[#title_feedzy_rewrite]

Three whales on Hyperliquid have placed a staggering $1 billion in long positions on Bitcoin with 40x leverage, signaling strong confidence in a price surge, while CryptoQuant’s on-chain data supports a healthy bull market with potential for further growth.

Three Whales’ $1B Bitcoin Long Positions on Hyperliquid Stir Market Frenzy

On May 21, 2025, three whales opened long Bitcoin positions with 40x leverage on Hyperliquid, collectively holding a staggering $1.03 billion in positions.

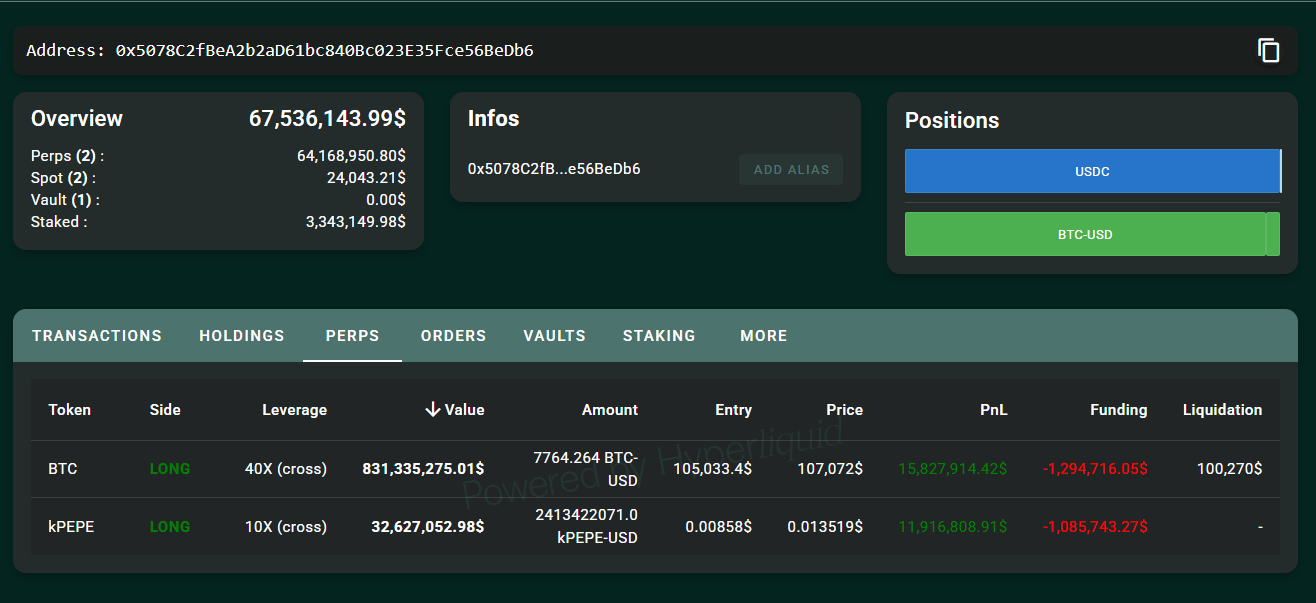

The first whale, identified as 0x5078, longed BTC at $105,033.4, and is currently up $15.83 million with a liquidation price at $100,270.

