[#title_feedzy_rewrite]

Bitcoin (BTC), the world’s largest and most influential cryptocurrency, is once again back in the spotlight after a sharp rally that pushed its price above the $110,000 mark – a level not seen since its previous all-time highs in March 2025. According to CoinMarketCap, BTC is up nearly 4% in the past 24 hours and 7.2% over the past week.

This resurgence has reignited bullish sentiment across the digital asset market and triggered renewed interest among both retail and institutional investors. But what exactly is driving Bitcoin’s surge today?

Institutional Inflows Continue to Accelerate

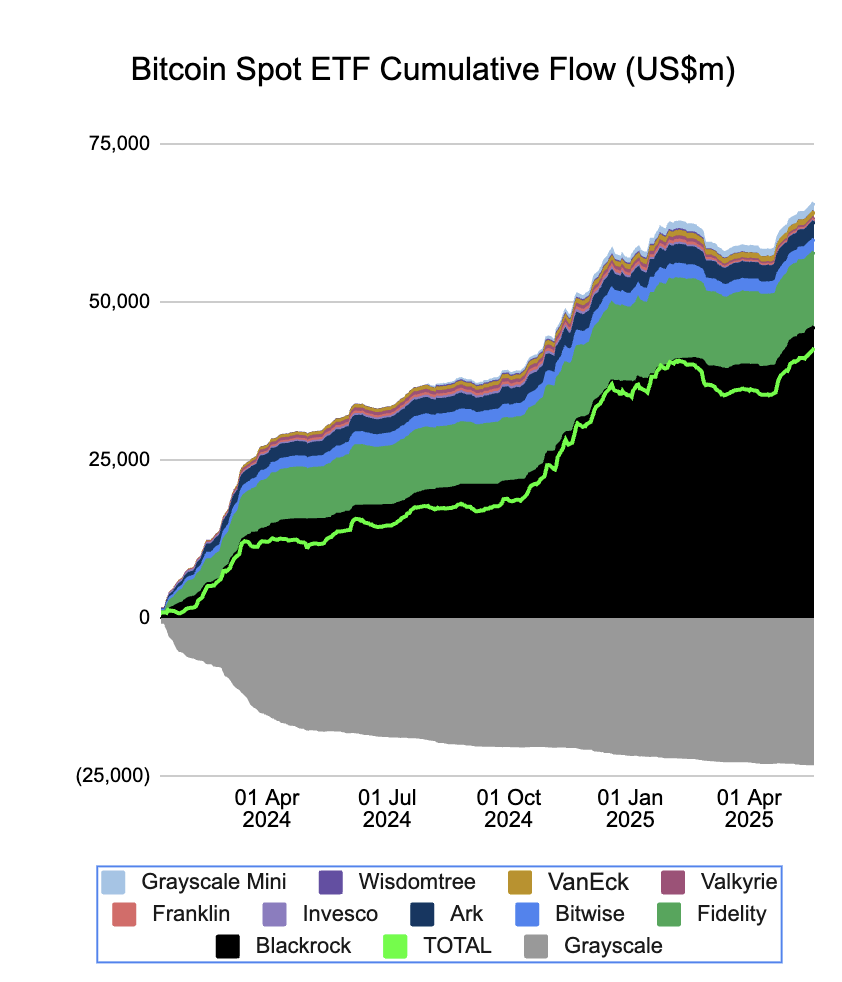

One of the most immediate catalysts behind Bitcoin’s price movement today is the ongoing influx of capital into spot Bitcoin ETFs in the United States. Since the approval of multiple spot Bitcoin ETFs by the U.S. Securities and Exchange Commission (SEC) earlier this year, institutional adoption has grown rapidly.

Data from Farside Investors, ETFs recorded a net inflow of $667.4 million on May 19, 2025, with BlackRock’s IBIT leading the surge with $305.9 million, followed by Fidelity’s FBTC at $188.1 million.

Source: Farside Investors

These products have lowered the barriers for institutional players such as pension funds, asset managers, and family offices to gain direct exposure to Bitcoin without dealing with self-custody or regulatory complexity. The demand surge from these entities is helping create consistent buying pressure that is lifting Bitcoin’s spot price.

