[#title_feedzy_rewrite]

As we approach mid-2025, a confluence of macroeconomic indicators, institutional involvement, and technical signals is stirring optimism among market observers. Could we be on the cusp of the next significant crypto uptrend?

Macroeconomic Factors Shaping Market Sentiment

One of the crucial drivers behind the possible shift to an upward trend is the evolving macroeconomic landscape. Recent signals from the United States Federal Reserve suggest a potential pause or reduction in interest rates, aiming to stabilize an economy grappling with high inflation and volatile growth patterns.

Lower interest rates traditionally incentivize investors to seek higher-risk assets, including cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH), pushing liquidity into these markets.

Further amplifying positive sentiment is the shift in regulatory attitudes globally. Notably, regulatory clarity in major economies such as the United States and Europe has gradually improved.

Recent developments, such as clearer crypto asset guidelines by the U.S. Securities and Exchange Commission (SEC) and the EU’s Markets in Crypto-assets (MiCA) framework implementation, provide stronger foundations for institutional capital inflows, reducing uncertainty and fostering confidence among retail investors.

Institutional Interest: A Catalyst for Uptrend

Institutional investment has repeatedly proven to be a significant indicator of impending market trends. The first half of 2025 has seen substantial institutional interest growth, characterized by increased investments from asset management giants like BlackRock, Fidelity, and Vanguard.

