[#title_feedzy_rewrite]

Worldcoin (WLD) is a cryptocurrency project combined with a global digital identity system, co-founded by Sam Altman, the CEO of OpenAI. As of now, WLD is trading around $1.50 with a total market capitalization exceeding $2 billion, ranking 68th in the cryptocurrency market.

Internal Factors of the Worldcoin

Worldcoin was founded in 2019 by Sam Altman, Alex Blania, and Max Novendstern, with Altman being the most prominent figure (also serving as the CEO of OpenAI). The project has raised over $250 million in funding from major venture capital firms such as a16z and Khosla Ventures.

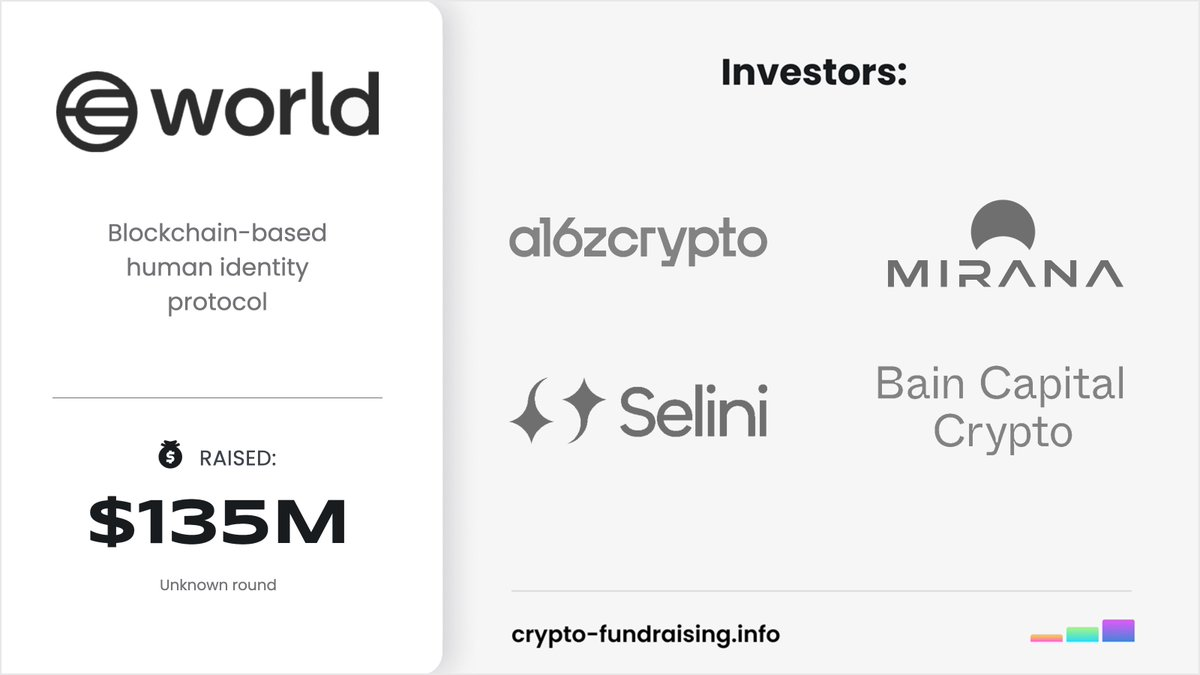

Most recently, in May 2025, Worldcoin (now rebranded as “World”) secured an additional $135 million through direct token sales of WLD to two venture capital firms: a16z and Bain Capital Crypto.

Source: Crypto Fundraising

This capital injection demonstrates strong backing from major investors and provides the necessary resources for the project to pursue its long-term vision. Worldcoin aims to build the world’s largest identity and financial network, targeting a user base of billions.

The core focus is solving the “Proof of Personhood” problem, distinguishing real humans from bots or AI in a future dominated by artificial intelligence. Each user, after downloading the World App and registering, must physically visit an Orb (a spherical device) to scan their iris and create their unique World ID.

The scanning process uses multispectral sensors to verify the uniqueness of the iris, and the image is deleted immediately on the device.

