[#title_feedzy_rewrite]

Based on weekly and daily candle structures, several top tokens, including XLM, FIL, ATOM, FET, AAVE, and HBAR – are setting up for major directional moves. Here’s a breakdown of their current technical outlook.

Bitcoin Price Prediction

Bitcoin is range-bound between $106,920 and $103,150. These are the key levels to watch. A breakout from either direction will likely determine the next significant move.

Notably, recent long positions opened near the lower range at $103,150 have already reached targets around $106,800. Intra-range levels like $104,100, $104,855, and $105,850 offer opportunities for scalping.

From a macro view, the market’s risk appetite is waning. Dominance metrics and RSI divergence suggest caution, particularly for altcoins. TOTAL3 appears overdue for a backtest at support around $794.23B.

If it holds and reclaims $933.22B on a daily close, the altcoin rally may resume. Otherwise, rising BTC.D and bearish divergences point to short opportunities on altcoins.

Source: TradingView

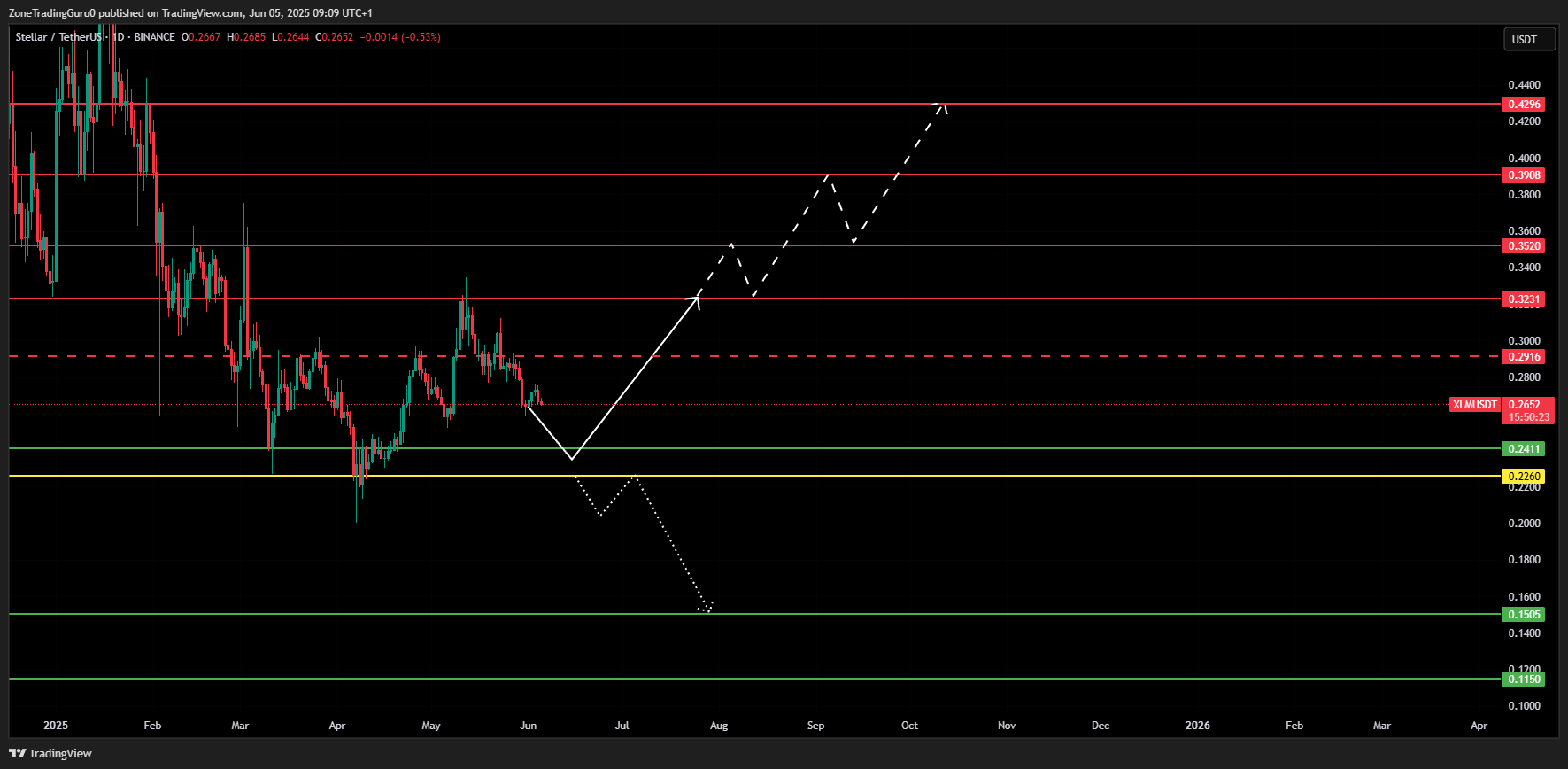

XLM Price Prediction

XLM appears to be entering a corrective phase, heading toward a major support zone at $0.2411–$0.2260. If a weekly candle closes below this region, it could signal a deeper move to the next support range at $0.1505–$0.1150.

Conversely, a strong rebound from the $0.2411–$0.2260 area could see price target resistance levels at $0.2916–$0.3231. A daily candle close above $0.3231 would confirm a bullish reversal, opening the path to $0.3520, $0.3908, and even $0.4296.

