[#title_feedzy_rewrite]

On May 23, 2025, U.S. spot Bitcoin ETFs recorded their highest daily inflow in over four months, reflecting growing institutional confidence as Bitcoin continues its upward trajectory past $111,000.

Bitcoin Spot ETFs Hit a 4-Month High in Daily Inflows

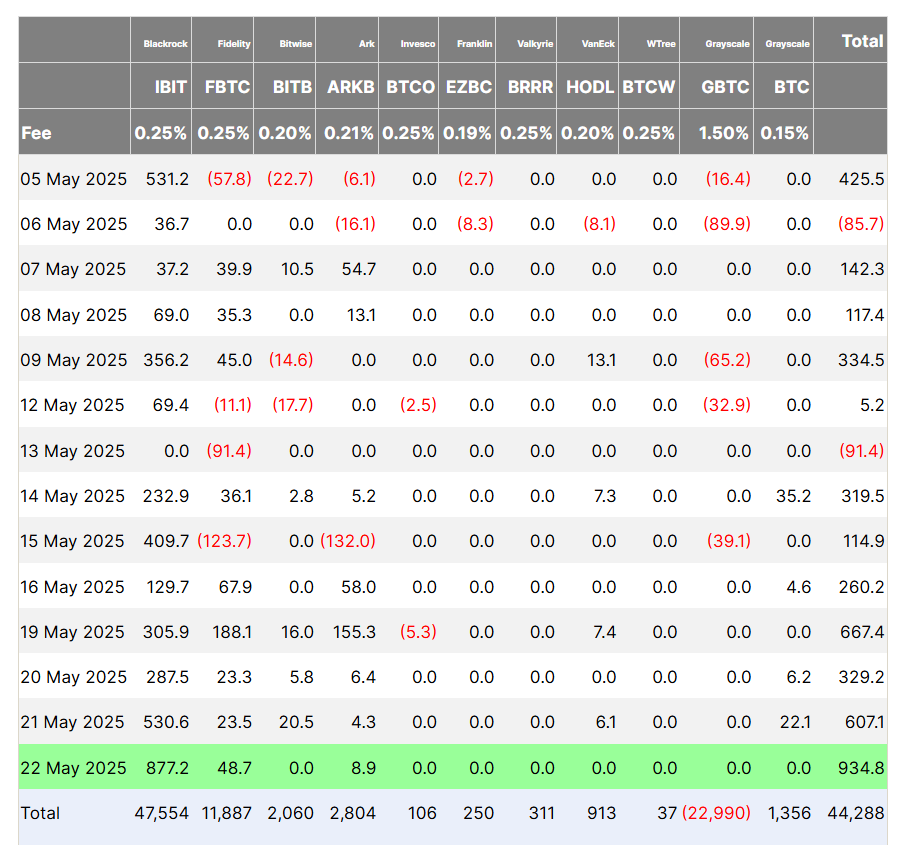

On May 22, 2025, U.S. spot Bitcoin exchange-traded funds (ETFs) witnessed a remarkable surge in investment, with a total net inflow of $934.21 million, according to data from Farside Investors. This marks the largest daily inflow in over four months, highlighting a significant shift in investor sentiment.

BlackRock’s iShares Bitcoin Trust (IBIT) led the charge, attracting $876.65 million, while Fidelity’s FBTC saw $48.66 million in inflows. Other ETFs, such as ARK 21Shares Bitcoin ETF (ARKB), recorded a modest $8.90 million, while Bitwise’s BITB reported no net flows for the day.

Source: Farside Investors

This influx is part of a broader trend, with U.S. spot Bitcoin ETFs accumulating nearly $2.8 billion in inflows over the past five trading days. The momentum aligns with Bitcoin’s recent price rally, which saw the cryptocurrency hit a new all-time high of $111,888 on May 22, up 7.3% from a low of $104,200 the previous day. The crypto market rose by 2.5%, reaching a capitalization of $3.48 trillion—its highest since February.

Learn more: Bitcoin ATH at $111,000, Nothing Can Stop BTC To The Moon

This surge in ETF inflows underscores growing institutional confidence, particularly as BTC continues to break price barriers, bolstered by positive market sentiment and technical indicators.

Since their launch in January 2024, U.S. spot Bitcoin ETFs have amassed over $44.2 billion in total net inflows, with IBIT alone maintaining a 20-trading-day streak of inflows without a single outflow since April 9.