Source: Hyperliquid

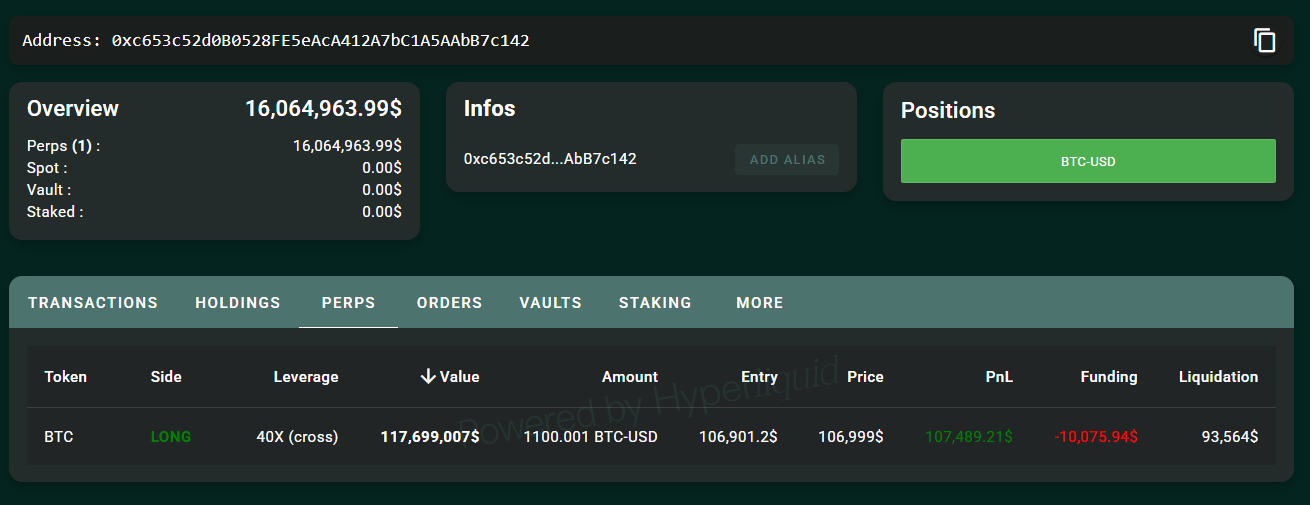

The second whale, 0xc653, entered at $106,901.2, currently up $107,490 with liquidation at $93,560.

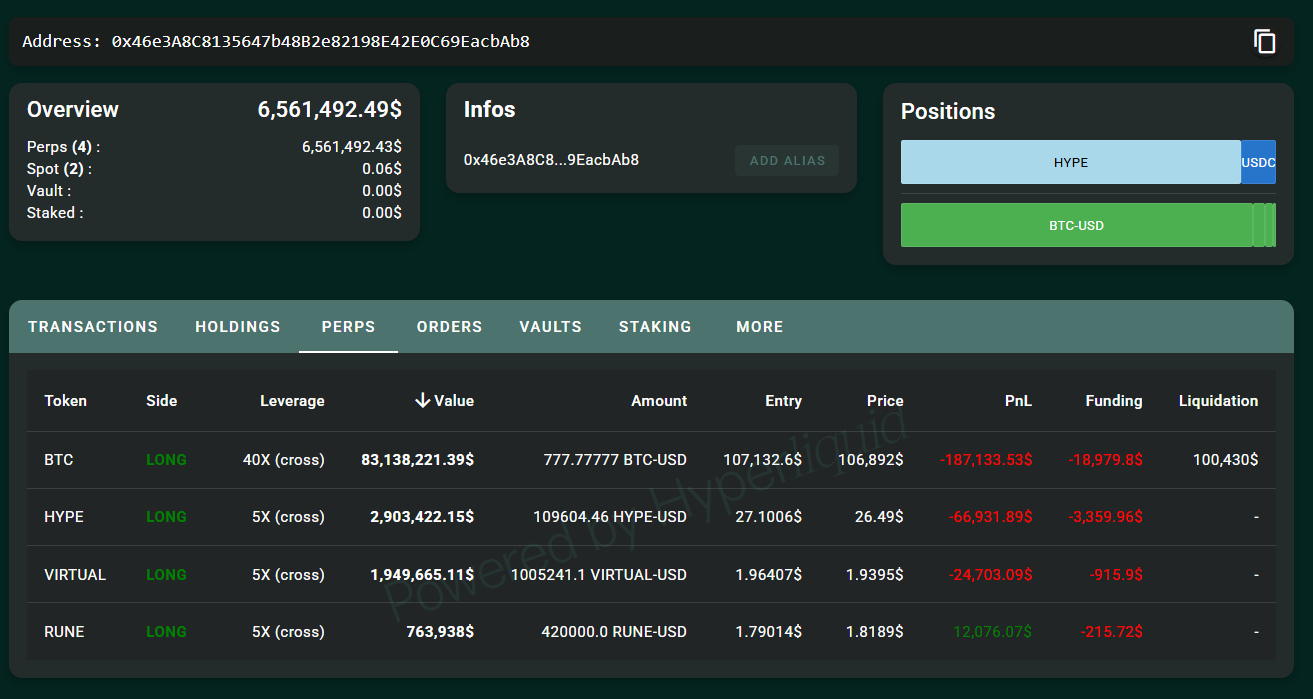

The third, 0x46e3, longed at $107,132.6, facing a $142,800 loss and a liquidation price of $100,430.

