[#title_feedzy_rewrite]

![[#title_feedzy_rewrite]](https://postcryptocoins.com/wp-content/uploads/2025/05/5-Cryptos-Ready-To-Explode-This-Bull-Run-1-UparQa.jpg)

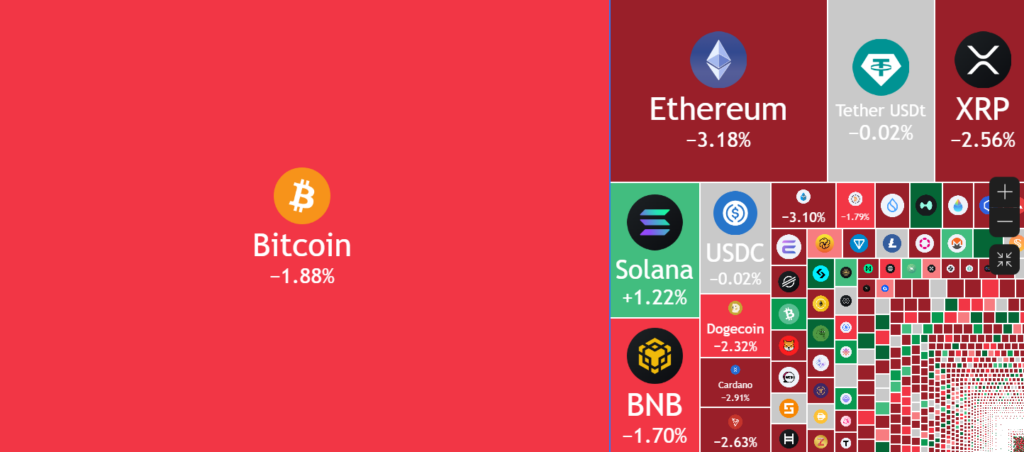

Bitcoin and top altcoins saw a significant pullback on Friday, erasing earlier-week gains. Bitcoin fell to $107,300, down 4.12% from its latest weekly high, while Ethereum fell more than 8% from its high. The pullback affected the overall cryptocurrency market, with the combined market capitalization of all altcoins except Bitcoin

- Bitcoin and altcoins saw a short-term correction, but analysts suggest it’s not the end of the ongoing crypto bull run.

- Global trade tensions and macroeconomic pressures triggered a pullback, yet institutional demand and ETF inflows remain strong.

- Historical market patterns show that such dips are typical in bull cycles and often followed by new highs.

Bitcoin and top altcoins saw a significant pullback on Friday, erasing earlier-week gains. Bitcoin fell to $107,300, down 4.12% from its latest weekly high, while Ethereum fell more than 8% from its high.

The pullback affected the overall cryptocurrency market, with the combined market capitalization of all altcoins except Bitcoin declining from $1.28 trillion to $1.19 trillion a drastic fall that indicates heightened market restraint.

Stock Market Sell-Off Contributes to Pressure

This digital currency downturn came on the heels of a larger financial market drop. Futures for large U.S. indexes such as the Dow Jones, S&P 500, and Nasdaq 100 lost over 1% on Friday, continuing losses that started earlier this week.

Market sentiment turned negative after renewed worries around international trade. In a TruthSocial post, former President Donald Trump lashed out at ongoing trade talks with the European Union, threatening to slap a 50% tariff on all products from the block.

Trump’s remarks sent transatlantic trade war jitters back into an ugly swing. Europe has already suggested it could respond with higher tariffs on US exports, including Boeing aircraft. Ryanair, Boeing’s biggest customer, has openly threatened to cancel a $33 billion order and turn to Airbus if tariffs are applied.

This geopolitical tension comes on the heels of Moody’s downgrade of the U.S. credit rating, further dampening investor confidence. Additionally, the recent passage of the so-called Big Beautiful Bill, which raises U.S. debt by $3.8 trillion over the next decade has added more fuel to the uncertainty in global markets.

Is the Crypto Bull Run Over?

Despite the temporary sell-off, analysts warn against calling the end of the ongoing crypto bull cycle. There are three reasons why this pullback could prove to be temporary:

1. Tariffs as a Negotiating Tool

Trump’s hard-line tariff bluff could be part of a well-rehearsed negotiating tactic. The same tactics have been deployed in the previous trade negotiations with China when tariffs were raised to 145%, only to be reduced to 30% in recent weeks. That could indicate a hope for a resolution instead of escalation.

2. Bitcoin’s Safe-Haven Role

Bitcoin is increasingly being viewed as a macroeconomic volatility hedge. More than $8 billion of inflows have flowed into spot Bitcoin ETFs since April. While institutional demand continues to climb and exchange supply goes down, Bitcoin’s scarcity model preserves long-term price sustainability.

Bitcoin’s rise from sub-zero prices to a record high of $111,900 this week is a reflection of its transformation as an internationally accepted store of value.

3. Market Corrections Are Normal

Volatility is the way of the crypto market. To illustrate, Bitcoin dropped from $109,300 in January to $75,000 in April only to skyrocket once again.In 2024, it rose to a high of $73,340 in March, fell to $49,390 in August, and rose again to all-time highs by November. This is all part of its wider growth trend.

Conclusion

Although the recent retreat in crypto prices is likely to spook some investors, it is in line with the correcting pattern exhibited by earlier bull runs. As geopolitical news and fiscal policies fuel short-term fluctuations, Bitcoin and its peers are likely to remain under pressure. Long-term fundamentals, however, especially for Bitcoin, continue to be solid.

While the global markets find their bearings with changing trade policies and fiscal facts, crypto investors can find opportunities in the din if history has anything to say about it.

Highlighted Crypto News Today

Injective Completes Inverse Head and Shoulders Pattern: Is $17 the Next Target?