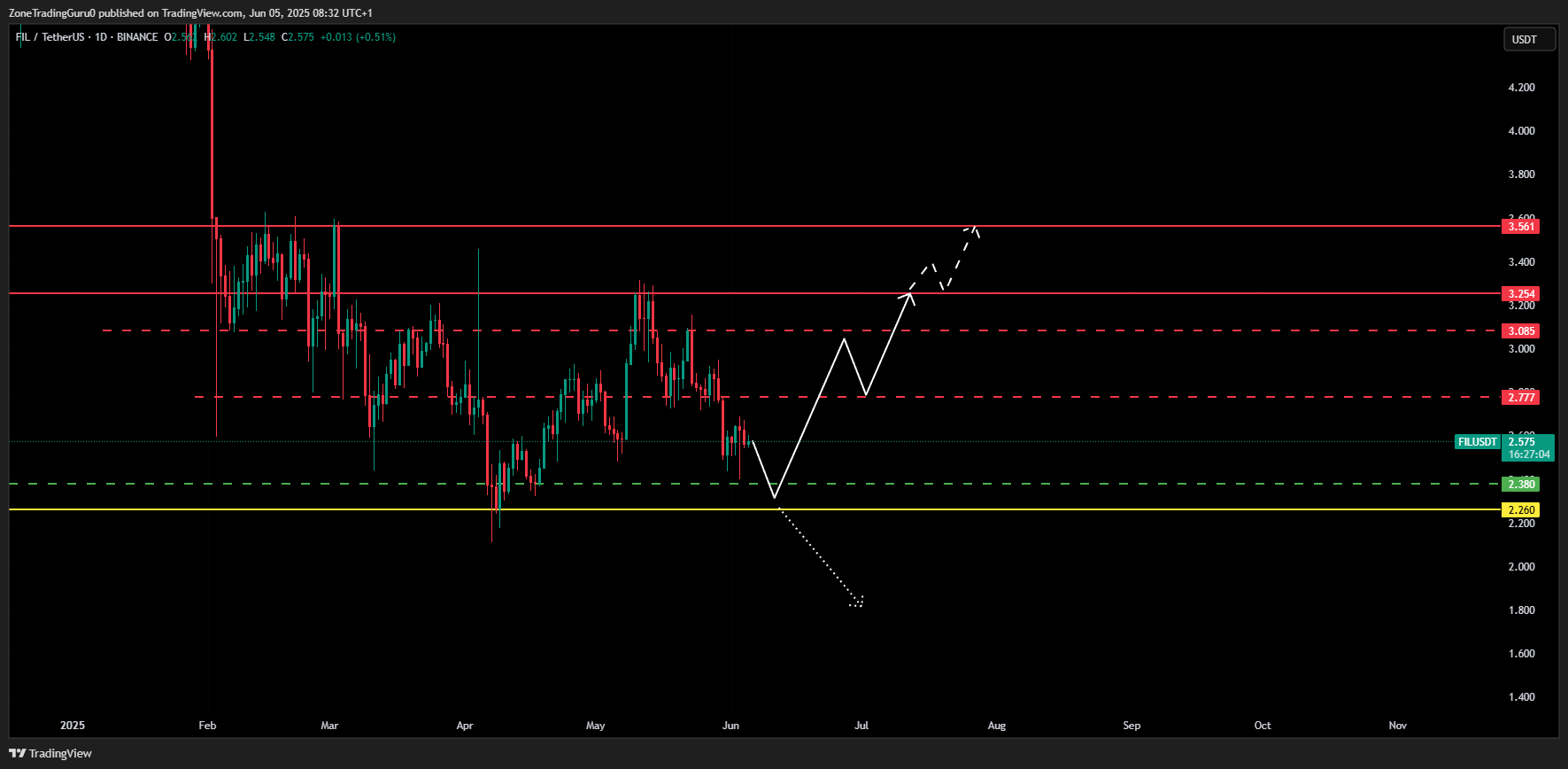

FILECOIN Price Prediction

FIL remains in a sustained downtrend, with potential to drop further toward key support at $2.38–$2.26. The $2.26 level is critical; a daily close beneath it may result in the formation of new cycle lows.

On the upside, a bounce from this area could test resistances at $2.777, $3.085, and $3.254. If price closes above the $3.254 mark on the daily timeframe, this may confirm bullish continuation toward $3.561 or higher.

