[#title_feedzy_rewrite]

Moody‘s AAA rating cut has, at the time of writing, sent real shockwaves through global markets as the…

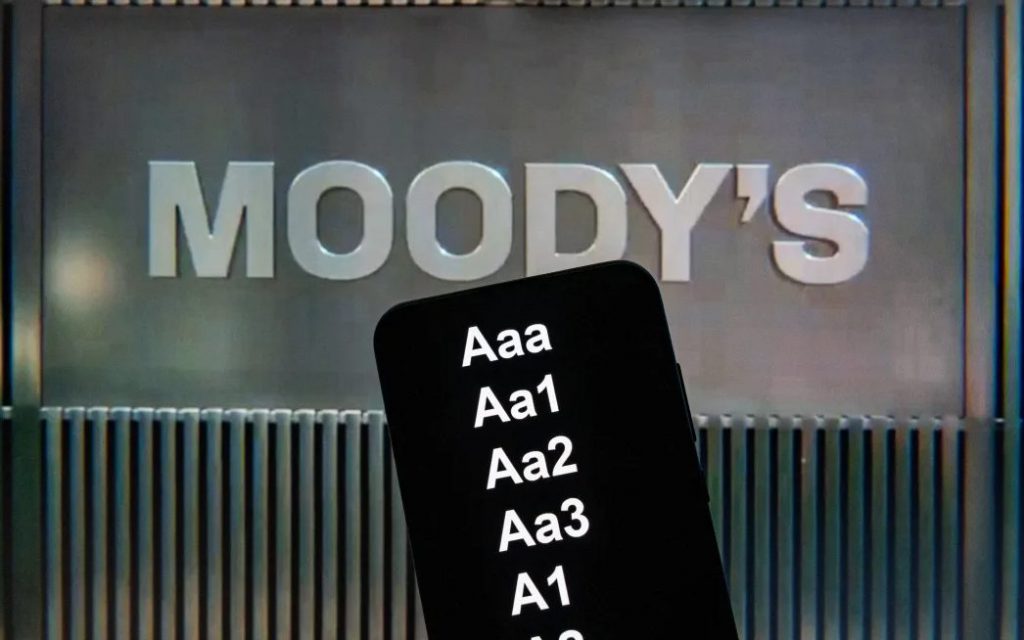

Moody‘s AAA rating cut has, at the time of writing, sent real shockwaves through global markets as the last major agency to actually downgrade U.S. credit status. Just recently, on May 16, 2025, Moody’s officially lowered the rating from AAA to AA1, and this has triggered immediate and also quite concerning volatility in treasury yields and also raised serious questions about America’s long-term debt sustainability. This historic downgrade, right now, reflects the growing concerns about what seems to be unsustainable fiscal deficits and also skyrocketing interest payments.

Also Read: 80% of Americans Want Bitcoin in National Reserves Over Gold

Moody’s Downgrade Fuels Market Volatility, Debt Risk, and Crypto Fear

Moody’s AAA rating cut wasn’t really an impulsive decision but rather the culmination of years and years of fiscal deterioration. The rating agency specifically cited America’s inability to address, such as, growing deficits, which has caused treasury yields to jump immediately after the announcement, for sure.

Moody’s stated:

“This one-notch downgrade on our 21-notch rating scale reflects the increase over more than a decade in government debt and interest payment ratios to levels that are significantly higher than similarly rated sovereigns.”

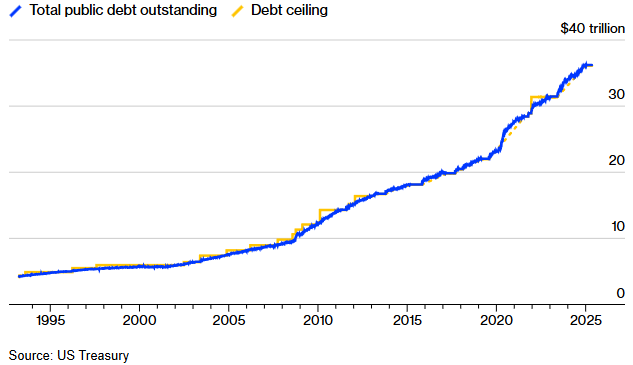

Trillion-Dollar Interest Burden

The most alarming effect of Moody’s AAA rating cut is, right now, the projection for U.S. interest payments. The market volatility following the downgrade has, in many ways, worsened the outlook for U.S. credit rating prospects and such.

Moody’s explained:

“Without adjustments to taxation and spending, we expect budget flexibility to remain limited, with mandatory spending, including interest expense, projected to rise to around 78% of total spending by 2035 from about 73% in 2024.”

Also Read: China to Promote Yuan For International Use, PBOC Governor Confirms

Market Implications and Treasury Yields

The market response to Moody’s AAA rating cut has been, like, immediate and also quite pronounced. Treasury yields spiked as investors demanded higher returns for holding U.S. debt, while the dollar also weakened against major currencies and other financial instruments.

Gene Dodaro, U.S. Comptroller General and head of the GAO, warned:

“We’re calling on Congress and the Administration to act now to develop and implement a strategy to address this acute challenge. Inaction could result in great difficulties for many Americans and impede policymakers’ flexibility to respond to future economic recessions or unexpected events.”

Long-Term Economic Impact

For average Americans, Moody’s AAA rating cut will likely mean, in many ways, higher borrowing costs. The downgrade’s impact on treasury yields influences, such as, mortgage rates, credit cards, and also auto loans, creating persistent and ongoing market volatility.

Also Read: Arthur Hayes Predicts The Start Of Altcoin Season & Its Sooner Than You Think

The GAO’s fiscal health report notes that interest payments will exceed, like, $1 trillion in FY 2025, highlighting the severe strain on the U.S. credit rating and also the potential for further deterioration if not addressed soon.

Moody’s noted:

“As deficits and debt have grown, and interest rates have risen, interest payments on government debt have increased markedly.”