[#title_feedzy_rewrite]

On May 18, 2025, the CME Group, the world’s leading derivatives marketplace, launched XRP futures, marking a pivotal moment for the cryptocurrency’s institutional adoption.

The new futures contracts generated $19 million in notional trading volume on their debut day, surpassing the launch performance of Solana SOL futures earlier in the year. This strong start has sparked optimism about XRP’s potential path toward a spot exchange-traded fund (ETF).

XRP Futures Surpass Solana with $19M First-Day Volume

CME Group launched XRP futures with two contract sizes: a micro-sized contract of 2,500 XRP and a larger one of 50,000 XRP, both cash-settled using the CME CF XRP-Dollar Reference Rate, calculated daily at 4:00 p.m. London time. On May 18, 2025, Hidden Road cleared the first trade—a block transaction—that set a strong tone for a successful debut.

First-day trading volume reached $19 million, surpassing Solana futures, which debuted on March 17, 2025, with $15 million in volume, as noted in a CME Group press release. This performance highlights XRP’s growing appeal among institutional traders seeking regulated exposure to altcoins beyond Bitcoin and Ethereum.

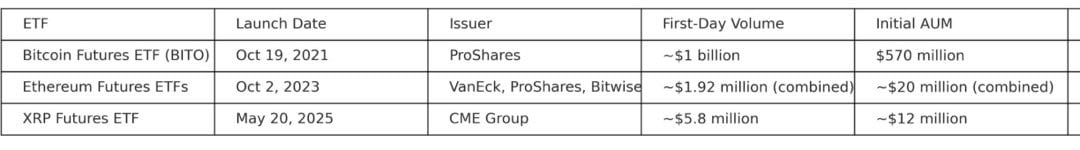

Reflecting a broader trend of rising institutional interest in XRP, this launch aligns with historical patterns. For instance, Bitcoin BTC and Ethereum futures debuted on CME in 2017 and 2021, respectively, paving the way for their spot ETF approvals in 2024, a precedent that fuels optimism for XRP’s future.

Source: X

At the time of the launch, XRP was trading at $2.35, down 3% over the past 24 hours but still showing resilience. The futures debut has fueled speculation that XRP could see a price rally, potentially reaching $3 if institutional momentum continues.

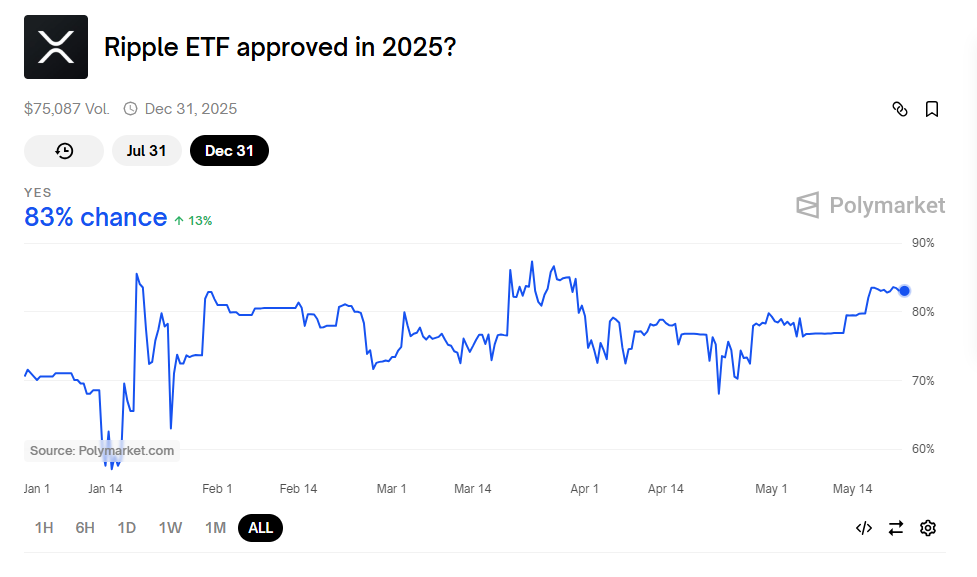

Polymarket Gives Spot XRP ETF an 80% Approval Odds in 2025

The successful launch of XRP futures on CME Group has significant implications for a potential spot XRP ETF. Multiple firms, including Bitwise and Franklin Templeton, have submitted spot XRP ETF applications, with Polymarket estimating an 80% chance of approval in 2025.

Source: Polymarket

The CME futures launch strengthens this case by providing a regulated derivatives market, a key requirement for SEC approval. The resolution of Ripple’s legal battle with the SEC in late 2024 has also removed a major regulatory hurdle, further boosting ETF prospects.

Bloomberg analysts Eric Balchunas and James Seyffart estimate an 85% chance of SEC approval for a spot XRP ETF this year, up from a previous 65% in their February outlook.

Hopes are high for an $XRP ETF approval by June 17, 2025 — the review deadline for Franklin Templeton’s spot XRP ETF. Bloomberg gives it an 85% chance, while Polymarket odds sit at 83%. pic.twitter.com/kavV2dqAjn

— Brett (@Brett_Crypto_X) May 18, 2025

However, challenges remain. Sustained liquidity and institutional engagement are critical for ETF approval, as initial futures launches often bring volatility. Despite this, the $19 million debut volume signals strong early demand, potentially positioning XRP for a price increase toward $3 in the near term, especially if ETF approval speculation intensifies.

The post Promising XRP Futures Launch Sparks Hopes for a Spot XRP ETF appeared first on NFT Evening.