[#title_feedzy_rewrite]

The crypto market is once again abuzz as Pump.fun prepares to officially debut its native token.

The project, widely credited with popularizing the current “meme 2.0” wave, has attracted both excitement and skepticism ahead of its token generation event (TGE). While the marketing firepower and cultural influence of Pump.fun are undeniable, the question looms large: what can we reasonably expect from the token’s price performance post-TGE?

To answer that, we turn to history. A careful examination of major TGE performances in the last euphoric market cycle – particularly during the late stages of the 2021 bull run, offers valuable insight into what the Pump.fun token may face in the weeks and months ahead.

Pump.fun: The Narrative Engine of 2025

What separates Pump.fun from many of the 2021-era projects is its meme-native identity and cultural virality. Rather than promising to “revolutionize finance” with complex architectures, Pump.fun offers creators and communities an easy way to launch meme tokens directly on Solana.

Its success is undeniable: over 100,000 meme tokens have been minted using the platform, and trading volumes routinely compete with top decentralized exchanges.

Now, the platform aims to capitalize on that momentum with an ambitious token sale. The details are striking:

- Target raise: $1 billion

- Implied FDV: $4 billion

- Allocation: 25% of supply sold in TGE, with the rest going to team, ecosystem, and community incentives.

Read more: Pump.fun to Launch Token & Airdrop, Targets $1B Raise at $4B Valuation

Source: Kaito

It’s a bold move that underscores both the platform’s confidence and the speculative nature of the market cycle it operates in.

The 2021 Case Study: Soaring High, Then Falling Fast

The latter half of 2021 saw a frenzy of high-profile crypto token launches. While many of these projects boasted strong fundamentals and impressive user metrics, the timing of their TGE – at the peak of market exuberance, ultimately set the stage for dramatic post-launch downturns.

Several key indicators support this view: Bitcoin dominance (BTC.D) has climbed above 56% for the first time since early 2021, signaling a rotation from altcoins back into BTC.

Ethereum has rallied nearly 45% in May alone, driven in part by ETF speculation. Meanwhile, meme coins like PEPE and WIF soared, mirroring past cycle peaks driven by speculation.

In 2017 and 2021, rising BTC dominance signaled altcoin exits before major market corrections. Rather than marking renewed bullishness, it signaled caution, suggesting that the broader market had exhausted its risk appetite.

Today’s metrics suggest Pump.fun may face similar hype-driven decline in coming weeks.

Take Flow (FLOW) for instance. Launched at $9.90, CVX hit $43.35 then fell to $0.40 by 2025—just 3.8% ROI.

Or consider Casper (CSPR), which launched in May 2021 at $1.29. Despite briefly peaking above $5, CSPR now trades near $0.012 – down more than 99% from its launch price. A similar trajectory befell Osmosis (OSMO) and dYdX (DYDX), both of which lost over 95% from their post-TGE highs.

Even top platforms like Convex Finance struggled once the bear market took hold. Despite hitting $60.33 in early 2022, CVX now sits below its launch price of $3.01.

| Project | TGE Date | TGE Price | ATH Price | Current Price |

| FLOW | 27/1/2021 | 9.9 | 43.5 (4/5/2021) | 0.375 |

| CSPR | 11/5/2021 | 1.29 | 5.12 (11/5/2021) | 0.0122 |

| OSMO | 19/6/2021 | 5 | 26.8 (3/12/2021) | 0.214 |

| CVX | 15/5/2021 | 3.01 | 60.33 (1/1/2022) | 2.7 |

| dYdX | 8/9/2021 | 14.3 | 27.66 (30/9/2021) | 0.574 |

Projects launching late in bull markets often crash as hype fades and sentiment weakens.

Echoes of the Past: Is Pump.fun Overvalued at Launch?

With a $4 billion fully diluted valuation at TGE, Pump.fun would instantly become one of the top meme tokens by market cap – potentially placing it in the same category as PEPE, DOGE, and BONK.

Yet unlike DOGE, which has over a decade of brand recognition, or PEPE, which evolved into a cultural symbol, Pump.fun’s value proposition is tied almost entirely to platform usage and meme market momentum.

This raises concerns similar to those faced by 2021 tokens: high TGE valuation, relatively short track record, and heavy insider allocation.

Historically, such setups tend to result in intense early trading volatility, followed by sustained sell pressure as early buyers seek to realize gains and unlocks begin to hit the market.

That said, Pump.fun’s latest platform metrics paint a compelling picture of user activity and growth:

- Trading fee revenue in 2025: $296.1 million, surpassing Ethereum’s $249.1 million and leading all protocols in weekly revenue for nine consecutive weeks.

- Tokens minted per month: Over 10 million in April 2025, averaging ~30,000 new tokens per day.

- Daily active users (DAU): Over 156,000 as of May 2025.