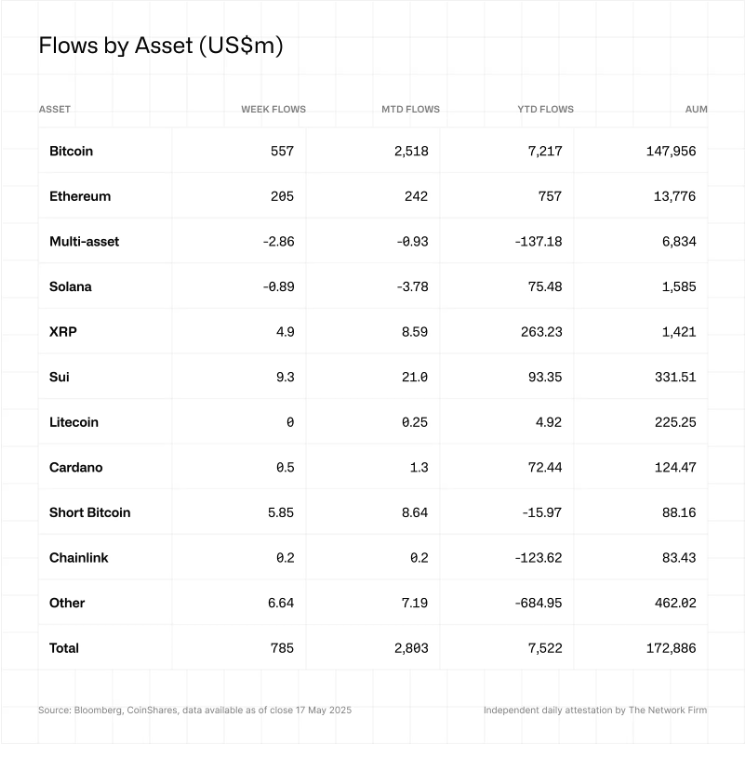

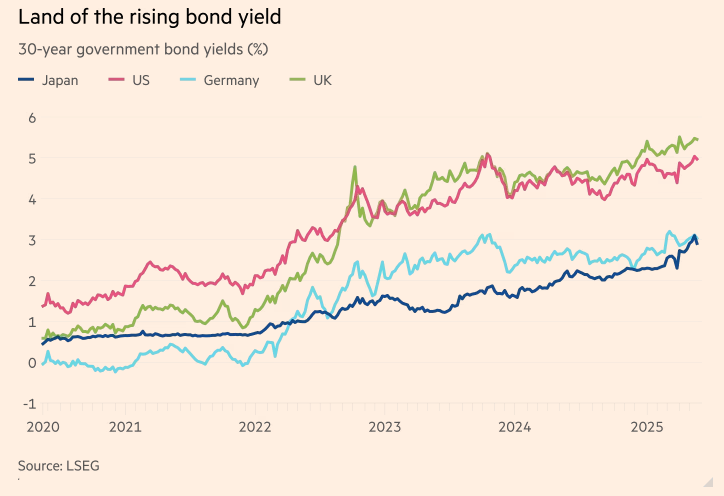

Recent data from CoinShares indicates institutional crypto products have attracted inflows of over $4 billion in the first half of 2025 alone, reflecting confidence in the long-term viability of cryptocurrencies as hedging instruments and strategic portfolio assets.

Source: CoinShares

Additionally, the approval of several Bitcoin spot exchange-traded funds (ETFs) globally has boosted market confidence. In the United States, the long-awaited approval of the Bitcoin spot ETF by prominent financial institutions, including BlackRock and Fidelity, marks a critical inflection point.

Following the approval, assets under management (AUM) in these ETFs quickly surpassed $10 billion within the initial month, underscoring strong institutional demand. The ETF launch has significantly reduced the barriers to entry for traditional investors, providing direct, regulated exposure to Bitcoin’s price movements, thereby expanding potential market participation significantly.

Money is Quietly Returning – But Not Everyone Sees It

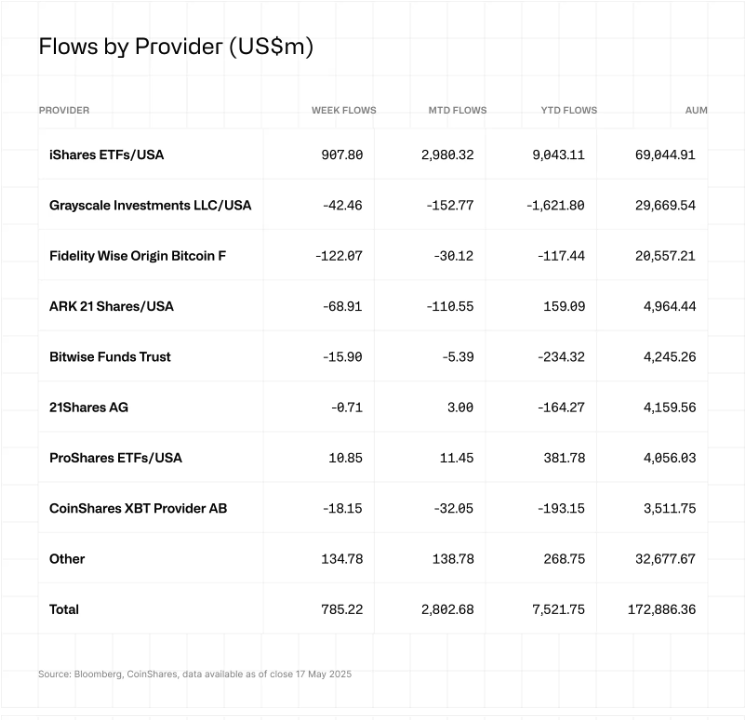

Interestingly, despite ongoing cautious rhetoric from the Fed regarding monetary easing, subtle signals indicate that liquidity is quietly returning to global markets. In the U.S., the Treasury General Account (TGA) has seen over $500 billion flow back into commercial banks, a consequence of Treasury spending during the debt ceiling negotiations.

This indirect liquidity injection, even without explicit quantitative easing (QE), has significantly boosted market liquidity.

Source: MacroMicro

China has also stealthily boosted liquidity by reducing reserve requirement ratios, expanding corporate credit lines, and subtly devaluing the Yuan against gold.

