[#title_feedzy_rewrite]

Ethereum enters June 2025 in the midst of a renewed rally after months of underperformance. Following a rough start to the year, ETH spiked ~45% in late May, outpacing both Bitcoin and the broader DeFi market.

This article will analyze all the factors to forecast Ethereum’s price trajectory through June 2025.

Fundamental: Upgrades, Staking and Tokenomics

The most important upcoming milestone is the “Pectra” hard fork – combining Prague and Electra. Scheduled for mid-March 2025, Pectra will double Layer-2 blob space, introduce account abstraction (letting users pay gas fees in stablecoins like USDC), and raise the validator staking limit from 32 ETH to 2,048 ETH.

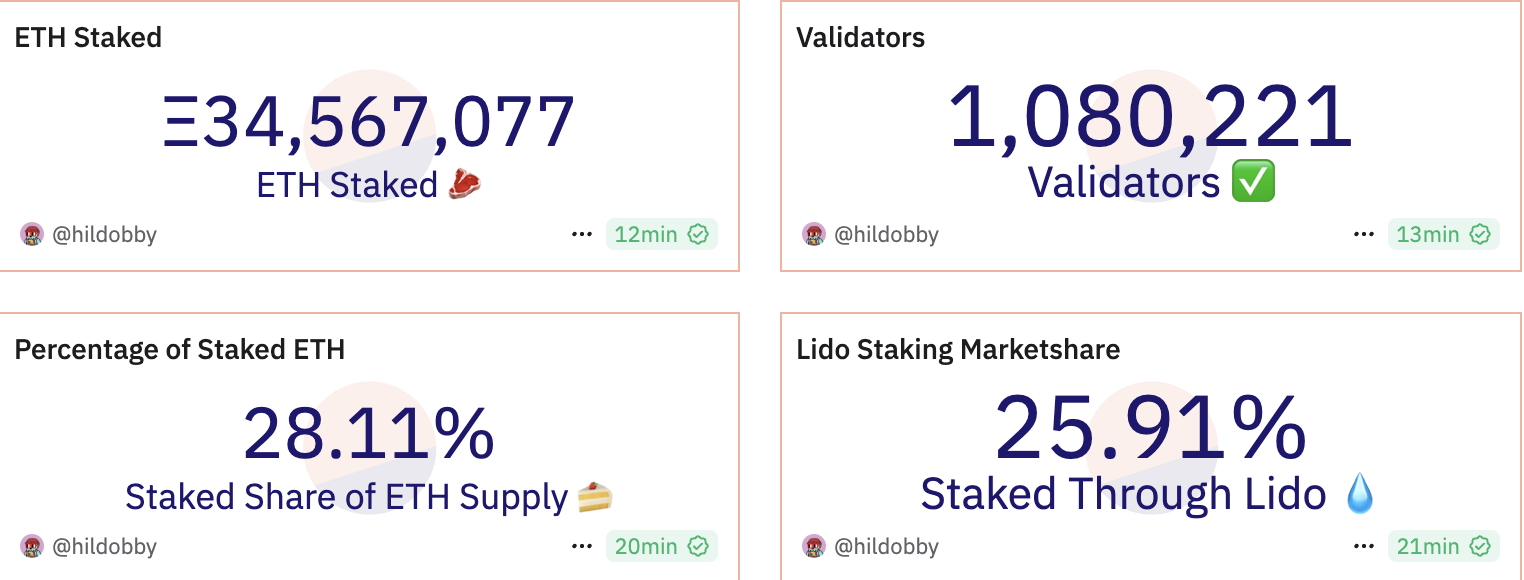

Ethereum’s staking ecosystem is robust. Over 27% of all eligible ETH is staked on PoS (versus ~2% for BTC), and staking yields around 3–4% per year. Major liquid-staking protocols like Lido now have ~$22.6 billion TVL (albeit down ~20% in recent weeks).

Source: Dune

More staking means fewer ETH supply on exchanges, giving Ether a scarcity boost.

In practical terms, these changes mean Ethereum can process many more L2 transactions per block, helping to sharply reduce gas fees, and make staking more efficient for large holders. Phase 2 of Pectra will add even more enhancements like Verkle trees for data efficiency, further boosting throughput.

Perhaps most crucial is the post-Merge tokenomics: with PoS issuance greatly reduced and transaction fees burned under EIP-1559, Ethereum’s net issuance is now often negative. In fact, since the 2022 Merge, about 170,000 ETH have been removed from circulation, giving ETH an annualized deflation of roughly –0.22%.

Source: Ultrasound money

Currently about 120 million ETH exist, with roughly 18.9 million (≈15.7%) locked in the ETH2 deposit contract.

