[#title_feedzy_rewrite]

Aave TVL doubles to a record $40.3 billion, signaling renewed strength in Ethereum’s DeFi ecosystem as institutional and retail interest drives unprecedented growth in 2025.

New week, new all-time high.

$40.3 billion net deposits

The highest TVL ever reached by a DeFi protocol. pic.twitter.com/XBRnruemQz

— Aave (@aave) May 12, 2025

Aave TVL Doubles in 2025

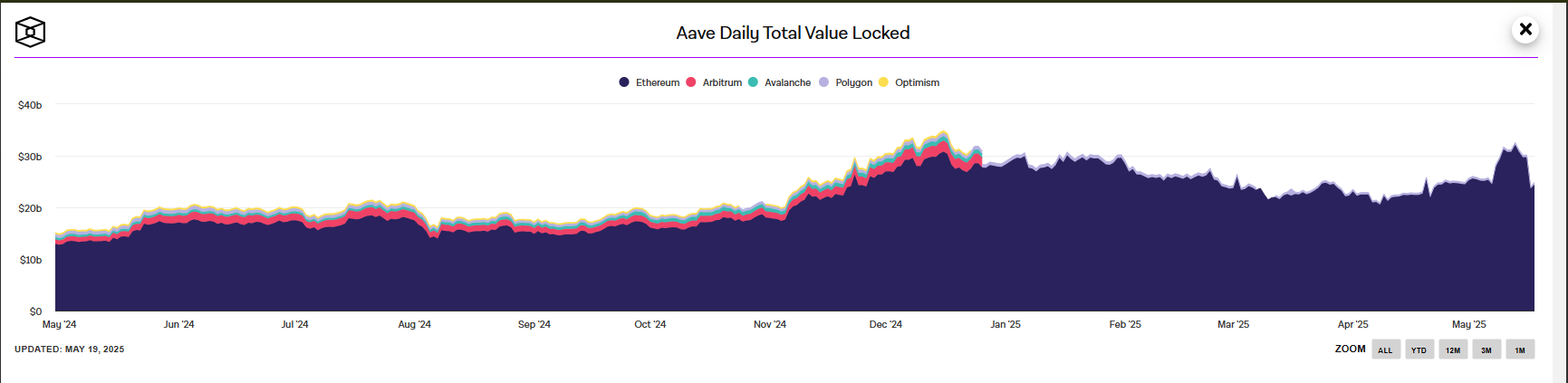

AAVE, Ethereum’s leading decentralized finance (DeFi) lending protocol, has reached an all-time high total value locked (TVL) of $40.3 billion as of May 12, 2025, a 50% increase from its year-to-date low of $20 billion.

Source: The Block

This milestone positions it as the top DeFi protocol by TVL, surpassing competitors like Lido DAO, which holds $33.8 billion. The surge reflects growing confidence in Ethereum’s ecosystem, fueled by improved market conditions and Ether’s price rally from $1,500 to $2,500 in the past month. Aave’s outstanding debt has risen to $10 billion, maintaining a healthy 33% debt-to-TVL ratio, indicating robust utilization and liquidity.

Learn more: Aave vs Jupiter: Ethereum vs Solana War in DeFi Sector

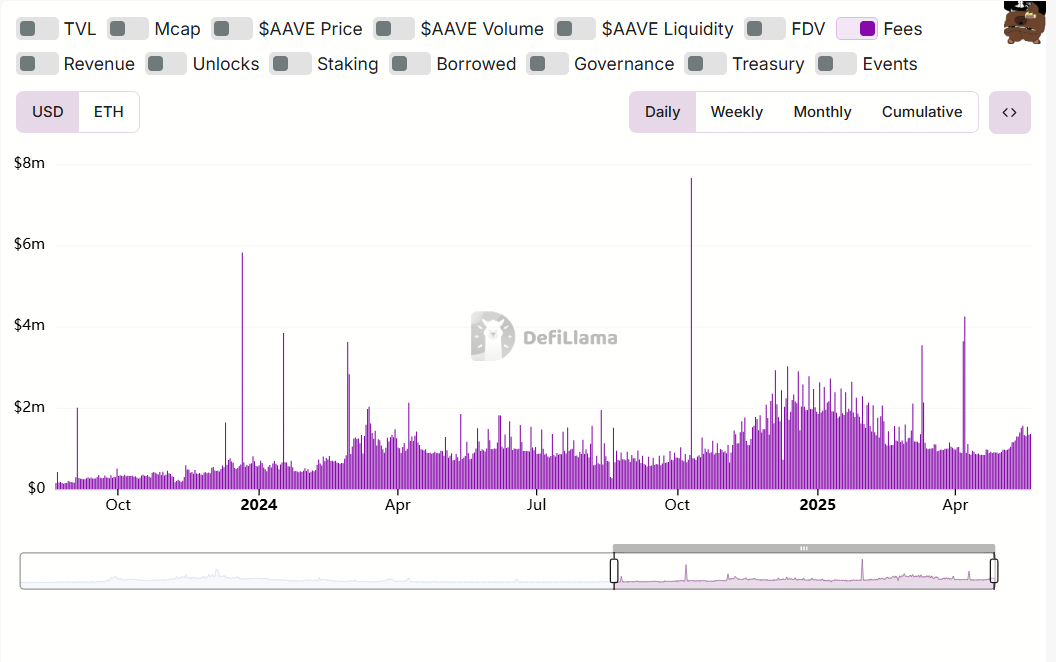

Aave’s daily fees have reached $1 million, and its lending markets across Ethereum and Layer 2 solutions like Arbitrum and Optimism have attracted $500 million in collateral netflows in a single week. The integration of Chainlink’s SVR, covering 27% of Aave’s TVL, enhances security and scalability, further boosting investor trust.

Source: DefiLlama

Ethereum’s DeFi Strength Persists Despite Competition

Ethereum ETH remains the backbone of DeFi, with a TVL of $77.15 billion, accounting for 51.24% of the sector’s total, despite fierce competition from Solana and L2 solutions like Arbitrum and Optimism.

Aave’s 19.63% share of DeFi TVL is bolstered by its robust ecosystem, hosting nearly 5,000 dApps, including Uniswap and MakerDAO, and over 290 million active addresses.

Solana’s DeFi ecosystem, featuring projects like Raydium and Jupiter, excels in high-frequency trading and memecoin surge, with 400+ DeFi and NFT projects and $1.8 billion in Raydium’s TVL alone.

Solana’s Proof-of-History (PoH) and low-cost transactions ($0.00025 per transaction) attract developers for scalable dApps, particularly in gaming and memecoins, but its 2,000 validators raise centralization concerns compared to Ethereum’s 800,000+.

L2 solutions like Arbitrum, with $8 billion in stablecoin volume, and Optimism challenge Ethereum’s mainnet by offering faster, cheaper transactions, diverting some liquidity. Despite this, Ethereum’s first-mover advantage, mature developer community, and Pectra upgrade ensure its DeFi dominance, while Aave’s cross-chain strategy counters Solana’s speed advantage.

Despite these hurdles, Aave’s innovative features, such as permissioned RWA collateral and the GHO stablecoin, bridge traditional finance and DeFi, attracting institutional interest.

The post Aave TVL Doubles Post-Downturn, Signaling Ethereum DeFi’s Comeback? appeared first on NFT Evening.