[#title_feedzy_rewrite]

Strategy stock is currently facing some significant pressure this week amid the ongoing Michael Saylor lawsuit troubles and…

Strategy stock is currently facing some significant pressure this week amid the ongoing Michael Saylor lawsuit troubles and also regulatory uncertainty, even as the company has just recently added about 7,390 Bitcoin to its holdings. At the time of writing, despite the rather unpredictable market volatility in the cryptocurrency space, many analysts still maintain their bullish outlooks on Strategy stock with some pretty ambitious price targets for the coming months.

Also Read: Grok Predicts What Genius Act Means For The Cryptocurrency Market

Strategy Stock Faces Michael Saylor Lawsuit, Bitcoin Accumulation & Regulatory Uncertainty Amid Market Volatility

Legal Challenges Impact Strategy Stock Performance

Strategy stock has been negatively affected by a class action lawsuit that was just recently filed against CEO Michael Saylor, which actually alleges insider trading related to the company’s Bitcoin purchases. This legal challenge, which is still developing, comes right at a time when Strategy continues its somewhat aggressive cryptocurrency accumulation strategy despite all of the regulatory uncertainty in the market right now.

Strategy’s Recent Bitcoin Acquisition

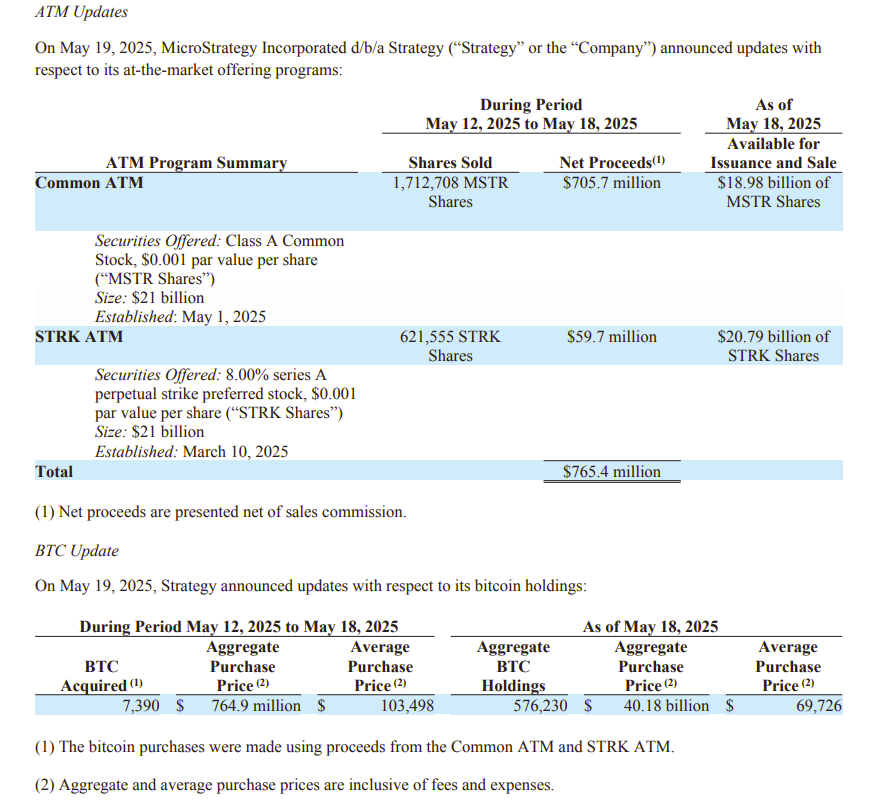

The recent SEC filings for Strategy stock confirm that the company has purchased an additional 7,390 BTC at an aggregate price of about $764.9 million, which brings their total holdings to approximately 276,230 Bitcoin as of today. These purchases were financed through the company’s ATM programs, which managed to generate around $765.4 million in net proceeds during the reporting period.

