[#title_feedzy_rewrite]

After remaining on the sidelines for years, the Ethereum (ETH) network was seen making headlines. The asset’s growth…

After remaining on the sidelines for years, the Ethereum (ETH) network was seen making headlines. The asset’s growth over the past couple of days has diverted the spotlight to ETH. Throughout the past month, the largest altcoin surged by nearly 50%. ETH was struggling to push past the $2,000 mark. But today, the asset was seen eyeing at $3,000. In addition, the market cap of the network also saw an uptick. All of these signs point to a bullish farewell to the month of May. But can Ethereum deliver?

Also Read: US Stocks, Bonds Sink as Debt Fears Caused by Trump Persist

How High Did Ethereum Rise Today?

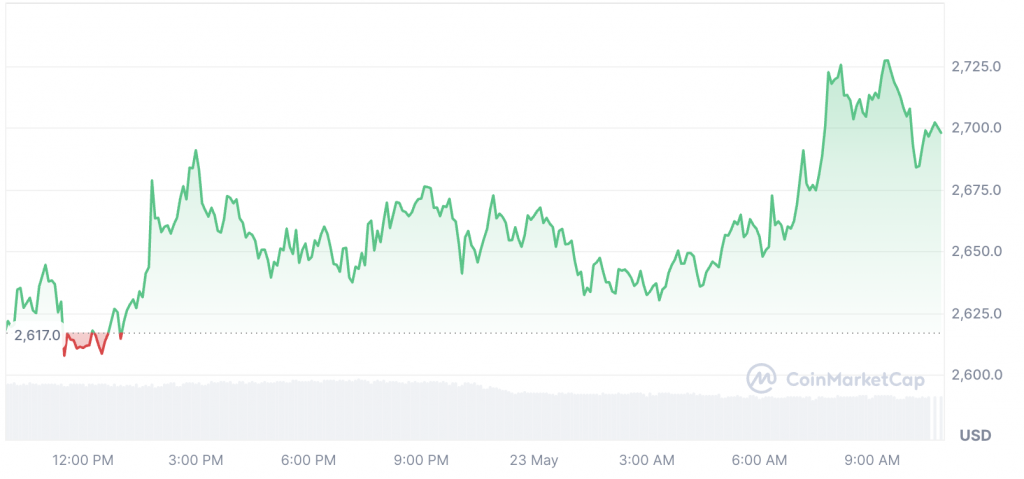

At the time of writing, the price of Ethereum stood at $2,699.50. The asset registered a 2.43% rise over the past 24 hours. During this period, ETH jumped from a low of $2,603.36 to a high of $2,731.22.

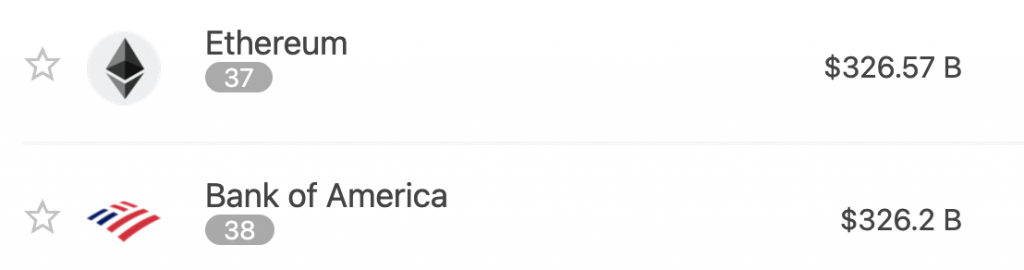

Ethereum is the second-largest cryptocurrency in terms of market cap. The altcoin’s market value is currently at $325.5 billion following a 2.39% daily increase. With this latest growth, ETH has managed to take over Bank of America, whose market cap stands at $326.2 billion. The altcoin is presently the 37th largest asset in the world. While this shift is bullish for the ETH market, it also highlights the evolving dynamics of wealth across the globe.

Also Read: Cardano ADA Price Surges 27%: $5 a Possibility?

May End Price Prediction

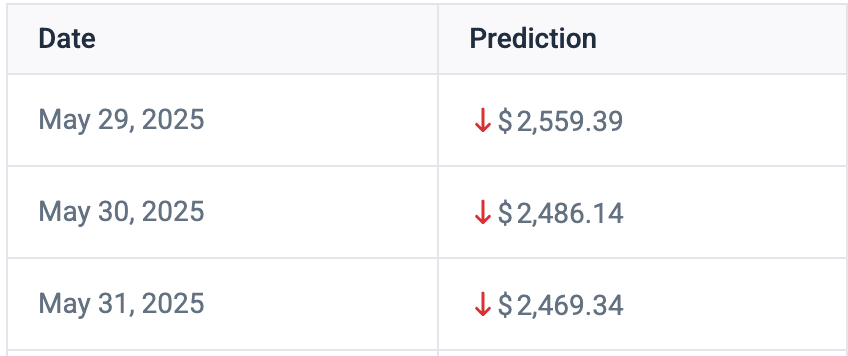

According to data from CoinCodex, the current bullish trend might encounter a hurdle. Ethereum will likely record a downtrend towards the end of the month. The largest altcoin might drop to a low of $2,469 on the last day of May. This can be disappointing for ETH investors who have been waiting patiently to see an increase in the altcoin’s price. It looks like they have to wait longer to witness the asset reach $3,000.

Also Read: BRICS Give Major Update on Ten-Year De-Dollarization Plan