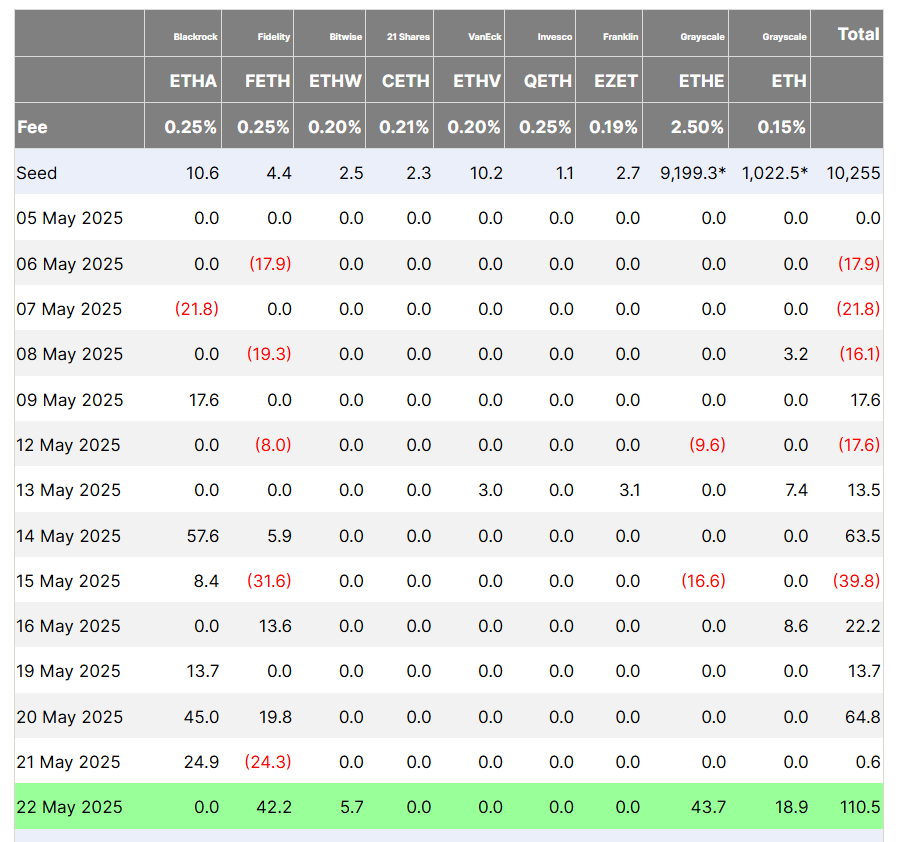

In contrast, Ethereum ETFs saw far more modest activity, witnessing a net inflow of just $12.3 million into U.S. spot Ethereum ETFs on May 22, a fraction of the inflows seen in Bitcoin ETFs.

U.S. Bitcoin Spot ETFs Control 6.35% of Total BTC Supply

The recent ETF inflows come at a pivotal moment for the crypto market, which has been buoyed by several bullish developments.

On May 22, JPMorgan Chase CEO Jamie Dimon announced that the bank would offer clients access to Bitcoin, a significant shift after years of skepticism. This move by a major financial institution likely contributed to the positive sentiment driving ETF investments.