Tokenomics & On-Chain Activity

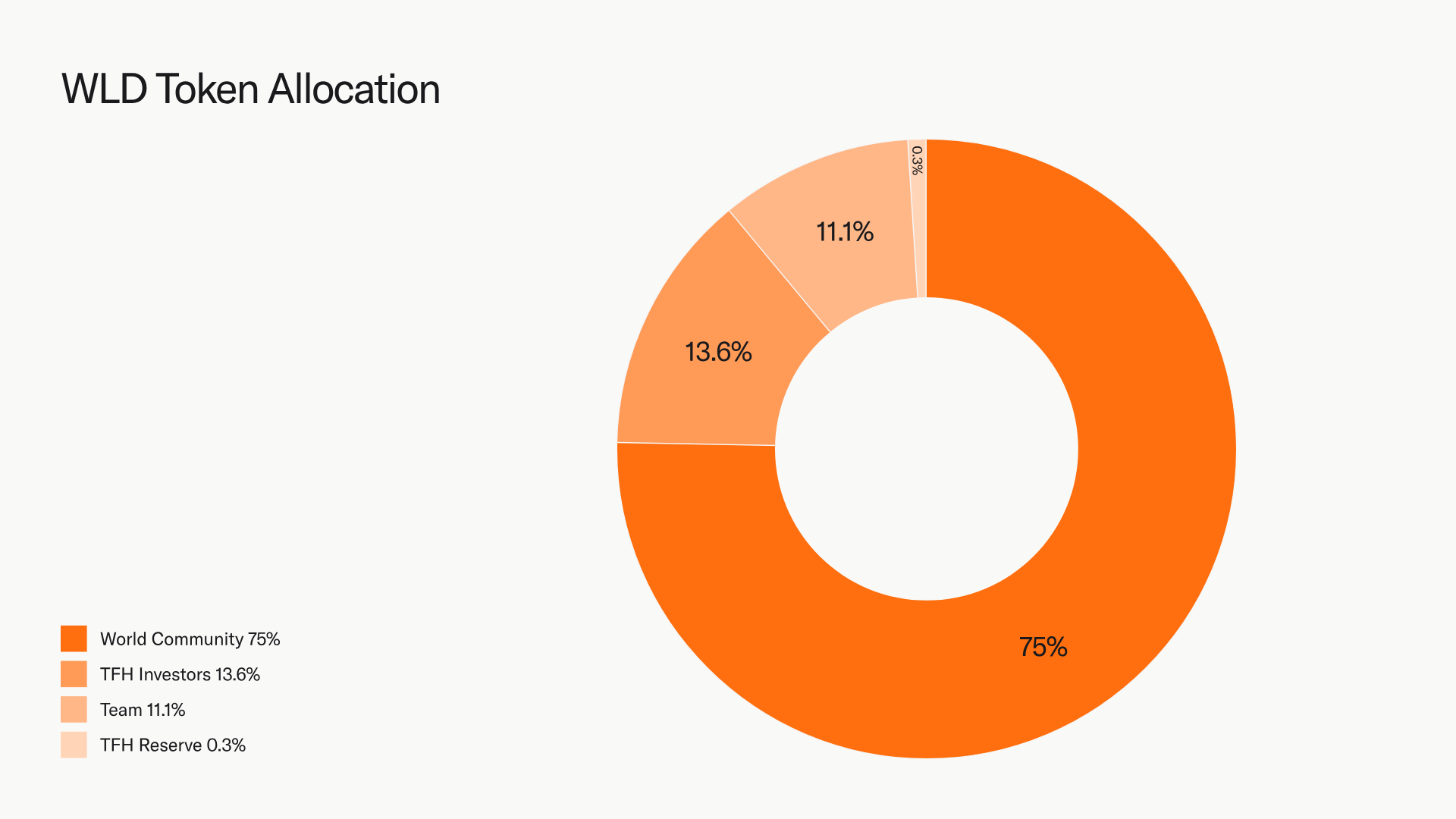

Worldcoin’s initial token allocation is structured as follows:

- 75% of the total WLD supply is designated for the Worldcoin community (primarily for user airdrops)

- 9.8% is allocated to the development team

- 13.5% to investors in Tools for Humanity (the organization behind the project)

- 1.7% to TFH’s reserve fund.

Source: Worldcoin

On-chain data shows WLD’s circulating supply has grown steadily due to ongoing token distribution. At the time of the token’s debut in July 2023, only around 100 million WLD were in circulation. By late April 2025, circulating supply jumped to around 1.3 billion WLD, or 13% of total supply.

After selling tokens to a16z and Bain Capital Crypto, circulating supply rose to about 1.51 billion WLD, or 15%.

Though the sale caused mild dilution, wallets with 1–10 million WLD now hold 798 million — over half the supply.