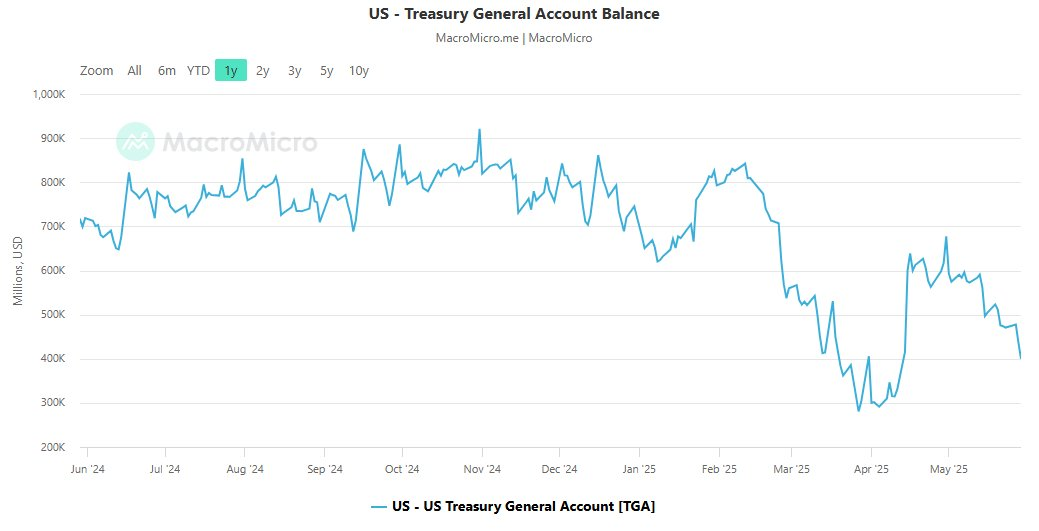

Similarly, Europe and Japan, constrained by rising bond yields, have quietly intervened in bond and currency markets through repo operations and bond repurchases, indirectly restoring market liquidity.

Source: LSEG

According to Michael Howell, CEO of Crossborder Capital, this shift is structural rather than cyclical, pointing towards sustained liquidity flows. Historical patterns indicate such liquidity initially targets lower-risk assets like Bitcoin, before eventually trickling down into higher-risk altcoins, repeating patterns from previous market cycles.

Market Sentiment and Investor Confidence

Investor sentiment often serves as a valuable precursor to trend reversals or continuations. Recent data from blockchain analytics platforms such as Glassnode and Santiment have highlighted a significant uptick in accumulation behaviors by whales and institutional addresses, particularly noticeable in Bitcoin and Ethereum holdings.

Large investors accumulating during periods of price stabilization suggest increasing confidence in potential upside movements.

Source: Glassnode

However, market sentiment remains mixed. While bullish signals are evident, caution persists among retail investors due to recent volatility and historical precedence of rapid reversals.

Social sentiment indicators illustrate growing but cautious optimism, suggesting that retail investors await more decisive bullish confirmations before committing further capital.

