[#title_feedzy_rewrite]

TAO enters June 2025 trading around $410–$420, reflecting steady interest amid broader consolidation. With new subnets launching and institutional backing growing, Bittensor’s momentum remains intact—setting the stage for a decisive move this month.

Current State of Bittensor

As of early June 2025, Bittensor is experiencing a phase of robust development, both in terms of technical infrastructure and community adoption. Having moved beyond its initial closed testing phase, the project is now actively expanding its ecosystem. New subnets are being launched at a steady pace, and practical use cases are becoming increasingly evident.

After more than a year of significant growth, TAO – the native token of the Bittensor network, is currently trading in the range of $410 to $420. While this represents a decline of roughly 45% from its all-time high recorded in April 2024, it is still over 13 times higher than the lows seen in mid-2023.

Daily trading volume remains consistently above $100 million, indicating strong market liquidity and sustained investor interest. With a market capitalization exceeding $3.6 billion, TAO is now positioned among the leading tokens in the AI and DePIN infrastructure sectors.

Source: CoinGecko

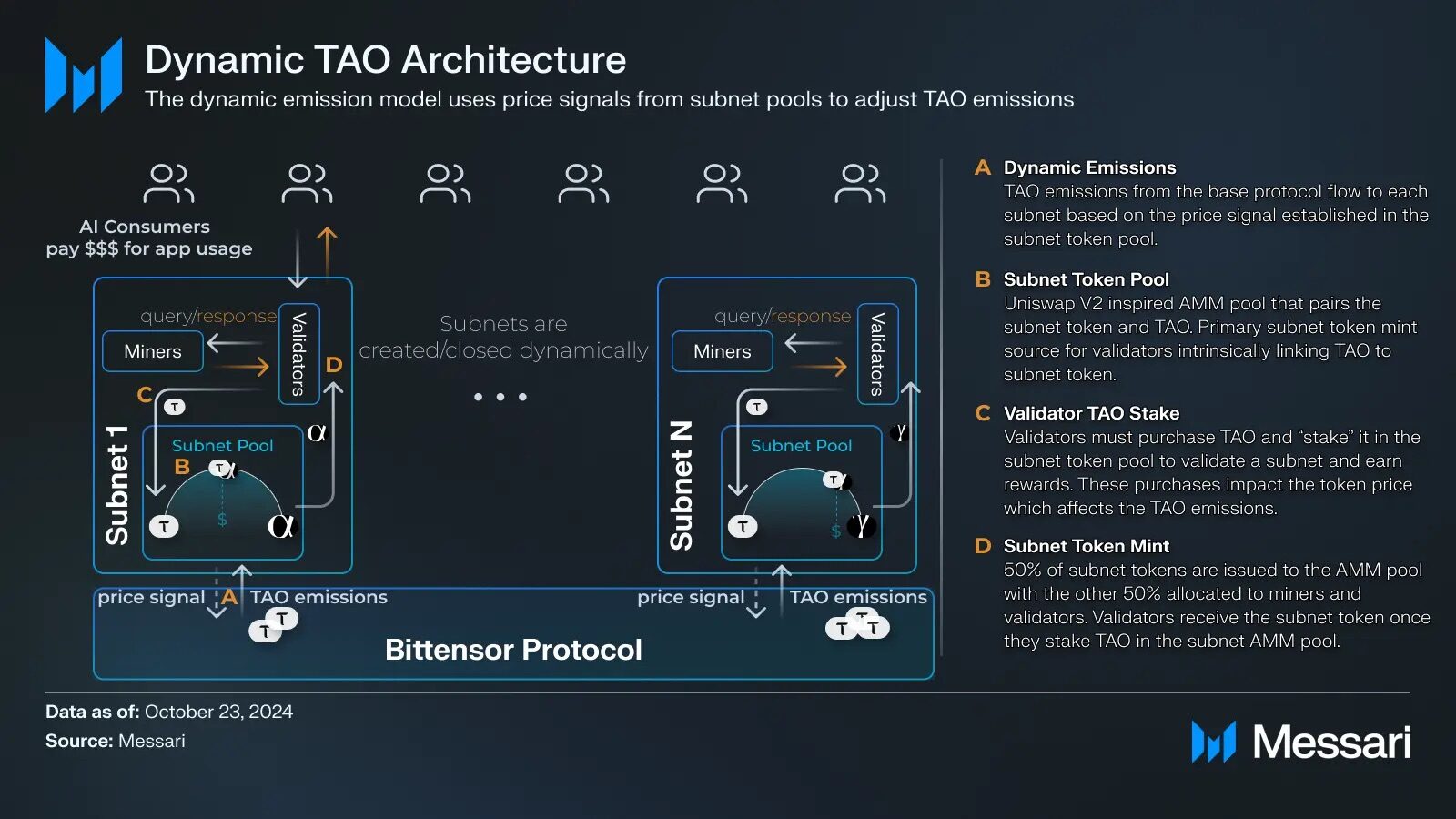

On the technical front, Bittensor has officially implemented its Dynamic TAO (dTAO) mechanism – a major milestone in decentralized incentive modeling. Under this new structure, AI subnets within the Bittensor ecosystem can now issue their own sub-tokens (Alpha Tokens) and receive rewards based on their actual contributions as determined by market demand.

This approach marks a fundamental shift in TAO distribution, fostering competition among subnets while removing the intermediary role of validators.

Source: Messari

Several high-profile subnets have already gone live, including NATIX StreetVision (focused on image data for mapping and autonomous vehicles), Vidaio (AI-driven video quality enhancement), and Nova (leveraging AI for medical and pharmaceutical research).

These subnets not only expand TAO’s utility landscape but also bring greater diversity to the network’s staking dynamics and reward distribution mechanisms. Together, these developments underscore Bittensor’s transition into a more mature and versatile infrastructure layer for decentralized AI applications.

Read more: Trading with Free Crypto Signals in Evening Trader Channel

Bittensor Ecosystem

Bittensor’s ecosystem has seen rapid evolution over the past year, marked by critical infrastructure upgrades and a growing roster of AI-specialized subnets. These advancements have positioned Bittensor as a leading decentralized AI network that combines open market dynamics with blockchain-native incentives.

EVM Compatibility Integration

Since October 2024, Bittensor has supported an EVM-compatible layer. Developers can run Ethereum smart contracts on its subtensor chain without changing the code. This feature expands Bittensor’s development potential. It lets Ethereum projects easily connect to its decentralized AI environment.

Child Hotkeys Mechanism

In August 2024, Bittensor launched “Child Hotkeys.” This system lets a parent key delegate staked TAO to child keys. This setup enhances network security and operational flexibility. Even if a child hotkey is compromised, the parent and other children remain unaffected. This innovation helps minimize risk in network staking and supports a more decentralized validator landscape.

