[#title_feedzy_rewrite]

Palantir stock actually dropped 3% right after the announcement of a $178 million Army AI deal, which has…

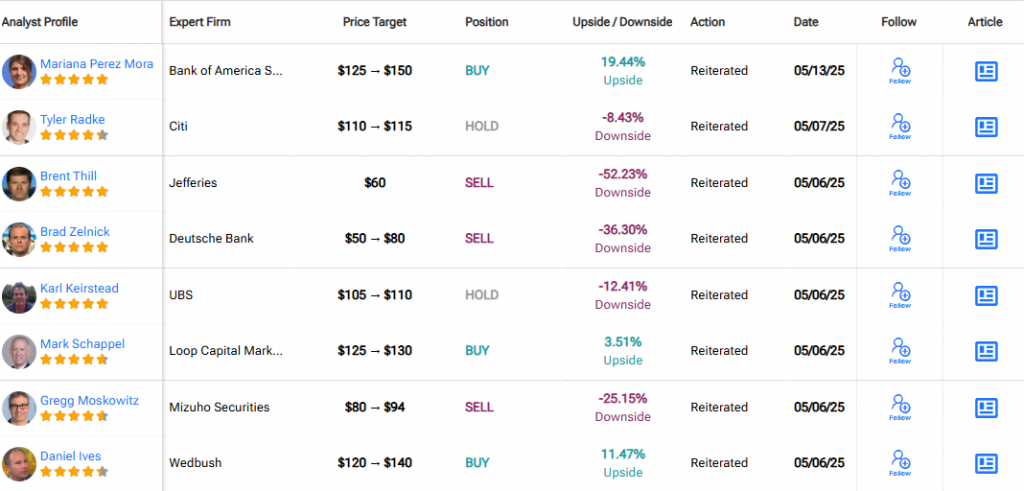

Palantir stock actually dropped 3% right after the announcement of a $178 million Army AI deal, which has many investors asking “why palantir stock is down today” despite what seems like positive news. This reaction reflects the ongoing market volatility and also regulatory uncertainty that has been impacting PLTR stock forecast lately. At the time of writing, what is palantir stock selling for sits around $125.59, even as Bank of America maintains an optimistic outlook with a $150 price target.

Also Read: Pi Coin Skyrockets 11.7% in 24 Hours: Is $2 an Option for PI?

How Palantir’s $178M Army AI Deal Shapes Stock Forecast Amid Market Volatility and Regulatory Uncertainty

Why Is Palantir Stock Down Today?

Palantir Technologies has just secured a $178 million contract with the U.S. Army for artificial intelligence capabilities, yet the market responded with a 3% decline in share price. This reaction kind of highlights the complex market volatility surrounding technology stocks, particularly those with high valuations such as Palantir. Many investors are wondering if palantir stock is a good buy despite this short-term fluctuation.

Bank of America analyst Mariana Perez Mora stated:

“Palantir’s AI capabilities position them uniquely in the government contracting space, with the new Army deal further validating their technological edge.”

PLTR Stock Price & How High Can Palantir Stock Go

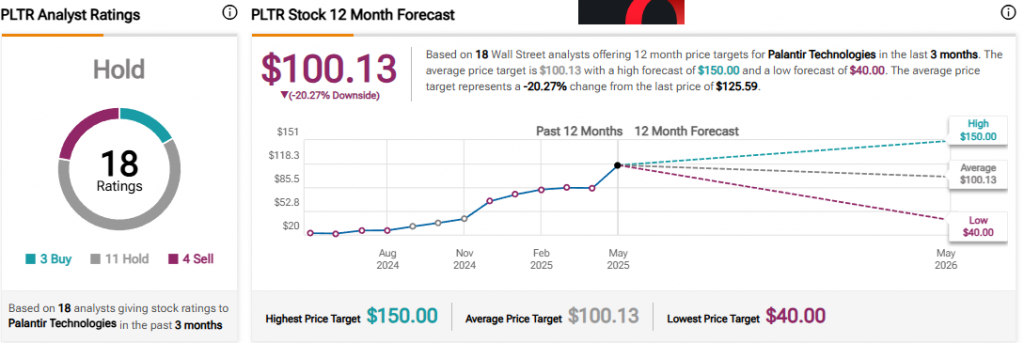

The significant spread between analyst price targets for Palantir—ranging from $40 to $150—reflects the regulatory uncertainty and also market volatility currently affecting the stock forecast. The consensus sits at approximately $100.13 right now, suggesting a potential 20.27% downside from recent trading prices.

Jefferies analyst Brent Thill maintains a bearish outlook and stated:

“Valuation concerns cannot be justified even with recent contract wins.”

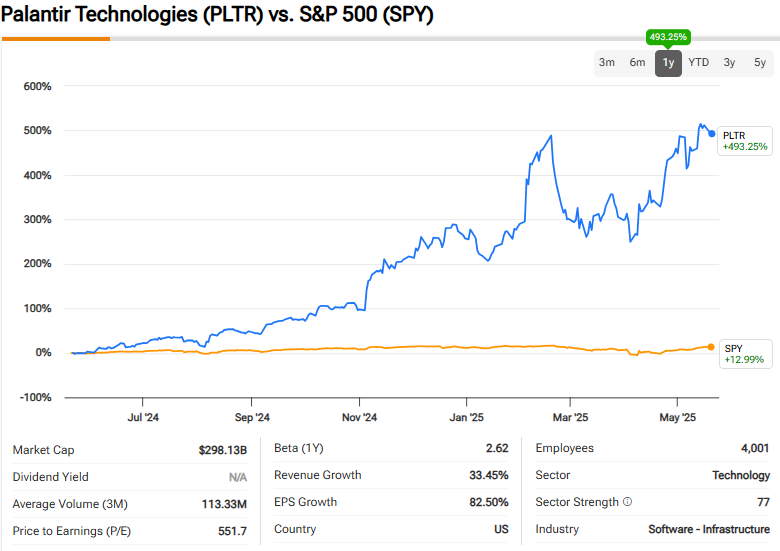

Palantir’s impressive growth metrics, including an impressive 33.45% revenue growth and also 82.50% EPS growth, stand in contrast to these valuation concerns, creating a rather complicated picture for investors analyzing PLTR stock forecast and wondering will palantir stock go up in the coming months.

Also Read: Exclusive: Bitcoin Empowering Global Finances, Reshaping Modern Portfolios

What Will Palantir Stock Be Worth in 2030

Despite recent price fluctuations and all, Palantir continues to outperform broader market indices with a 493% gain over the past year compared to the S&P 500’s 12.99%. For investors thinking long-term about what will the company’s stock be worth in 2030, the company faces some challenges in international markets while excelling in U.S. government and commercial sectors at the same time.

Market volatility remains a significant concern for Palantir investors, with the company’s stock price experiencing dramatic swings lately. Regulatory uncertainty surrounding AI technologies and government contracts presents additional potential headwinds as well.

Also Read: How High Will Dogecoin (DOGE) Surge Before The End Of Q2, 2025?

The $178 million Army AI deal reinforces Palantir’s strong position in the government sector despite short-term market reactions. As regulatory frameworks continue to evolve and market volatility persists, PLTR stock forecast remains highly debated among analysts, with Bank of America’s optimistic $150 target representing one end of a wide spectrum of expectations at this point in time. The question of how high can this company’s stock go continues to divide market experts, even as the company secures significant government contracts.