[#title_feedzy_rewrite]

![[#title_feedzy_rewrite]](https://postcryptocoins.com/wp-content/uploads/2025/05/intel-intl-stock-price-20-xOkDqt.jpg)

Intel Corporation stock (NASDAQ: INTC) opened Tuesday’s trading session at the $20.05 mark. It is now at its…

Intel Corporation stock (NASDAQ: INTC) opened Tuesday’s trading session at the $20.05 mark. It is now at its five-month low after slipping from a high of $27.40 in February and relatively held on at the $25 range in March. Since then INTL has only slipped in the charts and is unable to hold on to its resistance level.

The multiple crashes this year tipped INTL to the south never to quickly recover in the indices. This adds pressure on Inter stock’s performance as an upward tick is not on the horizon. Not just Intel Corporation, the majority of tech giants are in the red this year delivering only losses to investors.

Also Read: Daniel Ives: Buy Palantir (PLTR) After $795M US Army Deal

Buy Intel Stock Now: INTL Projected To Surge Double-Digits

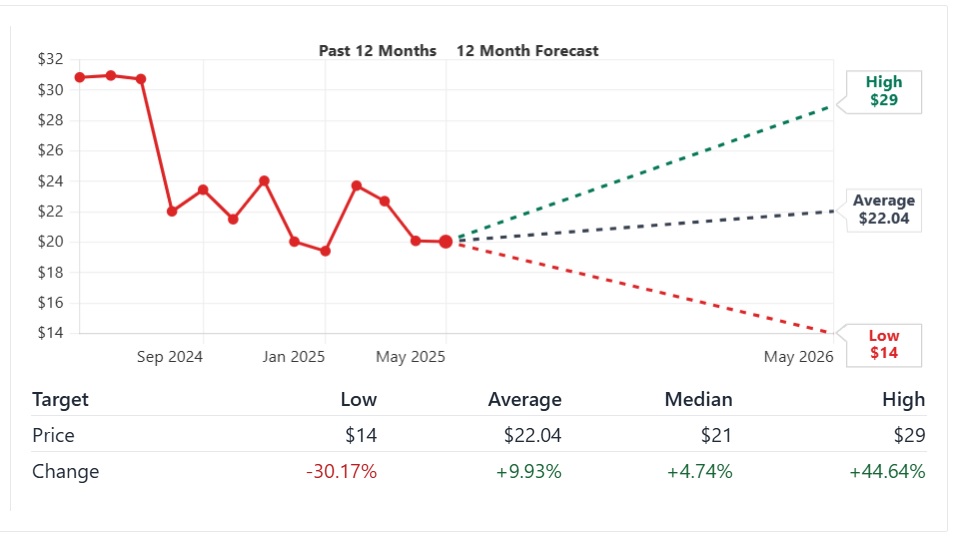

Top US equity prediction firm StockAnalysis has painted a bullish picture for Intel stock for the next 12 months. According to the price prediction, INTL could reach a high of $29 in the next 12 months in 2026 and remain on the greener side of the markets. That’s an increase of $9 per share from today and is a rewarding price rise.

Also Read: Rigetti Computing Stock Call: Buy RGTI at $13, Sell at $16

If the forecast turns out to be accurate, it would be an uptick and return on investment (ROI) of approximately 45%. That’s huge returns in a short timeframe as not every asset generates that much returns in a year. Therefore, taking an entry position now in Intel stock could be beneficial for traders with a one-year investment horizon.

“According to 24 professional analysts, the 12-month price target for Intel stock ranges from a low of $14 to a high of $29,” read the forecast. On the contrary, the prediction estimates that INTL could fall to $14 if the US markets enter bearish territory. It is advised to take caution before going all-in on INTL as the downside threat is more alarming.