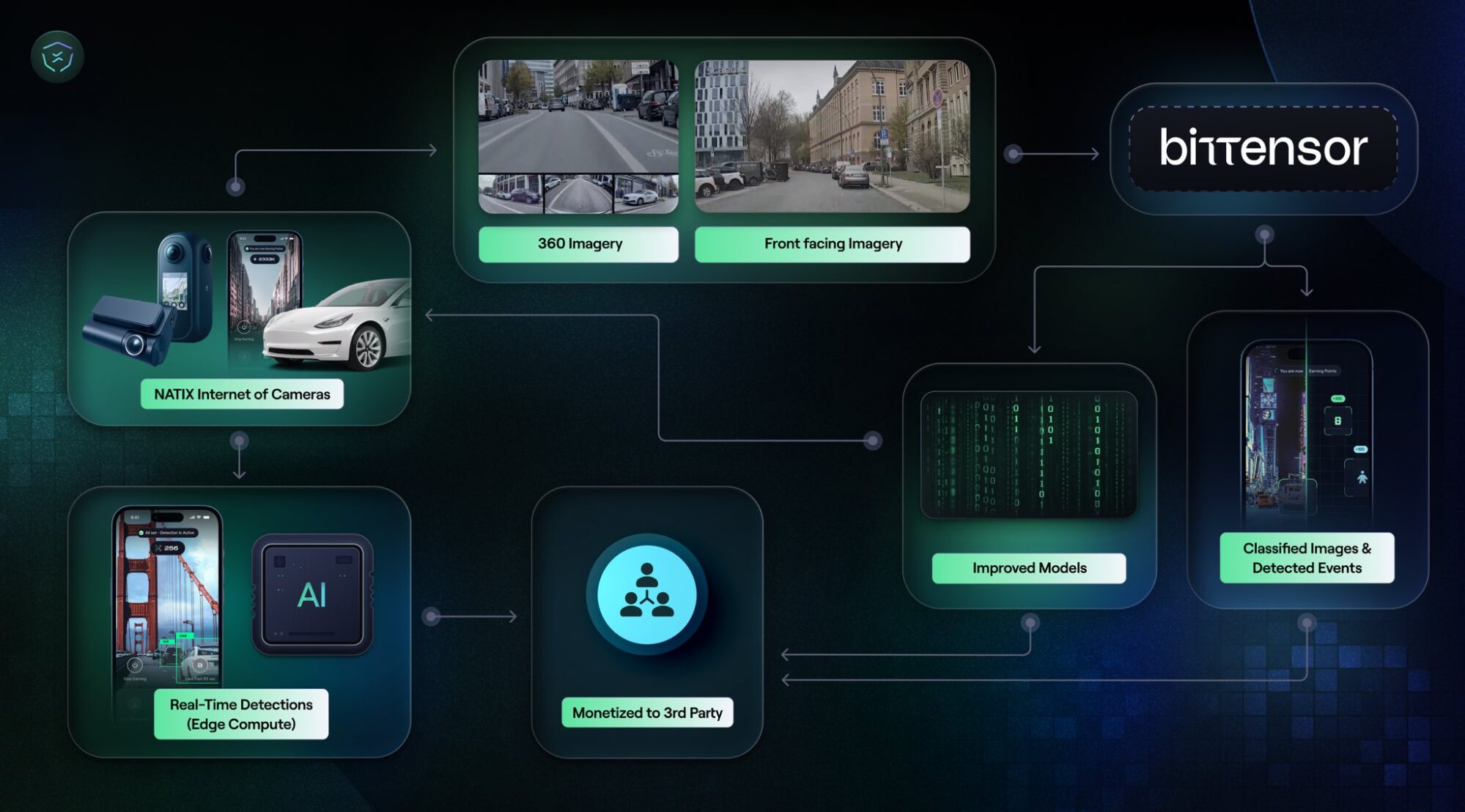

Bittensor’s ecosystem runs on subnets. Each subnet focuses on a specific AI task and can issue its own Alpha Token. For example, NATIX StreetVision (Subnet 72) recently launched to process real-world image data for mapping and autonomous driving use cases.

Source: Messari

Technically backed by Yuma, a firm under Digital Currency Group (DCG), the subnet highlights strategic alignment with major industry stakeholders.