Moreover, analysts now estimate that the cumulative ETF inflows since January 2025 have exceeded $38 billion – more than double Bloomberg Intelligence’s early-year forecast of $15 billion. As these funds accumulate more BTC, the circulating supply available on exchanges is shrinking, a bullish dynamic that amplifies price action.

As these funds accumulate more BTC, the circulating supply available on exchanges is shrinking – a bullish dynamic that amplifies price action.

Read more: Trading with Free Crypto Signals in Evening Trader Channel

A Softer Dollar and Fed Dovishness Revive Risk Appetite

Another powerful driver of Bitcoin’s rally today comes from the broader macroeconomic environment. The U.S. Dollar Index (DXY) has weakened over the past few trading sessions, falling from above 100 to around 99.40 as of May 22, 2025, data from Investing.com. This comes amid growing market expectations that the Federal Reserve will begin cutting interest rates before the end of the year.

Source: TradingView

In his most recent remarks at the Economic Club of Chicago, Fed Chair Jerome Powell acknowledged that while inflation remains above the central bank’s 2% target, it is gradually easing.

Powell added that the Fed remains data-dependent and is prepared to adjust policy if incoming economic indicators warrant a shift. He also highlighted that new trade-related tariffs could pose additional inflationary pressures, which the Fed will monitor closely.

This shift toward a more cautious and potentially dovish tone has reignited investor appetite for risk assets, including equities, tech stocks, and cryptocurrencies.

Bitcoin, often viewed as a macro hedge against fiat debasement and monetary easing, has historically benefited from such environments. As U.S. Treasury yields fall in anticipation of rate cuts, capital is rotating toward higher-beta assets with asymmetric upside potential, and Bitcoin remains a leading candidate.

