[#title_feedzy_rewrite]

Virtual Protocol has emerged as a unique player in the AI x Web3 sector, enabling investors to create, co-own, and monetize AI agents, contributing to one of the most promising AI projects in the Web3 space, offering a range of opportunities to earn Virtuals Protocol airdrops through participation and staking.

This guide walks you through how to stake the native VIRTUAL token and start earning rewards through the protocol’s innovative veVIRTUAL model.

What Is Virtual Protocol?

Virtual Protocol is a decentralized AI platform built on Base, Coinbase’s Ethereum Layer 2 solution, and Virtual Protocol focuses on aligning AI-powered agents with community-driven incentives. It enables users to create and co-own AI agents that can be integrated across gaming, data analytics, and creative applications, supporting the development of decentralized applications across multiple sectors.

At the core of the ecosystem is the VIRTUAL token, which acts as the main medium for transactions and staking and can be bought on supported exchanges by those looking to buy Virtuals Protocol to start engaging with the Virtuals Protocol ecosystem.

The protocol offers a unique staking mechanism where anyone can lock their VIRTUAL tokens to earn veVIRTUAL – a vote-escrowed token that grants governance rights and eligibility for airdrops and rewards, designed to benefit long-term token holders through active participation. The staking structure is also suitable for users looking to align with the project’s airdrop mechanisms.

The token has a fixed total supply and an actively monitored circulating supply, providing transparency and supporting healthy market dynamics for token holders. The staking structure is also suitable for users looking to align with the project’s airdrop mechanisms.

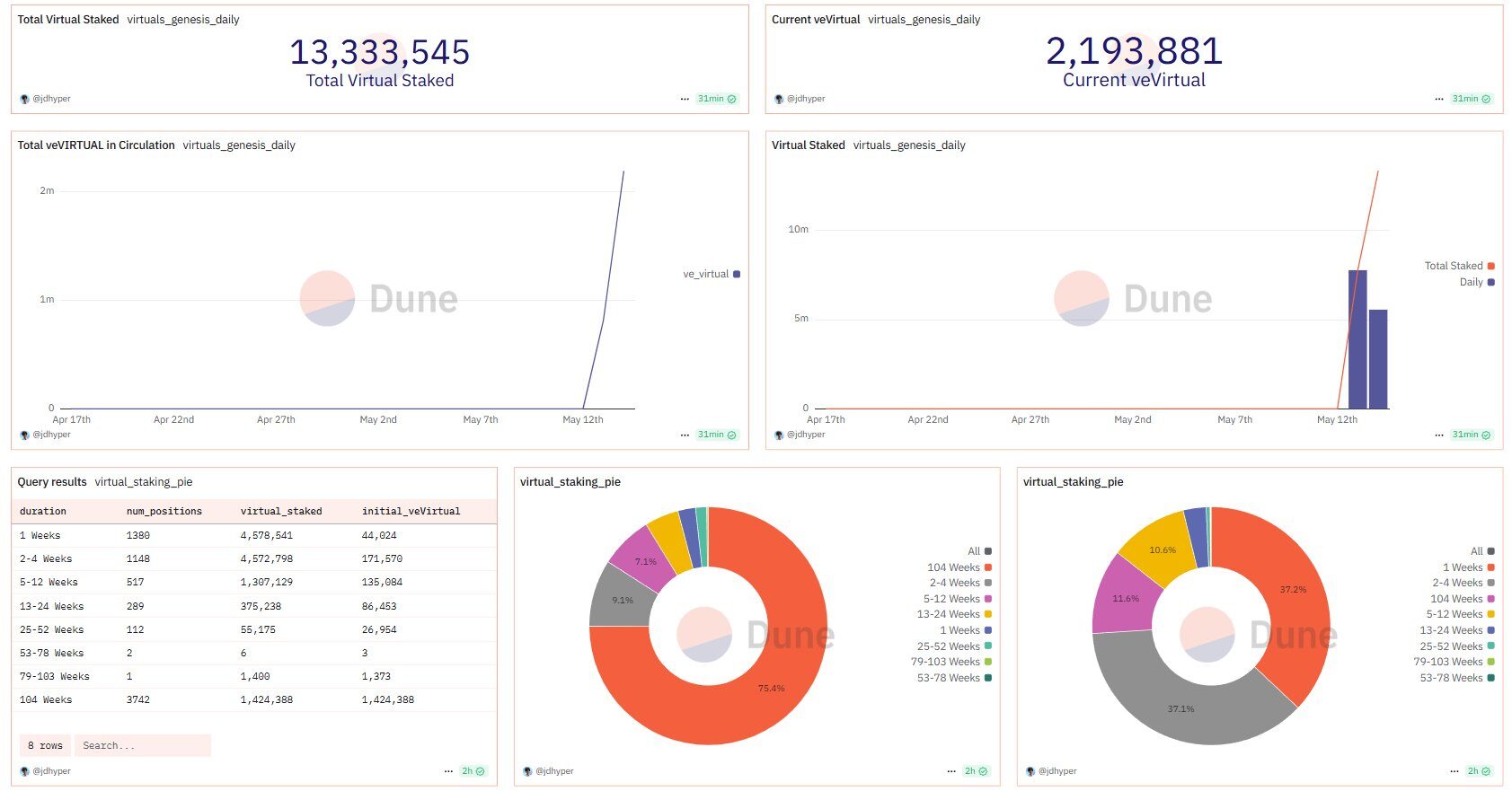

Source: Dune

Why Stake on Virtual Protocol?

Staking on Virtual Protocol is not only about earning crypto airdrops—it’s about long-term participation in the growth of the AI agent economy. Here are some compelling reasons to stake:

- Governance Power: veVIRTUAL holders can participate in key governance decisions.