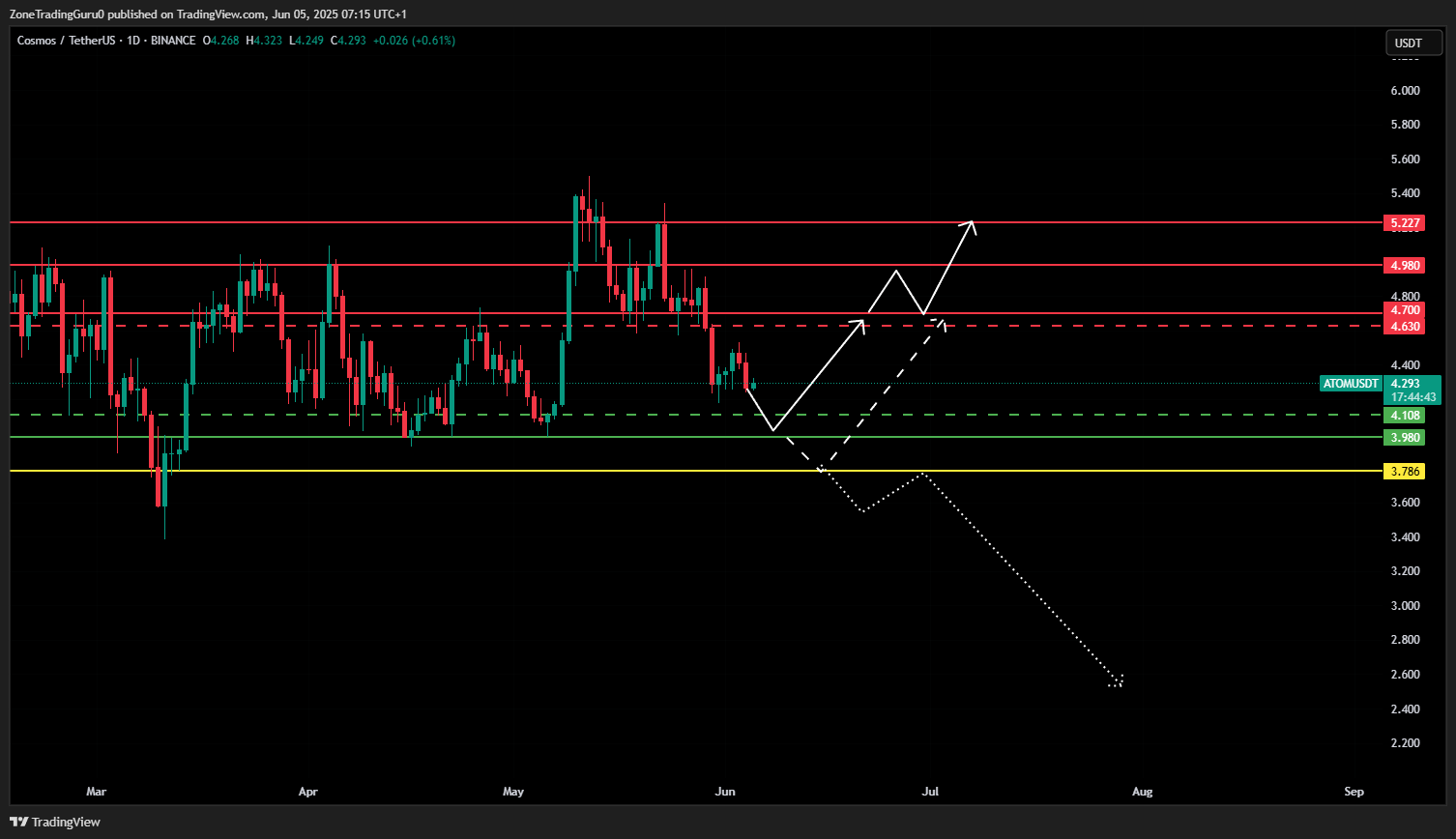

Cosmos Price Prediction

ATOM has been in a downward trend on lower timeframes and could revisit supports at $4.108–$3.98 or as deep as $3.786. Notably, $3.786 is a weekly support level. Any weekly candle close beneath it would raise the probability of a larger breakdown to previous lows.

A reversal from support could drive price back to test resistance zones at $4.63–$4.70. A daily close above $4.70 could mark a bullish shift, with next targets seen at $4.98 and $5.227.