These positions reflect a strong bullish outlook, as the whales are betting on Bitcoin’s price climbing higher despite the high risk of liquidation due to their leveraged trades.

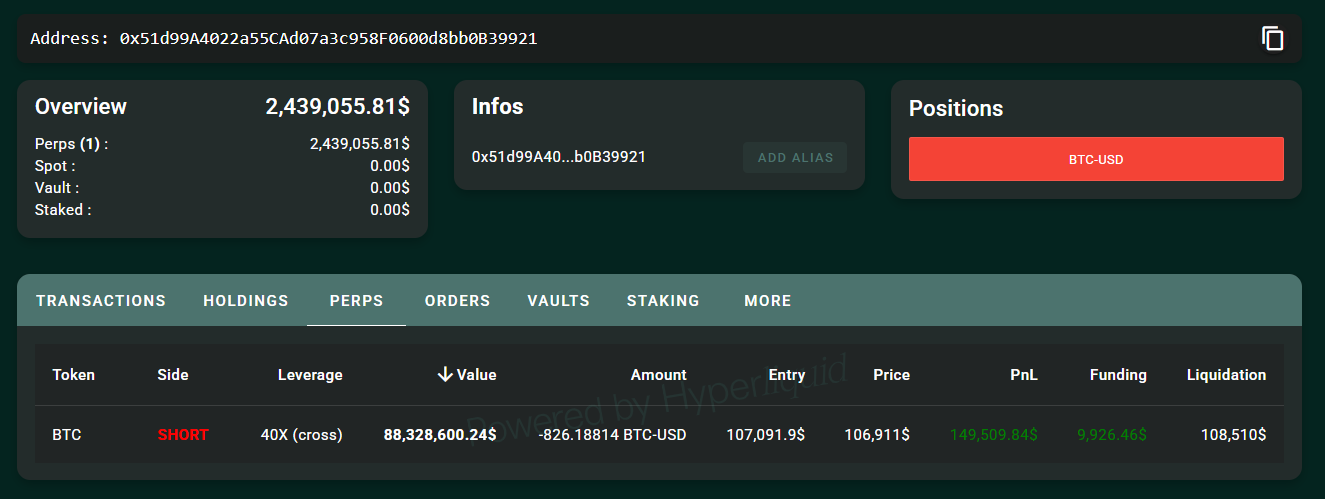

In contrast, a lone trader, 0x51d9, has taken a bearish stance, shorting Bitcoin BTC at $107,091.9 with a position worth $88 million, also at 40x leverage. This trader is currently up $149,509, with a liquidation price at $108,500.

The clash between these massive long and short positions has created a billion-dollar showdown, drawing attention from the crypto community.

The use of 40x leverage, a level that amplifies both gains and risks, suggests a powerful conviction in Bitcoin’s near-term growth. This could be interpreted as a bold prediction of a significant price breakout, potentially driven by their analysis of market trends, such as Bitcoin’s recent climb past $107,000 and growing institutional adoption as evidenced in record inflows for Bitcoin and Ethereum ETFs and JPMorgan’s shift in stance.

Alternatively, some speculate that these whales might have access to insider information, such as upcoming regulatory developments or major market-moving announcements. For instance, earlier in 2025, a whale’s leveraged long position on Bitcoin and Ethereum, closed just before a U.S. cryptocurrency strategic reserve announcement, raised suspicions of insider trading. While there’s no direct evidence of such knowledge in this case, the timing of these trades fuels speculation that these whales might know something and take action.

CryptoQuant: It’s not yet time to exit

Let’s dive into on-chain analytics to better understand Bitcoin’s future price movements.

On May 20, 2025, CryptoQuant suggests that Bitcoin’s recent price rebound, currently sitting at $106,000, lacks signs of overheating, a positive indicator for a sustainable bull market.