- Airdrop Eligibility: Only stakers are eligible for the Genesis Airdrops and upcoming Genesis Launchpad projects.

- Yield Opportunities: Staking VIRTUAL grants ongoing protocol rewards based on staking duration and commitment.

- Boosted Influence: Long-term stakers gain more veVIRTUAL, which translates to greater weight in decision-making and benefits.

Where to Buy VIRTUAL Token

To begin your journey with Virtual Protocol, the first step is to purchase the VIRTUAL token. Currently, VIRTUAL is listed on several decentralized and centralized exchanges. Among the most accessible options are Uniswap (on the Base network), MEXC, and Gate.io, which offer solid liquidity.

For users familiar with Web3 wallets like MetaMask, purchasing on Uniswap is a good option – just make sure you have ETH on the Base network to cover gas fees. Alternatively, centralized exchanges like MEXC and Gate.io provide a user-friendly experience and support fiat payment methods like credit cards or e-wallets.

Step-by-Step Guide: How to Stake VIRTUAL

Step 1: Set Up a Web3 Wallet

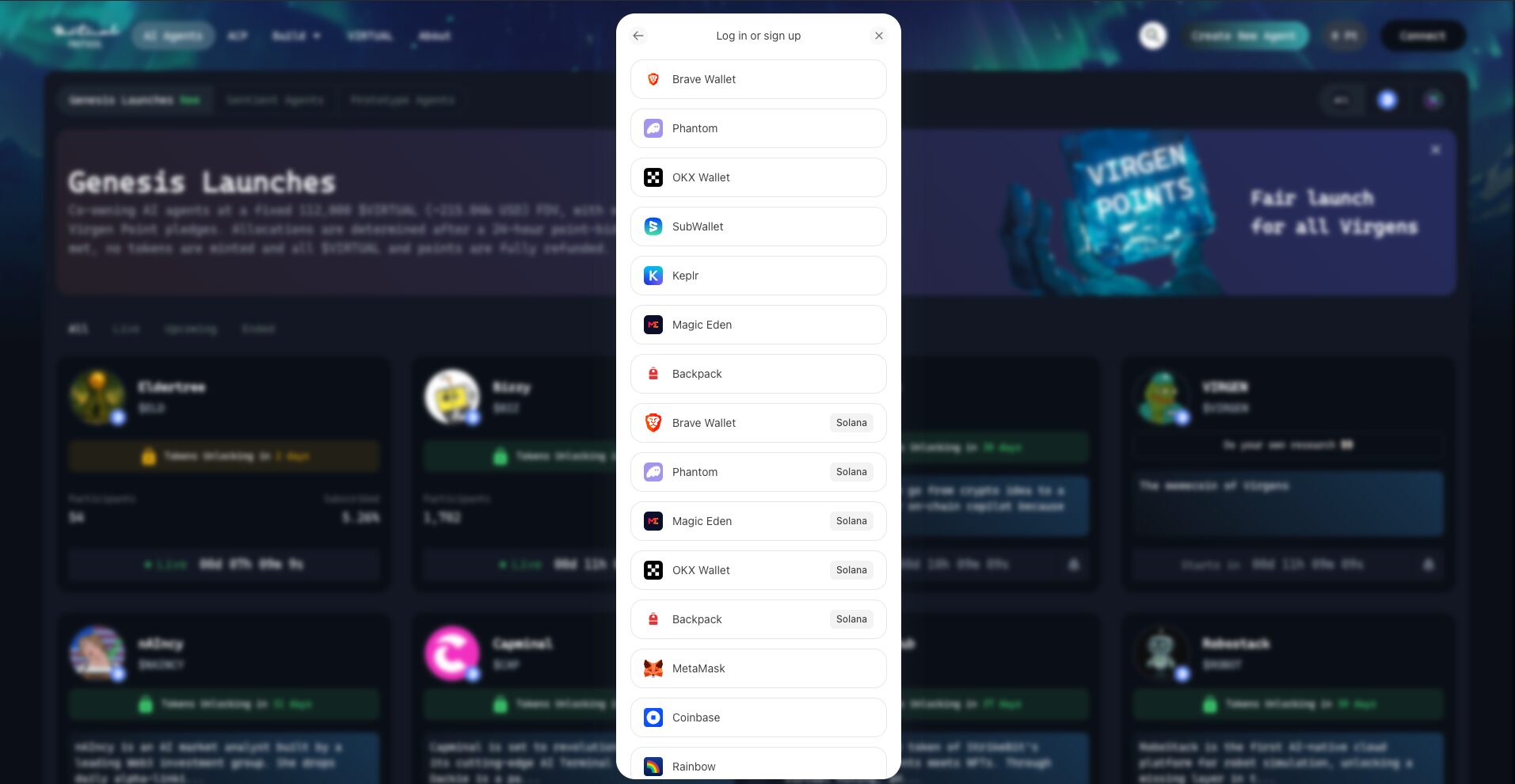

Before staking, make sure you have a Web3 wallet like MetaMask, OKX Wallet… Fund the wallet with ETH (for gas fees) and VIRTUAL tokens.

