[#title_feedzy_rewrite]

![[#title_feedzy_rewrite]](https://postcryptocoins.com/wp-content/uploads/2025/05/Bitcoin_rises_as_US_China_trade_talks_spark_bullish_crypto_bets-CcTqmE.jpg)

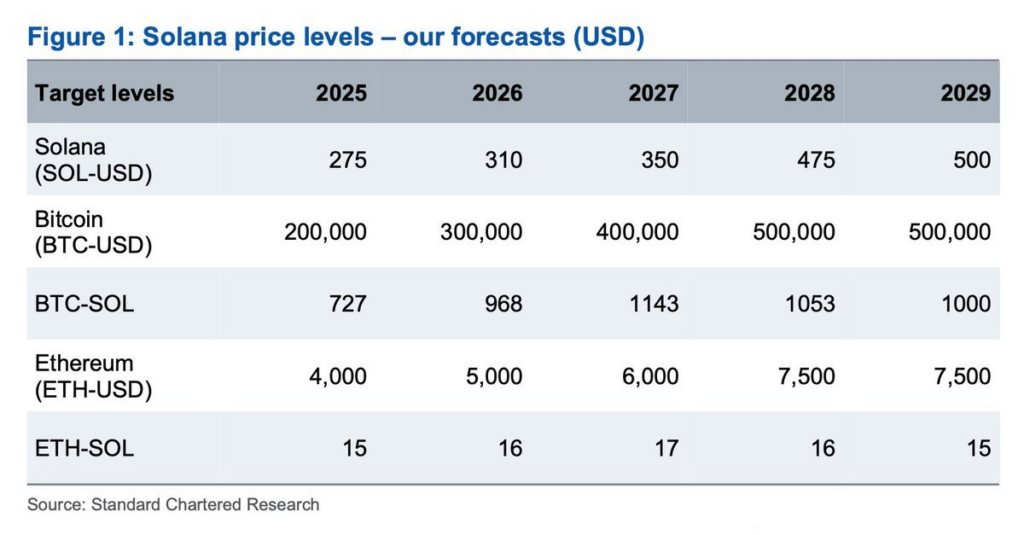

Standard Chartered has released a comprehensive five-year cryptocurrency forecast predicting Bitcoin will reach $200,000 by the end of 2025, significantly outperforming both Ethereum and Solana. The study, which was released on May 27, comes as Bitcoin has just dropped from its all-time high of almost $111,000 and is now consolidating

- Standard Chartered predicts BTC to hiy $200,000 by 2025 end.

- Bitcoin projected to peak at $500,000 by 2028-2029 timeframe.

- Ethereum and Solana expected to show steady but slower growth rates.

Standard Chartered has released a comprehensive five-year cryptocurrency forecast predicting Bitcoin will reach $200,000 by the end of 2025, significantly outperforming both Ethereum and Solana. The study, which was released on May 27, comes as Bitcoin has just dropped from its all-time high of almost $111,000 and is now consolidating around $109,000.

Bitcoin’s price trajectory until 2029 is predicted by the bank; it is anticipated to reach $300,000 in 2026, $400,000 in 2027, and a peak of $500,000 by 2028. It is anticipated that this $500,000 level will hold steady until 2029, demonstrating faith in Bitcoin’s long-term value proposition.

Bitcoin would have to increase by about 82% from its present price to hit the $200,000 mark. At this price point, Bitcoin’s market capitalization would approach $3.82 trillion, assuming the circulating supply remains relatively stable.

Institutional interest drives optimistic Bitcoin outlook

Geoffrey Kendrick, head of digital assets at Standard Chartered, has reiterated a long-term outlook suggesting Bitcoin could reach $500,000 by 2028. This projection is backed by recent SEC 13F filings, which indicate ongoing interest from institutional investors.

While some entities, such as the State of Wisconsin Investment Board, have reduced their exposure—exiting positions in the BlackRock iShares Bitcoin Trust during the first quarter of 2025—overall institutional involvement in Bitcoin remains active.

Due to increased government term premiums, a strategic shift away from U.S. equities to Bitcoin, and whale accumulation habits, Kendrick has raised his Q2 2025 Bitcoin projection to $120,000 by mid-2025.This mid-year target serves as a stepping stone toward the $200,000 year-end projection.

The analyst emphasized that institutional interest remains robust despite temporary ETF position adjustments, with Q1 2025 filings showing continued accumulation by major institutional investors.

According to Standard Chartered’s forecasts, Ethereum’s growth trajectory is more modest than Bitcoin’s. By the end of 2025, ETH should be worth $4,000. It will then rise to $5,000 in 2026, $6,000 in 2027, and $7,500 in 2028, and it will remain at this level until 2029.

Solana’s forecast shows even more measured growth, starting at $275 in 2025 and climbing to $310 in 2026 and $350 in 2027.

These projections suggest BTC will significantly outperform major altcoins over the next four years, potentially driven by its position as the primary store of value and inflation hedge in the digital asset ecosystem.