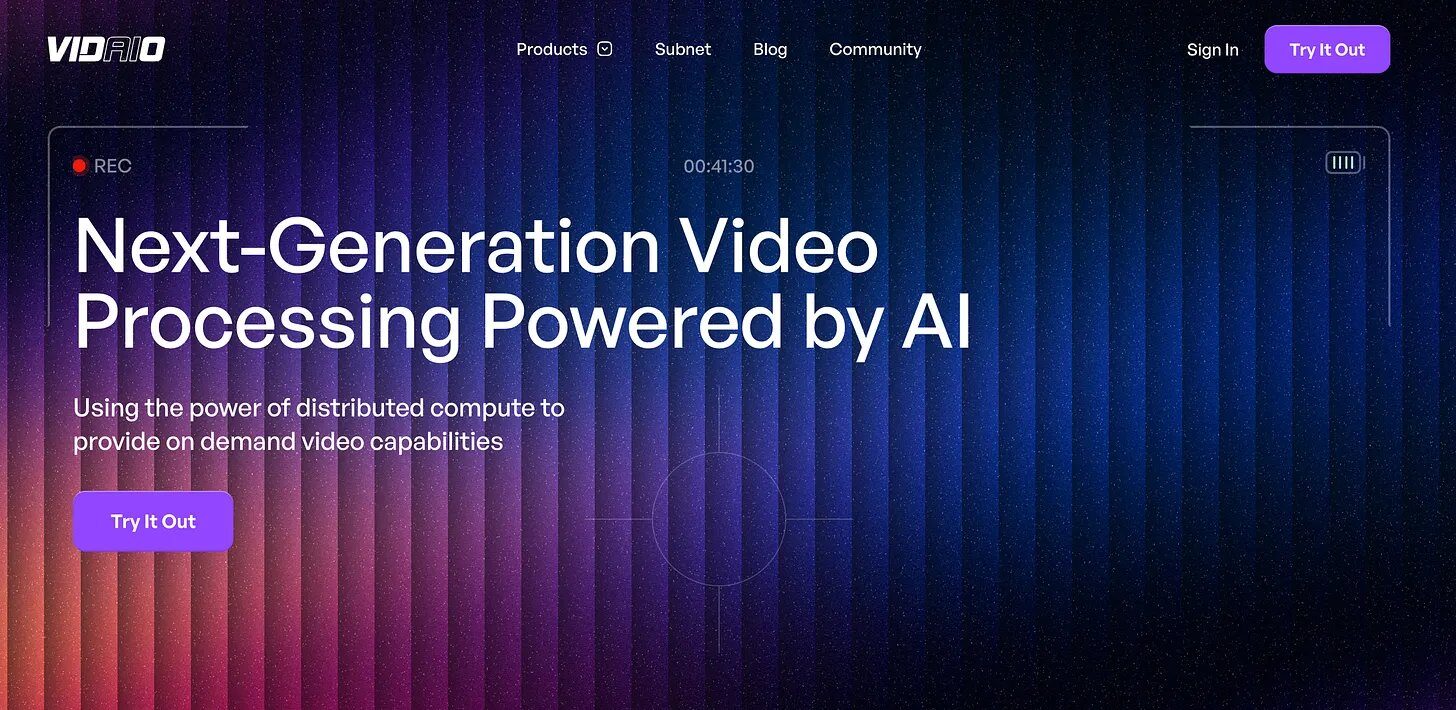

Similarly, Vidaio (Subnet 85) has gone live as a decentralized AI service focused on video enhancement and real-time media processing. Other emerging subnets, such as Nova (Subnet 68), are developing AI models for pharmaceutical research. More specialized AI subnets make Bittensor more useful in real life. They also attract developers to build on its AI infrastructure.

In March 2025, Bittensor achieved a significant milestone on the institutional front. Copper, a Swiss custody service, now supports TAO storage and staking through its secure MPC platform.

This move lets institutional investors securely store and stake TAO. It offers tools and confidence for professional market participation.

