[#title_feedzy_rewrite]

Coinbase, the largest U.S. cryptocurrency exchange, was hit with multiple class action lawsuits in May 2025 following a data breach that exposed 69,000 users, sparking outrage and legal action over alleged security failures.

A Wave of Lawsuits Targets Coinbase’s Security Flaws

Coinbase, the leading U.S.-based cryptocurrency exchange, is under fire as at least six class action lawsuits were filed against it between May 15 and May 16, 2025. The lawsuits stem from a significant data breach disclosed earlier in May, affecting 69,461 users. Hackers bribed overseas support agents to steal personal and financial data, prompting Coinbase to offer a $20 million bounty for information leading to the culprits’ arrest.

Read more: Coinbase Security Breach Scandal: $20 Million Hunt for Data Thieves

The legal actions, filed in federal courts across New York and California, accuse Coinbase of failing to maintain stringent security protocols, leaving users vulnerable to identity theft and financial fraud.

The lawsuits claim Coinbase’s negligence could lead to “substantial, immediate, and ongoing threats” for affected users, with potential long-term consequences since the compromised data cannot be recovered. One lawsuit in California even demands that Coinbase purge sensitive user data and hire third-party auditors to test its security systems.

Meanwhile, the community raised concerns about the scale of the breach, noting that it began as early as December 26, 2024, and continued until Coinbase received a credible ransom note in May 2025. The exchange refused to pay the $20 million ransom and has flagged plans to reimburse users tricked into sending crypto to phishing scammers, with estimated expenses ranging from $180 million to $400 million, per a filing with the U.S. Securities and Exchange Commission.

Coinbase Repeatedly Faces Legal Challenges

The Coinbase breach has sparked significant backlash on social media platforms like X. Users expressed frustration, criticized the exchange’s response, saying, “$20M bounty is a joke when they’re spending $400M on reimbursements.”

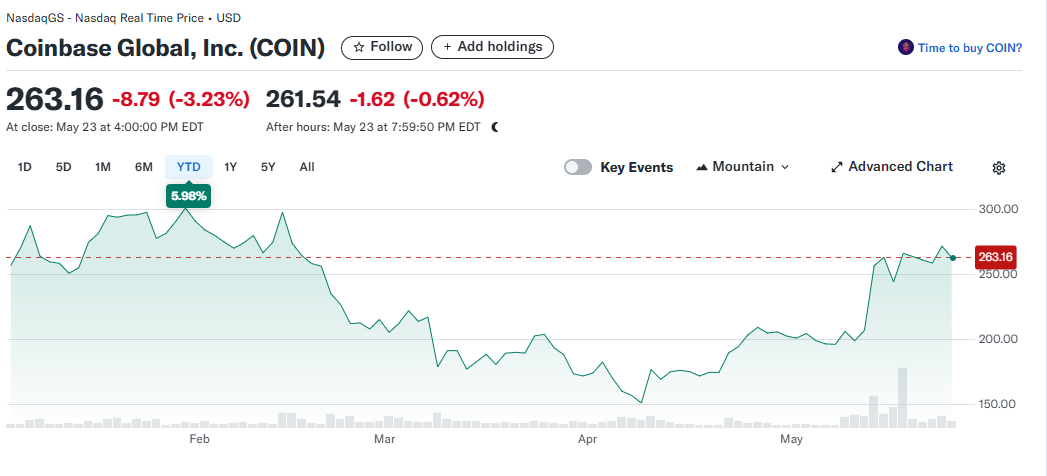

Coinbase’s stock price dipped 3.2% in after-hours trading on May 27, 2025, following the disclosure of the lawsuits, reflecting investor concerns over the financial and reputational fallout.

Source: Yahoo Finance

Coinbase has not directly commented on the lawsuits but pointed to a blog post outlining its response to the breach. The exchange’s filing just confirmed the breach’s timeline and the number of affected users. This incident adds to Coinbase’s legal challenges, as it faced similar lawsuits in 2023 over security lapses, according to Herman Jones, LLP.

Learn more: Is Coinbase Safe & Trustworthy in 2025?

The ongoing legal battle underscores the growing scrutiny of cryptocurrency exchanges as they navigate the balance between innovation and user protection in a rapidly evolving industry.

The post Coinbase Faces Class Action Lawsuits Over Security Breach Scandals appeared first on NFT Evening.