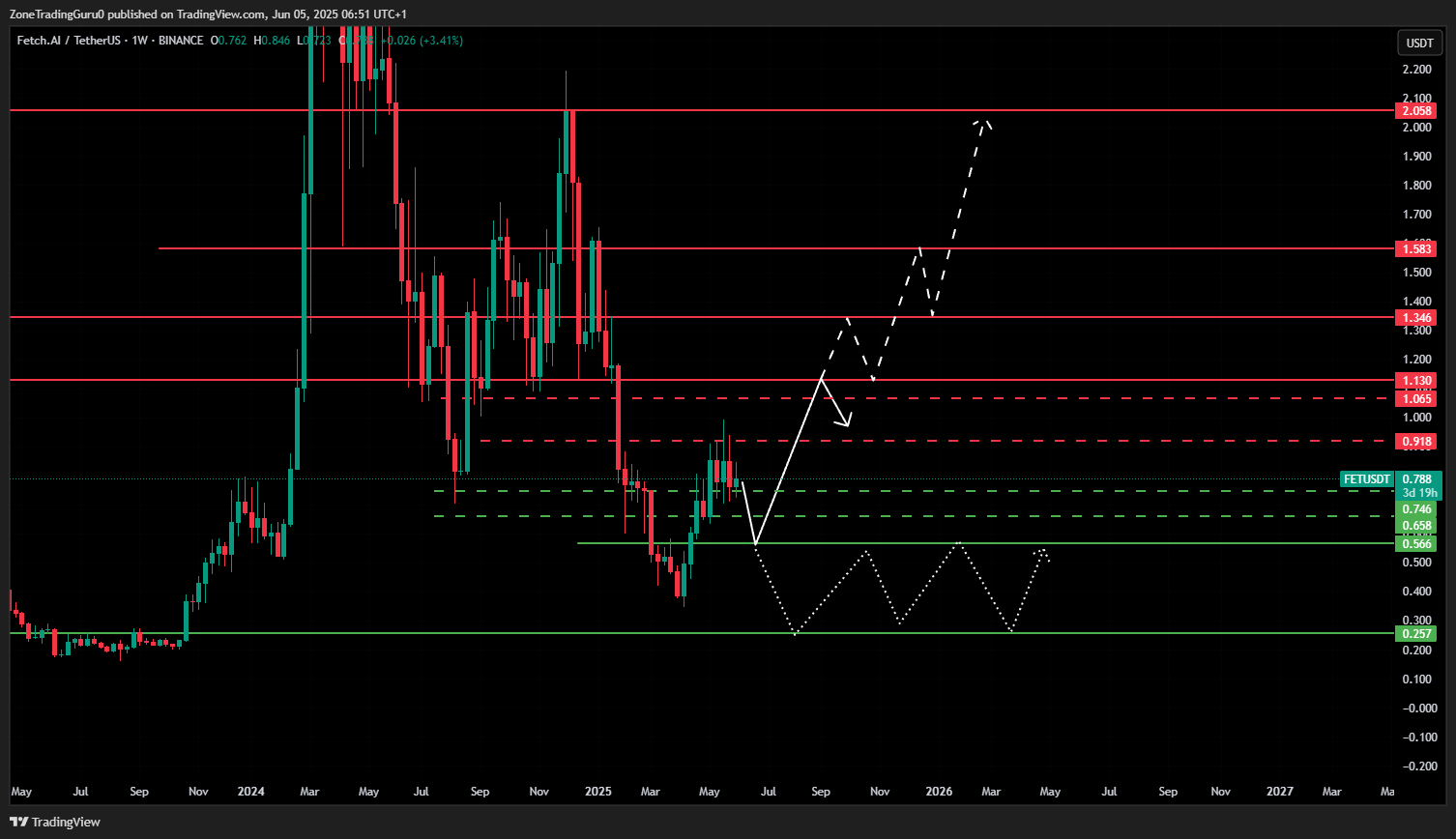

Fetch AI Price Prediction

FET continues to trade within a wide range between $1.13 and $0.566, with several minor resistance and support levels at $1.065, $0.918, $0.746, and $0.658. These zones present opportunities for short-term scalping strategies.

A weekly candle close above $1.13 would mark a significant breakout, potentially sending FET toward $1.346, $1.583, and even $2.058. On the downside, a break below $0.566 could see the token revisit previous lows and consolidate in a new range between $0.566 and $0.257.