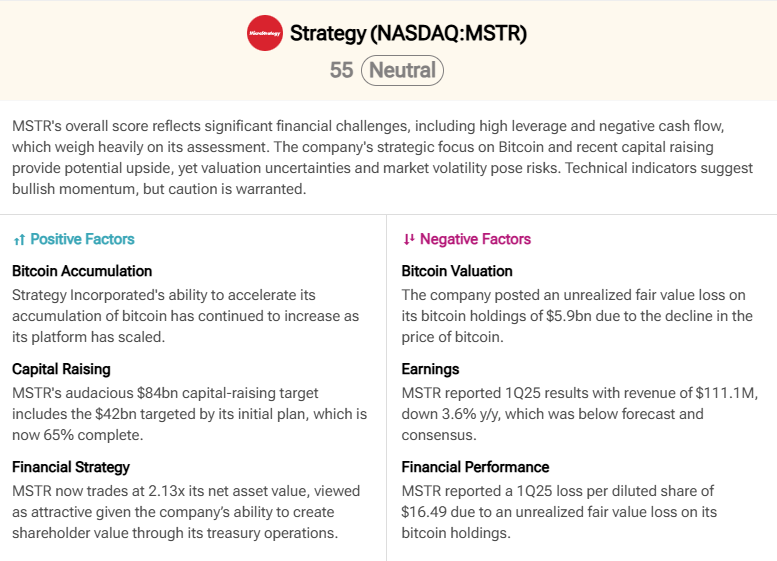

A recent financial analysis report stated:

“Strategy’s ability to accelerate its accumulation of bitcoin has continued to increase as its platform has scaled.”