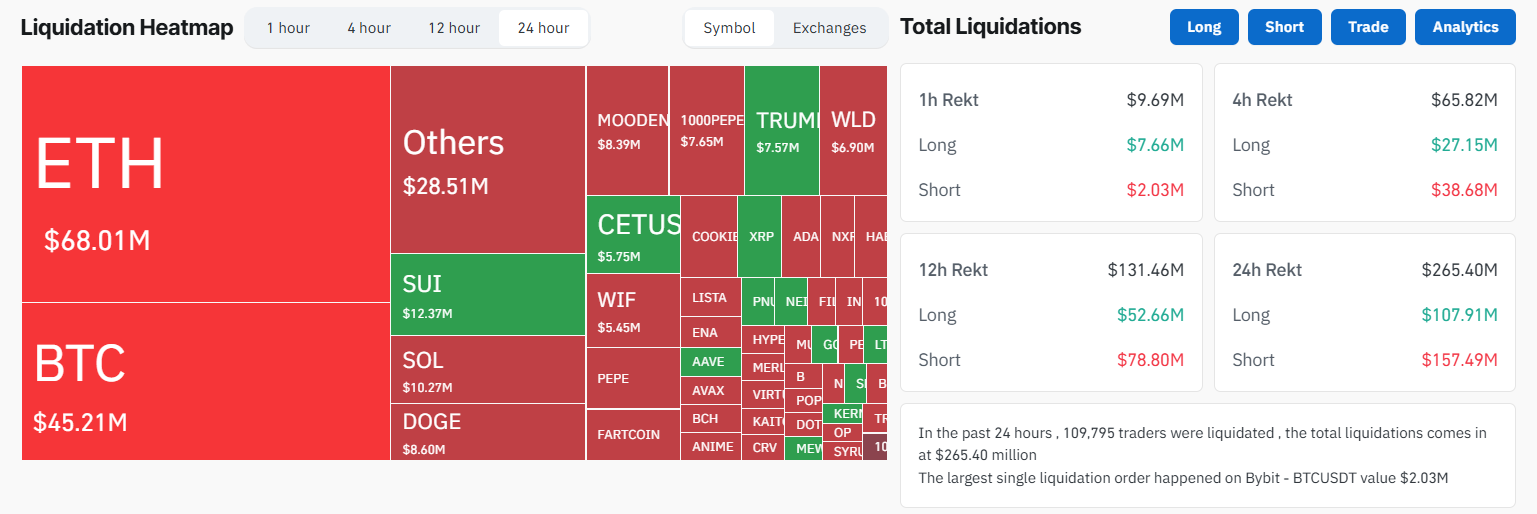

Additionally, a wave of short liquidations, totaling $265 million across the crypto market, with $45.2 million in short BTC positions, triggered a powerful short squeeze, further fueling Bitcoin’s price surge.

Source: CoinGlass

However, the market remains sensitive to external factors. The Cetus Protocol hack on the SUI blockchain, which resulted in losses exceeding $223 million, has introduced some uncertainty, particularly for tokens linked to the SUI ecosystem. While this event did not directly impact Bitcoin’s price, it serves as a reminder of the broader risks in the DeFi space, which could influence investor behavior in the coming days.

Despite this, the sustained inflows into Bitcoin ETFs suggest that institutional investors are increasingly viewing Bitcoin as a reliable store of value, even amidst such challenges.

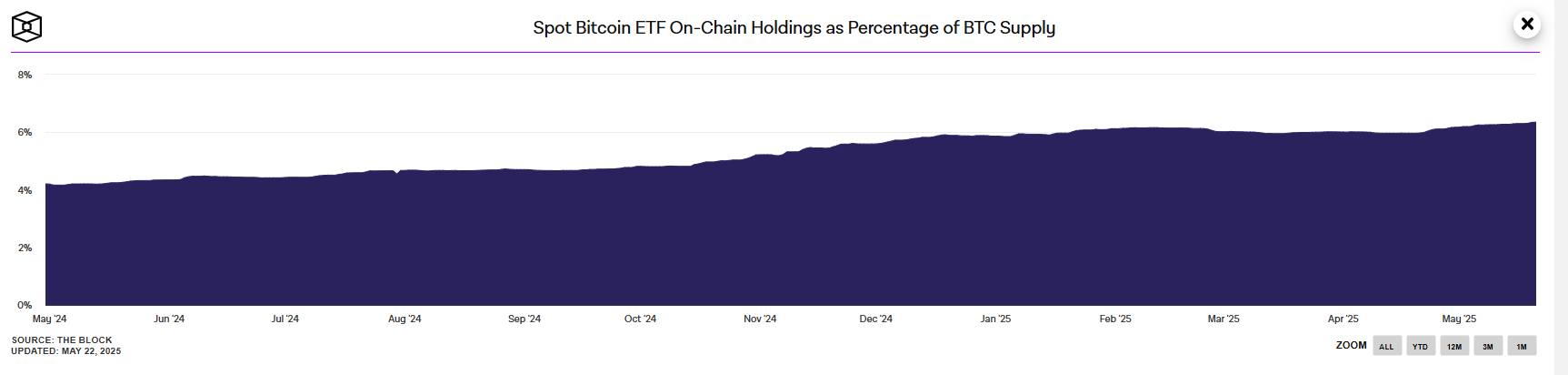

Looking ahead, the continued accumulation by ETFs could further tighten Bitcoin’s supply, potentially driving prices higher. U.S. spot Bitcoin ETFs now hold over 1.2 million BTC, 6.35% of the total supply. If this trend persists, Bitcoin’s role as a mainstream financial asset may solidify further, especially as more traditional institutions enter the space.

Source: The Block

The post Bitcoin Spot ETFs Smash $930M, Continuing a 7-Day Inflow Streak appeared first on NFT Evening.