On-Chain Data Points to Bullish Accumulation

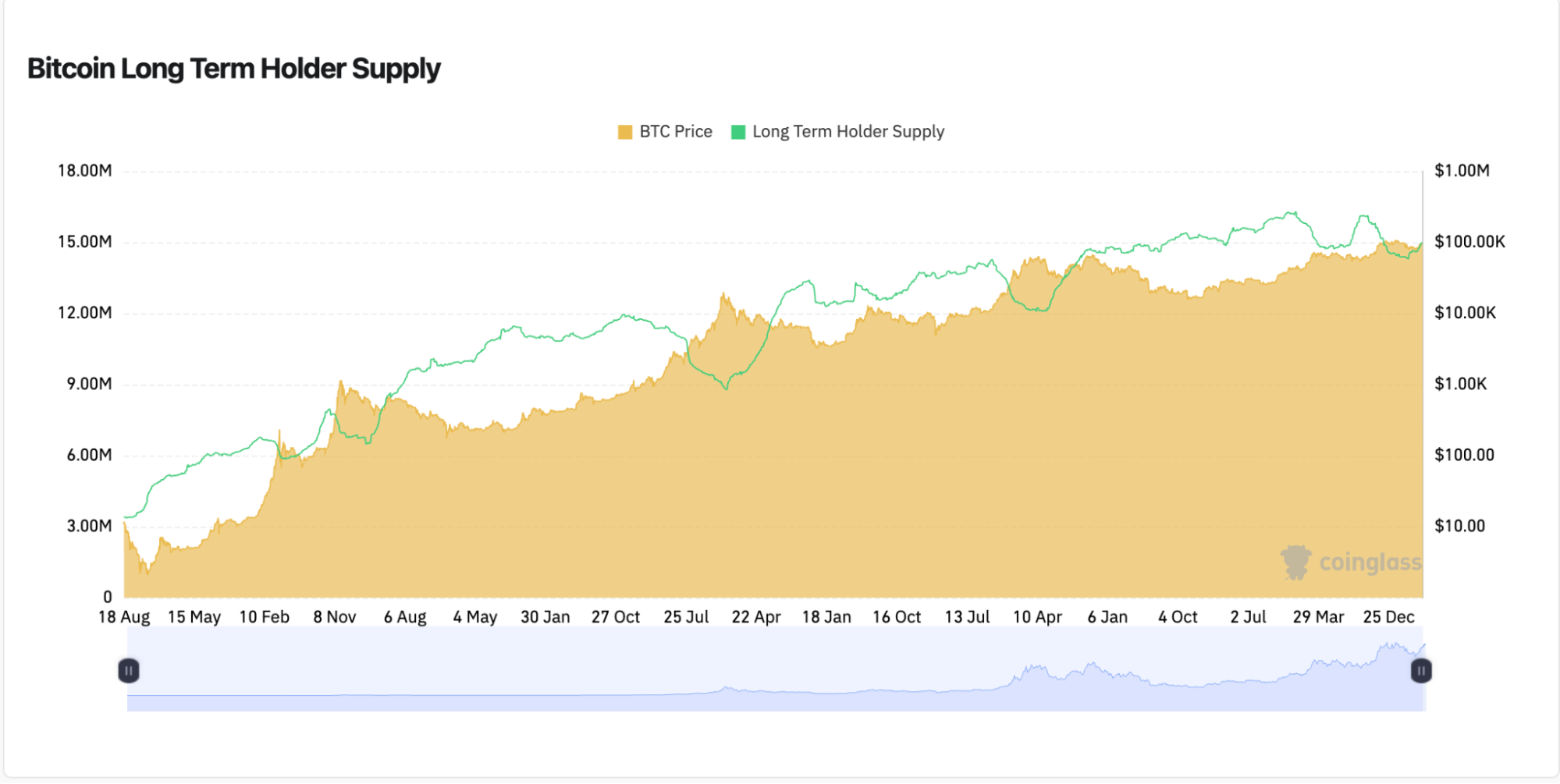

On-chain signals are sending a more nuanced picture of the current market environment. From CoinGlass, the supply held by long-term holders (LTH) has slightly declined for the second consecutive month, dropping from its peak of 14.29 million BTC in March.

Source: CoinGlass

This suggests that while many LTHs maintain a long-term view, some have begun realizing profits amid recent price surges – a pattern often seen near local tops.