With more ETH staked than ever before, and new supply continually offset by burns, Ethereum has effectively turned deflationary when network usage is high. This supply squeeze – combined with growing demand from DeFi users – underpins a positive outlook: lower net issuance amid rising usage could push prices upward over time.

Read more: Trading with Free Crypto Signals in Evening Trader Channel

Ethereum Ecosystem: DeFi, NFTs, and dApps

As of June 2025, it hosts over 1,300 DeFi protocols, with an aggregate TVL of about $46.3 billion. This dwarfs its nearest rivals (Solana $7.2B, BNB Chain $5.5B). Even as activity shifts to L2s, DeFi stack is robust: L2s like Arbitrum also host many Ethereum-native DeFi apps, and cross-chain bridges mean value locked on L2s still reflects Ethereum’s ecosystem.

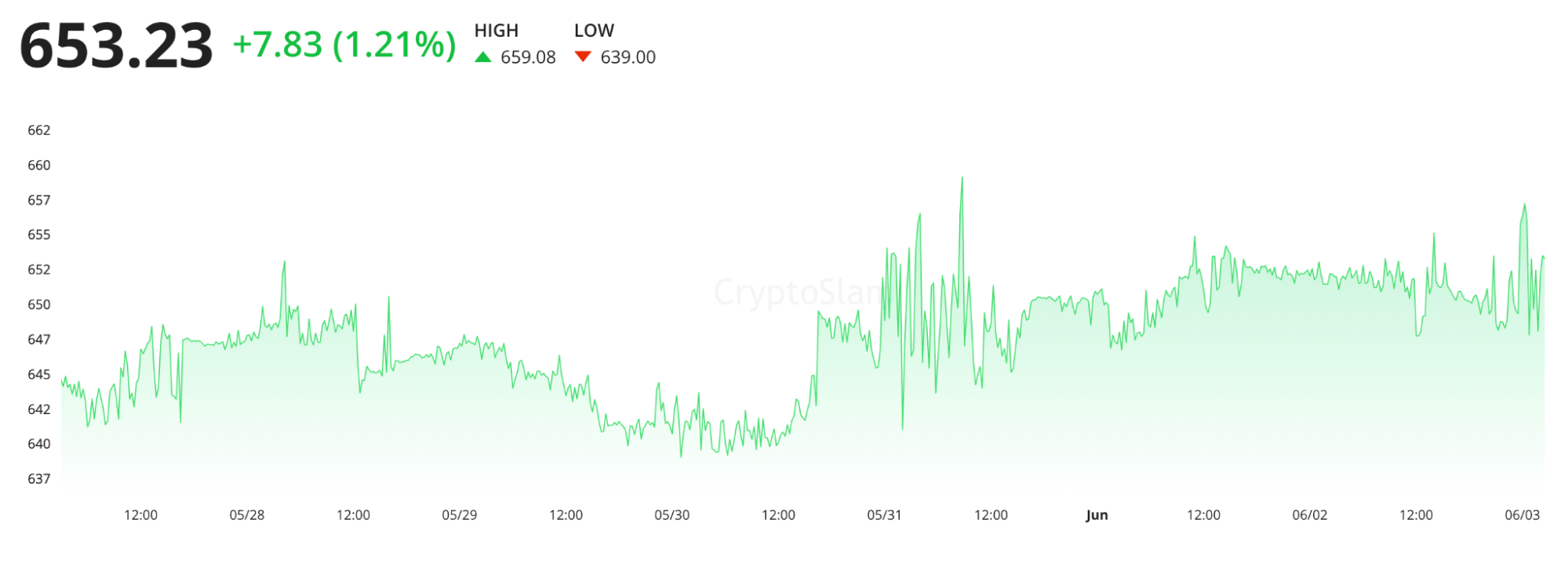

NFTs continue to be a key part of Ethereum’s ecosystem. After the 2021-22 hype and subsequent cooldown, the NFT market is stabilizing with renewed utility focus. Ethereum retains the lion’s share of NFT volume: data from CryptoSlam shows that in late May 2025 Ethereum NFTs accounted for ~$36.5M in weekly sales, up ~28% week-over-week and far above other chains.

Source: CryptoSlam

However, NFT trading remains relatively muted, meaning this segment is still re-emerging rather than booming. Nevertheless, any broader revival in NFTs or Web3 gaming would likely benefit Ethereum significantly, since most projects in these areas settle on ETH.

In summary, Ethereum’s fundamentals and ecosystem remain strong. It hosts the vast majority of DeFi value and NFTs, is advancing its core protocol with upgrades like Pectra and EIP-4844, and is backed by a large base of staked ETH that reduces inflation.

These positive drivers must be weighed against competition (other blockchains) and technical risks, but on balance Ethereum’s growth story looks intact as we enter mid-2025.