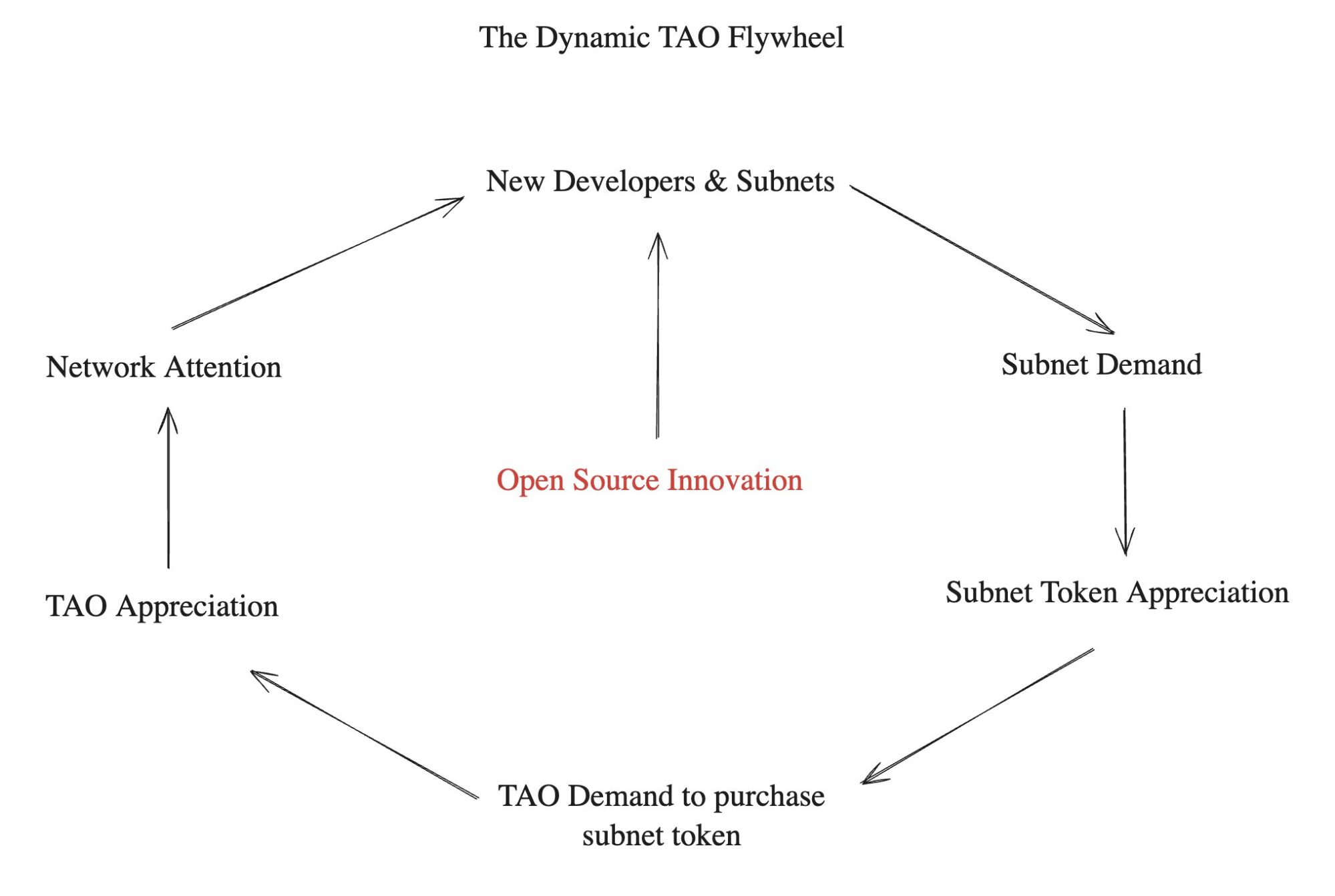

The introduction of Dynamic TAO (dTAO) on February 13, 2025, marked a transformative upgrade to Bittensor’s tokenomics. Under this model, each subnet issues its own Alpha Token and competes for TAO rewards through open market mechanisms. Subnets that deliver strong performance and attract greater user demand earn more TAO, creating a positive feedback loop.

For example, when Subnet A gains traction, its Alpha Token rises. This boosts TAO-to-Alpha rewards for its operators. This incentive pushes subnet developers to build better AI services. Validators and miners tend to join the most profitable subnets.. Poor-performing subnets are gradually phased out due to a lack of demand and reward allocation.

In essence, dTAO decentralizes reward distribution away from a fixed validator set and towards a market-driven “vote-by-capital” system. This ensures that capital allocation reflects real utility, pushing Bittensor toward a more meritocratic and decentralized reward structure.

Bittensor now features expanding AI subnets and Ethereum compatibility. It also offers better staking and institutional-grade integrations. The network is becoming a full-stack decentralized AI platform.

Recent tokenomic upgrades improve economic efficiency. They align long-term incentives between developers, operators, and stakeholders. This positions Bittensor as key AI-blockchain infrastructure.

Technical Analysis of TAO

As of early June 2025, TAO is currently consolidating within a sideways trading range between $389.3 and $490. This phase of market indecision follows a period of retracement from its previous highs and reflects a broader wait-and-see sentiment among traders. Within this consolidation zone, a minor support level around $435 has emerged, providing a temporary anchor for short-term strategies.

Scenario 1: Bullish Breakout Above $490

If the price successfully breaks above the upper boundary of the current range at $490, the next key resistance zone is located around $565. Given the recent pattern of price behavior, it is likely that TAO could enter a new consolidation phase between $490 and $565 before any decisive move occurs. A daily candle close (D1) above $565 would serve as a strong bullish signal, confirming market strength and potentially paving the way for a sustained rally toward the next resistance at $713.

