[#title_feedzy_rewrite]

On May 21, 2025, a U.S. federal jury delivered a guilty verdict against Braden Karony, CEO of SafeMoon, marking a significant moment in the fight against cryptocurrency fraud. Karony was convicted on all counts for orchestrating a scheme that defrauded investors of over $300 million. This case, which saw SafeMoon’s market cap soar to $8 billion before its collapse, underscores the vulnerabilities in the crypto market and the urgent need for stronger oversight.

The Rise and Fall of SafeMoon

SafeMoon launched in 2021, riding the wave of the NFT and DeFi boom, promising investors astronomical returns through its tokenomics model. The SEC’s 2023 complaint revealed that the token’s price surged by 55,000% between March and April 2021, reaching a market cap of $5.7 billion.

Source: SEC

However, this meteoric rise was fueled by deception. Karony, along with founder Kyle Nagy and CTO Thomas Smith, falsely claimed that liquidity pools were locked, assuring investors of safety. In reality, they siphoned funds for personal gain, buying luxury cars and properties, according to court documents.

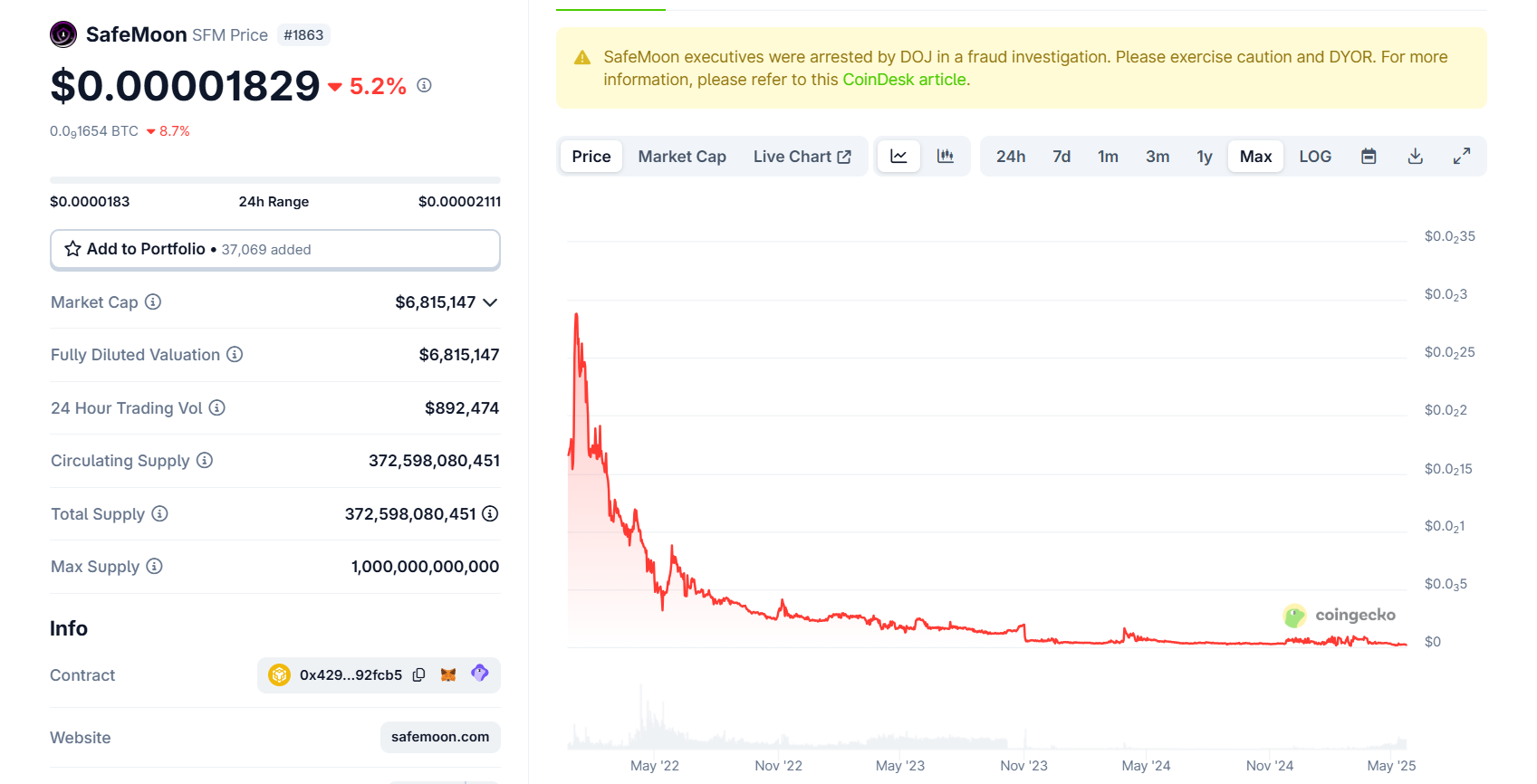

The scheme unraveled when the public learned the liquidity pools were accessible, causing a 50% price crash in April 2021. Karony continued to manipulate the market by propping up the token’s price with misappropriated funds, but the damage was done. By 2025, SafeMoon was a cautionary tale, with investors left holding worthless SFM tokens.

Source: CoinGecko

Crypto Misdeeds Without a Pause: An Ongoing Battle

The SafeMoon CEO debacle is not an isolated incident but part of a broader trend of fraud in the crypto industry. SafeMoon’s case mirrors other high-profile failures, like the 2022 FTX collapse, where executives misused customer funds.

Read more: 14 Months in Prison for SEC Twitter Account Hack and Fake Bitcoin ETF Post

The SEC has ramped up enforcement, with David Hirsch of the Crypto Assets and Cyber Unit emphasizing the lack of accountability in unregistered offerings, as per the SEC’s 2023 complaint against SafeMoon.

The broader market context shows a decline in investor confidence, with a 2024 CoinGecko report indicating that 60% of crypto investors are wary of new token launches due to fraud concerns. Karony faces up to 45 years in prison, a stark reminder of the legal consequences awaiting bad actors in this space.

The post SafeMoon CEO Faces 45 Years in Prison: Crypto Fraud’s Harsh Reality appeared first on NFT Evening.