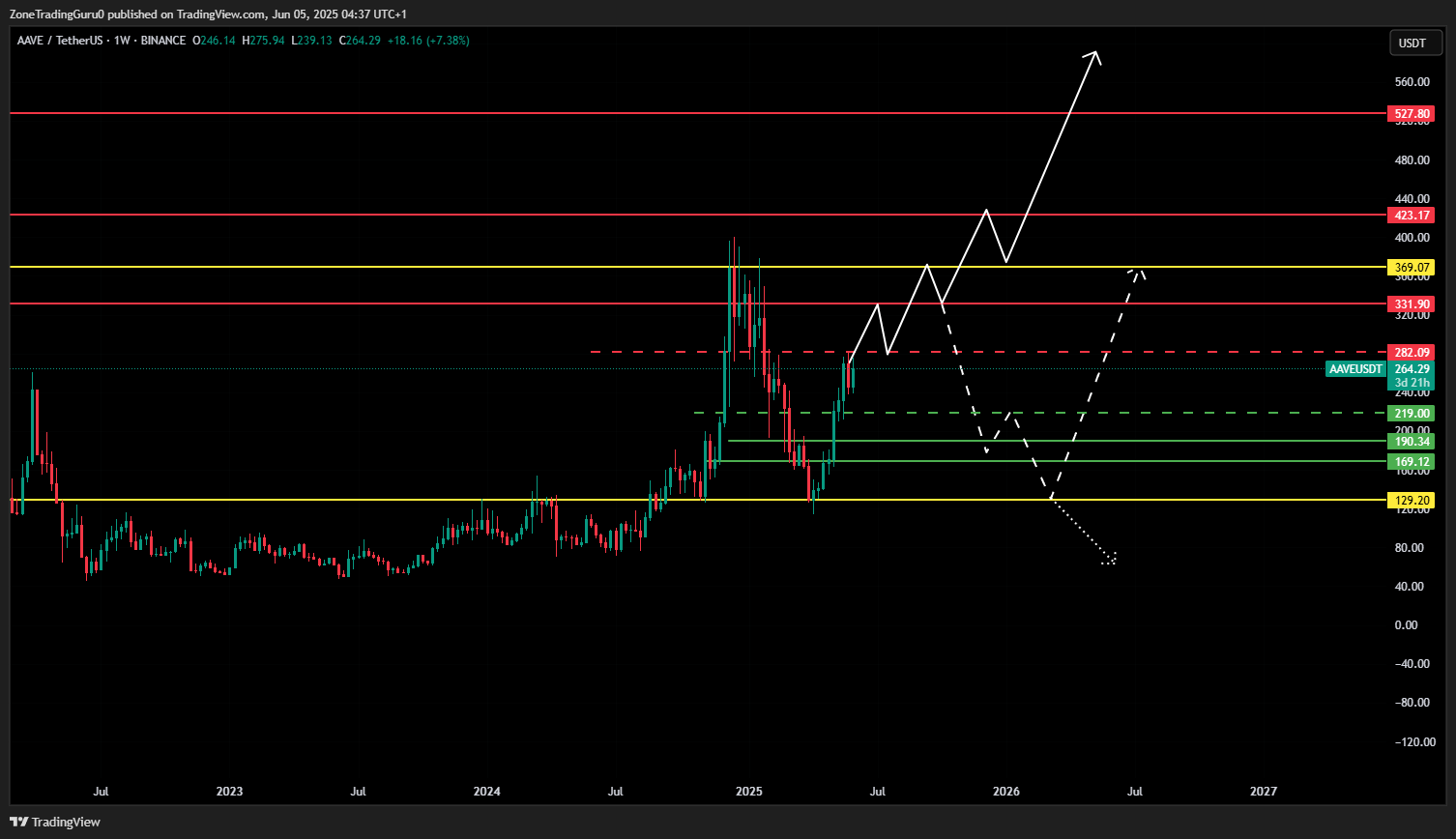

AAVE Price Prediction

AAVE has shown signs of a sustainable uptrend, with price currently targeting the previous high range of $331.9–$369.07. The $369.07 level is the key breakout point; a weekly candle close above this level could activate a bullish “Cup and Handle” pattern. If confirmed, upside targets may extend to $423.17, $527.80, or potentially new all-time highs.

Failure to clear $369.07 could prompt a pullback to supports at $282.09, $219.00, $190.34, $169.12, and $129.20. Among these, $129.20 is seen as the last line of defense. A weekly close below it would invalidate the bullish structure and suggest a move toward cycle lows.

HBAR Price Prediction

After an impressive ~8x rally from its lows, HBAR is undergoing a corrective move, approaching strong support at $0.13926. A bounce here could reignite bullish momentum, with upside targets at $0.26425. A weekly candle close above this resistance would strengthen the case for a continuation toward $0.33274 and $0.37477.

However, a close beneath $0.13926 would increase the likelihood of a prolonged consolidation phase around previous bottom levels.

Conclusion

Altcoins are reaching key technical junctions, with several showing signs of either major breakdowns or potential reversals. While Bitcoin consolidates, traders should closely monitor candle closes around identified support and resistance levels. Given current market sentiment and inter-market signals (such as TOTAL3 and BTC.D), downside risk remains elevated for altcoins in the near term.

Stay disciplined, and always confirm with multi-timeframe analysis before positioning.

Read more: Trading with Free Crypto Signals in Evening Trader Channel

The post Price Prediction 6/06: BTC, HBAR, AAVE, FET, ATOM, FIL & XLM appeared first on NFT Evening.