This bullish continuation would reflect renewed confidence in the asset, potentially triggered by fundamental catalysts such as subnet expansion or new institutional integrations. Traders looking to go long should watch for confirmation via volume and candle structure above $565 before committing to extended targets.

Scenario 2: Bearish Breakdown Below $389.3

Conversely, a breakdown below the $389.3 support line would signal a bearish reversal, with the first key target being $356.4. Should the selling pressure persist, TAO could revisit lower support levels at $317.1, $272.3, and $230.2 – all of which represent critical demand zones established during its previous accumulation cycle.

The $272.3–$230.2 range, in particular, represents a strong support cluster and will likely attract buying interest, especially from long-term spot investors. This zone marks the base of the last major rally and could act as a springboard for a new upward move if defended successfully. It’s a strategic area for accumulation by medium to long-term holders who believe in the project’s fundamentals.

Short sellers may look for a backtest of the broken $389.3 level – a common setup for confirming a breakdown, before targeting the aforementioned support zones.

TAO Price Prediction: Short-term Outlook

If TAO breaks and holds above the critical resistance zone at $450–$472, the bullish trend will likely continue. In that case, the price could advance toward the $500–$550 range in the short term.

A series of positive developments could drive this upward momentum, such as new product launches on the Bittensor network, growing institutional confidence—shown by Copper’s support for TAO staking—and a broader recovery in the cryptocurrency market.

If these conditions occur, $600 will act as the next major resistance. It sits near TAO’s all-time high from April 2024.

Investors should closely monitor key fundamentals, including ongoing network upgrades and the strong liquidity profile that currently supports TAO. If no major volatility or bad news appears, TAO may keep consolidating near current levels. A clearer move may come later.

The post TAO Price Prediction in June 2025 appeared first on NFT Evening.