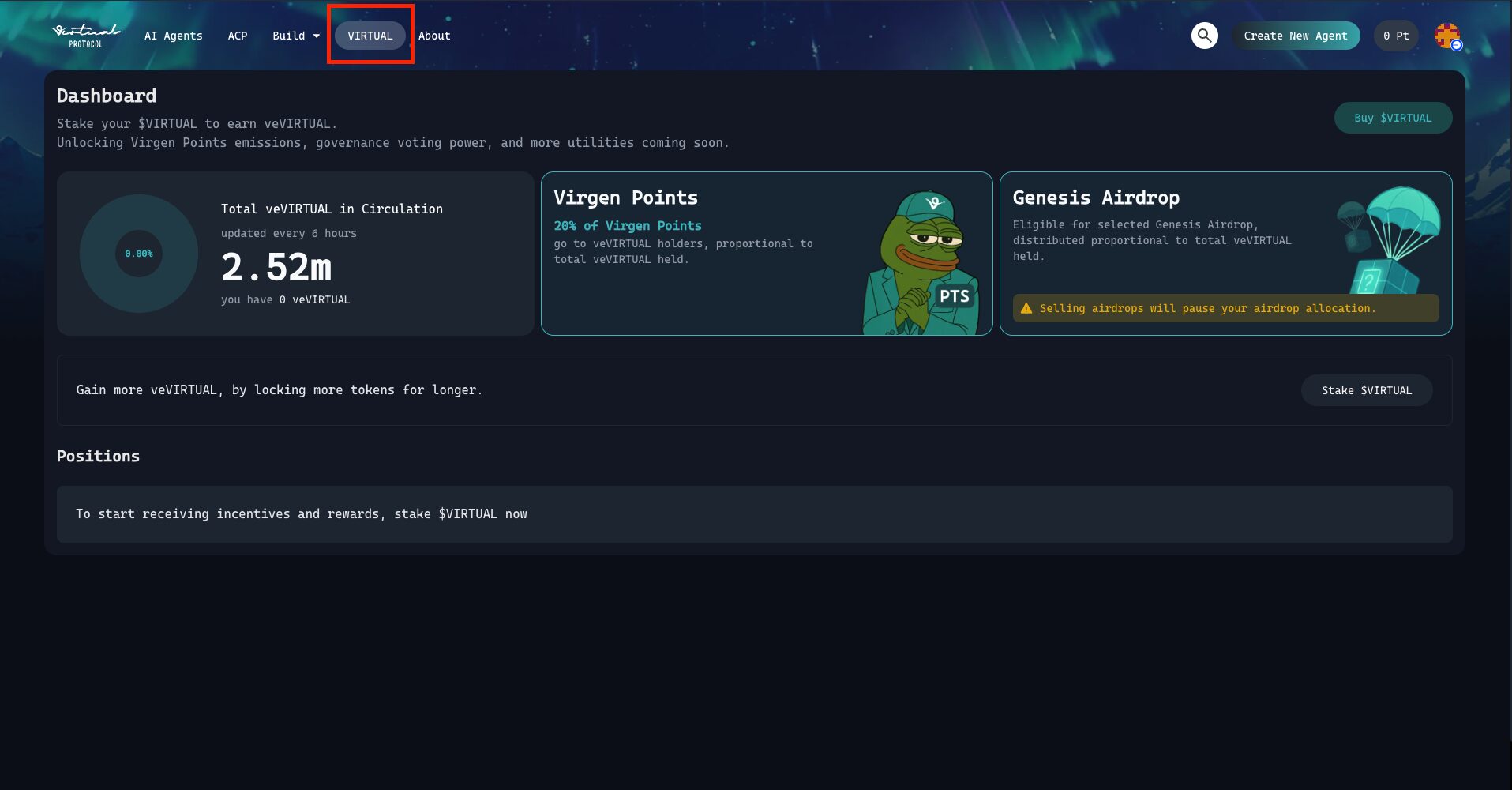

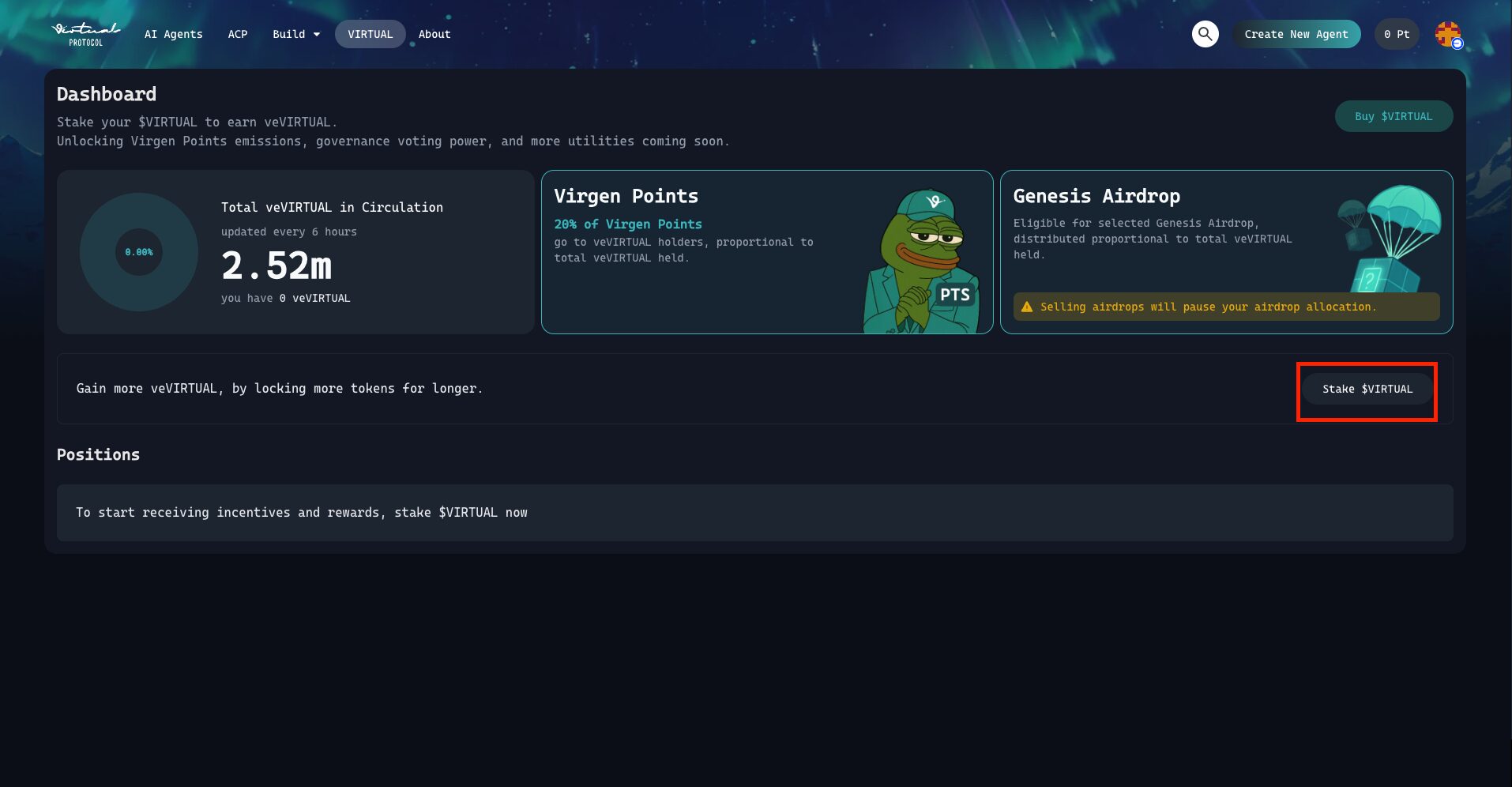

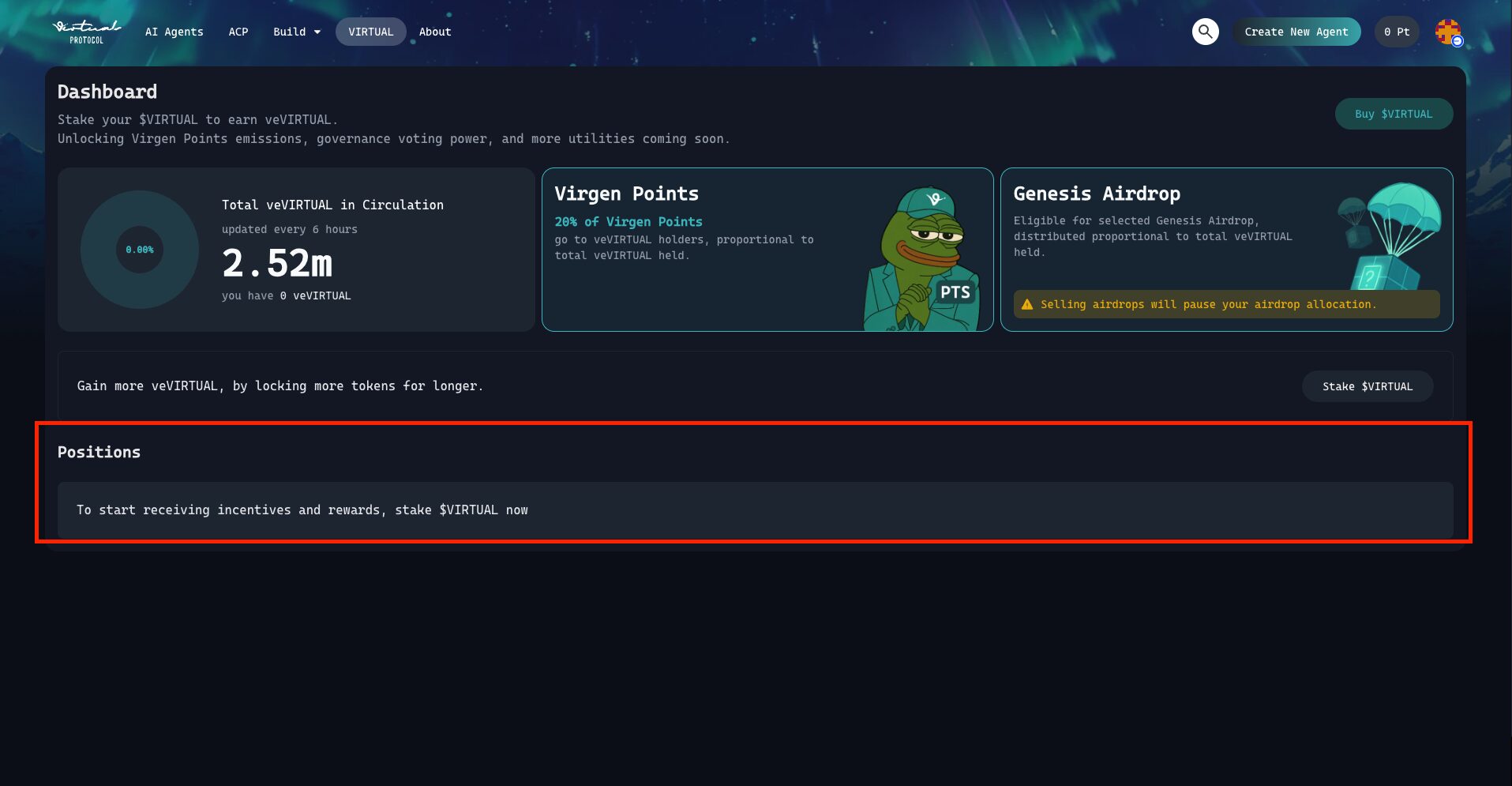

Step 2: Access the Virtual Protocol Dashboard

Navigate to the Virtual Protocol staking portal on the top left corner. Connect your Web3 wallet and ensure you’re on the Base or Solana network. This ensures fast and low-cost deployment of staking actions across the protocol.

