[#title_feedzy_rewrite]

Cathie Wood & Nvidia investment decisions have really drawn significant attention right now as the prominent investor continues…

Cathie Wood & Nvidia investment decisions have really drawn significant attention right now as the prominent investor continues to make some strategic portfolio adjustments. Wood’s Ark Invest has recently sold off its Palantir (PLTR) position at what appears to be peak valuation, while at the same time, insurance giant Progressive has also substantially increased its Nvidia (NVDA) holdings with a purchase of about 61,272 additional shares.

Also Read: Trump Opens Saudi Checkbook: 13 U.S. Stocks at Center of $600B Deal

Why The Wealthy Are Replacing The United States Dollar With Crypto and Gold

As uncertainty grows around traditional currency investments these days, wealthy individuals are increasingly turning to cryptocurrency and also gold as alternatives to the United States dollar. This shift definitely reflects broader concerns about inflation and monetary stability, with many high-net-worth investors in North America currently diversifying their portfolios through digital assets and also precious metals.

1. Wood’s Strategic Exit From Palantir

According to Benzinga’s reporting:

“Ark Invest, led by Cathie Wood, sold 660,681 shares of Palantir Technologies on Wednesday.”

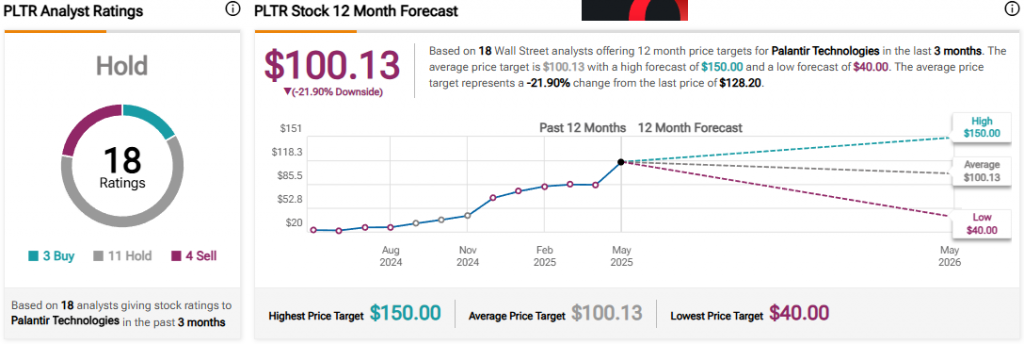

This Cathie Wood & Nvidia portfolio adjustment comes just as Palantir reached recent price highs on the Nasdaq, and it seems to suggest a well-timed profit-taking strategy. Wood’s active management approach continues to shape her technology investment thesis across various NVDA-adjacent sectors at the time of writing.

2. Progressive’s Bullish NVDA Position

While Wood reduces certain tech exposures right now, Progressive Insurance has demonstrated some remarkable confidence in Nvidia stock. The insurer’s acquisition of 61K NVDA shares certainly signals strong institutional backing for the semiconductor leader. This Cathie Wood & Nvidia market counterpoint really highlights the differing institutional approaches to technology investments that we’re seeing.

Also Read: De-Dollarization: 13 Nations Find New Chinese Yuan Usage, Shunning US Dollar

Strong Analyst Support for NVDA

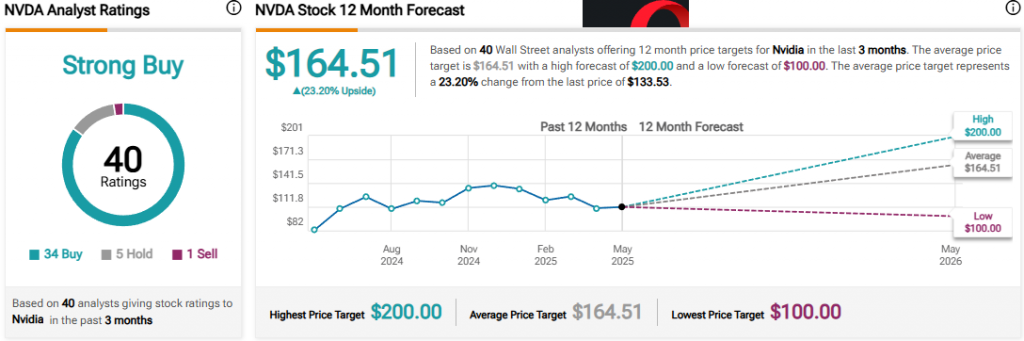

Wall Street continues to maintain an overwhelmingly positive sentiment toward Nvidia. With about 40 analyst ratings showing 34 buys, the average price target of $164.51 represents a 23.20% upside from current levels, as seen in the image above. Many major financial institutions have also recently reiterated their bullish stance on NVDA.

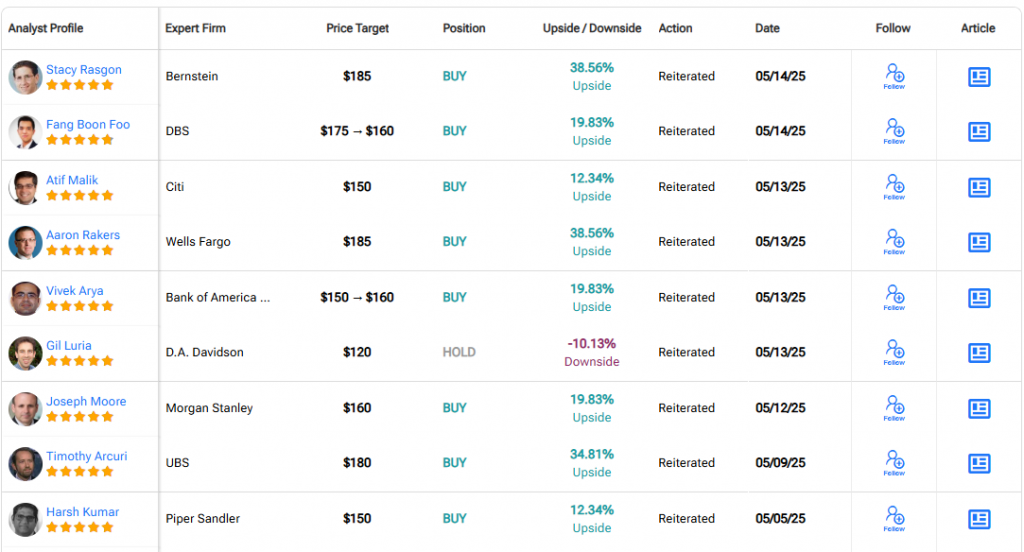

Multiple prominent analysts have confirmed their optimistic outlook for Nvidia stock:

Stacy Rasgon from Bernstein stated:

“We are reiterating our BUY rating with a $185 price target, representing 38.56% upside potential.”

This continued institutional confidence stands in stark contrast to the Cathie Wood & Nvidia portfolio shift away from companies like Palantir and such.

Also Read: New US Sanctions on 30+ Chinese Firms Spike Supply Chain Risks for Stocks

Investment Rotation Implications

The contrasting moves between Wood and Progressive highlight an emerging rotation within technology investments. While some investors are taking profits in companies like Palantir that have seen substantial appreciation, capital continues flowing into semiconductor leaders like Nvidia positioned at the center of the AI revolution.

For Nvidia stock, the consensus remains decisively positive despite the company’s already substantial market capitalization, with the Cathie Wood & Nvidia investment contrast serving as a fascinating case study in institutional investment strategies at this point in time.