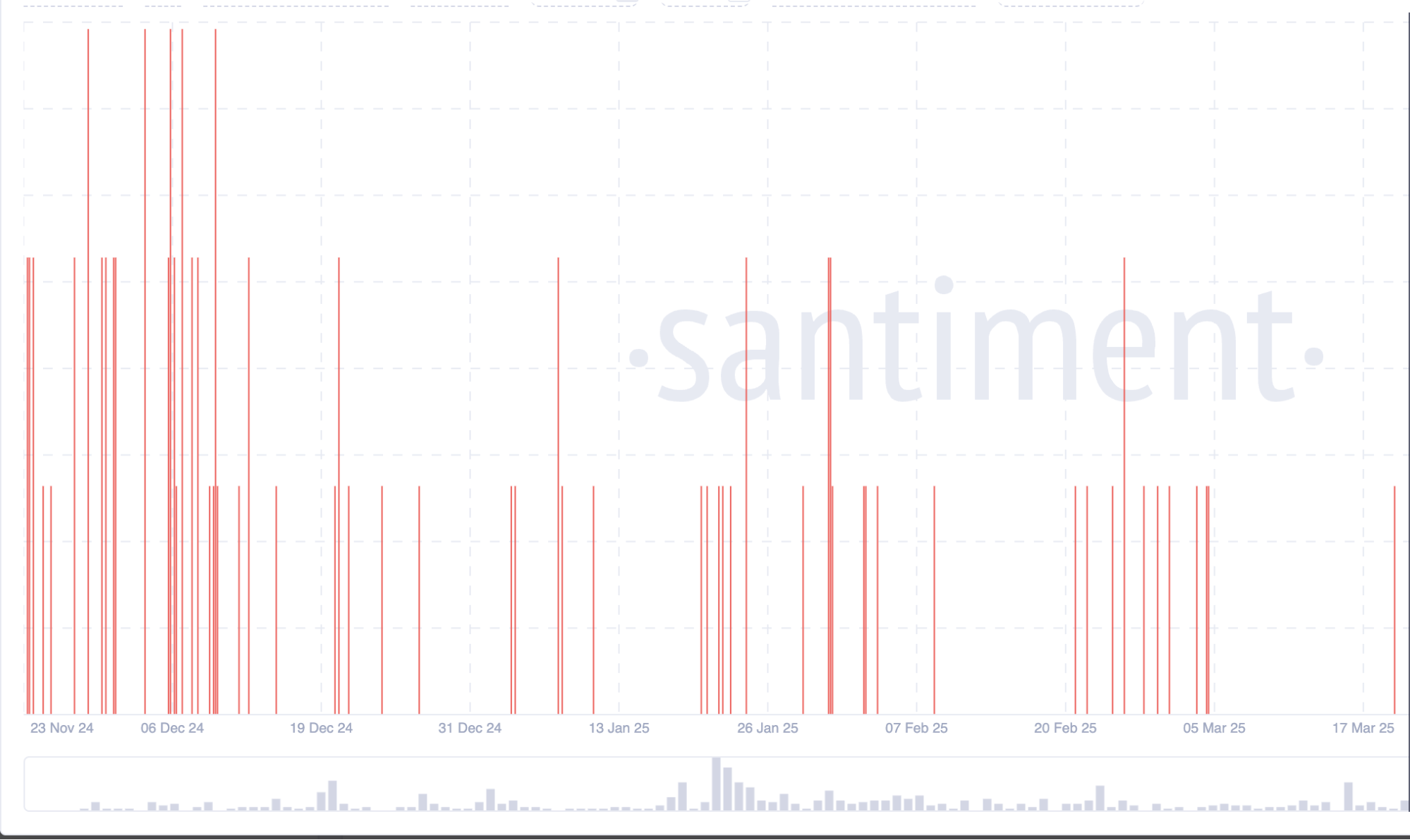

Sentiment data shows whale wallets added 13 million WLD in just the last week of April. This steady accumulation shows major investors trust WLD’s long-term value at current prices — a bullish sign.

Source: Santiment

Recent data from Arkham Intelligence also highlights the concentration of WLD holdings in prominent entities. The Optimism wallet holds about 2.85% of WLD, while Bithumb holds 1.36%.

These allocations show that much of the supply sits with Layer 2s and exchanges, hinting at Worldcoin’s listing strategy.

On the other hand, the team and early investors still hold about 23.3% of the total supply. As these tokens unlock over time, selling pressure may rise if stakeholders take profits.

