[#title_feedzy_rewrite]

More than 70 countries around the world are actively moving away from the US dollar in their international…

More than 70 countries around the world are actively moving away from the US dollar in their international trade, so de-dollarization is gaining serious momentum. The trend involves nations from ASEAN that are implementing local currency settlements and also developing alternative payment systems.

Meanwhile, we’re seeing de-dollarization efforts in Europe reaching unprecedented levels as officials question their Federal Reserve reliance. The BRICS nations have been working to ditch the US dollar as well, and countries are increasingly replacing the dollar in trade relationships, which represents the most serious challenge to American monetary dominance since World War II.

Also Read: De-Dollarization: Full List of Countries Dropping the US Dollar & Key Reasons

How BRICS, ASEAN, and Europe Countries Are Embracing De-dollarization in Trade

ASEAN Takes Historic Step with Yuan-Based Emergency Fund

Asia’s largest economies have just approved a groundbreaking rapid financing mechanism that will, for the first time ever, use regional currencies including the Chinese yuan instead of the US dollar. This decision was made during a meeting in Milan, Italy, and it’s being seen as a major breakthrough for countries looking to reduce their dollar dependency.

Ding Shuang, who serves as chief Greater China economist at Standard Chartered Bank, had this to say:

“Yuan’s inclusion in the CMIM system reflects growing acceptance of the currency on the global stage and marks a step forward in its internationalisation.”

China’s central bank governor Pan Gongsheng also described the move as:

“A breakthrough in diversifying the international monetary system in the region.”

CIS Countries Achieve 85% Local Currency Usage

The Commonwealth of Independent States has successfully implemented what might be the most successful regional de-dollarization initiative to date. Countries are conducting an impressive 85% of their cross-border transactions using local currencies rather than US dollars.

This achievement shows how countries can work together when they coordinate their monetary policies effectively.

European Officials Question Dollar Dependency

Perhaps most surprisingly, we’re now seeing de-dollarization sentiment reaching European shores as well. European central banking officials are questioning whether they can continue to rely on the US Federal Reserve for dollar funding during market stress.

Jane Foley, who heads FX Strategy at Rabobank, stated:

“Trump’s trade and foreign policies have forced Europe on a path towards reduced reliance on the US and this is likely to imply a desire for reduced reliance on the dollar.”

Also Read: De-Dollarization Surge: Why Europe’s Euro Bonds Could End US Dollar’s Reign

Foley also pointed out an interesting irony:

“Trump threatened countries that tried to de-dollarise with extra tariffs. Ironically, his isolationist policies may drive the trend.”

BRICS Alliance Leads Global Movement

The BRICS alliance has created what appears to be the most organized challenge to dollar hegemony in recent years. Iran and Russia have completely eliminated dollar usage in their bilateral trade.

Mohammad Reza Farzin, Iran’s central bank governor, was quite clear about their progress:

“We (BRICS members Iran and Russia) have entered into a currency agreement with Russia and fully removed the US dollar. Now we only trade in rubles and rials.”

China has been particularly aggressive in promoting yuan usage, which now accounts for 47% of its total global transaction volume. Brazil is now trading with China in yuan and real and has opened yuan clearing banks.

African Nations Implement Bold Policies

African countries are taking decisive steps toward monetary sovereignty. Tanzania has officially banned the use of foreign currencies for all local transactions and set the stage for Kenya and other EAC nations. Nigeria has joined BRICS as a partner country and has expressed interest in using local currencies in bilateral trade agreements. As for Ghana, is now paying for oil imports using gold.

Market Implications and US Dollar’s Future

Financial analysts are warning that the continued spread of these de-dollarization efforts could have serious consequences for the US economy. Adding to these concerns, a recent Moody’s downgrade of the US sovereign debt rating has further weakened faith in US assets as safe havens.

Deutsche Bank noted in a recent analysis:

“There is a risk that major shifts in capital flow allocations take over from currency fundamentals and that FX moves become disorderly.”

Goldman Sachs analyst Jan Hatzius noted:

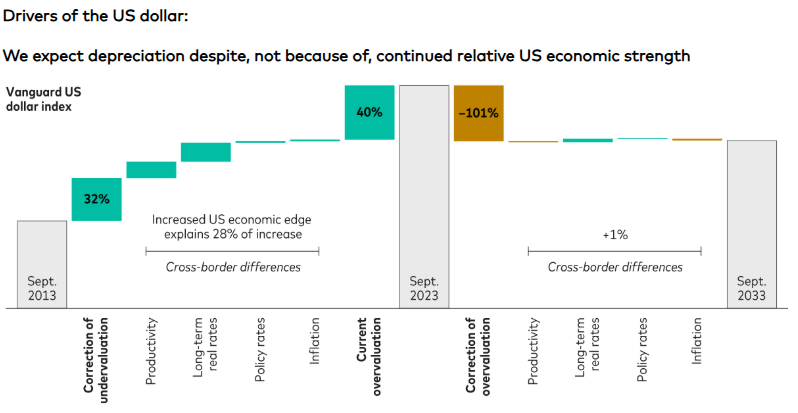

“I believe that the recent dollar depreciation of 5% on a broad trade-weighted basis has considerably further to go.”

Also Read: Brazil Central Bank Chief Warns De-Dollarization Won’t Happen Anytime Soon

The situation is being complicated by domestic factors as well. Trump’s tax bill would add $3 trillion to $5 trillion to the country’s debt, according to nonpartisan analysts. This ballooning fiscal debt, combined with trade frictions and weakened confidence, has weighed heavily on US markets.

Right now, this trend shows no signs of slowing down, and if anything, it appears to be accelerating as more countries join existing initiatives.