Market Trends and Macro Factors

Spot ETH ETFs are at the forefront. After US regulators approved multiple ETH ETFs in mid-2024. May 2025 saw a record $564 million of cumulative ETF inflows, and they continued into June. As of June 3, overall ETH ETF assets stand around $9.37 billion (roughly 3.06% of ETH’s market cap).

Market sentiment remains risk-on. June 2025 has seen tech stocks and crypto move broadly in tandem: for example, Nasdaq’s slight gains and Bitcoin’s rise to ~$69k have positively correlated with ETH’s rebound.

With inflation cooling, the Fed has held rates steady (4.25–4.50%) in recent meetings, signaling a possible pivot to rate cuts later in 2025. Lower interest rates would likely boost crypto again, since “generally, lower rates mean higher prices for cryptocurrencies”.

Source: CME Group

Historically Ethereum often sees renewed activity in the latter half of the year. On-chain metrics are already bullish: network active addresses and transaction counts have ticked up with the market rebound. Overall, the market is leaning bullish into June but traders will remain cautious around macro events that could trigger volatility.

Institutional Views & Regulation

In May 2025, newly-installed SEC Chair Paul Atkins announced plans to issue clearer guidance on which crypto tokens are considered securities, and even suggested allowing registered brokers to trade “non-securities, such as bitcoin or ether” on alternative trading systems.

This marks a significant departure from the prior SEC stance.

SEC Chair Paul Atkins

Such developments reduce policy uncertainty: if Ethereum (ether) is explicitly deemed a commodity rather than a security, it could further legitimize ETH markets. Moreover, global regulations (Europe’s MiCA, Asia’s evolving rules) remain a mixed bag, but institutional interest in ETH appears largely undeterred.

For example, Circle is preparing for a US IPO at a high valuation, reflecting confidence in crypto infrastructure.

Some nations (China, India) maintain strict crypto bans, which limit demand, but others are exploring blockchain technology (CBDCs, tokenized assets). Ethereum’s strong support for private and permissioned variants (e.g. Quorum, Polygon Edge) means it often plays a role in enterprise and central bank experiments, even outside pure crypto speculation.

In short, while regulation could introduce short-term volatility, the current news flow around ETH in mid-2025 is mostly positive to neutral, especially compared to 2022-23.

On the institutional side, research from banks and asset managers highlights ETH’s strong fundamentals and the inflationary mathematics favoring a higher price if demand holds. For example, Bloomberg analysts have noted the potential for ETH staking and revenue models to support prices soon.