Step 3: Navigate to the Staking Section

Once connected, go to the “Staking” section. You’ll find the interface that allows you to stake your VIRTUAL tokens.

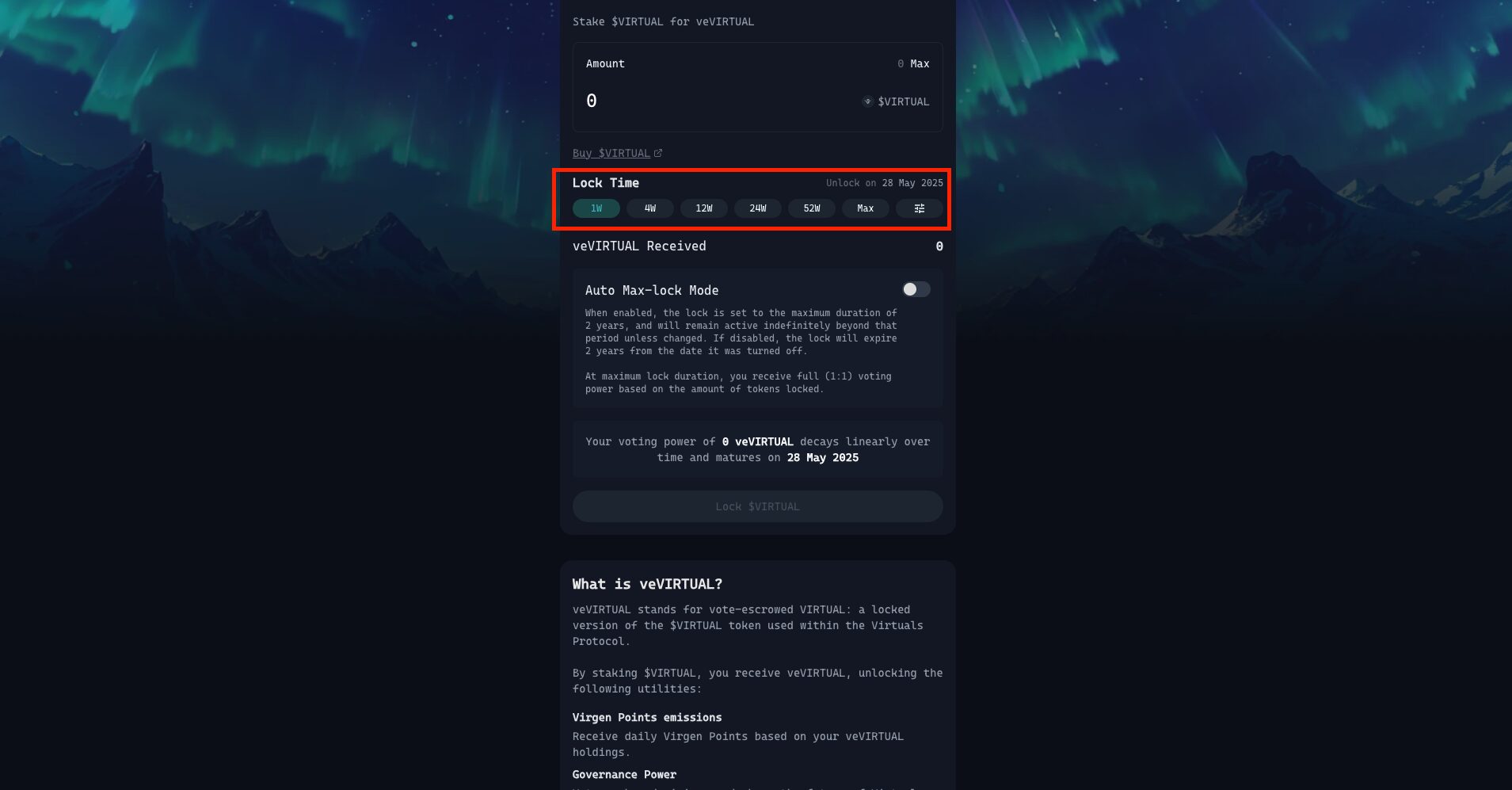

Step 4: Choose Lock Duration

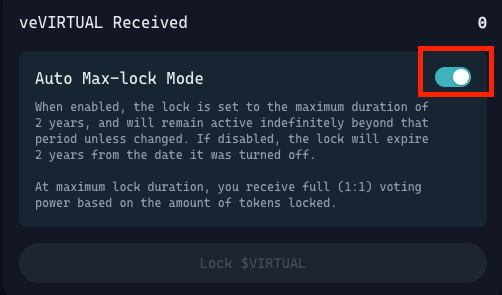

Select the amount of VIRTUAL you wish to stake and choose the lock duration. The longer you lock your tokens (up to 2 years), the more veVIRTUAL you will receive. Users can also opt for the “Auto Max-Lock” feature to automatically lock for the full term and receive a 1:1 ratio of veVIRTUAL to VIRTUAL.

Step 5: Confirm the Transaction

Approve the staking transaction in your wallet. You may be prompted to sign two transactions: one to approve the token spend and another to lock the tokens.

Step 6: View Your veVIRTUAL Balance

After the transaction is confirmed, your veVIRTUAL balance will be visible on the dashboard. This token represents your stake and voting power.