Learn more: XRP Price Prediction in Q2/2025: Bullish Signal

However, in the next few months, token unlocks from the team and treasury stay modest. Furthermore, the recent purchases by a16z and Bain suggest they may intend to hold their tokens for the long term. Most selling pressure now comes from users who get monthly token grants and sell them.

Dune Analytics data shows that millions of WLD are distributed monthly to both new and existing users. For example, 1 million new users get 16 WLD, 6 million get 3 WLD. This could add about 34 million WLD to circulation monthly.

Source: Dune

Progress of “Iris Scanning” Deployment

Since its official launch in July 2023, Worldcoin has significantly expanded its network of Orb devices worldwide. The project reports that it has deployed approximately 1,500 Orbs across more than 35 cities in over 20 countries, with a strong presence in Europe, Asia, and Latin America.

By the end of April 2025, Worldcoin had verified over 12.5 million users across 160 countries. In May 2025, the project officially launched in the United States after a long period of anticipation – deploying Orbs in six major cities (Atlanta, Austin, Los Angeles, Miami, Nashville, and San Francisco) and establishing “World Spaces” as user experience centers tailored to the American market.

Source: Worldcoin

Additionally, Worldcoin has formed partnerships with Kalshi – a licensed prediction market platform, and Morpho – a decentralized lending protocol, to explore the integration of World ID, aiming to broaden the utility of its unique digital identity system.

Worldcoin’s vision is gradually taking shape: expanding its user base while building real-world applications for World ID, laying the groundwork for WLD’s long-term value.

Technical Analysis

During the second half of 2023, Worldcoin (WLD) traded within a relatively stable range of $1 to $2. However, in a sharp rally fueled by the AI investment narrative, and growing attention on Sam Altman and AI-related projects – WLD surged to its all-time high of approximately $11.74 on March 10, 2024.

This peak proved unsustainable. In the months that followed, WLD experienced significant downward pressure due to profit-taking and an expanding circulating supply, eventually retreating to around $2 by the end of 2024. Notably, Worldcoin launched its Layer 2 blockchain, Worldchain, in October 2024, amid this price decline.

On the daily chart, WLD has recently formed a series of higher highs and higher lows since April 2025, signaling a short-term uptrend. The price broke above the 50-day moving average (MA50) at the $0.90–$1.00 range in early May – a near-term bullish indicator.

Meanwhile, the 200-day moving average (MA200) remains above current price levels, hovering around $1.50–$1.60, indicating that the longer-term trend has yet to fully reverse to the upside. However, the gap between MA50 and MA200 is narrowing.

If upward momentum continues, a golden cross – where the MA50 crosses above the MA200, could form, further strengthening bullish momentum.

Source: TradingView

Liquidity and market momentum around WLD are also worth noting. Trading volumes tend to spike during bullish sessions, suggesting strong buying interest when price breaks out.

Overall, technical indicators suggest that Worldcoin is in a short-term recovery phase after establishing a bottom earlier this year. Price patterns and momentum indicators point to a positive outlook, though confirmation of a sustained uptrend would require WLD to break through key resistance levels on strong volume.

Fundamental Analysis

Bitcoin has been setting new all-time highs, recently surpassing the $112,000 mark. The total cryptocurrency market capitalization has also climbed to approximately $3.6 trillion – an increase of more than 10% in just a few weeks. This surge signals a return of capital to risk assets, driven by investor optimism that the bear market may be over and a new growth cycle is emerging.

