[#title_feedzy_rewrite]

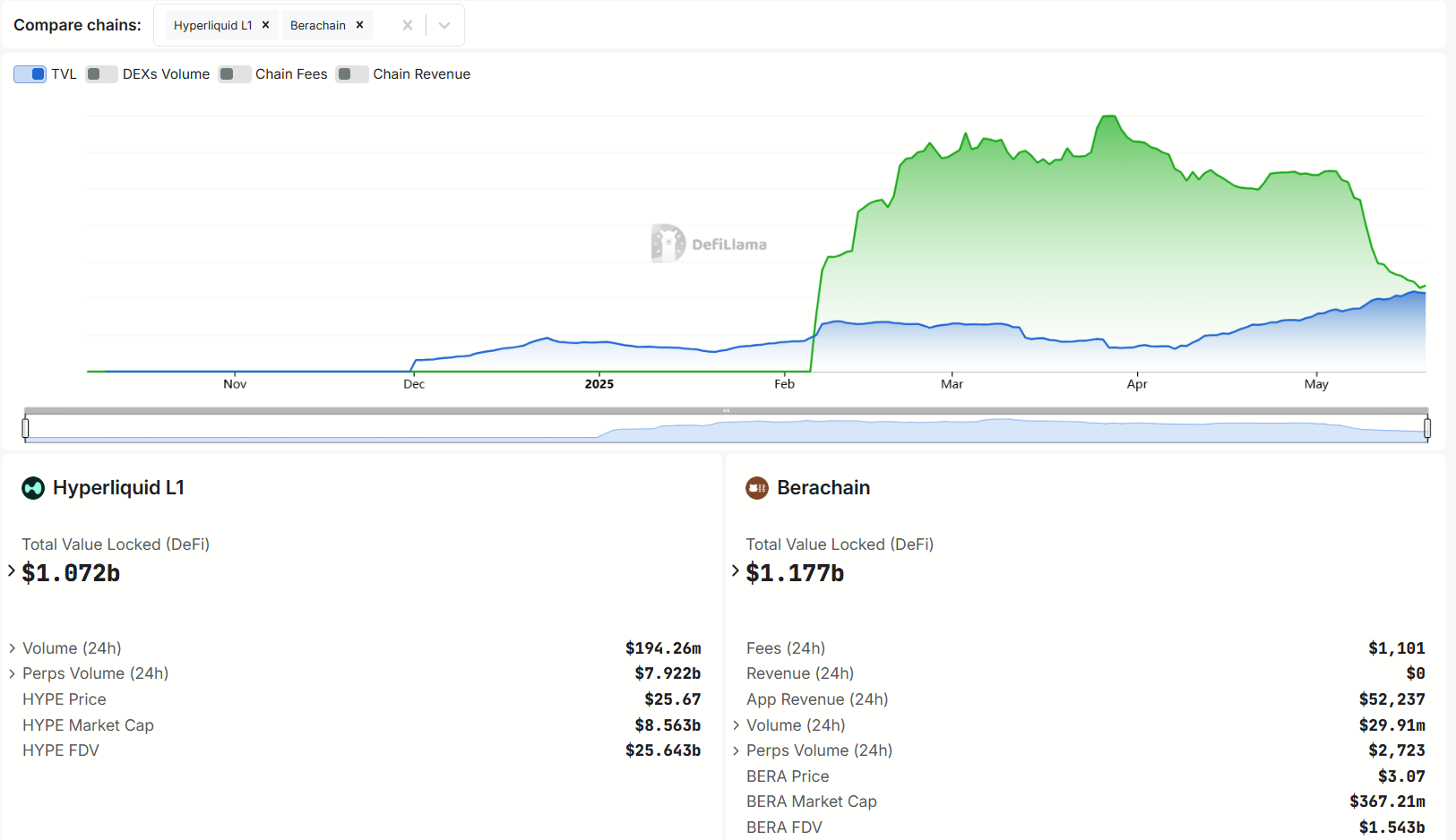

On May 17, 2025, Hyperliquid L1’s Total Value Locked (TVL) is about to surpass Berachain’s, with on-chain data showing Berachain at $1.184 billion and Hyperliquid at $1.085 billion, reflecting a competitive DeFi landscape marked by organic growth and market fluctuations.

Hyperliquid Dominates Perp DEXes with Steady TVL Growth

Hyperliquid emerges as a leader in crypto derivatives trading, with its TVL reaching $1.085 billion as of May 19, 2025. Hyperliquid’s 24-hour volume at $195.83 million and perps volume at $7.92 billion, significantly outpacing Berachain’s $25.29 million.

Source: DefiLlama

Hyperliquid’s growth is largely organic, as emphasized by an analyst, who contrasted it with Berachain’s reliance on a “massive farming campaign”.

HyperEVM about to flip Berachain for TVL

One had a massive farming campaign

One was completely organically bootstrapped

Hyperliquid.$HYPE vs $BERA pic.twitter.com/qYvY4Cu2ho

— 800.HL (@degennQuant) May 17, 2025

Hyperliquid’s HYPE token, priced at $25.48 with a market cap of $8.57 billion as of May 19, 2025, underscores its market strength, ranking #18 globally.

Source: TradingView

The platform’s focus on organic activity, evidenced by its rejection of VC funding and community-driven approach, has fueled its rise.

Berachain’s TVL Decline Signals Sustainability Concerns

Berachain, once a DeFi leader, has seen its TVL drop rapidly from its peak at $3.351 billion in March 2025 to just $1.184 billion today.

Source: DefiLlama

Berachain has a Proof-of-Liquidity (PoL) model and conducted a massive farming campaign launched after its February 2025 mainnet debut.

berachain pulled in $3.5B TVL with points and incentives — and is now bleeding capital, users, and doing <$10k/day in revenue.

hyperliquid’s L1 just crossed $1B TVL without grants, ecosystem farming, or forced liquidity games.

no bribes — just reflexive flow from the most… pic.twitter.com/pCv5q0LnmC

— Simon (@simononchain) May 18, 2025

Berachain’s BERA token, trading at $3.06 with a market cap of $364.6 million and a fully diluted valuation of $1.532 billion, has also struggled, down nearly 80% from its ATH at $14.83 earlier in the year.

The platform’s reliance on incentivized liquidity, including private LP deals, has raised concerns about sustainability. Berachain’s 24-hour volume of $26.28 million pales in comparison to Hyperliquid’s, signaling a potential shift in DeFi user preference toward more organic ecosystems.

The broader DeFi market is watching closely, as Hyperliquid’s steady growth challenges Berachain’s earlier dominance. This trend may signal a preference for platforms with sustainable, user-driven growth over those reliant on short-term incentives.

The post Hyperliquid Asserts Dominance, Set to Surpass Layer 1 Berachain appeared first on NFT Evening.