Utility of Staking

The utility of staking on Virtual Protocol lies not only in token rewards but also in the access it grants to exclusive ecosystem features and governance influence.

1. Genesis Airdrops

The Virtuals team has launched Genesis Airdrops reserved exclusively for veVIRTUAL holders. These airdrops come from partner projects, internal initiatives, and new protocol integrations.

2. Governance Participation

veVIRTUAL holders vote on:

- Treasury allocation

- Agent-related incentives

- Protocol upgrades

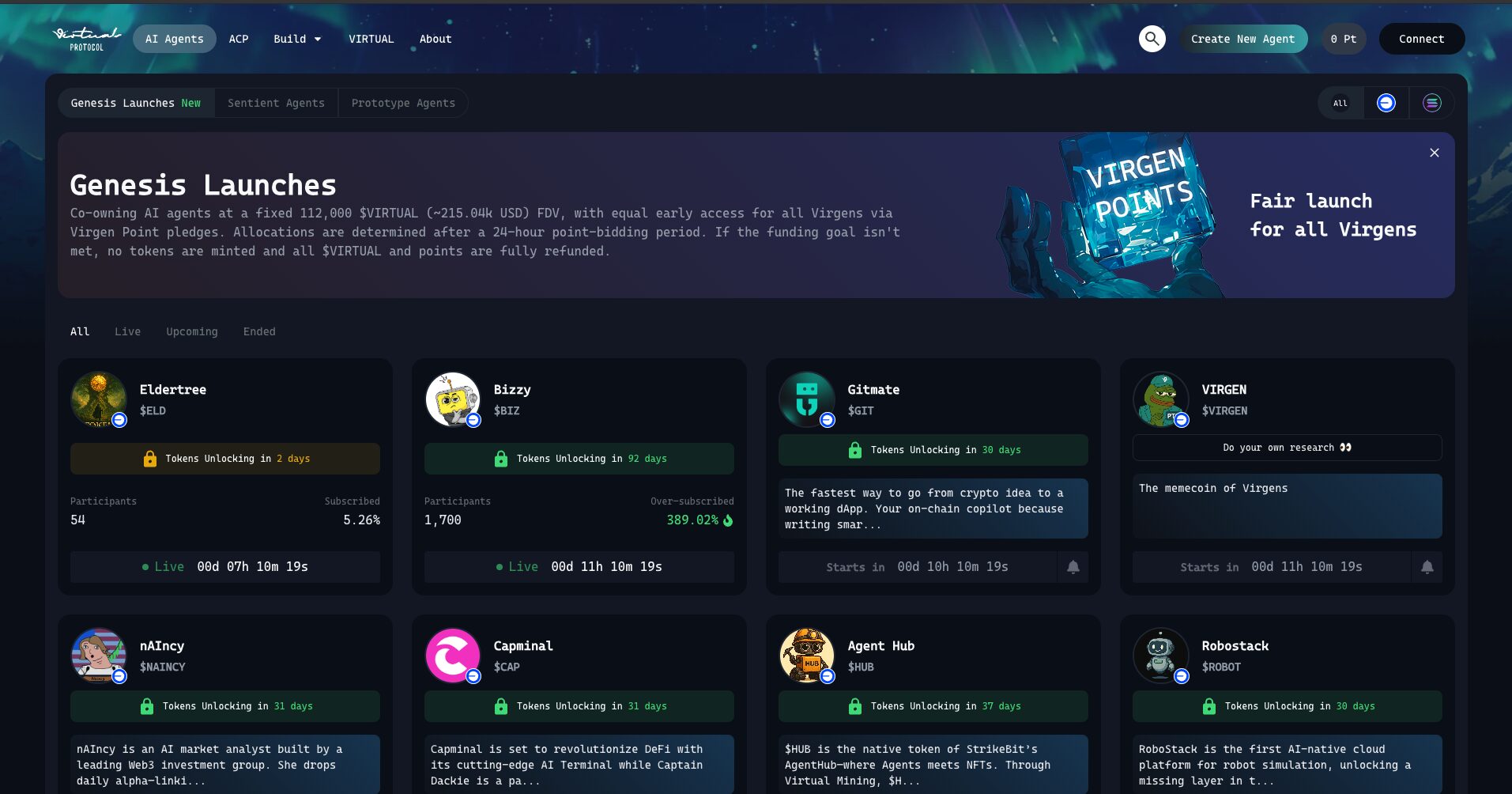

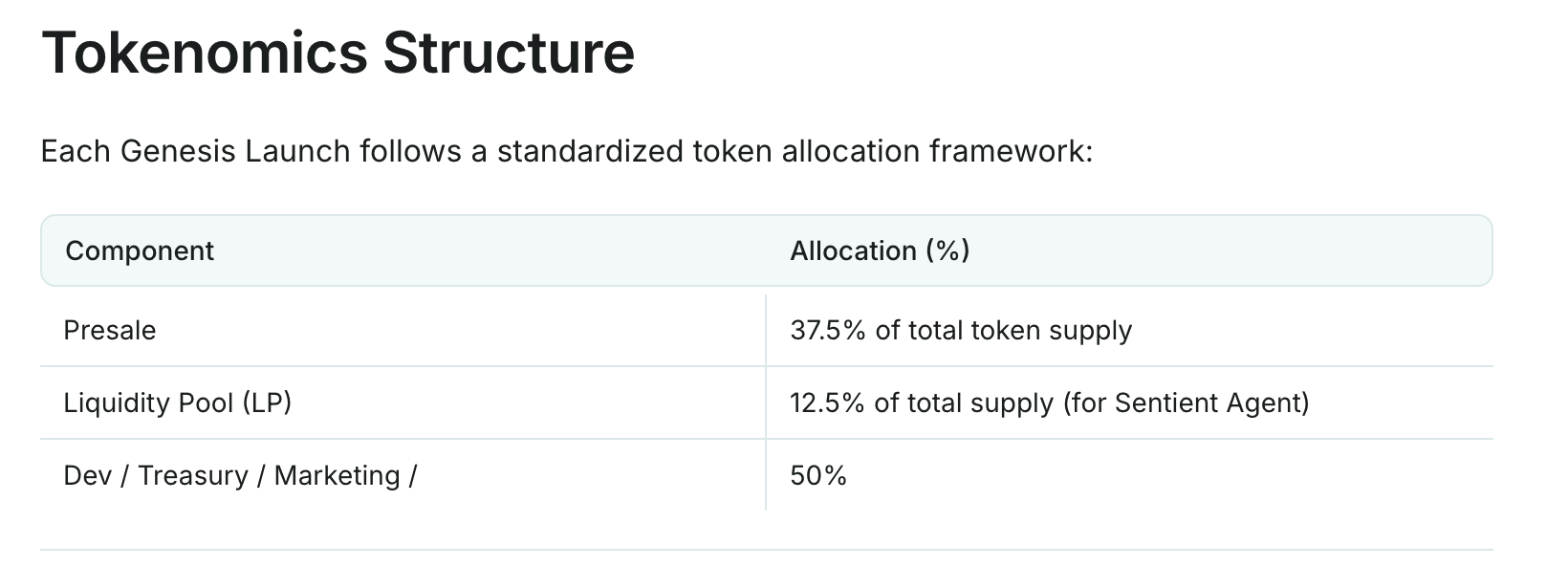

3. Genesis Launchpad Access

Projects launching within the Virtual ecosystem often conduct community sales or allowlist campaigns for veVIRTUAL holders.

4. Protocol Rewards