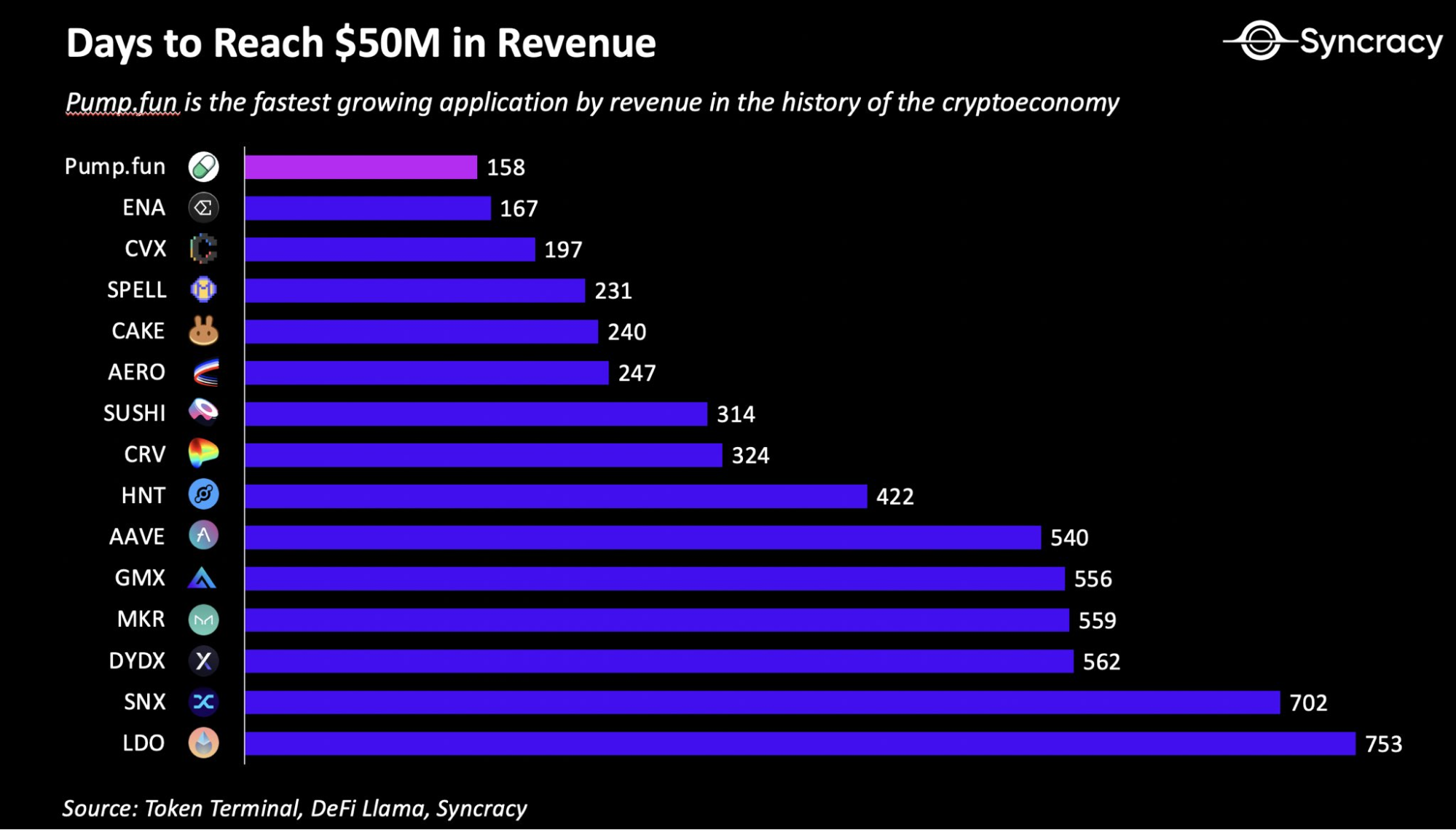

Source: Syncracy

Still, these impressive metrics raise questions about long-term sustainability. Many tokens on Pump.fun exist for only a few days, catering to short-term speculation rather than community building.

The explosive growth in token creation could quickly lead to oversaturation, echoing the fates of previous hype-driven ecosystems.

Potential Price Pathways: Scenarios Post-TGE

Assuming Pump.fun launches at an initial market cap of approximately $1 billion based on circulating supply, the token could follow one of several paths depending on market sentiment and investor behavior.

In a bullish case, reminiscent of dYdX’s launch, the token might see a sharp price surge driven by hype and FOMO, potentially peaking at 2–3 times its TGE price within days.

This would likely be followed by a gradual decline as early investors lock in profits and vesting schedules begin to release more tokens into circulation.

A more neutral outcome could mirror Osmosis, where the token trades sideways or experiences modest growth for a short period. Retail interest might keep it afloat, but consistent sell pressure from seed investors could push the price back toward TGE levels within two to three months.

The bearish case, similar to Casper’s trajectory, would involve the market rejecting the high valuation outright. This could trigger a swift wave of selling, particularly if initial liquidity is thin.

The token might then fall 80–90% from its launch price within a few months, reflecting broader concerns over sustainability and overvaluation.

Conclusion

Pump.fun’s token launch is set to be one of the most talked-about events of this cycle. It combines meme culture, Solana’s revival, and airdrop-fueled engagement into one highly speculative package. While short-term volatility could create opportunities for savvy traders, long-term holders should be wary of entering at peak valuations.

History suggests that tokens launched during euphoric phases, especially those with high FDV and aggressive private allocations – often face brutal corrections.

Unless Pump.fun can deliver sustained platform growth, novel use cases for its token, and disciplined emission schedules, it risks becoming another cautionary tale of bull market exuberance.

Read more: Trading with Free Crypto Signals in Evening Trader Channel

The post Pump.fun Token Debut: Can It Surpass a $4 Billion FDV? appeared first on NFT Evening.