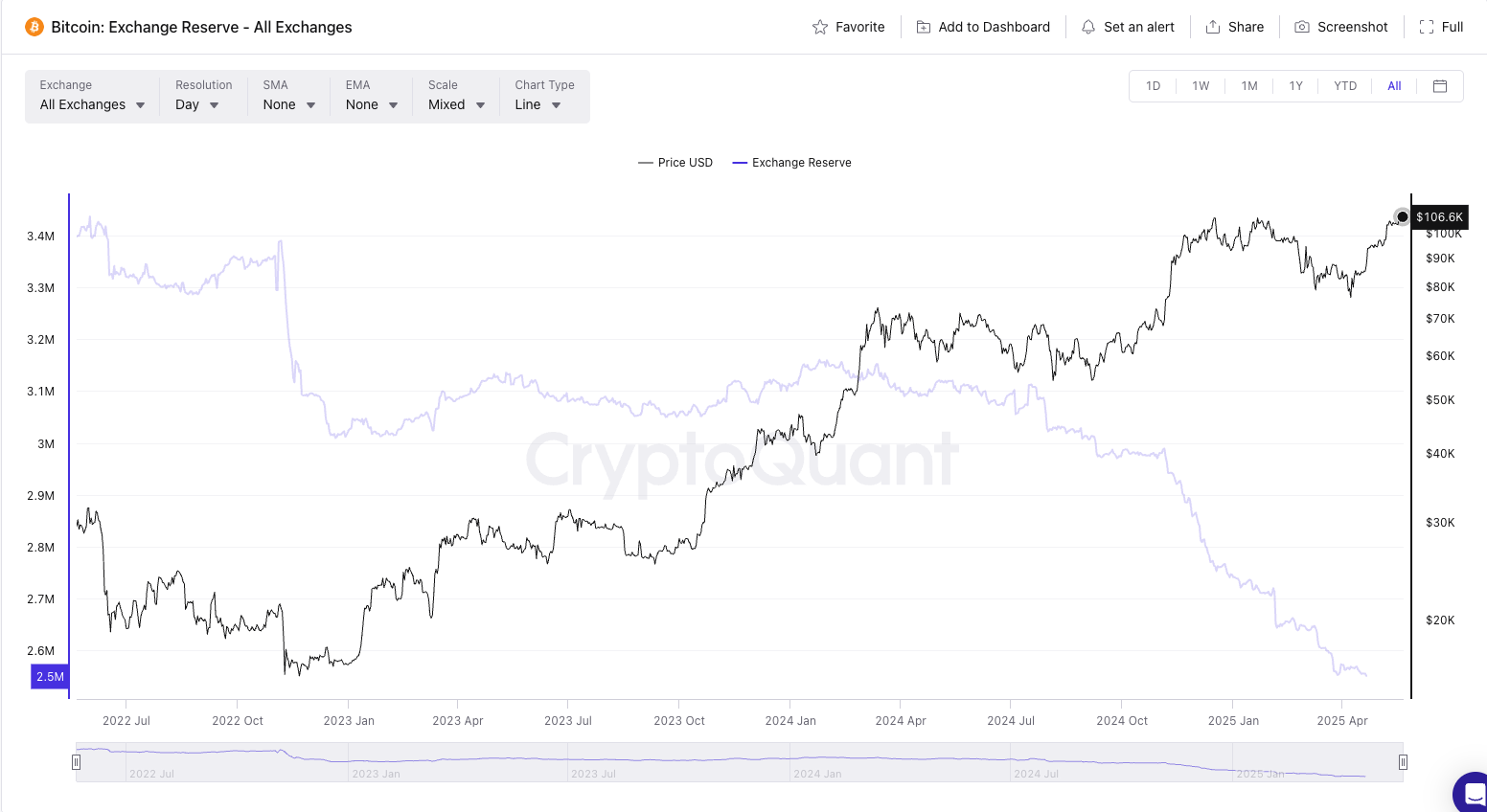

Meanwhile, exchange balances continue to trend downward. Data from CryptoQuant indicates that BTC held on centralized exchanges has fallen to around 2.6 million, down from over 3.4 million in 2022.

Source: CryptoQuant

However, analysts caution that a portion of these outflows may reflect internal reshuffling between ETF custody wallets and cold storage rather than direct investor accumulation.

Whale wallets, on the other hand, are showing clear signs of accumulation. According to Santiment, wallets holding between 10 and 10,000 BTC have collectively added over 83,000 BTC in the past 30 days. This surge in large-scale accumulation underscores a broader institutional confidence in Bitcoin’s medium- to long-term trajectory.