Technical Analysis – Ethereum Price Structure

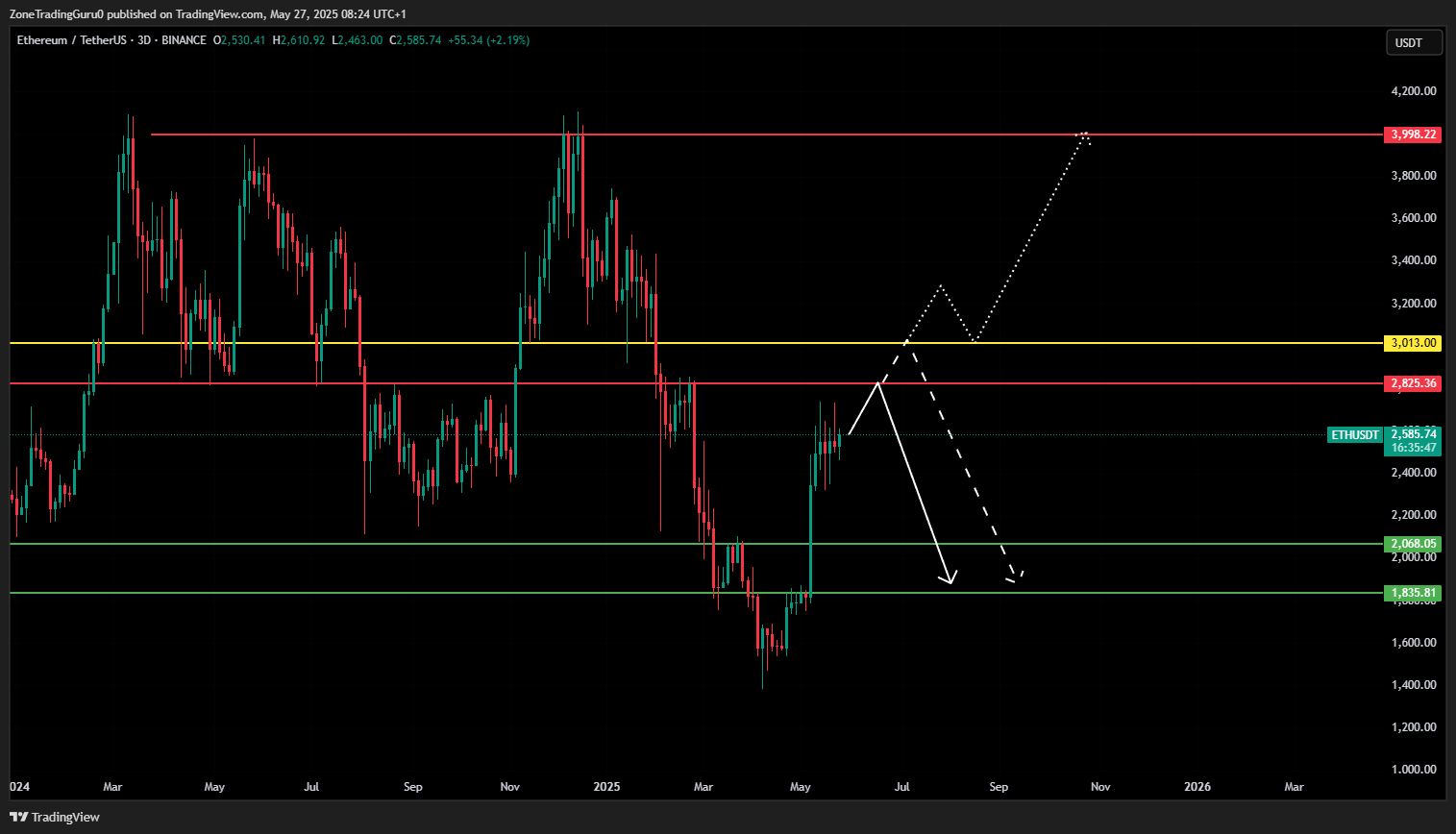

Ethereum has now recorded six consecutive weekly green candles without any notable pullback, a pattern that often precedes sharp corrections in the crypto market. Such uninterrupted upward momentum can be structurally unsustainable, particularly when not supported by significant consolidation or volume expansion. This suggests investors should be prepared for potential downside volatility in the near term.

Currently, ETH is facing two major resistance levels: the first around $2,825.36, and the second – a more critical threshold – at $3,013. This $3,013 zone is identified as the key breakout level that could define whether Ethereum’s bullish momentum continues or fades.

Analysts are currently watching two main scenarios:

- Scenario 1: Bull Trap Near $3,013

Ethereum may initially push toward the $2,825.36 resistance zone, potentially sweeping liquidity with a sharp wick up to the $3,013 region. However, if no daily candle successfully closes above $3,013, this would signal a failed breakout attempt. In such a case, the price could reverse direction sharply, potentially triggering a broader correction that sees ETH retracing toward the $2,000 area.

- Scenario 2: Bullish Continuation Above $3,013

Should Ethereum manage to close a daily candle convincingly above the $3,013 resistance, it would signal a confirmed bullish breakout. In this case, traders could look for a retest of the $3,013 level as support, offering a potential long entry zone. If validated, the next technical target would be the previous cycle high near $4,000, marking a continuation of the uptrend.

These levels and scenarios offer key guidance for short-term traders and investors evaluating ETH’s price action amid rising ETF-driven optimism. As always, risk management remains crucial, especially in a market known for sudden reversals and liquidity hunts.

Short-Term for Ethereum Price Prediction: June 2025

In the short term, Ethereum’s price trajectory for June 2025 appears cautiously optimistic, supported primarily by sustained ETF inflows and a relatively stable macroeconomic backdrop. If these favorable conditions persist, ETH could retest the mid-to-high $2,800 range, with a potential breakout pushing it briefly above the psychological $3,000 mark.

The most influential driver remains the flow of capital into Ethereum spot ETFs. Since their approval earlier this year, these financial instruments have attracted consistent institutional interest, providing a strong underlying bid for ETH. As long as these inflows remain net positive and steady, they offer a reliable source of demand that can counterbalance selling pressure from profit-taking or broader market risk-off sentiment.

Beyond ETF flows, the overall market maintains a positive sentiment toward Ethereum, largely because investors anticipate upcoming network upgrades that aim to improve scalability and validator efficiency. This forward-looking optimism helps sustain price momentum, even in the absence of explosive news.

In summary, Ethereum will likely trade with a mild upward bias throughout June, as long as ETF demand remains strong and macro conditions—such as interest rates or regulations—don’t suddenly deteriorate.

While a sustained move above $3,000 would likely require a catalyst – such as a large inflow week or a surprise upgrade rollout – the baseline projection remains modestly bullish.

The post Ethereum Price Prediction in June 2025 appeared first on NFT Evening.