The longer the lock, the higher the reward multiplier. Rewards are distributed periodically and may include additional VIRTUAL tokens or tokens from ecosystem partners.

How to Earn Virgen Points

To participate in a Genesis Launch, users must accumulate Virgen Points, which function like tickets to access early token sales. More points mean higher allocations and better pricing.

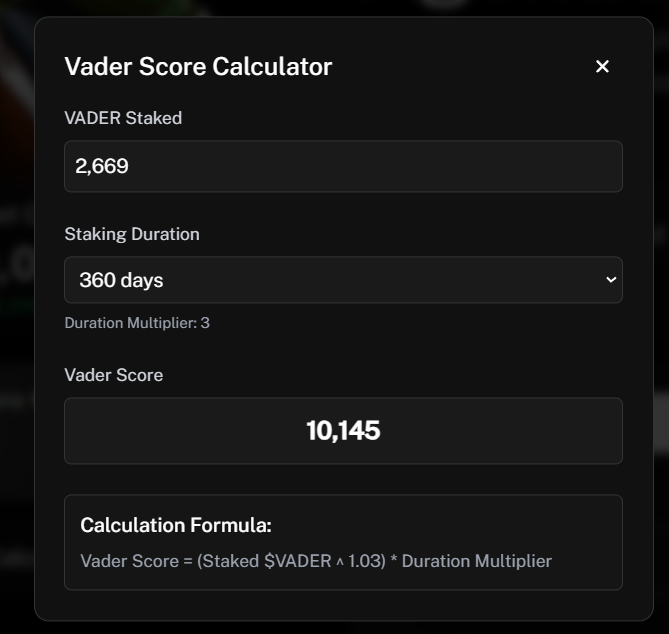

Points can earn in various ways – by holding or staking VIRTUAL, participating in campaigns like Virtual Trenches, staking partner tokens (e.g., $VADER or $AIXBT), or contributing content about Virtuals on social platforms. Additional points are awarded for holding Genesis tokens for over 24 hours or generating community engagement.

Note that Virgen Points typically expire after 14 days and must be used promptly, preventing hoarding and encouraging ongoing activity.