Short Liquidations Add Fuel to the Rally

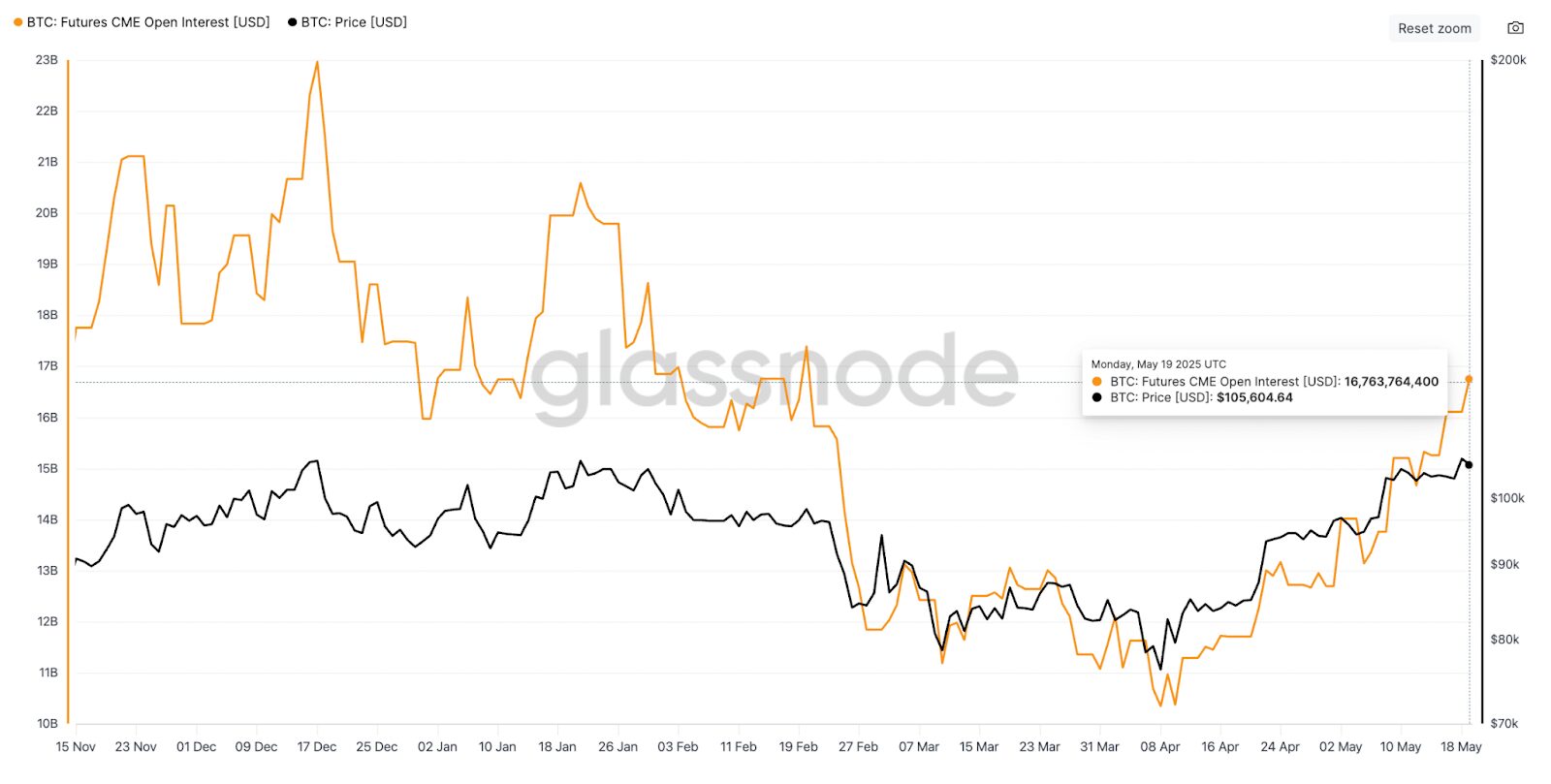

Bitcoin’s rapid upward move is also being amplified by derivatives market dynamics. Data from Coinglass show that more than $262 million worth of BTC short positions were liquidated in the past 24 hours, as of May 21, 2025. Binance alone recorded $66.3 million in short liquidations on the BTC/USDT pair, marking the largest single-day liquidation for the exchange this year.

Source: Glassnode

Such short squeeze events are common in crypto markets, especially after periods of low volatility. Combined with thin liquidity across some exchanges, these dynamics can accelerate price movements dramatically, and that’s exactly what appears to have unfolded in this latest rally.

Bitcoin Dominance Rises Amid Altcoin Consolidation

Another sign of renewed Bitcoin strength is its rising dominance index – this metric reflects Bitcoin’s increasing share of the total cryptocurrency market capitalization and signals a shift in investor preference toward BTC over riskier altcoins. Currently sitting at approximately 64%, according to TradingView.