Source: CryptoQuant

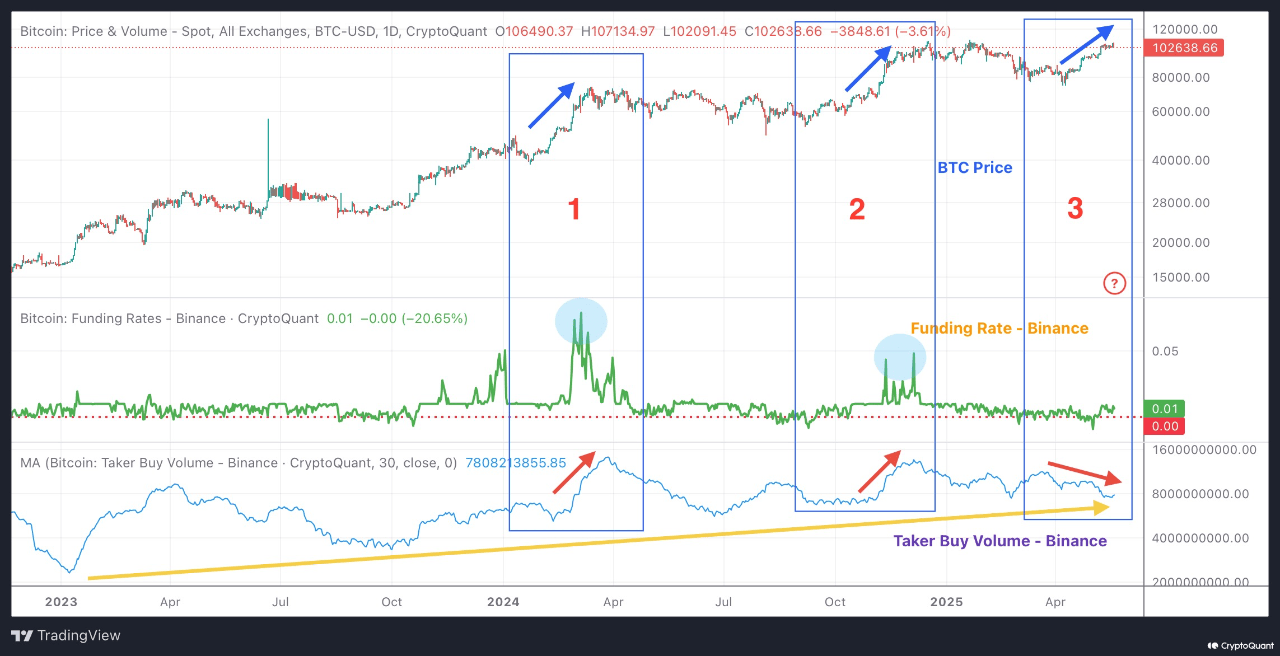

CryptoQuant highlights a recurring pattern in Bitcoin’s price cycles: during this bull run, each time Bitcoin reached a new all-time high, Binance recorded sharp spikes in market buy volume and funding rates, followed by corrections due to market overheating (Chart – Boxes 1 and 2).

These overheated phases led to prolonged corrections, during which investor sentiment weakened, and many traders exited the market. However, as the market “lightened” from reduced selling pressure, Bitcoin eventually surged to new highs.

Now, as Bitcoin appears poised to break through its previous highs again after a recent correction, the pattern is notably different (Chart – Box 3). Unlike the previous rallies, this rebound is occurring without an overheated funding rate, and Binance market buy volume is trending downward, signaling a more cautious market.

While some might view the declining buy volume as a sign of weak momentum, CryptoQuant argues it reflects a healthier rally. They point to two key reasons:

First, the rapid overheating in the previous two rallies triggered significant corrections that dampened sentiment and shook out weaker hands. In contrast, the current “lightweight” market, with moderate funding rates and lower buy volume, suggests a more stable foundation for growth, reducing the risk of a sharp downturn.

Second, despite short-term fluctuations, Binance market buy volume has shown a steady upward trend since 2023 (Chart – Yellow Arrow), indicating sustained buying interest over the long term.

This persistent buying sentiment supports the case for further upside, suggesting that it’s not yet time to exit the market.

Conclusion

The aggressive long positions taken by whales on Hyperliquid, totaling $1 billion with 40x leverage, reflect their strong confidence in Bitcoin’s bullish market outlook. Coupled with CryptoQuant’s analysis, which highlights a healthier rally without overheating and sustained long-term buying interest on Binance since 2023, the data suggests a promising trajectory for Bitcoin.

Both the whales’ bold bets and on-chain metrics from CryptoQuant point to expectations of continued growth, with Bitcoin potentially reaching $115,000-$120,000 in the near term, provided market stability persists.

The post A Billion-Dollar Bet: 3 Hyperliquid Whales Bet Big on Bitcoin Bullish Sentiment appeared first on NFT Evening.