Also Read: Ethereum: AI Predicts ETH Price For The Next Six Months

Analyst Outlook Remains Positive Despite Challenges

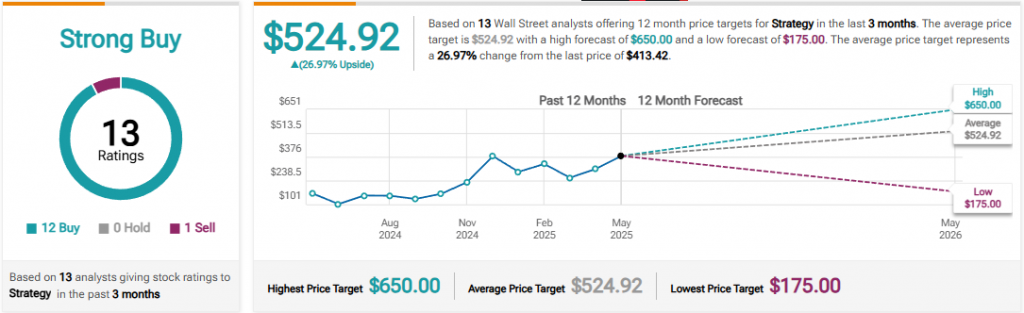

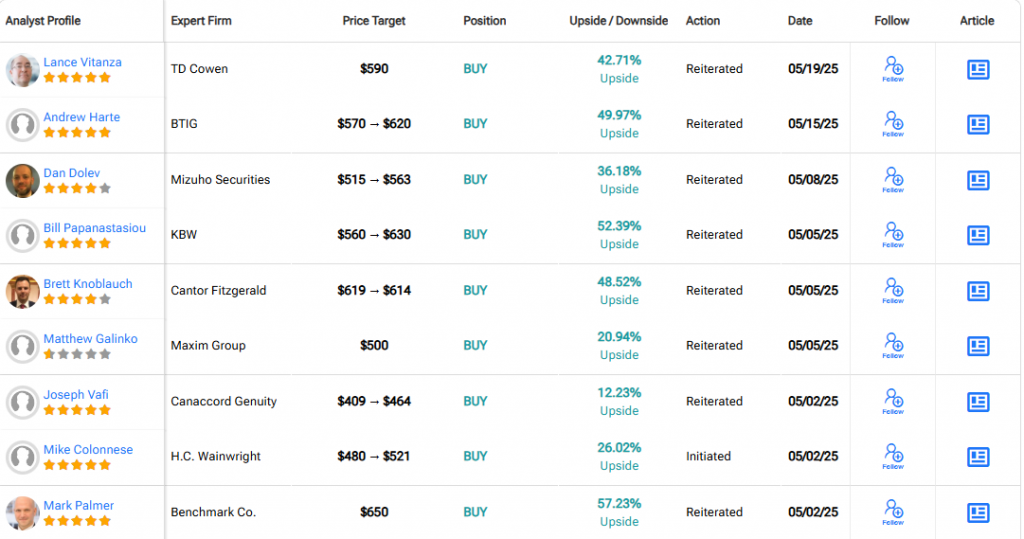

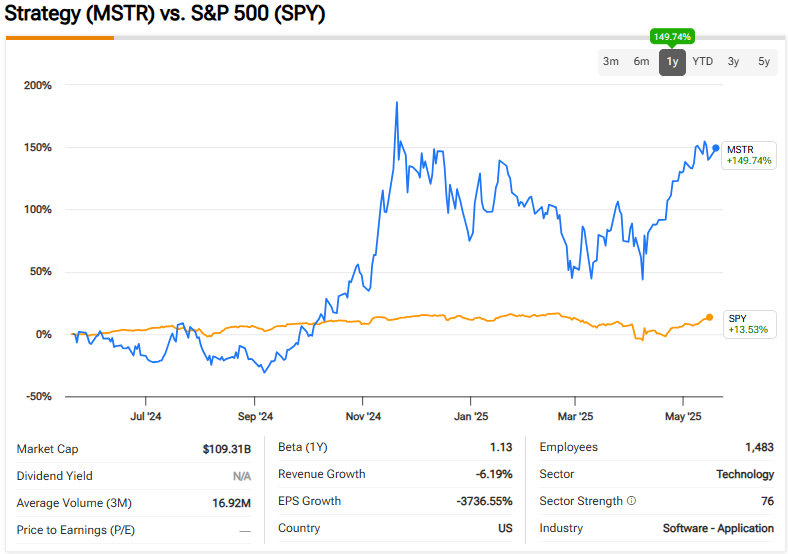

Strategy stock still maintains strong analyst support despite all of the recent volatility and uncertainty. Based on the opinions of about 13 Wall Street analysts, the company currently carries a “Strong Buy” recommendation with an average price target of roughly $524.92, which actually represents a potential 26.97% upside from where we are today.

Andrew Harte from BTIG stated:

“We are reinforcing our Buy rating on Strategy shares and maintaining our $570-$620 price target range following the company’s continued Bitcoin accumulation strategy.”

Financial Performance Amid Bitcoin Volatility

Right now, Strategy stock is facing some challenges as the company just recently reported their Q1 2025 results with revenue of about $111.1M, which is down approximately 3.6% year-over-year. The company has also posted a loss of around $16.49 per diluted share due to Bitcoin’s rather unpredictable price fluctuations during this period.

Also Read: AI Predicts Pepe Coin Price For The End of May 2025

Market Performance vs. Broader Indices

Even with all of the recent challenges and setbacks, Strategy stock has actually delivered some exceptional returns for investors, outperforming many major indices with a remarkable 149.74% gain compared to the S&P 500’s modest 13.53% over the past year. The market volatility remains a significant concern for Strategy stock investors as regulatory uncertainty continues to affect cryptocurrency markets in general.

While the regulatory and legal headwinds do persist today, Strategy stock’s Bitcoin accumulation strategy and the strong analyst support that we’re seeing right now suggest that the ambitious $1,800 price target might still remain attainable for long-term investors who are willing to tolerate the significant market volatility that comes with this investment.

Also Read: Microsoft (MSFT) Hosts Conference to Focus on AI Profits