Recent Staking & Airdrop Returns

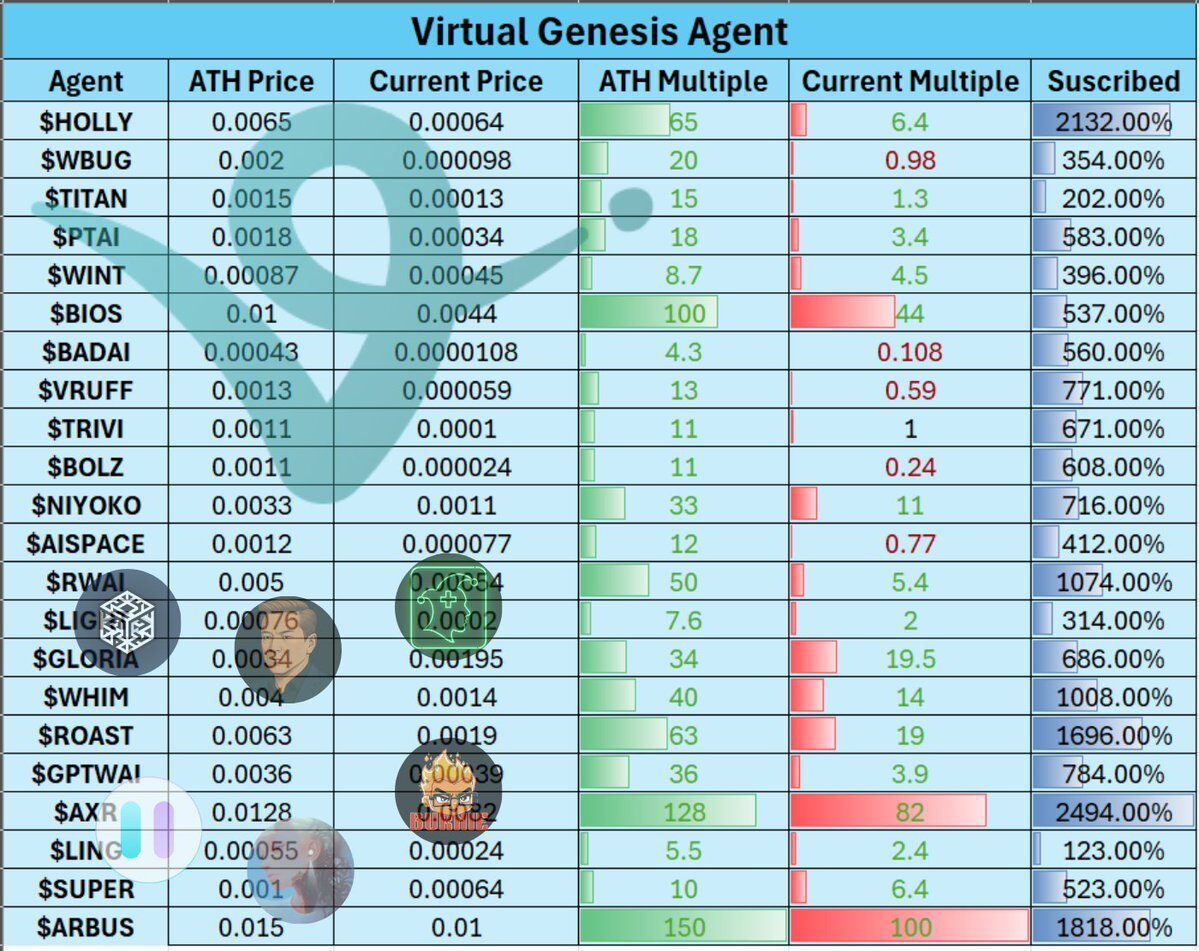

During the Genesis Launch of Arbus AI (ARBUS) in mid-May 2025, many participants reported substantial returns. One investor shared that they used 460 points along with a small amount of VIRTUAL to purchase ARBUS, estimating a 20x return compared to the initial price.

Just days earlier, the Axelrod (AXR) token sale also delivered significant gains. One participant contributed approximately 1.2 VIRTUAL and 7,100 points to receive 9,503 AXR — valued at around $170 at the time.

These examples showcase the double-digit ROI potential for active participants. Market sentiment around these launches has been overwhelmingly positive, reinforcing confidence in the protocol’s reward mechanisms. These not only determine how incentives are distributed but also influence investor behavior across staking, airdrops.

While there is no fixed APR like in traditional DeFi pools, Virtuals’ model emphasizes rewarding meaningful contribution. Instead of stable yield, investors gain early access to new tokens at discounted prices and can receive token airdrops based on engagement.

Source: The Smart Ape

Although these returns can be harder to quantify using conventional metrics, the success of recent events indicates that staking in the Virtuals ecosystem can be highly attractive for anyone who actively engages and supports the platform’s long-term vision. Contributors who help build, test, or promote Virtuals-based tools and content also play a crucial role in sustaining ecosystem momentum.

Downside to Consider

While staking is generally seen as a secure and passive strategy, it is not without risks. The first major concern is illiquidity – once you stake your VIRTUAL tokens, they are locked and cannot be withdrawn until the term ends.

This means you won’t be able to sell or move your tokens if market conditions change. If the price of VIRTUAL drops significantly during this period, you will not be able to exit your position or limit your losses, making staking a potentially high-risk strategy during volatile market conditions.

Another key danger is smart contract vulnerability, and while the protocol has undergone audits, no system is entirely immune to security flaws that could put investor funds at risk. As with any decentralized finance (DeFi) protocol, Virtual Protocol is reliant on code-based smart contracts that, if flawed or exploited, could compromise funds.

Finally, there is an opportunity cost. Locking your tokens in staking means those assets cannot be deployed elsewhere, such as in other yield-generating protocols or investments — which could lead to missed financial opportunities.

It is essential to assess your risk tolerance and fully understand the commitment before opting for long lock durations.

Tips for Maximizing Your Rewards

To get the most out of your staking experience with Virtual Protocol, consider a few practical strategies. First, using the Auto Max-Lock feature ensures you receive the maximum possible amount of veVIRTUAL, improving your eligibility for future airdrops and boosting your governance power.

Second, participate actively in governance. By voting on proposals and contributing to discussions, you not only shape the future of the protocol but also position yourself for potential retroactive rewards.

Finally, for those who don’t plan to hold VIRTUAL long-term, staking still offers an attractive utility. By locking tokens to earn veVIRTUAL, users can leverage their veVIRTUAL position as collateral to borrow other assets or participate in secondary yield opportunities, turning short-term exposure into productive capital without giving up liquidity entirely.

Conclusion

Staking VIRTUAL through the Virtual Protocol is more than just a passive income strategy — it’s an invitation to co-create and co-own the future of AI on the blockchain. By locking your tokens and participating in governance, you contribute to the protocol’s success while enjoying tangible rewards. This also supports your ability to create long-term value within a decentralized AI economy.

Whether you’re a seasoned staker or new to Web3, Virtual Protocol’s friendly interface, strategic incentives, and rapidly growing ecosystem make it a compelling choice for those seeking passive income and for long-term engagement.

The post How to Stake Virtual Protocol: A Step-by-Step Guide to Earning Rewards appeared first on NFT Evening.