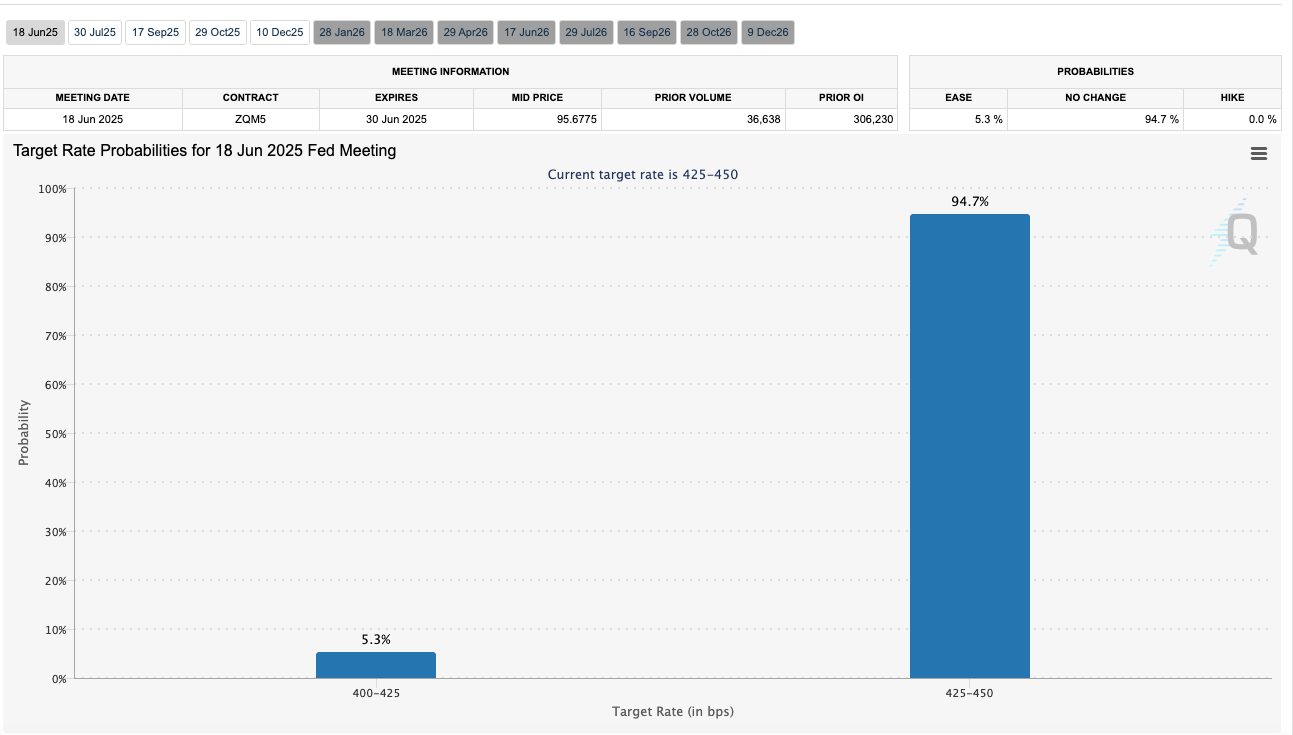

At the same time, the global interest rate environment appears to be stabilizing compared to the volatility seen in 2022–2023. After an aggressive tightening cycle to curb inflation, the U.S. Federal Reserve has paused rate hikes. Market participants are now anticipating potential rate cuts by late 2025, contingent on inflation remaining under control.

Source: CME Group

However, one critical macro factor is the regulatory landscape. As previously discussed, Worldcoin sits at the intersection of several highly sensitive themes: biometric data, digital identity, privacy, and cryptocurrencies. This places the project under heightened scrutiny from global regulators. A worldwide shift is underway to establish legal frameworks around digital identity and data privacy.

For example, the European Union already enforces the strict General Data Protection Regulation (GDPR) and plans to introduce even stricter rules for projects that handle sensitive data like Worldcoin.

If authorities in Germany, France, and other countries conclude that Worldcoin violates data protection laws, they may require the project to change its operational model or even halt its activities within the EU.

From a market sentiment perspective, Worldcoin occupies a unique position. The project straddles two of the most prominent technology narratives today – AI and blockchain. As a result, any developments related to Sam Altman or the broader AI sector could indirectly influence WLD’s price action and investor perception.

Worldcoin Price Prediction: WLD Price Outlook in Short-Term

In the coming weeks, an optimistic scenario suggests that WLD could continue its upward trajectory, targeting the $2.00–$2.40 range within the next 1–2 months, potentially revisiting the highs last seen at the end of 2024.

A more likely base case: WLD swings between $1.00–$2.00 short term, driven by speculation.

Investors should watch the ~$1.30 level closely, as it represents a nearby resistance where technical pullbacks may occur. On the support side, $1.00 — or $0.85 in deeper pullbacks — acts as a strong cushion. If WLD can maintain support above these thresholds after minor corrections, it would reinforce the ongoing bullish structure.

In summary, Worldcoin is currently at a pivotal juncture. If the project follows its roadmap and rides market tailwinds, WLD could see short-term gains.

Read more: Trading with Free Crypto Signals in Evening Trader Channel

The post Worldcoin Price Prediction: WLD Short-term Price Forecast appeared first on NFT Evening.