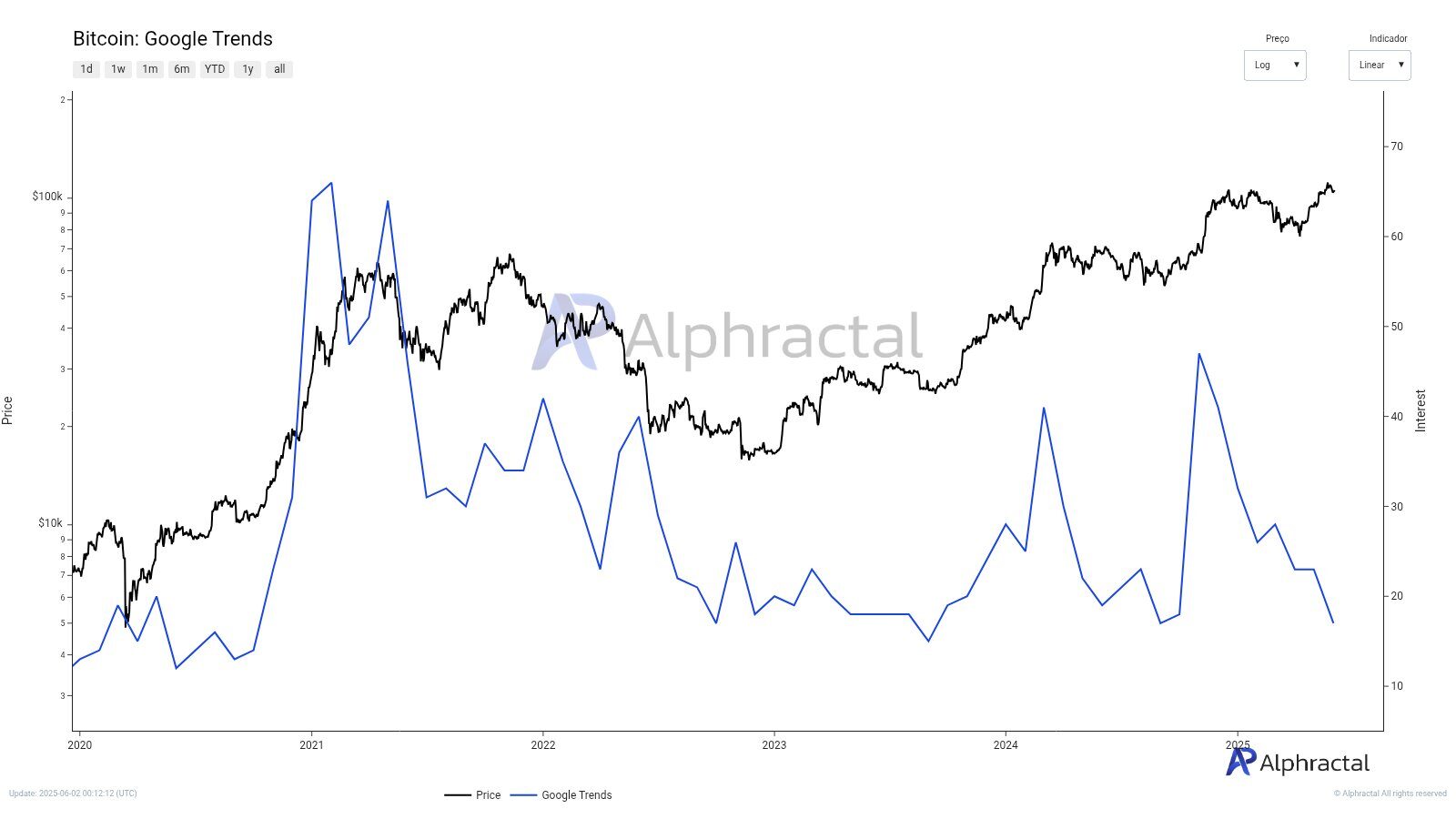

Interestingly, recent data from Google Trends provides additional insights into current market engagement levels. Google searches for Bitcoin have dropped to 17 points – levels observed previously when Bitcoin traded at $54,000 (September 2024) and $26,000 (August 2023).

Source: Alphractal

This matches interest levels from the market bottom in late 2022, despite Bitcoin currently trading above $100,000. The relatively low public search interest indicates a lack of sufficient engagement and implies the market may need significant volatility in the coming weeks to reignite widespread investor curiosity and interest.

Conclusion

Considering the current blend of macroeconomic factors, growing institutional adoption, technical indicators, and measured investor sentiment, there is compelling evidence supporting the potential onset of a cryptocurrency market uptrend. However, prudence remains advisable given historical market volatility and persistent external risks.

Investors are encouraged to closely monitor key indicators, such as regulatory developments, institutional investment flows, and technical support and resistance levels, to make informed decisions. While optimism is warranted, comprehensive risk assessment remains critical to navigating the complexities of crypto market cycles effectively.

Read more: Trading with Free Crypto Signals in Evening Trader Channel

The post Is the Uptrend Coming Soon? appeared first on NFT Evening.