[#title_feedzy_rewrite]

![[#title_feedzy_rewrite]](https://postcryptocoins.com/wp-content/uploads/2025/05/oklo-stock-price-48-4x7zGe.jpg)

The energy sector has been brimming with profits lately, and OKLO stock is among the ones that experienced…

The energy sector has been brimming with profits lately, and OKLO stock is among the ones that experienced a massive surge in price. It has spiked 123% year-to-date and has doubled investors’ money in less than five months. The energy-based stock entered 2025 at $21 and touched a high of $55 in February. It saw a dip thereon and is now hovering around the $48 range on Tuesday’s opening bell.

Also Read: Rigetti Computing Stock Call: Buy RGTI at $13, Sell at $16

The dip is merely considering the market crashes after Trump’s Liberation Day in early April. OKLO stock managed to hold its ground and has dipped only 10% from its yearly high. This is a much better performance as leading tech stocks are trading double-digits in the red in YTD. In this article, we will explain how high the energy-based equity could trade by the end of 2025.

Also Read: D-Wave Quantum Stock Rises 1,200% in a Year: Should You Buy?

OKLO Stock Forecasted to Rise Another 20%: See the Target

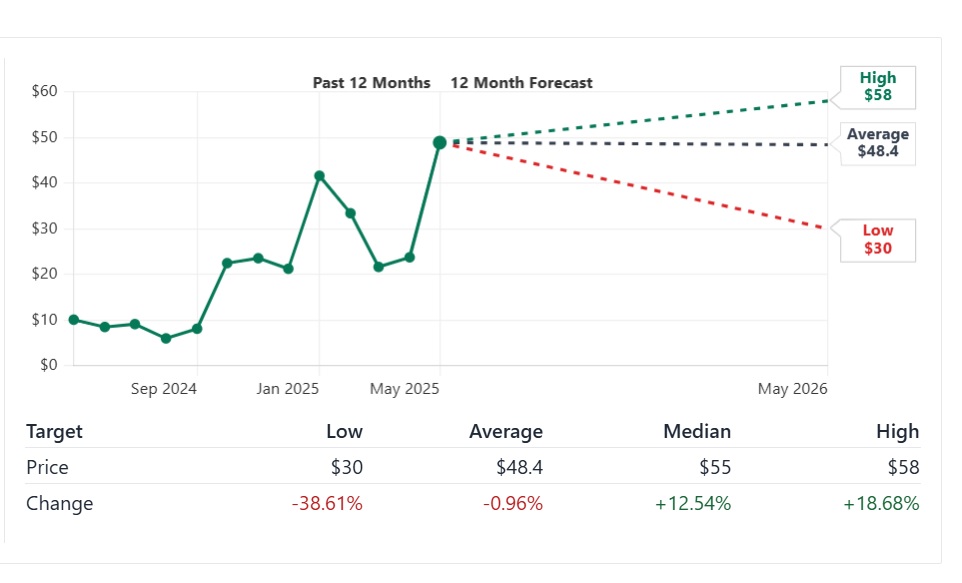

Leading equity prediction firm StockAnalysis has painted a bullish picture for the OKLO stock in 2025. According to the price prediction, the energy stock that deals in advanced fission power plants is set to surge by another 20% soon. This puts the equity in the must-buy category as it could deliver profits.

Also Read: US Crackdown Sparks Nvidia to Launch New AI Chips for China: Stock Set to Surge?

The analytical firm projects OKLO stock to reach a high of $58 in 2025, which is a surge of 20% from its current price. Therefore, an investment of $1,000 could turn into $1,200 if the forecast turns out to be accurate. That’s stellar returns as not every financial asset generates double-digit profits in a year.

“According to 5 professional analysts, the 12-month price target for OKLO Inc. stock ranges from a low of $30 to a high of $58. The average analyst price target of $48.4 forecasts a -0.96% decrease in the stock price over the next year,” read the prediction.