Souce: TradingView

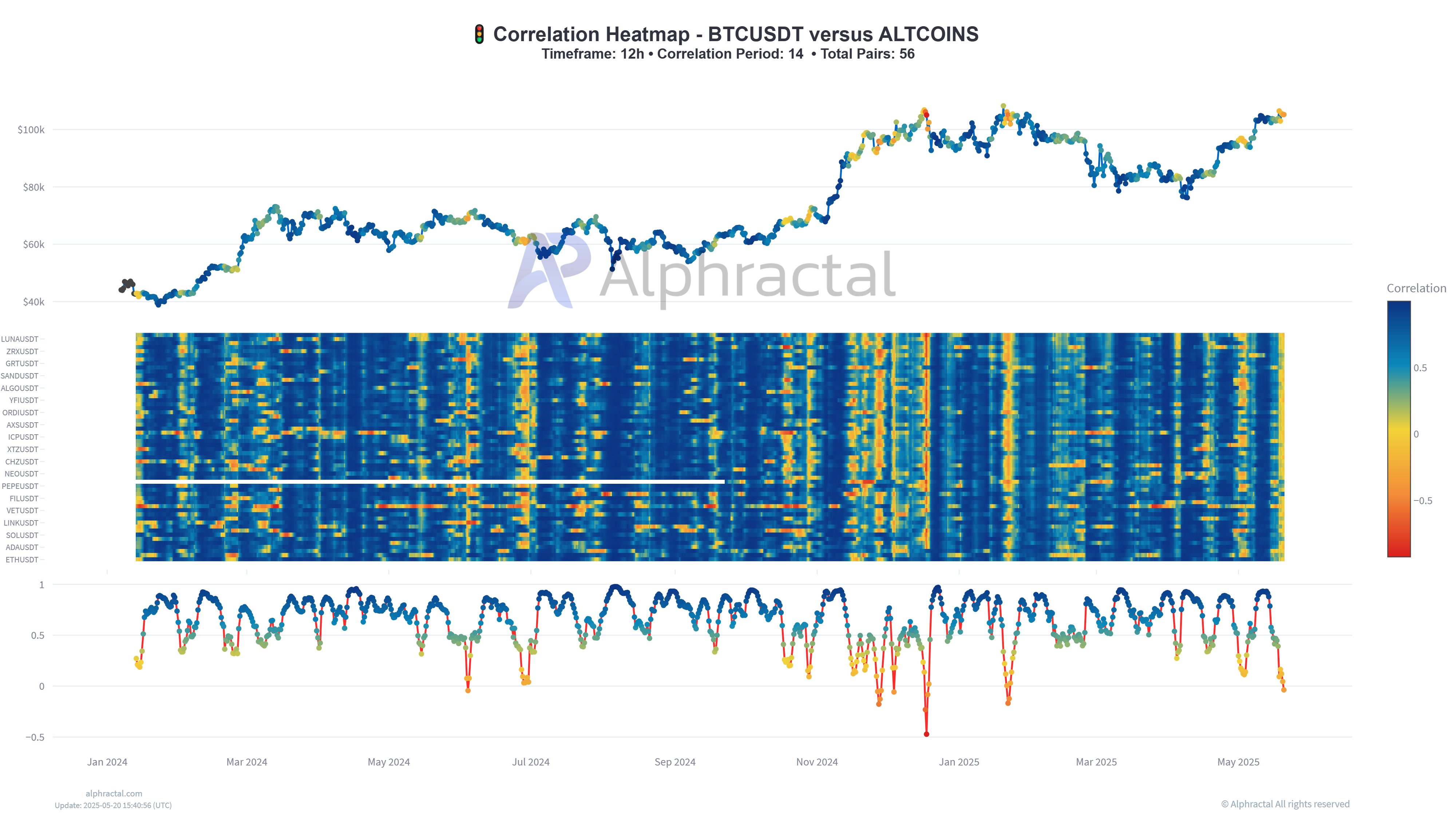

However, while Bitcoin continues to climb, many altcoins are failing to follow its upward momentum. According to a correlation heatmap, the relationship between Bitcoin and the broader altcoin market has weakened significantly in recent sessions. This divergence may be interpreted as a cautionary signal.

One possibility is that the current rally is being driven disproportionately by a small number of large players or ETF inflows, rather than broad-based market participation. In such cases, rallies can prove fragile and vulnerable to abrupt corrections. Alternatively, the trend could indicate that Bitcoin is entering a phase of solo price discovery, temporarily decoupled from the rest of the market as investor preference shifts toward assets perceived as safer or more fundamentally sound.

Either way, the lack of confirmation from altcoins suggests that risk has increased, especially for those entering near all-time highs. Investors may want to adopt a more measured stance, waiting for stronger confirmation signals or technical retracements before increasing exposure. In volatile market phases like this, patience and discipline can often be more valuable than chasing momentum.

Source: Alphractal

Conclusion

Bitcoin’s rally today is not the result of a single event but a confluence of supportive factors – robust ETF inflows, a weakening U.S. dollar, favorable macro signals, bullish on-chain data…

However, Bitcoin may not only hold above $110,000 but also attempt a decisive breakout toward new all-time highs, potentially surpassing March 2025.

Read more: How to Read a Liquidation Heat Map: An Essential Analytical Tool for Derivatives Trading

The post Why Is Bitcoin Up Today – May 22, 2025? appeared first on NFT Evening.