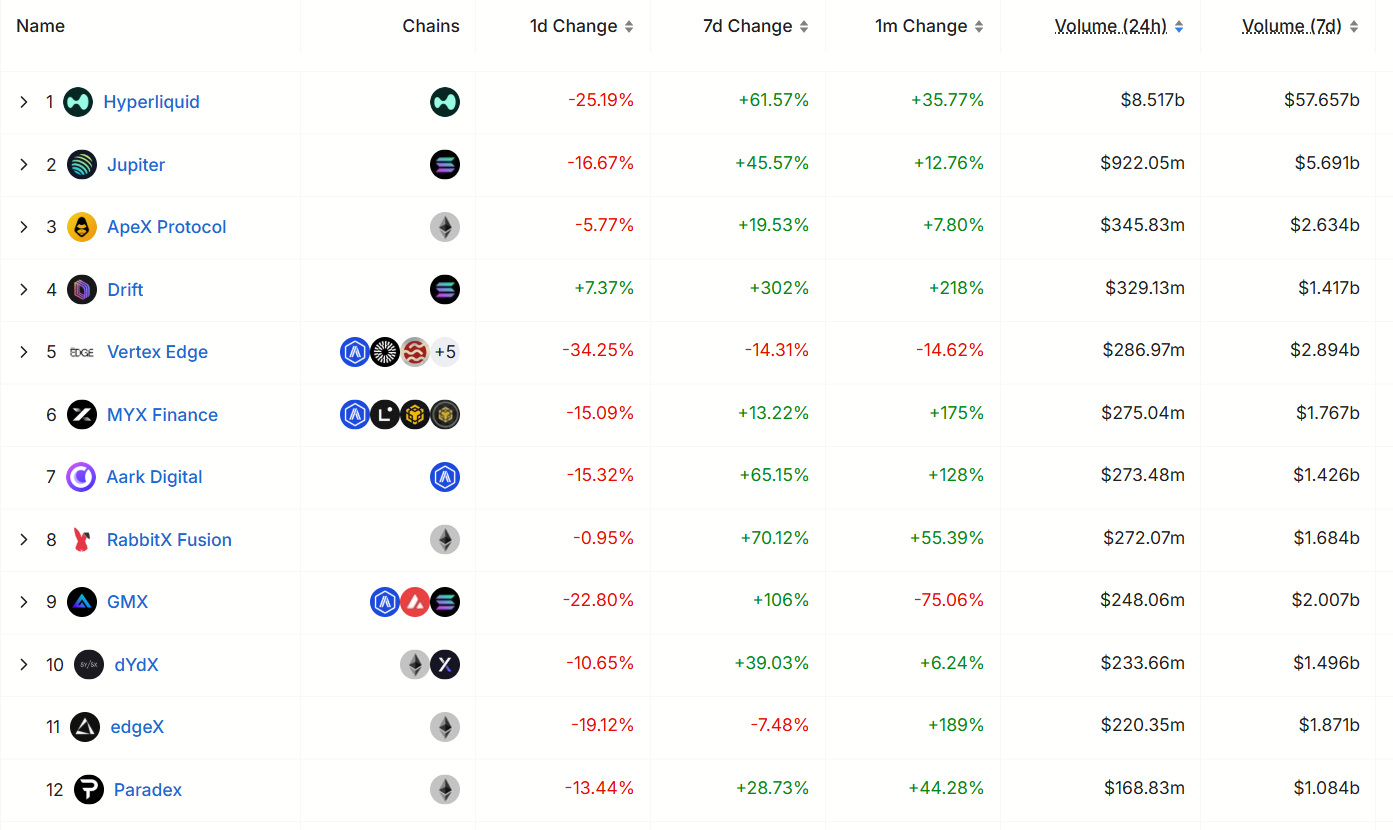

Source: DefiLlama

By leveraging its own Layer-1 blockchain, Hyperliquid ensures fast transaction speeds and low fees, addressing common pain points in DeFi trading. The platform’s infrastructure, including a novel consensus mechanism called Hyper BFT that can process up to 200,000 transactions per second, enables it to support a fully on-chain order book, a feature typically found in centralized exchanges.

Read more: Hyperliquid Destroyed Ethereum in Daily Fees Gained

HYPE Surges 60% Monthly, Showing Remarkable Price Recovery

Hyperliquid HYPE strengthens its crypto derivatives leadership with an innovative economic model, eliminating gas fees for perpetual futures, offering maker rebates, and keeping low taker fees. This cost-effective approach attracts retail investors and high-volume traders seeking competitive advantages.

The platform’s recent launch of its native token, HYPE, priced at $25.33 with a 24-hour trading volume of $165 million as of May 14, 2025, has also enhanced its ecosystem. The token is expected to improve liquidity, governance, and incentivization, further fueling Hyperliquid’s growth.

Source: TradingView

The impact of Hyperliquid’s rise extends beyond its platform, contributing to the broader adoption of decentralized financial services. By offering a high-performance, transparent alternative to centralized exchanges, Hyperliquid is helping to bridge the gap between traditional finance and DeFi.

Read more: Hyperliquid Ecosystem: From Perp DEX to Emerging Crypto Ecosystem

The post Hyperliquid Emerges as a Leader in Crypto Derivatives Trading appeared first on NFT Evening.